Survive tax compliance

Generate powerfully accurate crypto tax reports.

One crypto tax calculator, all of your activity

Support for hundreds of exchanges, wallets and blockchains. Add your wallets to see your entire crypto portfolio on the dashboard.

Exporting made easy

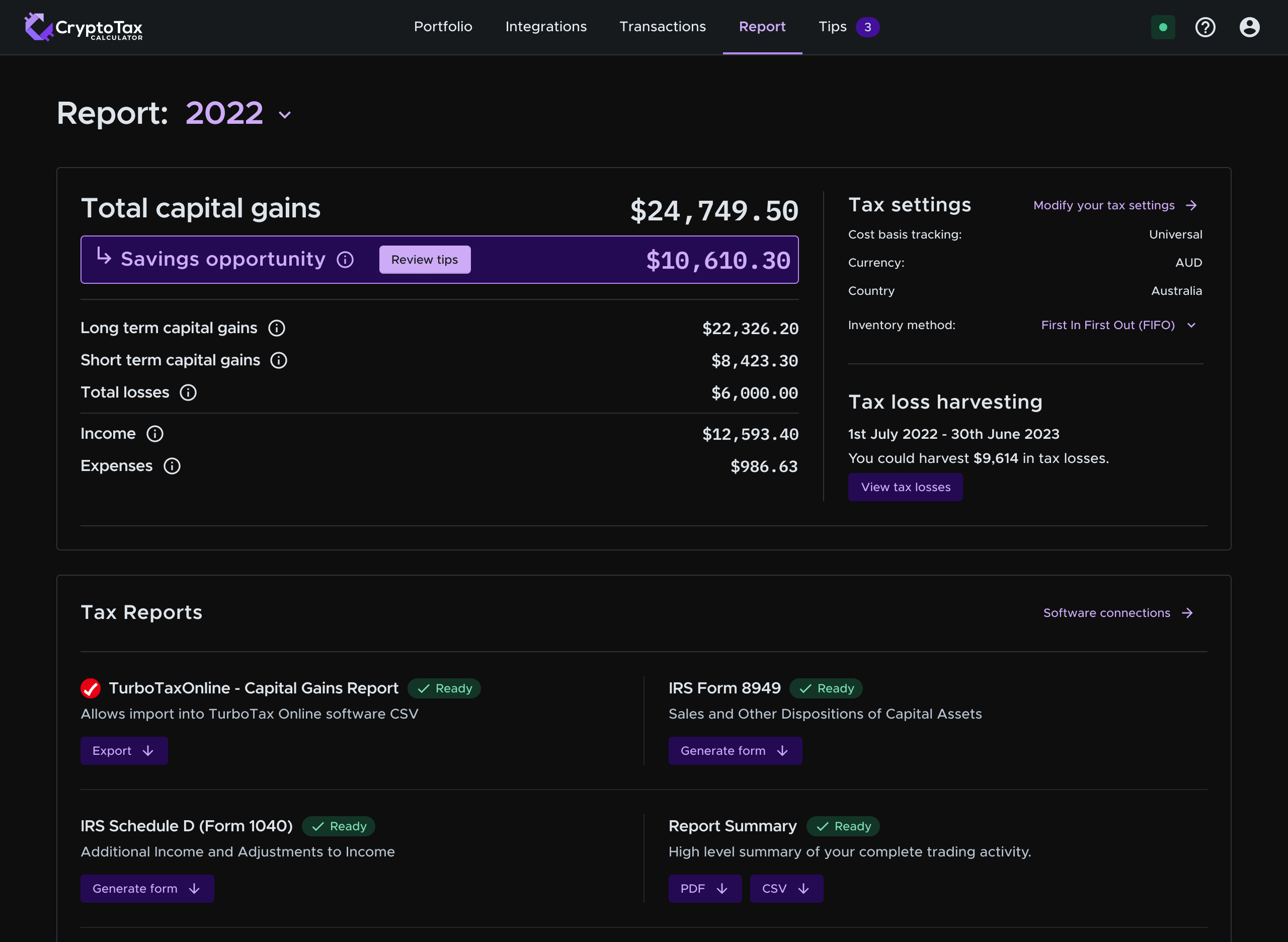

Detailed tax reports provide a breakdown of realized capital gains and income. Easily share reports with your accountant or file them yourself with the TurboTax integration.

IRS supported tax forms

Tax calculation algorithms built in compliance with IRS guidelines for crypto tax reports that are accurate to US standards.

Get Started

Crypto Tax Calculator

Comprehensive crypto tax reports made simple with Crypto Tax Calculator.

No credit card required

Learn more about pricing

Find a plan that suits your needs.

Learn more about crypto tax

Stay up to date with the latest information from the resource centre.

Frequently asked questions:

01.Can you download reports for different tax years?

Yes, you can! In our app, you have the option to choose a specific financial year (which correspond with your country’s tax season), or select custom dates. There is no added cost for downloading more than one year’s tax report.

02.Do you have the option to choose what inventory method you use?

Yes, we do! Before generating your crypto tax report, you can choose the type of inventory method you’d like to apply to your transactions. We have options for First In First Out, Last In First Out, Highest In First Out and more.

03.How do I generate a crypto tax report for all of my activity?

To generate a tax report, you’ll need to navigate to our ‘get report’ section in the app. You then select your chosen financial year and inventory method, and our software will provide you with an overview of transactions from that time period. You also have the option to customize long term gain thresholds as applicable to your personal circumstances.

04.What does the crypto tax report provide summaries of?

You have the option to download reports from a range of choices, including but not limited to; Report Summary, Capital Gains Report, Income Report, Trading PnL Report and more.

05.What about exporting options?

The various reports are downloadable in CSV and PDF formats so you can inspect these locally and share them with your tax professional. Where applicable, the reports are also exportable in your local tax format. For example, if you are based in the US you can export to the IRS 8949 form. We also support exports to popular tax software platforms such as TurboTax.

06.Couldn’t I just get my tax professional to do this?

We always recommend you work with your accountant to review your records. However manually preparing your books can be extremely time consuming, and many accountants will just use software such as Crypto Tax Calculator to do this, charging a hefty premium.