Effortless crypto accounting

So web3 businesses and their tax professionals can stay ahead of tax liabilities and spend less time in spreadsheets.

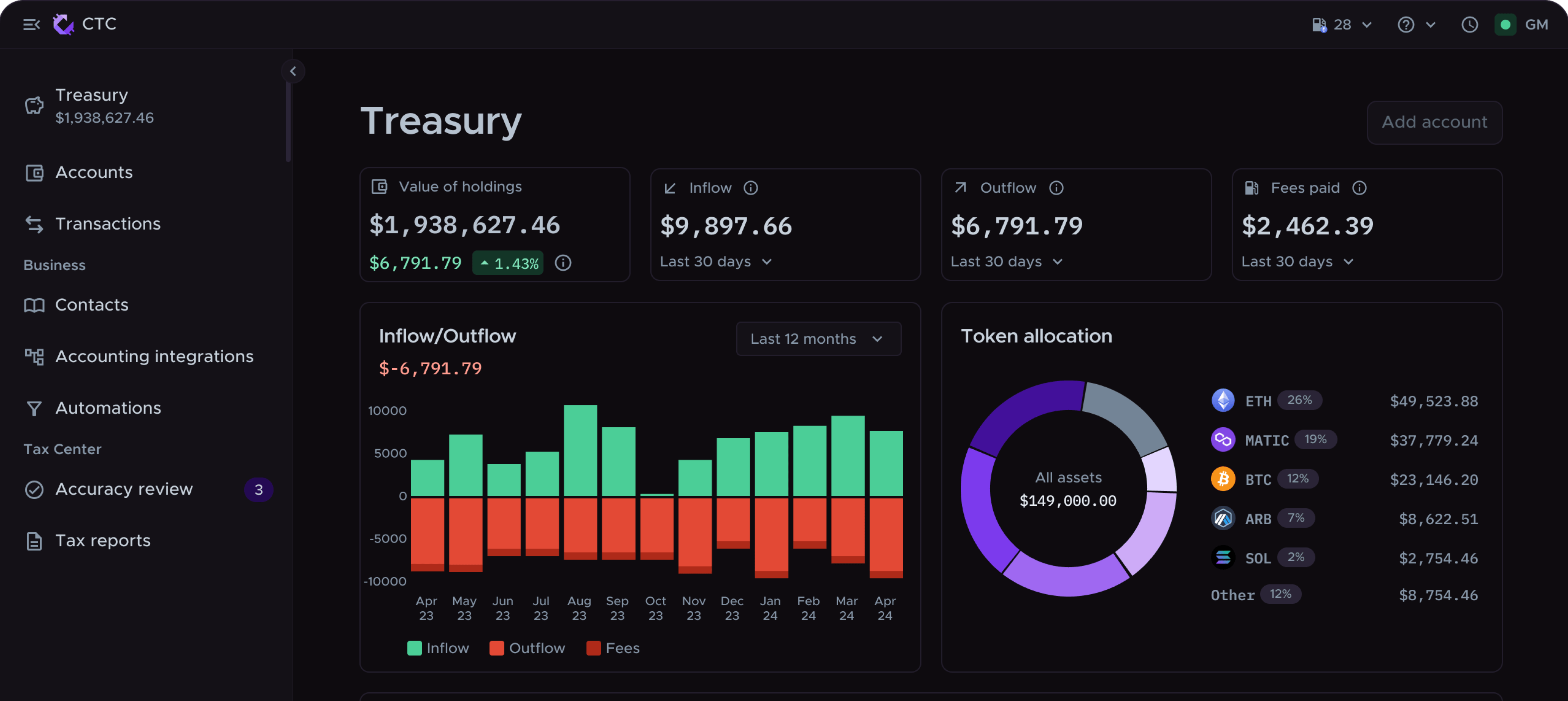

Automate your crypto bookkeeping

Sync and centralize transactions

Import from 1000+ sources. Centralize your crypto activity, and save valuable time typically spent on tracking transactions across various platforms.

Automated labeling, rules, and reconciliation

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow and get your IRS and SEC-compliant tax reports with ease.

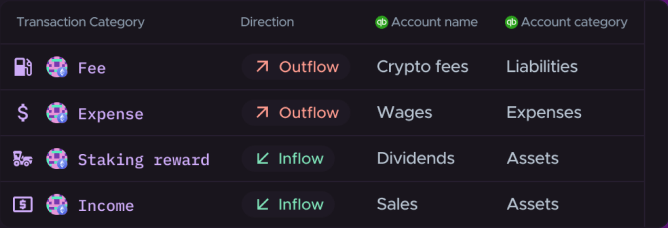

Directly connect with Xero & Quickbooks

CTCs smartest ever rules-based engine integrates directly to Xero & Quickbooks, so you or your tax professional can seamlessly connect your crypto activity to your Chart of Accounts.

Identify key contacts

Assign wallets to known entities, helping you make sense of transactions and quickly uncover anomalies.

Create rules

Set automated rules so transactions are automatically mapped on import, saving time.

Map to your Chart of Accounts

Map transactions directly to QBO or Xero. Sync transactions into your FIAT accounting software.

Confidently compliant

CTC adapts to the rapidly changing regulatory landscape, and generates audit-proof reports. Rest easy knowing your business is protected if the tax authorities come knocking.

Safe and secure

CTC adheres to world-class security protocols. Our platform is SOC 2 Type 2 certified and features single sign on to keep your confidential data protected.

Trusted by industry leaders

We partner with leaders in the accounting industry to help demystify crypto compliance.

Accountant working with crypto clients?

CTC is the only platform that enables you to collaborate with all of your clients, from hobbyist investors to enterprises, all in one place.

Train staff on one tool - built for both individual and business clients.

“Crypto Tax Calculator does the job spectacularly”

We’ve been looking for a product to help us manage our clients’ crypto tax returns, and Crypto Tax Calculator does the job spectacularly. Not only does the team keeps on top of all HMRC changes so we can have full confidence in the reports we produce, but their product is an efficient way to bring in a client’s data from a constantly growing multitude of exchanges, blockchains, and wallets. Couldn’t ask for anything better.

Joe David

Founder, Myna Accountants

“Crypto Tax Calculator’s software enables our team to tackle the most complex DeFi scenarios.”

...from liquidity protocols, to NFT ecosystems, and remain at the forefront of crypto tax reconciliation. As specialists in cryptocurrency reporting, accuracy is completely essential to us, our clients and our accounting partners, which is why we love CTC.

Oliver Woodbridge

Director, Tax On Chain

“Crypto Tax Calculator is a tool we couldn’t live without.”

As an accounting firm that specialises in crypto taxes, Crypto Tax Calculator is a tool we couldn’t live without. Being able to aggregate client’s transactions across all exchanges and blockchains into one data feed brings incredible efficiencies to the crypto tax compliance process.

Marc Phillis

Director, Cryptocate

5-Star Support

Our team genuinely care about helping you do your crypto tax. Get real help from real people whenever you need it.

Official Partners

Backed by Coinbase Ventures, we’re proud to offer best-in-class support for the Coinbase ecosystem.

Learn more

We're thrilled to partner with MetaMask, the leading self-custodial wallet, to make crypto taxes a breeze.

Learn more

Why CTC for Business

At Crypto Tax Calculator, our team has spent years perfecting the transformation of complex on-chain activity into audit-friendly tax reports for individuals.

CTC for Business takes the powerful algorithms and easy reporting CTC has been known for, and supercharges them for businesses of all sizes. With the ability to handle millions of transactions, and plans to suit your business size, CTC can grow as your company does.

Plus, you'll get access to all-new features, like enhanced portfolio reporting and a smart rules engine, and integrate directly with your accounting platform—saving you and your tax professional from your crypto tax nightmare.

Connect over 1000 sources