New airdrop tax guidance in Australia

The ATO has recently updated its website guidance on Airdrops in a positive way for Australian taxpayers.

The previous guidance was that an airdrop of an ‘established token’ is taxable, with no further information on the definition of an ‘established token’. Equally, there was no guidance on how a ‘non-established token’ airdrop would be taxed. Thankfully, the ATO has now clarified its general position further via its website.

The new section added to their airdrop tax article speaks to ‘initial allocation’ airdrops. It states that an initial allocation of tokens with no trading prior to the airdrop (aka this is the first time the token will be out in the wild, so to speak) is not taxable, nor is it a capital gains tax event. Further, the airdropped tokens will have a zero-cost basis for CGT purposes and the timing for the 12-month CGT discount is from the time that the tokens are received by the user.

Some notable airdrops that appear to be initial allocations based on the examples provided by the ATO are:

- Ethereum Name Service ($ENS) in November 2021

- LooksRare ($LOOKS) in January 2022

- ApeCoin ($APE) in March 2022

- Gnosis Safe ($SAFE) in August 2022

This new guidance should give Australian crypto users some tax relief as they will no longer be required to include non-established tokens they received via an airdrop as ordinary income. For example, the $ENS airdrop was at $43 per token when first received but quickly dropped in value and is now sitting at around $15 at the time of writing. Before this update to the ATO’s guidance, it could be assumed that the $ENS airdrop would be considered income. This meant that if a taxpayer received $ENS tokens as part of the airdrop previously, they may have had a high tax bill than the asset is currently worth.

Please note that this new airdrop guidance is unlikely to apply to airdrops related to forking, such as the $LUNA v2 token after the demise of $UST.

How Crypto Tax Calculator can help you categorise your airdrop

In the Crypto Tax Calculator platform, we give you an easy way to help categorise your airdrop transactions accordingly.

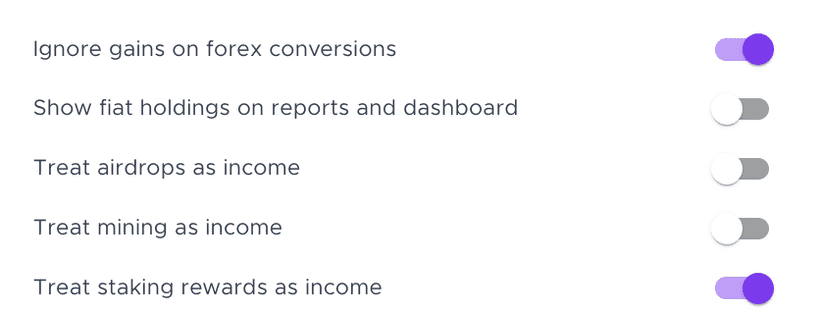

To accommodate these new guidelines in the Crypto Tax Calculator platform, you can toggle airdrops so they are not treated as income. To do so, visit the ‘Settings’ page and toggle the ‘treat airdrops as income’ into the off position.

This will automatically attribute a zero-cost basis to all airdrops. For any airdrops that don’t fit into the initial allocation category, you could categorise these as ‘rewards’ or ‘income’ instead.

As always, if you have any questions regarding the treatment of specific transactions, we recommend talking to a local tax professional.

Thanks to Harrison Dell, Director of Cadena Legal, for this written contribution.

Disclaimer: The content of this guide is for general informational purposes only. It is not legal or tax advice. Viewing this guide, purchasing or using Crypto Tax Calculator does not create an attorney-client relationship or a tax advisor-client relationship.

The information in this guide represents the opinions of experienced crypto tax professionals; however, some of the topics in this guide are still subject to debate amongst professionals, and tax authorities could ultimately release guidance that conflicts with the information in this guide. The information contained in this guide is based on the authors’ interpretation of current guidelines. Changes to the guidelines may be retroactive and could significantly alter the views expressed herein. Therefore, use this information at your own risk and for information purposes only.

Consult a professional regarding your individual tax or legal situation.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Cryptotaxcalculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.