Accurate crypto taxes. No guesswork.

Accountant-endorsed tax reports.

Follows HMRC tax guidelines

4.8/5 TrustPilot

Built to support HMRC Tax Guidelines

Full support for the unique HMRC reporting requirements, including UK specific rules around mining, staking, and airdrops. Same Day and Bed & Breakfast wash sale rules are also supported.

Pay the least tax possible

Least Tax First Out is an exclusive algorithm that optimises your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a disposal event.

Be confident in the numbers

Easily see what's going on across all your wallets and exchanges so you can make the best decisions at all times.

Make compliance a breeze

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow and get your audit-proof tax reports with ease.

No credit card required

Official Partners

Backed by Coinbase Ventures, we’re proud to offer best-in-class support for the Coinbase ecosystem.

Learn more

We're thrilled to partner with MetaMask, the leading self-custodial wallet, to make crypto taxes a breeze.

Learn more

5-Star Support

Our team genuinely care about helping you do your crypto tax. Get real help from real people whenever you need it.

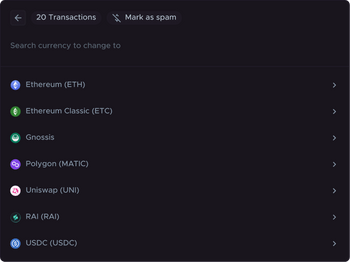

Tailored Support ForNFTsDeFi ProtocolsExchangesBlockchains

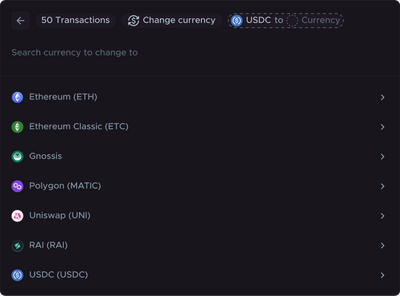

Fallen down the crypto rabbit hole? Don’t waste hours scouring block explorers and drowning in spreadsheets—import transactions automatically from over 1000 sources.

Find your integrations

Every Tax Report You Need

Sort your clients' taxes with ease, no matter the nature of their crypto activity.

Capital gains

Income

Transactions

Expenses

Audit report

+8 other detailed reports

Start with a free account

Learn

Helpful guides to understand the numbers and breeze through tax season.

UK Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in The UK.

Learn about UK crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes so you can file with confidence.

Learn about NFT taxesAll in one portfolio tracker

Track your entire portfolio, PnL and tax liability all in the same place.

portfolio value:

£89.436,20

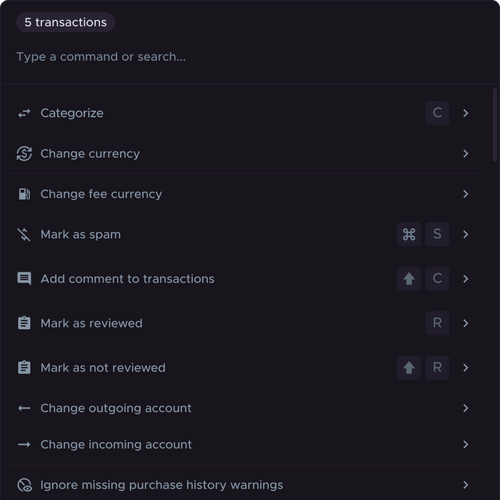

Built for speed

Optimized interface for bulk operations with keyboard shortcuts.

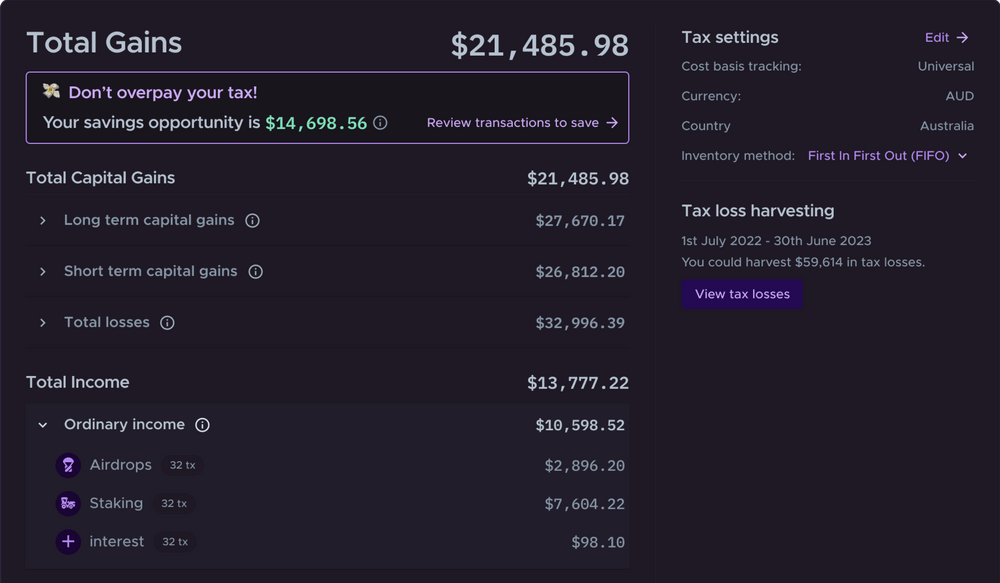

Automatically identified tax saving opportunity

All your transactions clearly grouped by their tax impact with your potential savings opportunity highlighted.

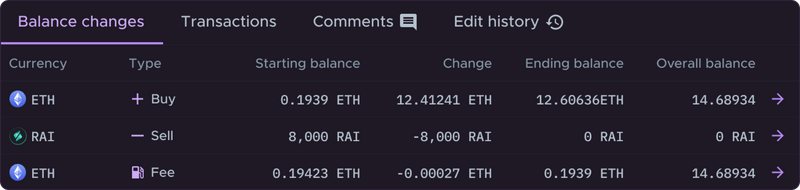

Full tax calculation transparency

See the exact breakdown of how each transaction is calculated. Understand the `why` and `how` behind your tax figures.

Altcoin pricing oracle

300k+ currencies priced accurately on import. Historical prices for all micro-cap memecoins.

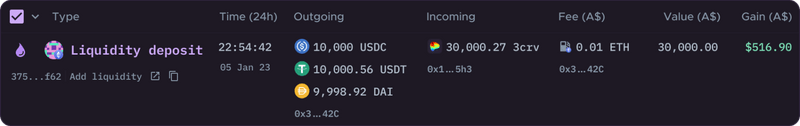

Complete DeFi support

Unified tracking and tax reporting for all your crypto assets across all your exchanges and wallets.

No credit card required

Use What The Pros Use

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

Best Crypto tax Software? after importing data onto @koinly @CryptoTaxHQ and @ZenLedgerIO the clear winner had the best UI Crypto Tax Calculator is the winner - detailed thread tomorrow

CTC has a really good Reconcilliation section where it flags up issues and presents them in logical order so you can tick them off one by one. It's still work but it's just more intuitive I found

Just did my crypto taxes with @CryptoTaxHQ and got my report summary. Overall, very pleased with the process! Highly recommend if you have not yet decided on what crypto software to use. Did my taxes in a few hours and going to my tax guy tomorrow.

I’ve used a few but the best I found was https://cryptotaxcalculator.io . I’m in UK (I think they’re in Aus) so YMMV. GL

Unlike other tax items where you have to wait for 1099s' or bank statements, you can code all of your Crypto and Defi as soon as the ball drops on new years and get a good estimate of where your taxes lie. @CryptoTaxHQ is still my first recommendation for tools.

2021/2022 taxes completed and paid. Use your bear market time wisely. Big shoutout to @CryptoTaxHQ, second year running I've used them. I've tried a few of these calculators and CTC blow their competitors out the water.

A cryptid is tentatively back from hiatus but will be keeping update frequency low rn. Uncle Sam unretired me 4 a mission to JPN so had to finish taxes early. Got it done thx to #CryptoTaxCalculator (@CryptoTaxHQ). I have no affiliation w/ them. Pls just keep it alive🙏

@CryptoTaxHQ I literally could not function without ctc. I've got multiple assets on multiple blockchains doing 5-10k transactions a year. Doing that by hand would be pure insanity.

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

Trusted By Accountants

Our platform has been developed in deep collaboration with accountants and tax lawyers.

“Crypto Tax Calculator does the job spectacularly”

We’ve been looking for a product to help us manage our clients’ crypto tax returns, and Crypto Tax Calculator does the job spectacularly. Not only does the team keeps on top of all HMRC changes so we can have full confidence in the reports we produce, but their product is an efficient way to bring in a client’s data from a constantly growing multitude of exchanges, blockchains, and wallets. Couldn’t ask for anything better.

Joe David

Founder, Myna Accountants

“Crypto Tax Calculator’s software enables our team to tackle the most complex DeFi scenarios.”

...from liquidity protocols, to NFT ecosystems, and remain at the forefront of crypto tax reconciliation. As specialists in cryptocurrency reporting, accuracy is completely essential to us, our clients and our accounting partners, which is why we love CTC.

Oliver Woodbridge

Director, Tax On Chain

“Crypto Tax Calculator is a tool we couldn’t live without.”

As an accounting firm that specialises in crypto taxes, Crypto Tax Calculator is a tool we couldn’t live without. Being able to aggregate client’s transactions across all exchanges and blockchains into one data feed brings incredible efficiencies to the crypto tax compliance process.

Marc Phillis

Director, Cryptocate

“The most advanced and accurate crypto tax calculator on the market”

“The most advanced and accurate crypto tax calculator on the market”

Harrison Dell

Tax Lawyer & Web 3 Founder - Cadena Legal

Frequently Asked Questions

At CTC, we design our product with security in mind. We follow industry standard best practices to keep your data safe.

What is the best crypto tax software for UK investors?

Crypto Tax Calculator is the top choice for UK investors because it: Complies with HMRC rules, including Bed and Breakfast and Same Day. Handles complex transactions like staking, DeFi, and NFTs. Generates HMRC-ready reports, including SA100 and SA108 forms. Integrates with popular accounting tools like QuickBooks. With automated features and a user-friendly interface, Crypto Tax Calculator simplifies tax reporting, saving you time and reducing errors. Sign up today to experience the difference!

What happens if I miss the crypto tax deadline in the UK?

In the UK, the deadline for filing Self Assessment tax returns is 31 January following the end of the tax year (e.g., 31 January 2026 for the 2024-2025 tax year). Missing this deadline can result in automatic penalties, even if you owe no tax. For instance: Late filing penalties: £100 for up to 3 months late, with additional daily penalties if delays persist. Late payment penalties: Interest accrues from the payment due date, typically 31 January. HMRC may issue higher penalties for deliberate non-compliance or underreporting. To avoid these penalties, ensure you keep accurate records and file your taxes on time. Crypto Tax Calculator can streamline this process by generating HMRC-ready reports, minimising your risk of missing deadlines.

Can I claim tax relief for crypto losses in the UK?

Yes, the HMRC allows you to offset capital losses from cryptocurrency against your capital gains, reducing your overall tax liability. For example: If you sell Bitcoin at a £5,000 loss and Ethereum at a £10,000 gain in the same tax year, you’ll only pay tax on the net gain of £5,000. Unused losses can be carried forward to offset future gains, provided they are reported to HMRC. To claim relief, include your losses in your Self Assessment tax return and maintain accurate records of transactions. Crypto Tax Calculator automates this process, ensuring all eligible losses are applied to reduce your tax burden.

How are staking rewards taxed in the UK?

Staking rewards are treated as income by HMRC and are subject to Income Tax and potentially National Insurance contributions depending if you are operating as a business or not. The taxable value is the market value of the reward in GBP at the time it is received. For example: If you earn 0.1 ETH through staking when ETH is valued at £1,500, the taxable income is £150. When you later sell or dispose of staking rewards, any profit beyond the initial value is subject to Capital Gains Tax. Crypto Tax Calculator simplifies this process by automatically separating income and capital gains calculations, ensuring accurate reporting under HMRC rules.

How do I calculate crypto taxes for airdrops and forks?

Airdrops and forks can be taxed differently depending on the circumstances: Airdrops: If received without any actions, they are subject to Capital Gains Tax at disposal. If earned through tasks, they are treated as income at the time of receipt, with CGT applying at disposal. Hard forks: Assets received through a fork are subject to Capital Gains Tax when disposed of. The cost basis is calculated based on the market value of the forked tokens at the time of receipt. Crypto Tax Calculator tracks these complex events, applying the correct HMRC rules for each scenario, and helps ensure compliance with UK tax regulations.

How can I reduce my crypto taxes?

To legally minimise your crypto taxes in the UK, consider these strategies: Utilise the annual CGT allowance: For the 2024-2025 tax year, the first £3,000 of gains are tax-free. Offset losses: Report capital losses to reduce your overall tax liability. Losses can also be carried forward. Tax-efficient planning: Consider tax-loss harvesting, where you sell underperforming assets to offset gains. But beware of the bed and breakfast rule which is designed to prevent wash sales. Use crypto tax software: Tools like Crypto Tax Calculator help identify opportunities to reduce taxes while staying compliant. Crypto Tax Calculator simplifies tax-saving strategies, including loss tracking and allowance optimisation, ensuring you pay only what's necessary.

Do I need crypto tax software for the UK?

Crypto tax software is advisable for UK investors due to the complexity of HMRC tax rules. For example: The Same Day Rule requires all crypto transactions on the same day to be grouped for calculating the average cost basis. The Bed and Breakfast Rule adjusts gains when crypto is sold and repurchased within 30 days. Manually applying these rules can be error-prone and time-consuming. Crypto Tax Calculator automates the process, calculating taxes accurately while ensuring compliance with HMRC regulations. It also provides HMRC-ready reports, making tax filing faster and more efficient. Alternatively, use our guide on How To Calculate Your Crypto Tax in The UK if you want to calculate your taxes manually.

Does Crypto Tax Calculator support HMRC rules like Bed and Breakfast and Same Day?

Yes, Crypto Tax Calculator is designed to comply with HMRC-specific rules such as the Bed and Breakfast Rule and the Same Day Rule: Same Day Rule: Automatically groups transactions made within the same day and calculates the adjusted cost basis. Bed and Breakfast Rule: Identifies disposals and repurchases within 30 days, adjusting gains or losses accordingly. By automating these calculations, the software reduces errors and ensures your tax reports meet HMRC standards. Generate detailed tax summaries with just a few clicks and save time during tax season.

Does Crypto Tax Calculator software track both income and capital gains taxes?

Yes, Crypto Tax Calculator tracks both Income Tax and Capital Gains Tax (CGT). It categorises transactions based on their tax type: Income Tax: Staking rewards, mining income, or payments received in crypto are calculated based on the market value at receipt. CGT: Disposals like selling or swapping crypto are calculated using HMRC’s average cost basis method. Crypto Tax Calculator simplifies tracking by separating income and capital gains events, ensuring compliance with HMRC rules. It also generates comprehensive reports that include both types of tax liabilities, ready for inclusion in your tax return.

Can Crypto Tax Calculator generate HMRC-ready tax reports?

Yes, Crypto Tax Calculator generates tax reports that are fully compliant with HMRC requirements, including: SA100 (Self Assessment Tax Return): Summarizes income, including crypto earnings, for reporting to HMRC. SA108 (Capital Gains Summary): Breaks down disposals, showing gains or losses for each transaction. These reports are formatted for easy submission to HMRC, saving time and reducing the risk of errors. With detailed transaction records and summaries, you'll have all the information needed for a stress-free tax filing experience.

What types of transactions can Crypto Tax Calculator handle?

Crypto Tax Calculator supports a wide range of transactions, including: Trading: Buying and selling crypto on exchanges. Staking: Rewards earned from staking activities. Mining: Income from mining cryptocurrencies. Airdrops: Tokens received through promotional events. NFTs: Buying, selling, and holding non-fungible tokens. DeFi activities: Including lending, borrowing, and liquidity pools. The software identifies taxable events, applies HMRC rules, and calculates both income and capital gains for accurate tax reporting.

Can I use Crypto Tax Calculator for previous tax years?

Yes, Crypto Tax Calculator supports retroactive calculations for prior tax years with a single subscription, helping you: Correct missed or inaccurate filings. Report gains and losses from earlier transactions. Carry forward unused capital losses to offset future gains. The software ensures compliance with historical HMRC rules and generates reports tailored to the tax regulations of the relevant year. Whether you're catching up or filing amended returns, Crypto Tax Calculator simplifies the process.

What crypto tax software integrates with accounting tools like QuickBooks?

Crypto Tax Calculator's business product integrates with popular accounting tools like QuickBooks and Xero allowing you to: Import transaction data directly into your accounting software. Track crypto-related income and expenses alongside traditional finances. Generate consolidated reports for tax filings and business accounting. These integrations streamline bookkeeping for both individual investors and businesses, reducing administrative workload while maintaining compliance with UK tax laws.

How does HMRC track cryptocurrency transactions?

HMRC uses advanced tools and methods to monitor crypto activity, including: Exchange data: HMRC requires exchanges operating in the UK to share user data. Blockchain analytics: Sophisticated tools trace transactions across public blockchains. International cooperation: Data-sharing agreements with foreign tax authorities enhance visibility into offshore holdings. Using Crypto Tax Calculator helps ensure all transactions are accurately reported, minimising the risk of discrepancies or penalties.

Do I need to report crypto held on foreign exchanges?

Yes, UK residents must report all global crypto holdings, including those on foreign exchanges. HMRC requires: Detailed records: Include the market value in GBP of all crypto assets held. Tax on disposals: Gains from selling or swapping crypto on foreign platforms are subject to UK tax rules. Crypto Tax Calculator simplifies compliance by converting foreign transactions into GBP and applying HMRC's tax guidelines, ensuring nothing is overlooked in your report.

Get started for free

Import your transactions and generate a free report preview

No credit card required