How to submit your crypto taxes with TurboTax

In the US, cryptocurrencies and crypto assets are treated by the Internal Revenue Service (IRS) as property instead of a currency. As a result, the taxation rules for cryptocurrencies and crypto assets are those which apply to capital assets.

We have a full breakdown of crypto capital gains tax events, income tax events, exceptions to tax rulings and more in our detailed US Crypto Tax Guide. Check it out if you’d like more specific information on what crypto activity is and isn’t taxable by the IRS.

Record keeping requirements

The Internal Revenue Code requires US taxpayers to maintain records that are “sufficient to establish the positions taken on tax returns.” This means that in order to stay compliant, you will need to maintain sufficient records of your crypto transaction history - including but not limited to: receipts, sales, transfers, other disposals of cryptocurrencies and/or crypto assets, as well as the fair market value of the cryptocurrency or asset at the time.

Get started on your crypto taxes in TurboTax

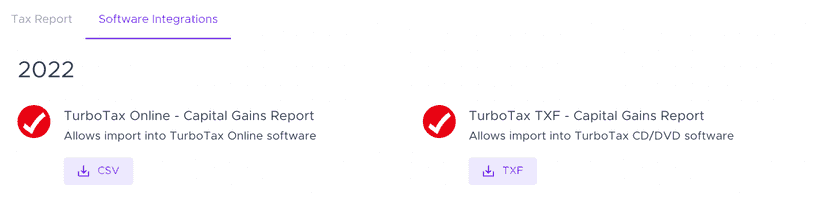

As mentioned above, the IRS requires taxpayers to provide sufficient records of their crypto activity. When using TurboTax to submit your individual tax return, the requirements are no different. Using Crypto Tax Calculator, you can calculate your crypto capital gains, losses, income and/or expenses to then submit them on TurboTax. We have a software integration that allows you to download compatible report files for both the TurboTax Online version, and the TurboTax Desktop version.

How to report crypto capital gains and losses on TurboTax

- Log into your TurboTax account.

- In the left hand menu, select “Federal”

- Navigate to “Investments and savings”, and click “show more”.

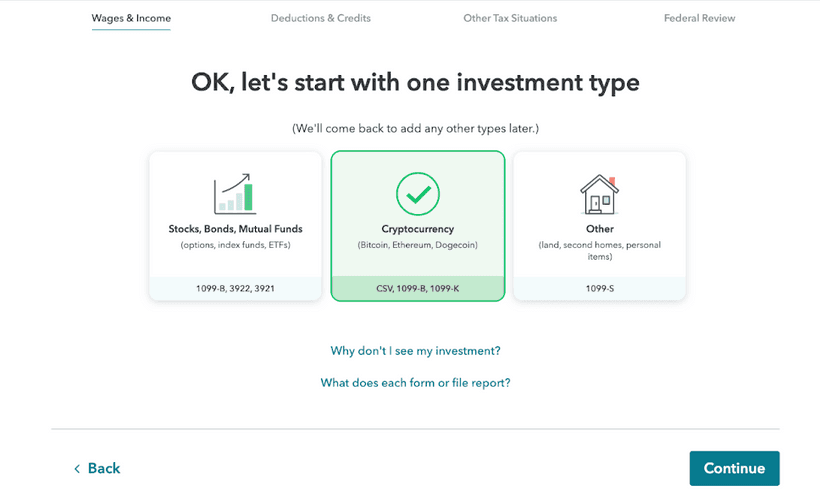

- In this section, you will see the option “Stocks, cryptocurrency, mutual funds, bonds, other”. Click this.

- Select “Cryptocurrency” as your investment type.

- After selecting this option, you will be presented with a list of crypto exchanges. At this point, you would’ve already used Crypto Tax Calculator to aggregate all your crypto transaction data, so select “Change how I enter my form” instead.

- If you haven’t already, make sure to download your Crypto Tax Calculator report from our platform by navigating to the “Reports” tab, and clicking “Download Reports”. From this window, you can choose to download a CSV of your crypto tax return for TurboTax from the “Software integrations” tab.

- Download your TurboTax compatible CSV file.

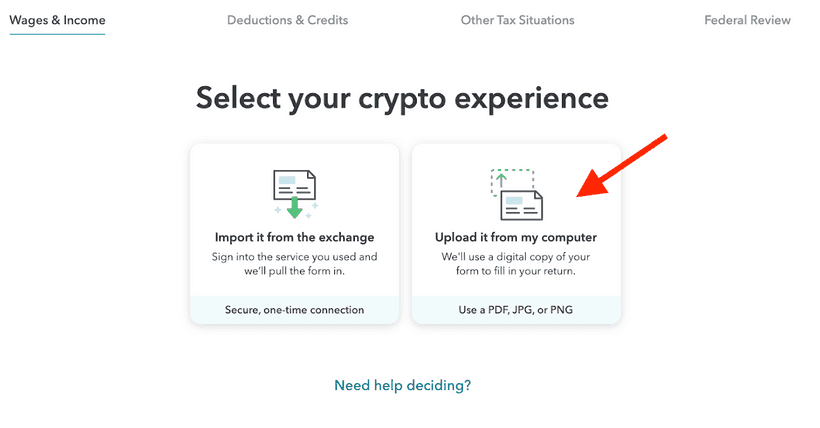

- Navigate back to TurboTax and select “Upload it from my computer”.

- When prompted to fill out the name of the crypto service you used, select “other” from the drop down menu and enter Crypto Tax Calculator.

- Proceed by uploading the TurboTax compatible CSV file.

- As always, double check the summary presented to you to ensure all of the values are correct and matching your report.

- You’re done with the capital gains tax section, now onto income!

How to report crypto income on TurboTax

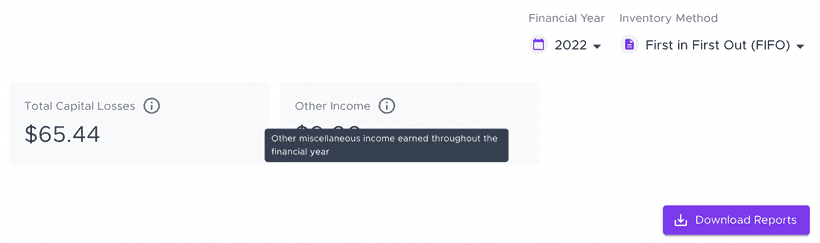

Now that your capital gains tax reporting is sorted, let’s move onto reporting your crypto income on TurboTax! This part is a little different. Our TurboTax compatible CSV only aggregates capital gains and/or losses, so in order to fill out your crypto income earned, you’ll need to navigate back to the “Reports” page.

On the “Reports” page, you will be able to see a block titled “Other Income”. Make sure the correct financial year is selected, as you’ll need to use this figure to input into TurboTax. Another way to view your crypto income for a specific financial year is by downloading an “Income Report” via the “Download Reports” section.

Now that you know where to find your crypto income figure, let’s jump back over to TurboTax.

- Log into your TurboTax account.

- In the left hand menu, select “Federal”.

- Navigate to the “Wages & Income” section.

- Find the section titled “Less Common Income” and click “show more”.

- Scroll down to the “Miscellaneous Income” option and hit the start button.

- Scroll down once again to the “Other reportable income” option and click start.

- You have two options at this stage: you can either enter the total for all of your crypto income for that particular financial year, or you can choose to split the entries by type of activity (e.g. mining income, airdrop income etc).

- Choose your method, add your values sourced from the Crypto Tax Calculator “other income” block or the “Income Report”, and then you’re done!

Wrapping up

Before you can finish up submitting your crypto taxes on TurboTax, you will be prompted to review each and every transaction. As you will have already gone through the reconciliation process on the Crypto Tax Calculator platform, there is no need to repeat yourself. If you choose to skip this step, scroll to the bottom of the page and click “continue”.

After this, you’re done! Give yourself a pat on the back, you’ve made it.

Disclaimer: The content of this guide is for general informational purposes only. It is not legal or tax advice. Viewing this guide, purchasing or using Crypto Tax Calculator does not create an attorney-client relationship or a tax advisor-client relationship.

The information in this guide represents the opinions of experienced crypto tax professionals; however, some of the topics in this guide are still subject to debate amongst professionals, and tax authorities could ultimately release guidance that conflicts with the information in this guide. The information contained in this guide is based on the authors’ interpretation of current guidelines. Changes to the guidelines may be retroactive and could significantly alter the views expressed herein. Therefore, use this information at your own risk and for information purposes only.

Consult a professional regarding your individual tax or legal situation.

Die auf dieser Website bereitgestellten Informationen sind allgemeiner Natur und stellen keine Steuer-, Buchhaltungs- oder Rechtsberatung dar. Es wurde ohne Rücksicht auf Ihre Ziele, Ihre finanzielle Situation oder Ihre Bedürfnisse erstellt. Bevor Sie aufgrund dieser Informationen handeln, sollten Sie die Angemessenheit der Informationen im Hinblick auf Ihre eigenen Ziele, Ihre finanzielle Situation und Ihre Bedürfnisse prüfen und professionellen Rat einholen. Cryptotaxcalculator lehnt jegliche ausdrückliche oder stillschweigende Garantien, Zusicherungen und Gewährleistungen ab und haftet nicht für Verluste oder Schäden jeglicher Art (einschließlich menschlicher Fehler oder Computerfehler, fahrlässiger oder sonstiger Art oder zufälliger Verluste oder Folgeschäden), die sich aus oder in ergeben Verbindung mit, jegliche Nutzung oder Vertrauen auf die Informationen oder Ratschläge auf dieser Website. Der Benutzer muss die alleinige Verantwortung für die Verwendung des Materials auf dieser Website übernehmen, unabhängig vom Zweck, für den diese Verwendung oder Ergebnisse verwendet werden. Die Informationen auf dieser Website sind kein Ersatz für eine fachkundige Beratung.