What is Bridging?

What is bridging?

Just as the name suggests, a blockchain bridge connects two different chains and allows assets to move from one to the other. Bridging is a relatively new transaction type that has been born out of necessity as more blockchains are created and DeFi users wish to move their assets from chain to chain to take advantage of different opportunities.

Bridging often consists of many different transactions and can even result in the change of the underlying asset to a pegged or wrapped derivative (depending on the bridge and source/destination chain). Crypto Tax Calculator can handle these complex transactions, allowing you to reconcile any cross-chain transactions and report your tax obligations correctly.

What are the tax implications of bridging?

Right now, there is a lack of specific guidance on the tax implications of bridging crypto assets from the majority of tax regulatory bodies around the world. This has led to two dominant schools of thought on the issue: those who see bridging as a taxable event (conservative), and those who do not (aggressive). Let’s dive in.

In most regions, a capital gains taxable event regarding crypto activity happens when there’s a ‘disposal’ of an owner’s asset. A disposal is defined as a change of ownership in a specific asset; for example, when selling ETH for BTC. The seller is ‘disposing’ of their ETH to receive BTC in return.

The conservative approach:

For those who classify bridging as a taxable event, they view the bridging event itself as a disposal. When transferring a crypto asset cross-chain, they believe that this asset has left the beneficial ownership of it’s original holder when making this journey. The discussion hinges on the argument that moving assets across fundamentally different blockchains might be considered creating materially different assets, accompanied by the argument that by granting the smart contract the ability to make this cross-chain journey, the owner is giving up ownership over their assets.

The aggressive approach:

In the aggressive approach, it is argued that because of the lack of guidelines available from your tax regulatory body, bridging is the equivalent of transferring crypto between two wallets owned by the same user. You would argue that, as a result, this doesn’t constitute a disposal event, and as such, you wouldn’t incur capital gains tax.

We recommend that you work with a local tax professional to decide what approach is best for your personal circumstances.

How can Crypto Tax Calculator help?

Handling Bridging in the Platform

To handle bridging in the platform, follow these simple steps:

-

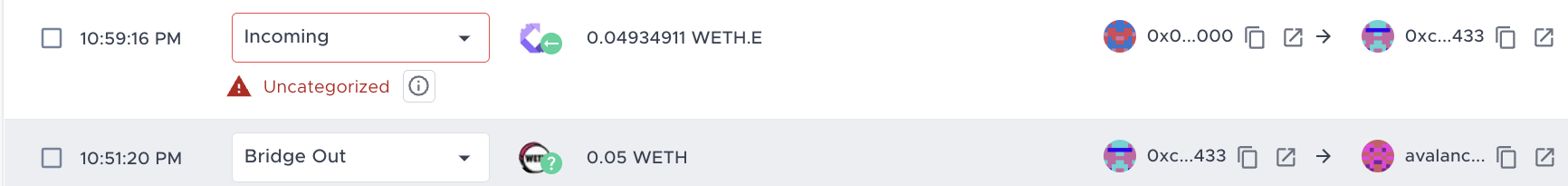

Find the transactions related to the bridging event under ‘Review Transactions’. Usually they will be split into an ‘outgoing’ component (sending to the bridge) and an ‘incoming’ component (receiving the asset on the other chain). The example below shows 0.5 WETH being bridged from Ethereum to Avalanche.

-

Re-categorize the ‘outgoing’ component as ‘Bridge Out’. Do this by clicking on the category box, selecting ‘Advanced’ and then choose the category ‘Bridge Out’ on the right side of the page.

-

Re-categorize the ‘incoming’ component as ‘Bridge In’ using the same process as step 2.

-

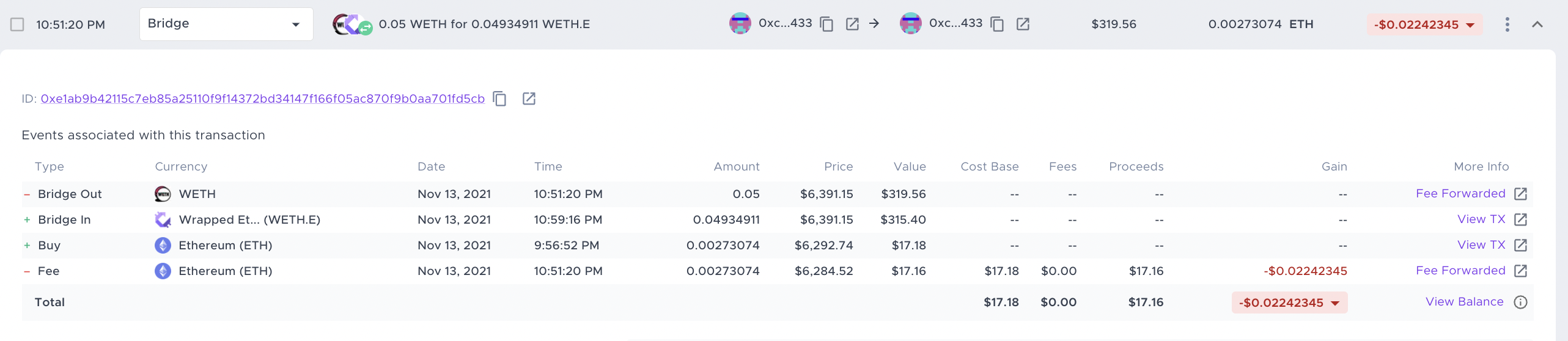

The two components will then group to form a single line categorized as a ‘Bridge’. The cost basis from the original asset will be moved across to the asset on the destination chain, even if it is a pegged or wrapped version of the original asset.

Important Notes

- Both the ‘Bridge Out’ and ‘Bridge In’ components must occur within a 24 hour timeframe for them to be grouped together.

- A ‘Bridge Out’ will match with the next ‘Bridge In’ in chronological order if the following criteria are fulfilled:

- The two components are within 24 hours

- The amount that is received is similar to the amount that was sent (5% tolerance accepted)

- If multiple bridges of the same amount are done in the same 24 hours, ensure that the corresponding ‘Bridge Out’ and ‘Bridge In’ are chronologically one after the other.

- Bridging transactions will not be auto-categorized, they require manual selection due to the complex nature of the transaction.

- The cost basis of the original asset on the source chain will be transferred to the asset that is received on the destination chain whether it is the same asset or a pegged/wrapped version.