Need help with your Bitcoin taxes? Use Crypto Tax Calculator to calculate your capital gains and get a tax report ready for the IRS or TurboTax.

The IRS treats Bitcoin as property, meaning any profit you make when disposing of it is subject to capital gains tax. But not all gains are taxed equally.

If you held your Bitcoin for more than a year, you may qualify for long-term capital gains rates, which are typically much lower than short-term rates.

Understanding the difference between short-term and long-term capital gains can help you reduce your tax bill and time your crypto transactions more strategically.

In this guide, we’ll break down exactly how Bitcoin capital gains are taxed in the U.S., with clear examples to help you navigate the rules for the 2024 and 2025 tax years.

Bitcoin Capital Gains Tax

When you dispose of Bitcoin that you held as an investment (e.g., sell it), the profits (or losses) are treated as capital gains (or losses). The tax rate you pay on a Bitcoin gain depends on your holding period:

- Short-term: Held for 1 year or less before selling and taxed at ordinary income tax rates.

- Long-term: Held for more than 1 year before selling and taxed at capital gains tax rates.

This distinction is crucial.

Long-term capital gains rates are significantly lower than short-term rates for many people.

For example, a $10,000 Bitcoin profit taken as a short-term gain might be taxed at 22% (if that’s your income bracket), whereas if the same profit were long-term, it might be taxed at 15% or even 0%.

Timing your crypto sales to qualify for long-term treatment can save a lot in taxes – in this case, possibly thousands of dollars.

{{bitcoin-capital-gains-tax-callout-1}}

{{bitcoin-capital-gains-tax-cta-1}}

Short-Term vs. Long-Term Tax Rates

Short-term capital gains tax

If you hold Bitcoin for 1 year or less before selling (starting from the day after you acquire it to the day you dispose of it), it’s a short-term gain.

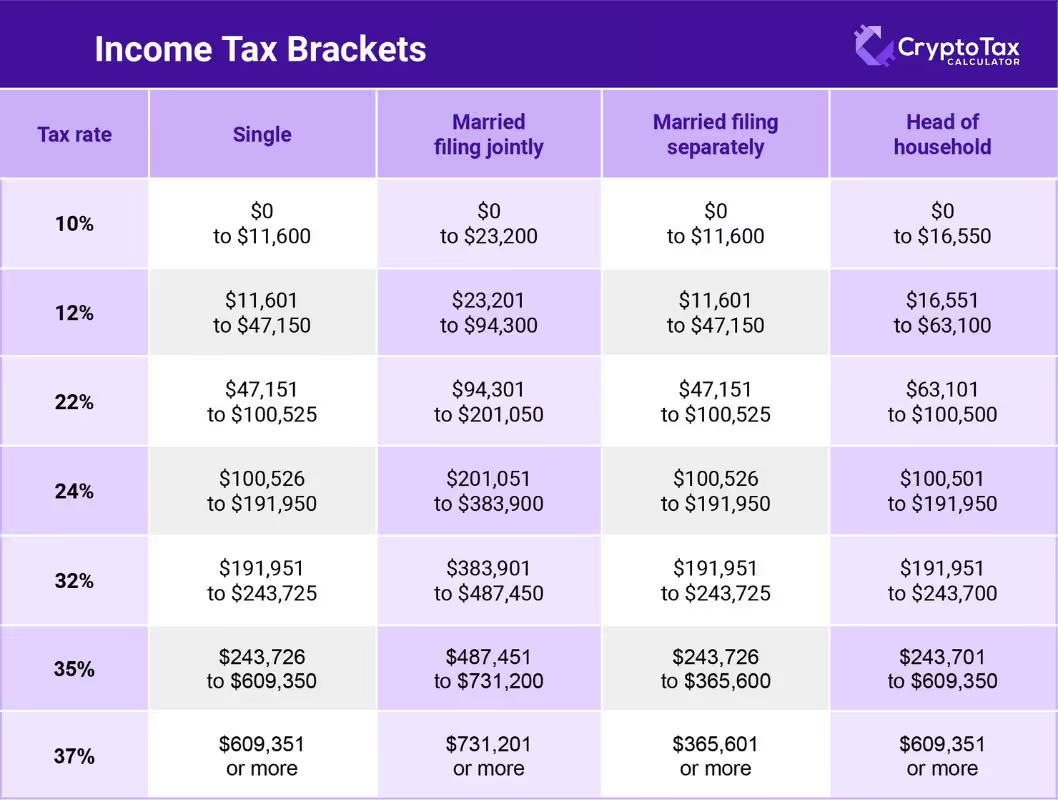

Short-term gains are taxed at your ordinary income tax rates. This rate is based on your income tax bracket for the year (ranging from 10% up to 37% federally).

Short-term tax example:

You bought 1 BTC in June 2024 for $50,000 and sold in December 2024 for $60,000. That $10,000 gain is short-term and would be added to your other income. If you’re in, say, the 24% tax bracket, that gain might cost you about $2,400 in federal tax.

Long-term capital gains

If you have held Bitcoin for more than 1 year before selling it, it’s a long-term gain.

Long-term gains benefit from lower tax rates – 0%, 15%, or 20% at the federal level, depending on your total taxable income. High-income taxpayers pay 20%, most middle-income folks pay 15%, and some lower-income taxpayers pay 0% on long-term gains.

Long-term tax example:

You bought 1 BTC in June 2022 for $50,000 and sold in July 2024 for $60,000. That $10,000 is long-term. Suppose your income puts you in the 15% capital gains bracket – you’d owe $1,500 in federal tax on the gain. If your income was low enough, you might owe 0%. Even if you’re a high earner in the 20% bracket, that’d be $2,000, still less than the short-term scenario.

In addition to federal tax, remember state taxes may apply to crypto gains (most states tax capital gains as ordinary income). Also, very high earners might owe an extra 3.8% Net Investment Income Tax on crypto gains, which applies to singles with income of more than $200,000, married couples filing jointly with income of more than $250,000, and married couples filing separately with income of more than $125,000.

Bitcoin Tax Brackets

The tax rate that applies to your Bitcoin transactions depends on a few key factors, including whether you have income or a capital gain, how long you held your Bitcoin before selling, and your taxable income for the year.

Short-term capital gains and Bitcoin income

Your Bitcoin income and short-term capital gains (meaning gains on crypto you held one year or less) are taxed exactly the same way. They’re both taxed at your ordinary income tax rate, just like the income you receive at your job. These tax rates range from 10% to 37%, and the amount you’ll pay depends on your household income.

Keep in mind that Bitcoin income or a short-term gain could push part of your income into a higher tax bracket. For example, if your taxable income was $100,000 but you have $10,000 of Bitcoin income, you’ve moved from the 22% to the 24% marginal tax bracket.

Don’t worry though — you’ll only pay the higher rate on the portion of your income that falls into that higher tax bracket. It won’t affect the way the rest of your income is taxed.

Long-term capital gains

Long-term capital gains, meaning gains on assets you’ve held for at least one year, are taxed at either 0%, 15%, or 20%. The rate you’ll pay depends on your taxable household income. The table below breaks down the three capital gains tax brackets and their corresponding income ranges.

Other Bitcoin tax rates

In addition to federal income and capital gains taxes, there are other taxes you could be subject to as well. Here are some other taxes to consider:

- Net Investment Income Tax (NIIT): If you have high income (over $200k single / $250k joint), you may owe an extra 3.8% NIIT on investment income, including crypto gains. This effectively makes the top long-term rate 23.8% and the top short-term rate 40.8% for the wealthiest taxpayers.

- State taxes: Don’t forget your state. States like California tax capital gains at the same rate as regular income (which can be another 10%+ for top earners). Some states have no income tax, which is obviously favorable for crypto gains. Plan accordingly if state tax is significant.

- Important: The tax brackets and thresholds often adjust slightly each year for inflation. Always check the latest figures when filing. The rates (0%,15%,20%) for capital gains remain fixed by law, but the income ranges they apply to edge up annually.

Bitcoin Capital Gains Tax Events

Many people buy and sell Bitcoin on exchanges or trade BTC for other cryptocurrencies. It’s important to know that every trade or exchange is a taxable event under U.S. tax law. Here’s what that means in practice:

Selling Bitcoin for USD

When you sell BTC for dollars, you have a capital gain or loss based on the difference between your cost basis and the amount you receive when you sell it. In most cases, your cost basis is the price at which you purchased the Bitcoin, but could also include trading fees.

For example, if you purchase $1,000 of BTC and sell it later on for $1,500, you have a capital gain of $500 and will have to pay capital gains taxes on that amount. On the other hand, if you sold the BTC for $750, you would have a capital loss of $250 and could use that to offset your gains, ultimately reducing your tax liability.

Trading Bitcoin for other crypto

The IRS considers trading crypto for crypto as two transactions: you “sold” your Bitcoin (triggering a gain/loss) and you “bought” the new crypto.

So if you trade 0.1 BTC for 2 ETH, you calculate gain/loss on the 0.1 BTC as if you sold it for the market value of 2 ETH at that time. That gain/loss is taxable. The market value of the ETH (in USD) becomes your basis for those ETH going forward. Crypto-to-crypto trades do not avoid taxes – they are taxable events.

Using Bitcoin to buy something

As discussed, spending BTC is essentially the same as selling it, at least in the eyes of the IRS. If you use Bitcoin to buy a car, pay a bill, or any other purchase, it’s a taxable disposition of that BTC. The IRS made it clear that using crypto for purchases triggers capital gains or losses just like selling it for cash.

There is currently no de minimis exemption, so whether it’s a $5 coffee or a $50k car, it’s technically reportable. Proposed legislation might exempt small crypto purchases in the future, but not yet.

Exchanging Bitcoin for stablecoins

Exchanging Bitcoin for stablecoins is treated exactly the same as disposing it or swapping it for any other cryptocurrency. You treat it as selling BTC for the dollar value of the stablecoin you got. You’ll pay capital gains taxes on the difference between your cost basis in the BTC and the value of the stablecoin you receive.

Converting wrapped Bitcoin

Even moving BTC to another format can be taxable. For instance, converting BTC to WBTC (Wrapped Bitcoin on Ethereum) could be seen as trading one asset for another (since WBTC is a token distinct from BTC).

In practice, some argue it’s just a custodial change, but until the IRS provides clarity, it’s safest to treat wrapping/unwrapping as a taxable event (and many tax professionals do). Essentially, if you exchange BTC for any different token, assume it’s taxable.

Non-taxable events

Moving your own Bitcoin between wallets or exchanges (transfers) is not taxable. For example, transferring BTC from your Coinbase account to your private wallet isn’t a sale – it’s just a transfer, no different from moving your stock shares from one brokerage account to another without selling them. Just make sure to keep notes so you can later match that withdrawal and deposit as the same coin.

Additionally, buying Bitcoin with fiat is not a taxable event by itself. Tax only comes into play when you dispose of Bitcoin or receive crypto as income.

Bitcoin Income Tax Events

Not all Bitcoin-related tax events are capital gains. Some are ordinary income.

Important: All Bitcoin income needs to be reported in USD on your tax return for the year received. Exchanges or platforms may issue a Form 1099-MISC or other forms if you meet certain thresholds (e.g. Coinbase issues 1099-MISC for staking/interest over $600). But even if you don’t get a form, you are responsible for reporting the income. Good record-keeping is crucial. Note the date, amount of BTC, and USD value for each instance of income.

Here are common scenarios where Bitcoin is taxed as income:

Mining income

Mined Bitcoin is taxable as income upon receipt. When a block reward or mining payout hits your wallet, you should record its USD value at that time. That value is gross income to you.

If you mine as a business, you would report the income on Schedule C (and you can deduct related expenses like equipment and electricity, with net profit also subject to self-employment tax). If you mine as a hobby or on a small scale, report the income as other income on your 1040 (expenses might not be deductible in that case).

Either way, after you’ve recognized the mining income, that amount becomes your cost basis for those mined coins. Later, if you sell the mined Bitcoin at a different price, you’ll have a capital gain or loss on that sale.

Staking rewards and interest

While Bitcoin itself doesn’t have staking, you might earn yield on your BTC through various platforms (like interest-bearing accounts or DeFi protocols that use BTC). Any interest or reward paid in Bitcoin is taxable income at the moment you receive it, measured in USD.

For example, if you have 0.5 BTC in a lending platform and it pays you 0.005 BTC (worth $150) in interest over a year, that $150 is ordinary income. Some people analogize this to “staking” income or “yield,” but the tax treatment is the same as interest or reward income. You'd report it just like bank interest (though if it’s substantial or business-like, it could go on Schedule C). The point is: additional BTC you receive (that you didn’t purchase) is income.

Airdrops

If you receive new coins or tokens for free that are airdropped into your wallet, that’s taxable income. This could happen on Bitcoin (though more common on other chains) if, say, a new token is airdropped to BTC holders or someone randomly sends you crypto.

The IRS has stated that airdrops are taxable at fair market value when you have dominion over the coins. So if you received some promotional token worth $100, you have $100 of miscellaneous income. That $100 becomes your basis in the token for when you sell it later.

If an airdrop has no market value at receipt – meaning it’s not yet tradable – you might delay recognition until it does, but that can be a gray area. Most airdrops that have any liquidity are considered taxable immediately.

Bitcoin forks

When a hard fork of Bitcoin occurs, it can result in taxable income. The IRS has clarified that if you receive new cryptocurrency from a fork, you have to recognize it as ordinary income at the moment you have control over it. The income amount is the fair market value of the new coins when they’re credited to you.

For example, when Bitcoin Cash (BCH) split from Bitcoin, anyone who received BCH in their wallet had to report that BCH’s value as income.

If you don't actually receive any new coins (for instance, your exchange doesn't support the fork and never gives you the new crypto), then you have no income from that event. Simply holding Bitcoin through a fork doesn't create income unless new coins come into your possession.

After you acquire forked coins, those coins establish a cost basis equal to the income reported. Any later sale of those coins will trigger a capital gain or loss.

Notably, a fork does not affect your original Bitcoin's cost basis or taxes — your BTC itself isn't taxed at the time of the fork (you still hold it at the same basis as before). Only the new assets from the fork are taxable when received.

Salary or payments in Bitcoin

If an employer pays you in BTC, or a client pays you in BTC for work, that is wage or self-employment income just as if they paid you in dollars. You should receive a W-2 or 1099 reflecting the USD value of the Bitcoin on payday. You’ll owe income tax (and payroll tax) the same as normal.

For instance, if you did freelance work and earned 0.1 BTC when it was worth $2,500, you have $2,500 of income. If you later sell that BTC for $3,000, you have a $500 capital gain. Note that getting paid in crypto does not dodge any taxes – it’s simply income in a different form.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Crypto Tax Calculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.

.jpg)