Multiple methods below

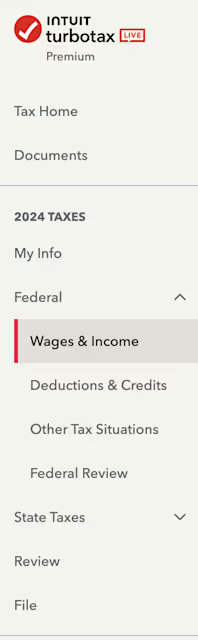

As of February 2025, TurboTax has two different main page layouts upon login. This article covers both layouts. If the sidebar shown in Layout 1 is not visible on your screen, please skip ahead to Layout 2.

As of February 2025, TurboTax has two different main page layouts upon login. This article covers both layouts. If the sidebar shown in Layout 1 is not visible on your screen, please skip ahead to Layout 2.

Earnings from yield farming or lending crypto in DeFi platforms are taxed as income at the time they are received. However, depositing into and withdrawing from a liquidity pool may be treated as a disposal, which is a capital gains event.

Receiving cryptocurrency as payment for goods or services is treated as income at its market value when received. There are instances where the “value” of the work will be taxed instead of the value of the crypto received. Professional advice should be taken if you are unsure.

If you actively participate to receive an airdrop (e.g., completing tasks), the tokens are treated as income at their market value upon receipt.

Mining rewards are taxed as income. Those undertaking mining activities to an extent to which they are operating a business will be subject to additional tax obligations.

Cryptocurrency earned through staking is considered income at the market value at the time of receipt.

Adding liquidity: If adding assets to a liquidity pool results in a change of ownership or creates a new token (e.g., LP tokens), it may be considered a taxable disposal, with CGT applying to any gains. The answer to this can usually be found within the terms and conditions of the protocol.

Removing liquidity: Removing assets from a liquidity pool may also be a disposal, potentially triggering CGT based on the gain or loss relative to the cost basis.

Liquidity pool rewards are generally treated as taxable income upon receipt, subject to Income Tax.

Selling tokens received through an airdrop is a taxable disposal.

Tokens received without any action (eg, unsolicited distributions) are not taxed as income upon receipt. Instead, they are subject to Capital Gains Tax (CGT) when sold, with the cost basis typically being zero or the fair market value at the time of receipt if explicitly stated by HMRC.

Tokens earned through performing tasks (eg, completing activities) are taxed as income at the market value in GBP upon receipt. When sold, the gain or loss is subject to CGT, calculated using the market value at receipt as the cost basis.

Disposing of NFTs is treated similarly to crypto disposals, with gains subject to CGT.

Gifting crypto to someone triggers CGT based on the market value at the time of the gift. Gifting to registered charities or your spouse or civil partner does not trigger a taxable event. Here, we have often seen individuals gifting tokens to others but keeping them in their own wallet. If this is the case, it is very important to document the gift. Consider speaking to a tax advisor if you are uncertain of your position.

Spending cryptocurrency on goods or services is considered a disposal.

Exchanging one cryptocurrency for another (e.g., BTC for ETH) is treated as a disposal for tax purposes.

Any profit made when you sell crypto for fiat currency (e.g., GBP) is a taxable event.

In most cases of buying and selling cryptocurrency as a retail investor, you are participating in investing rather than trading. The two are treated differently for tax purposes.

The key difference between investing and trading – along with the different tax treatments, is how losses generated in the crypto-activity can be used.

In their guidance, HMRC have explicitly stated that they would expect it to be exceedingly rare that any crypto-activity constituting buying & selling crypto would be classified as “trading”.

If you are uncertain, speak to a tax advisor as there are always exceptions, including but not limited to, developing tokens and large scale mining.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto.

A

B

C

F

G

M

N

O

P

S

T

U

This guide shows you two methods for uploading your crypto tax information to TurboTax. Updated for 2025.

Given the popularity of TurboTax in the US and Canada for tax reporting, you'll probably want to learn how to report your crypto profit or loss alongside your regular income and capital gains.

To comprehensively report your crypto on Turbo Tax, you will need to upload both a crypto capital gains report and a crypto income report.

You can get both of these reports from Crypto Tax Calculator, which supports both the Desktop and online versions of the TurboTax app.

Here's a quick overview of how to file your crypto tax in TurboTax. Read on for detailed step-by-step instructions with screenshots of the TurboTax software.

{{turbotax-callout-1}}

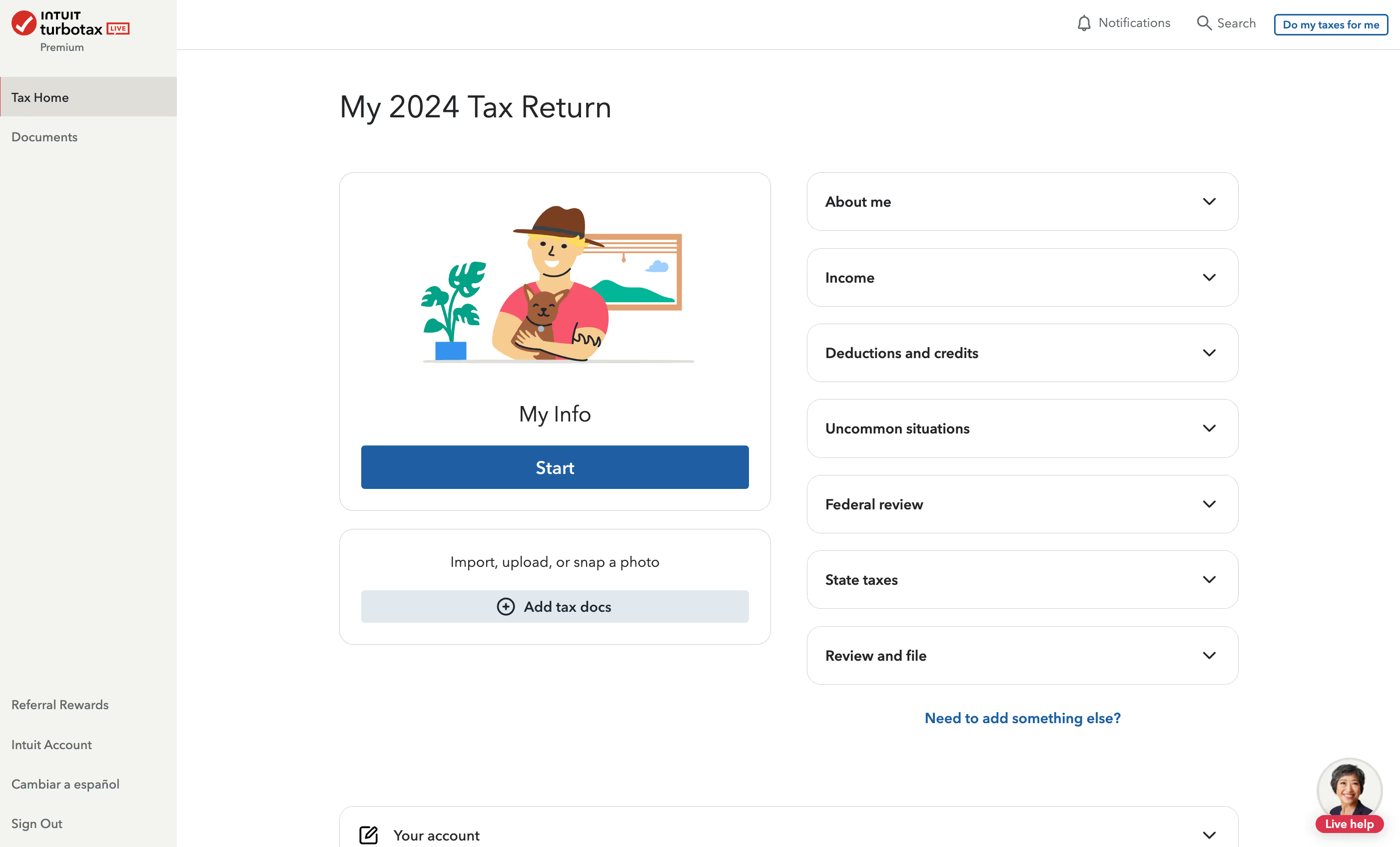

Go to the TurboTax website and create an account or sign in if you already have one. Follow the prompts to set up your account. Make sure to check the box for "I sold stock or crypto" or a similar option if it’s available.

Click on the Federal Tab on the sidebar once you have completed the “My info” section to start filing your wages and income. Follow the prompts and check crypto investment-related boxes.

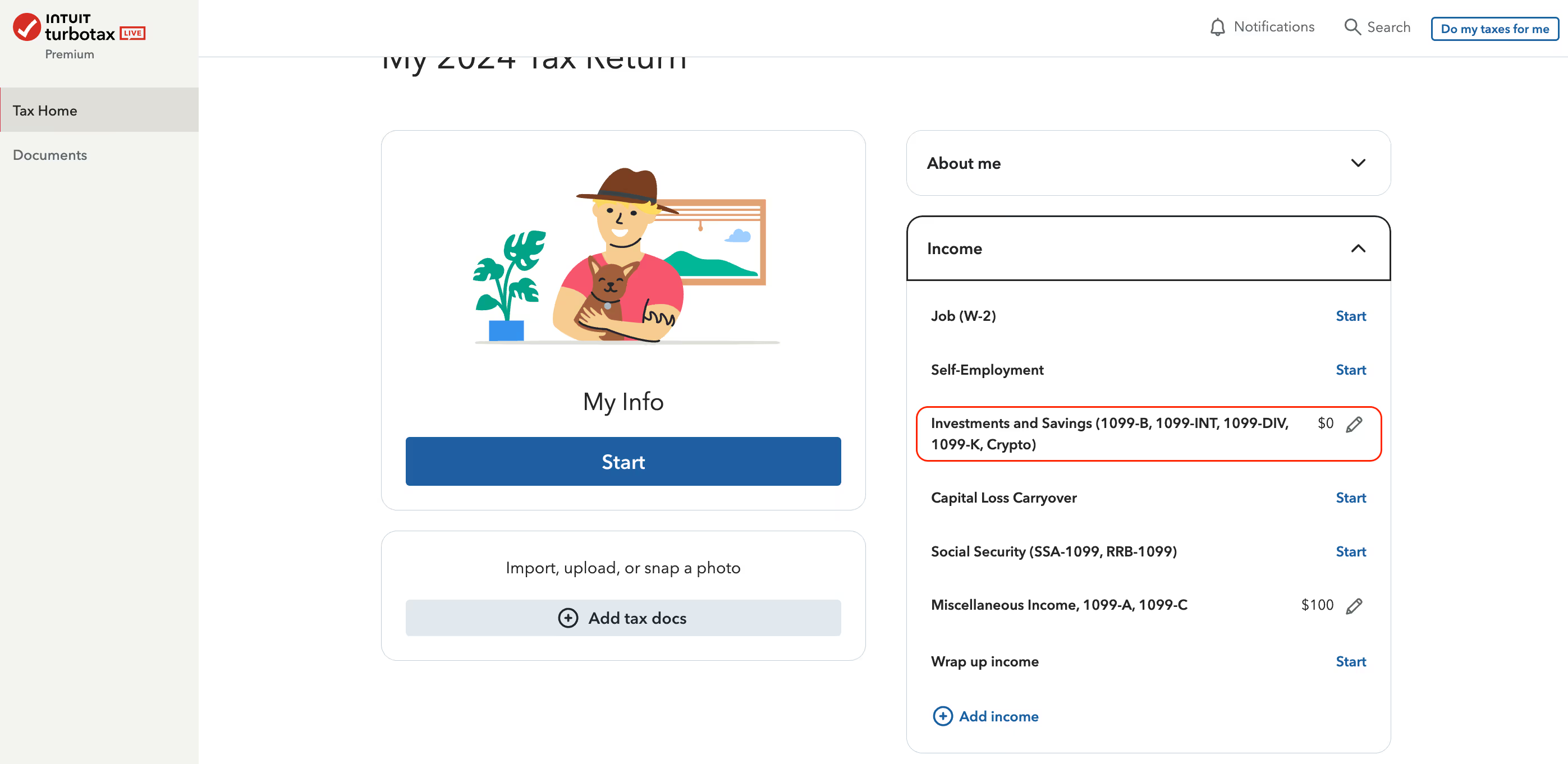

TurboTax updates its website from time to time and provides different workflows tailored to its users' individual situations. After prompts, you will be led to a page that looks similar to the image below. Click Start on Investments and Savings and answer the questions accordingly.

If you don’t see this option, scroll down and look for Investments and Savings to get started.

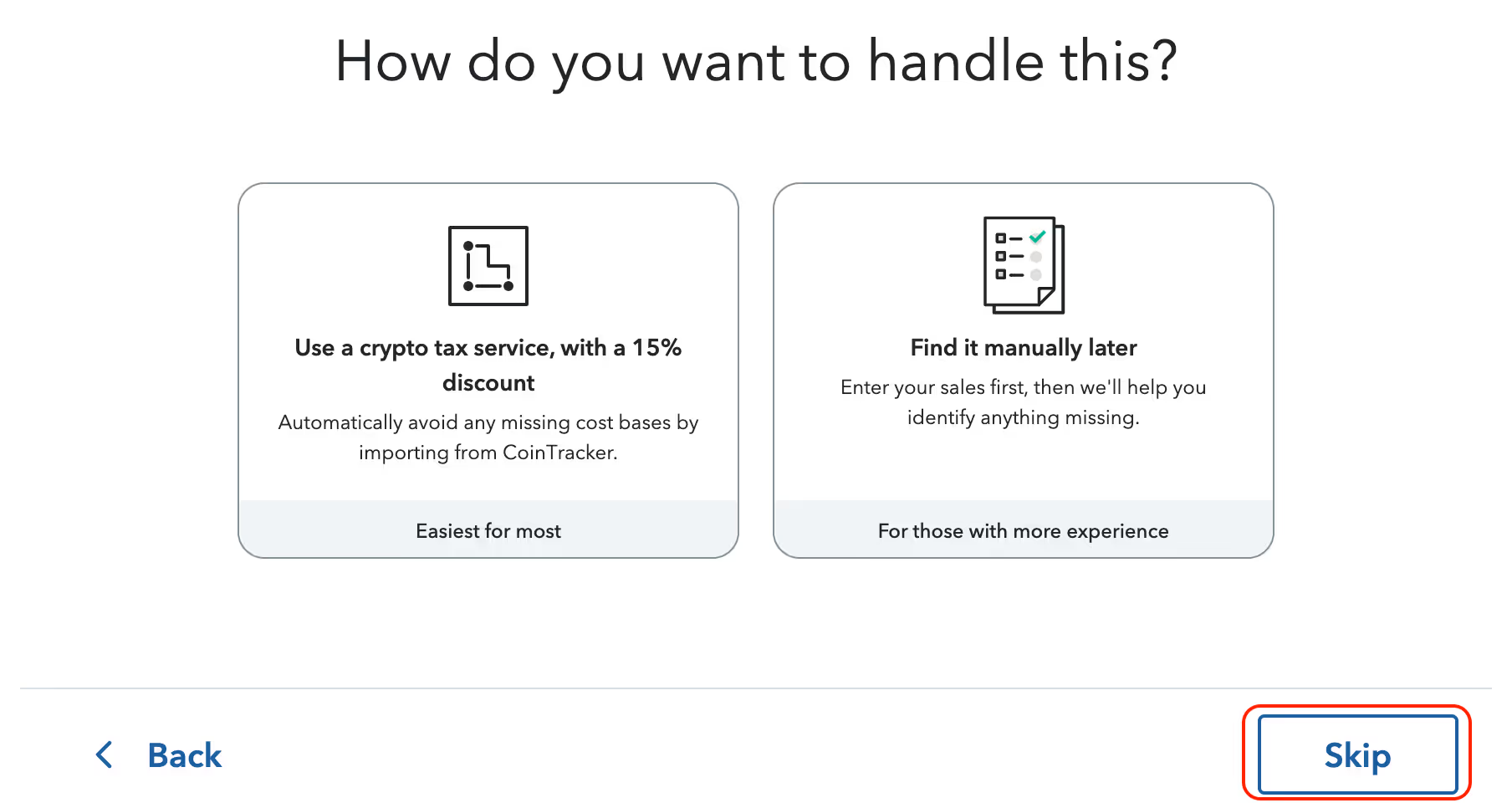

When asked how to handle it, click Skip.

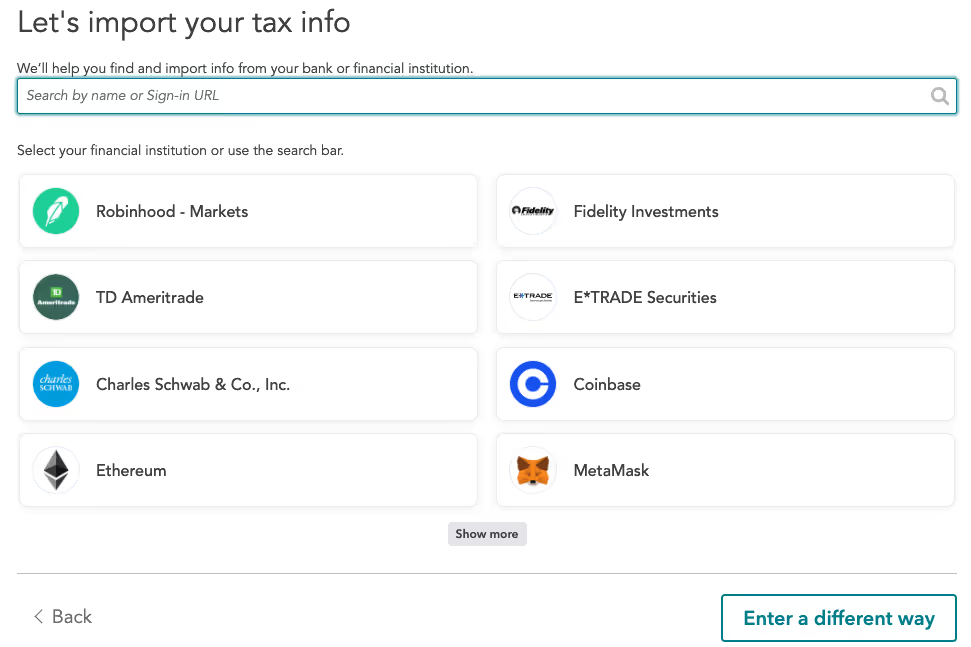

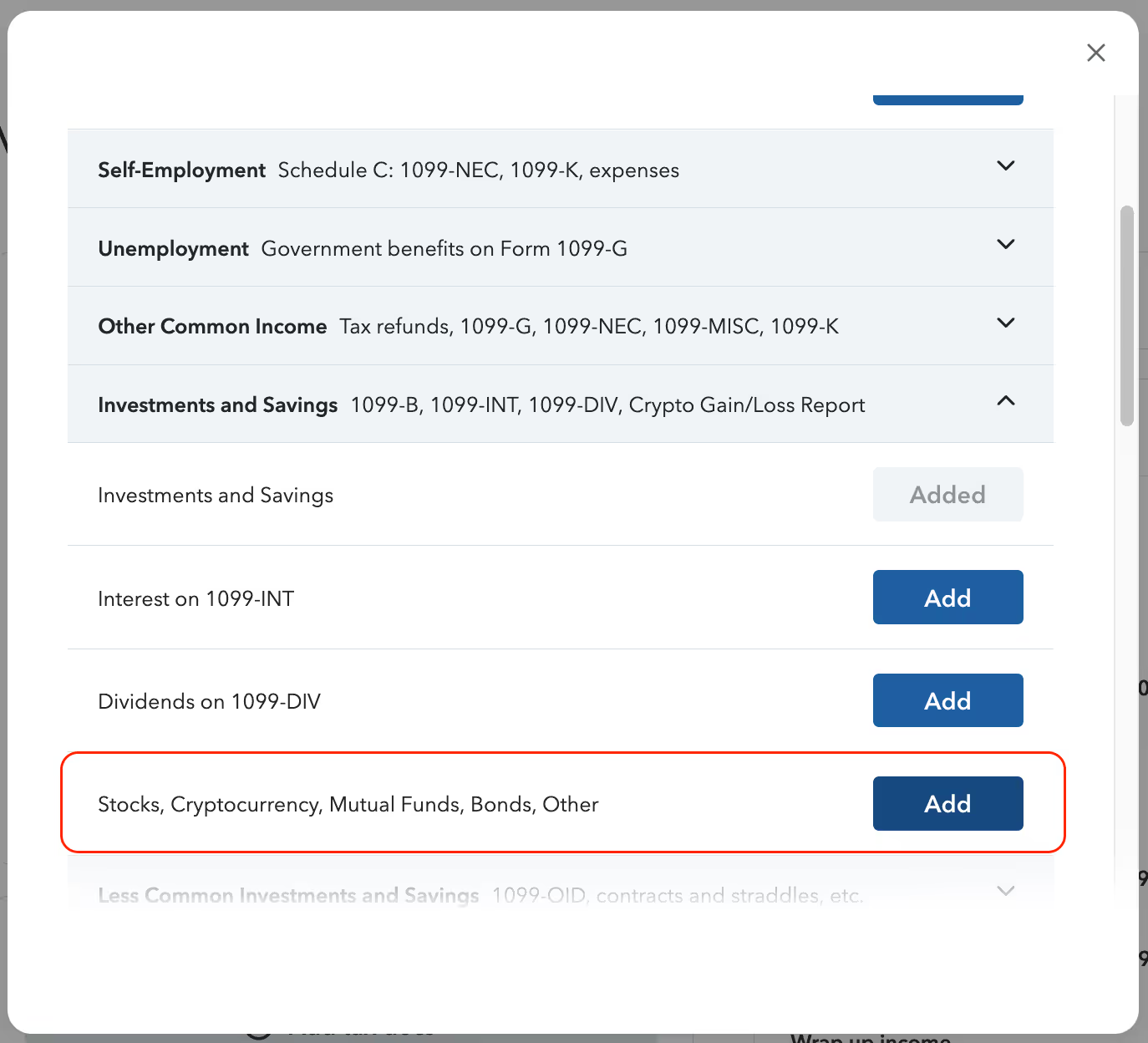

You will be prompted to choose which cryptocurrency service to import your information. Select Enter a different way.

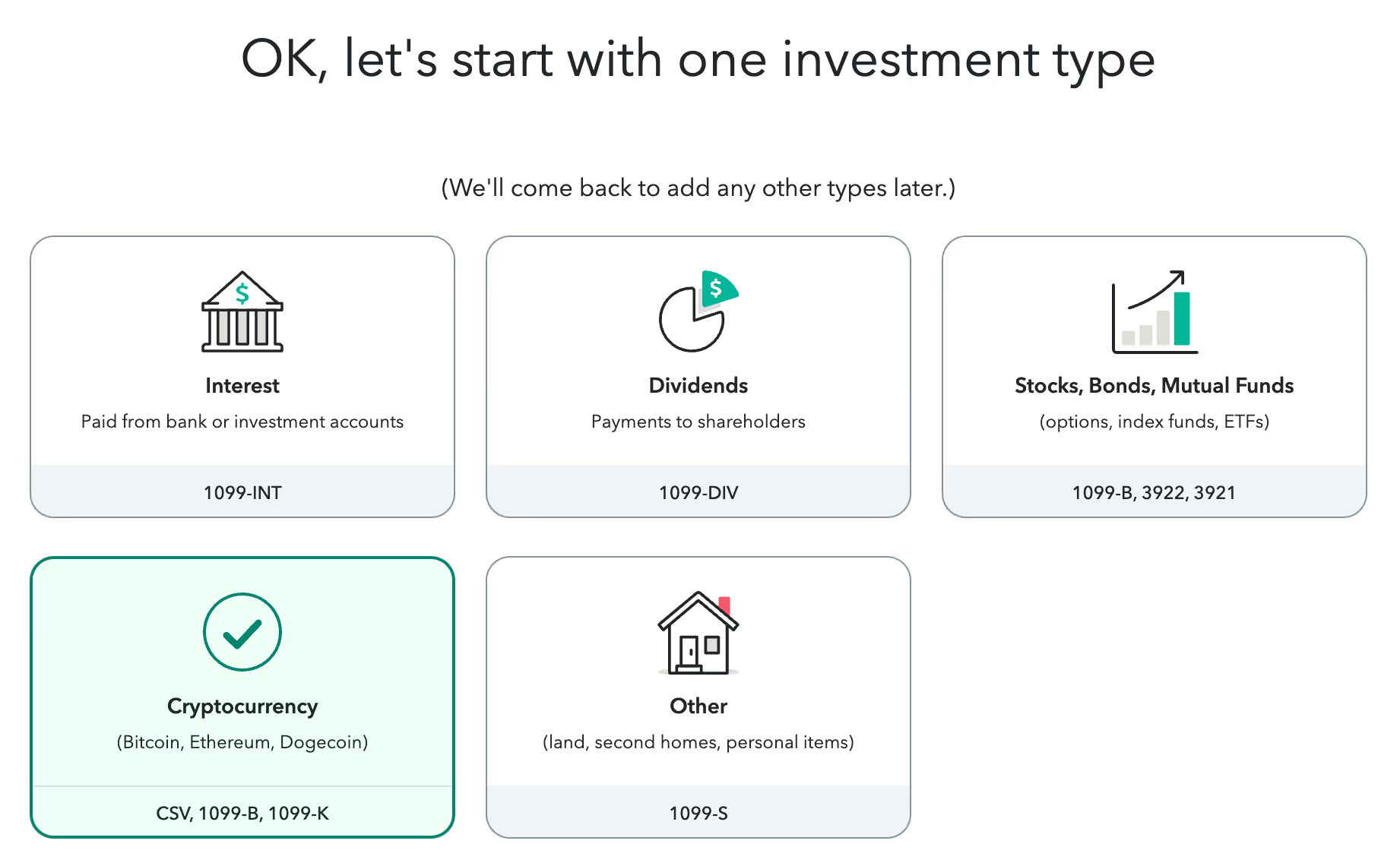

Then select Cryptocurrency.

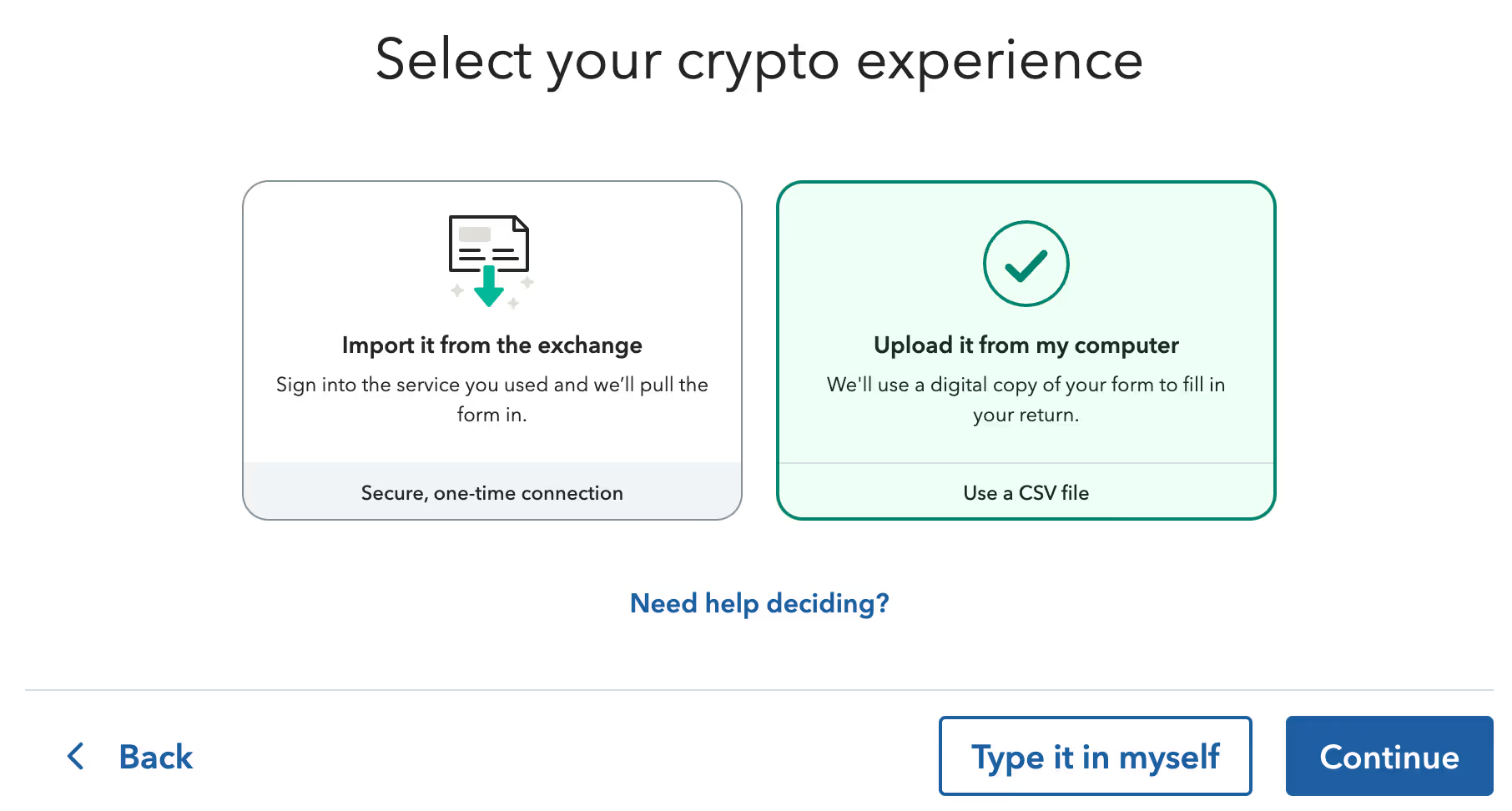

Then select Upload it from my computer.

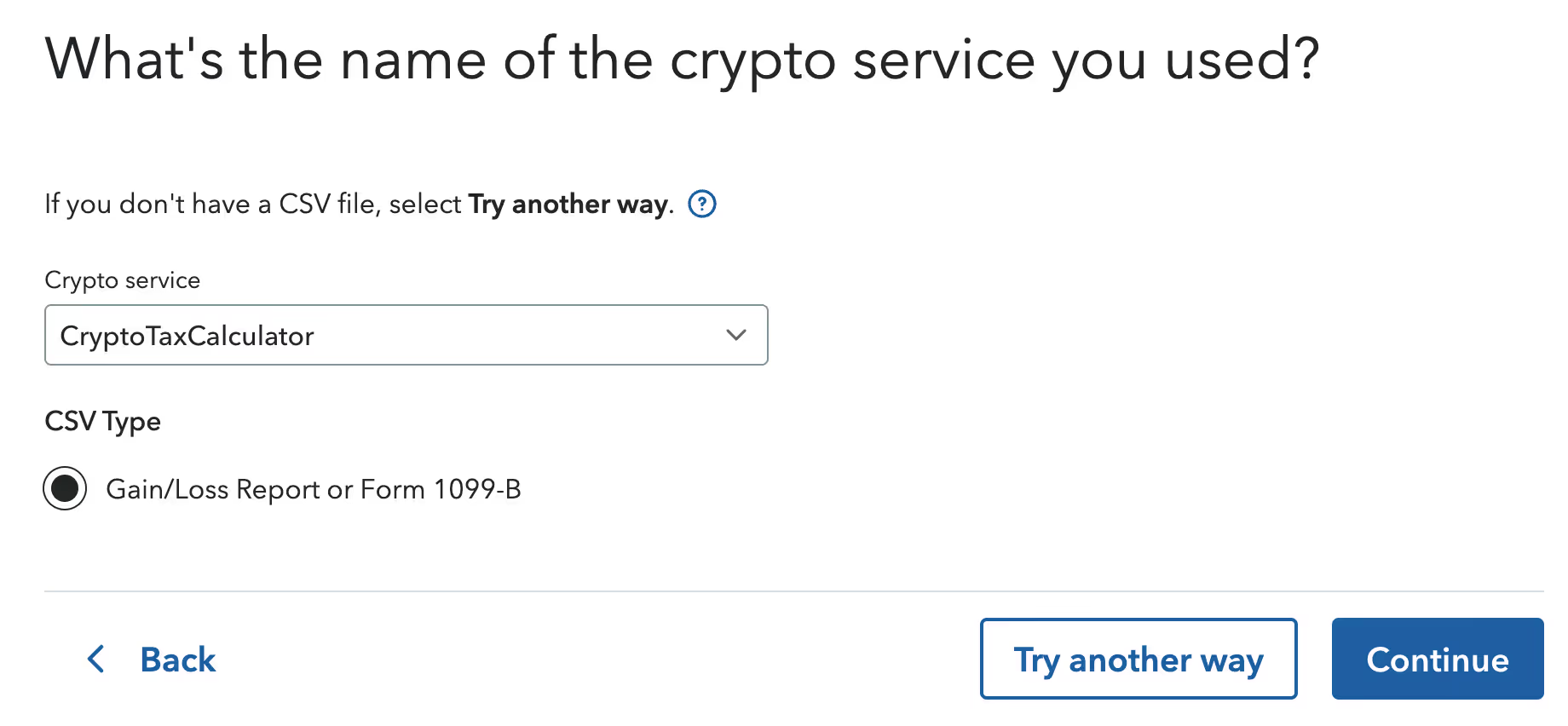

Select CryptoTaxCalculator in the 'Crypto service' dropdown menu, and select Gain/Loss Report or Form 1099-B as your CSV Type, and click Continue.

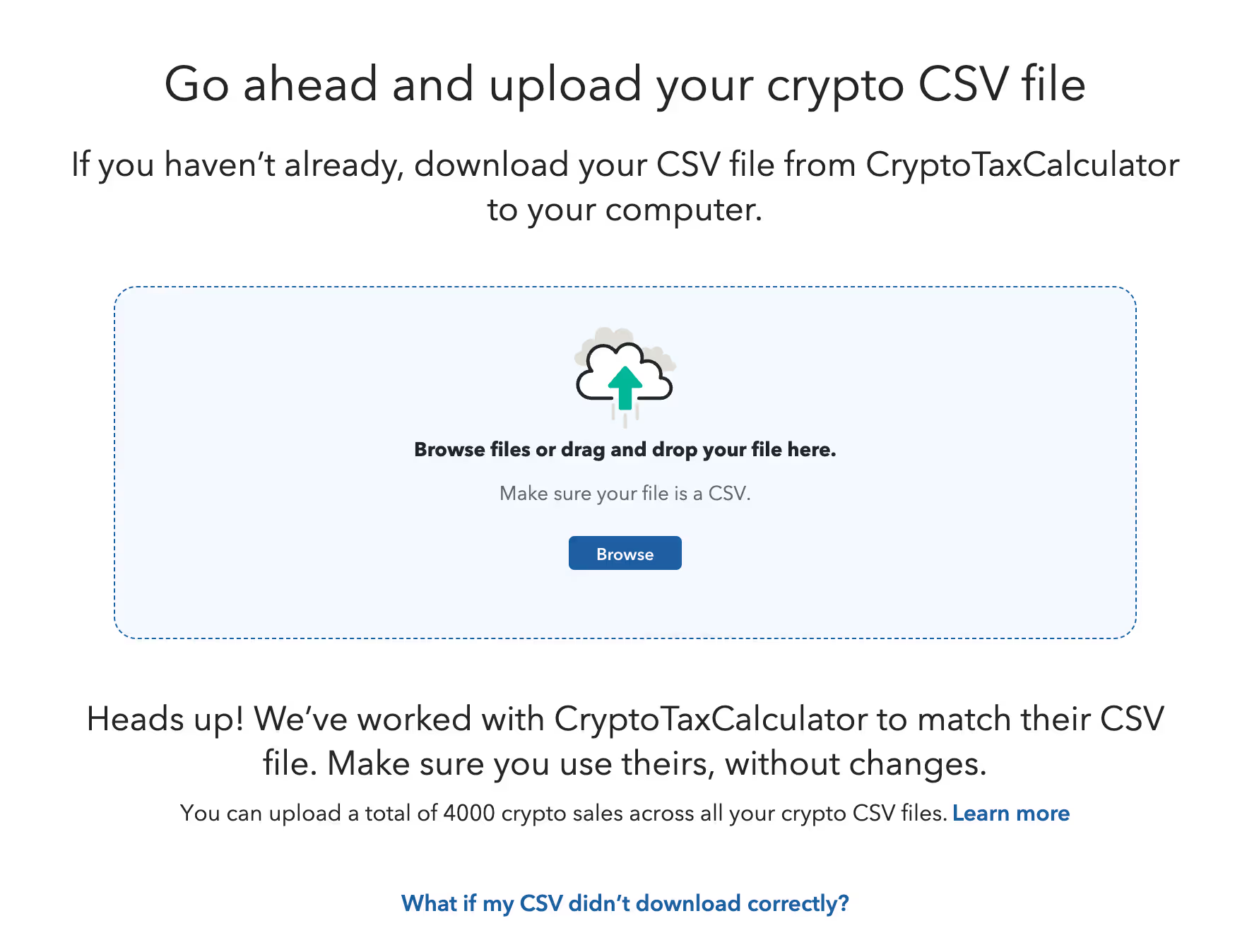

If you have already downloaded the TurboTax file from Crypto Tax Calculator onto your computer, you can now upload it to TurboTax.

If you have not downloaded this form yet, follow the below steps to download the TurboTax Online report from your CTC account and import it directly into TurboTax:

Once the file is uploaded, you can review the imported transactions. A few things to be noted:

{{turbotax-cta1}}

Note: TurboTax has two different main page layouts. If your screen looks different from the one shown below, please follow the instructions in this section instead.

After setting up your account and logging in, you should see the following page.

Click the edit icon next to Investments and Savings and answer the questions based on your situation.

If you don’t see this option in the dropdown menu, click Add income, then select the Investments and Savings category that includes cryptocurrency.

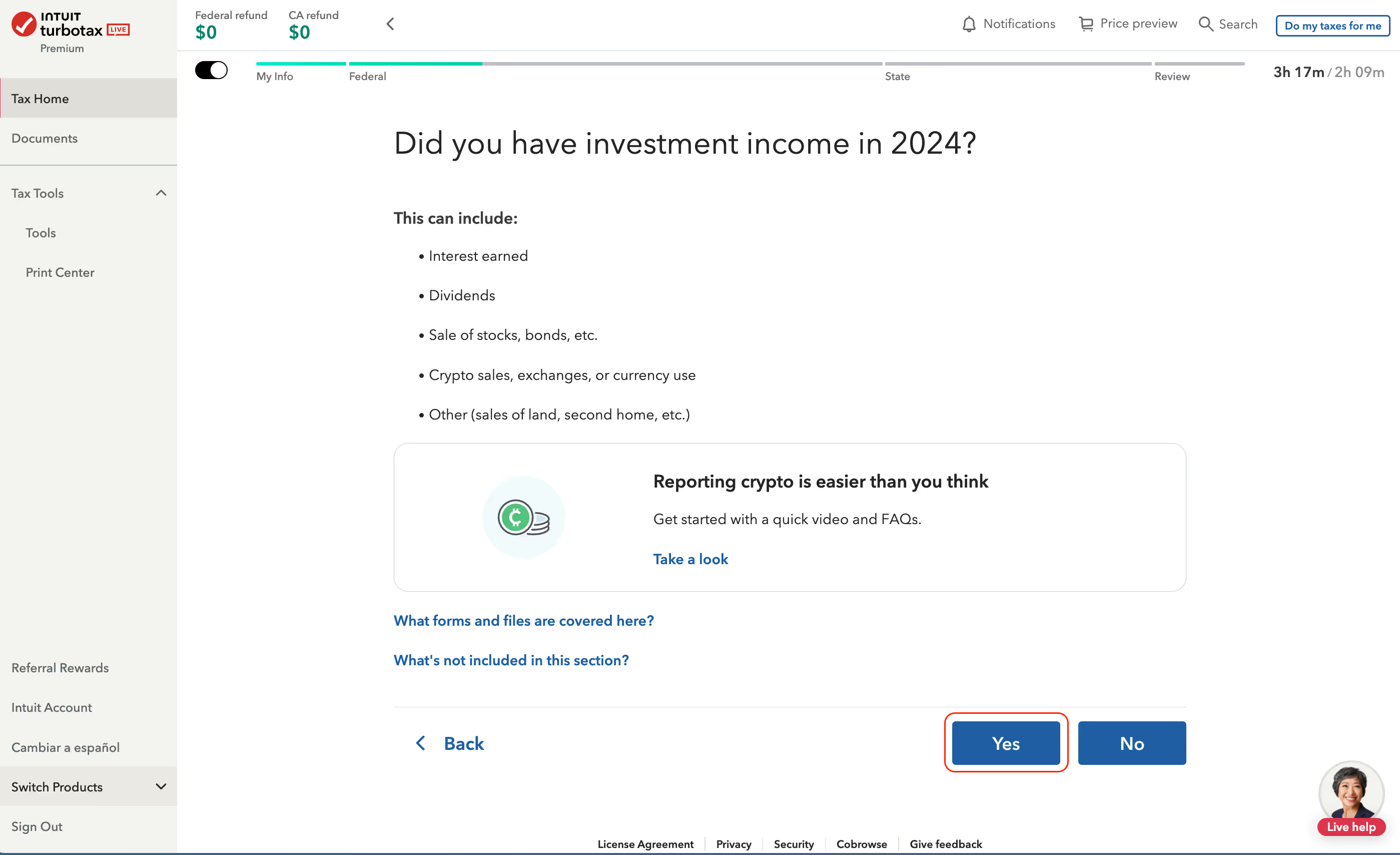

Select Yes to proceed.

Return to Step 4 in the section above and continue with the instructions.

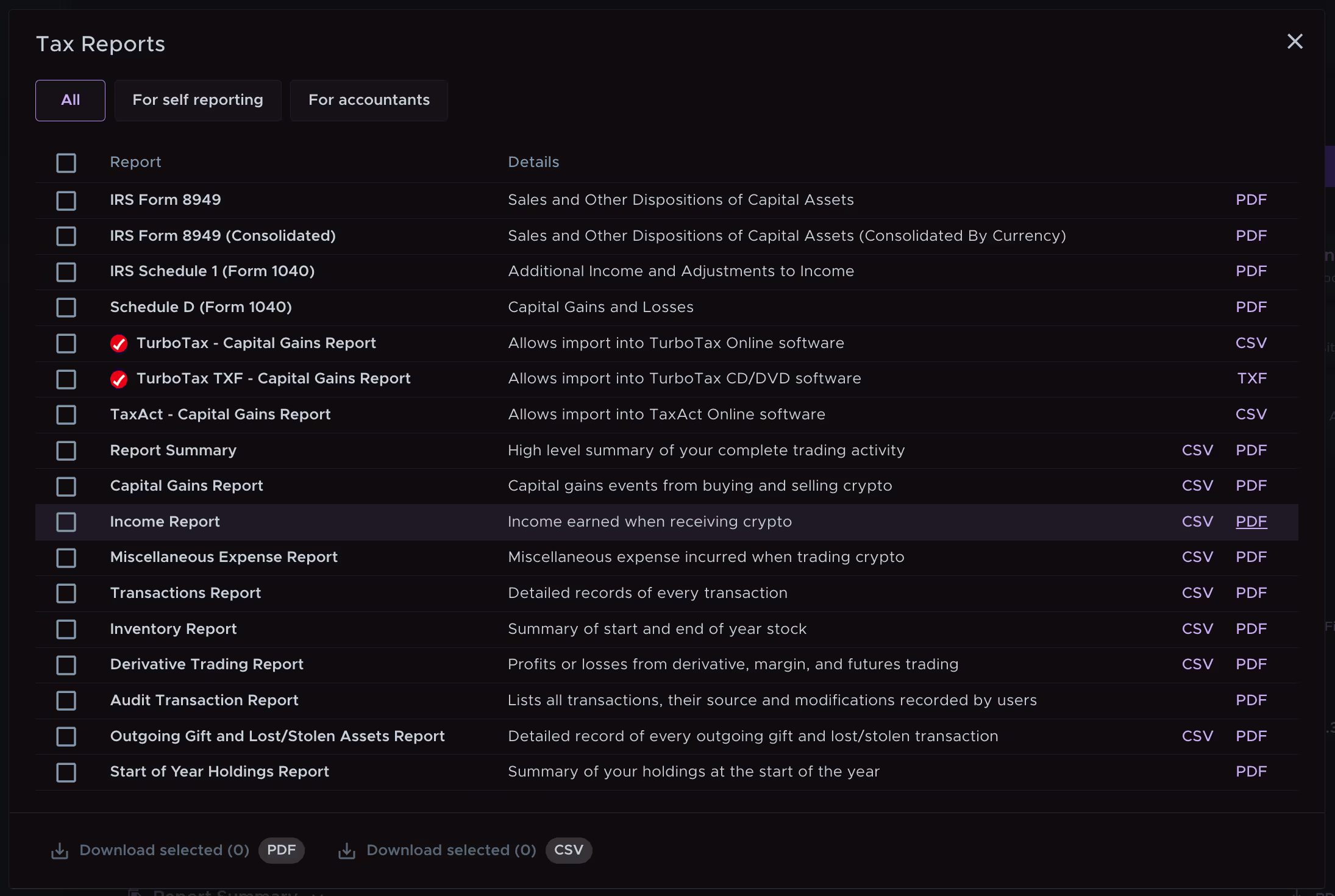

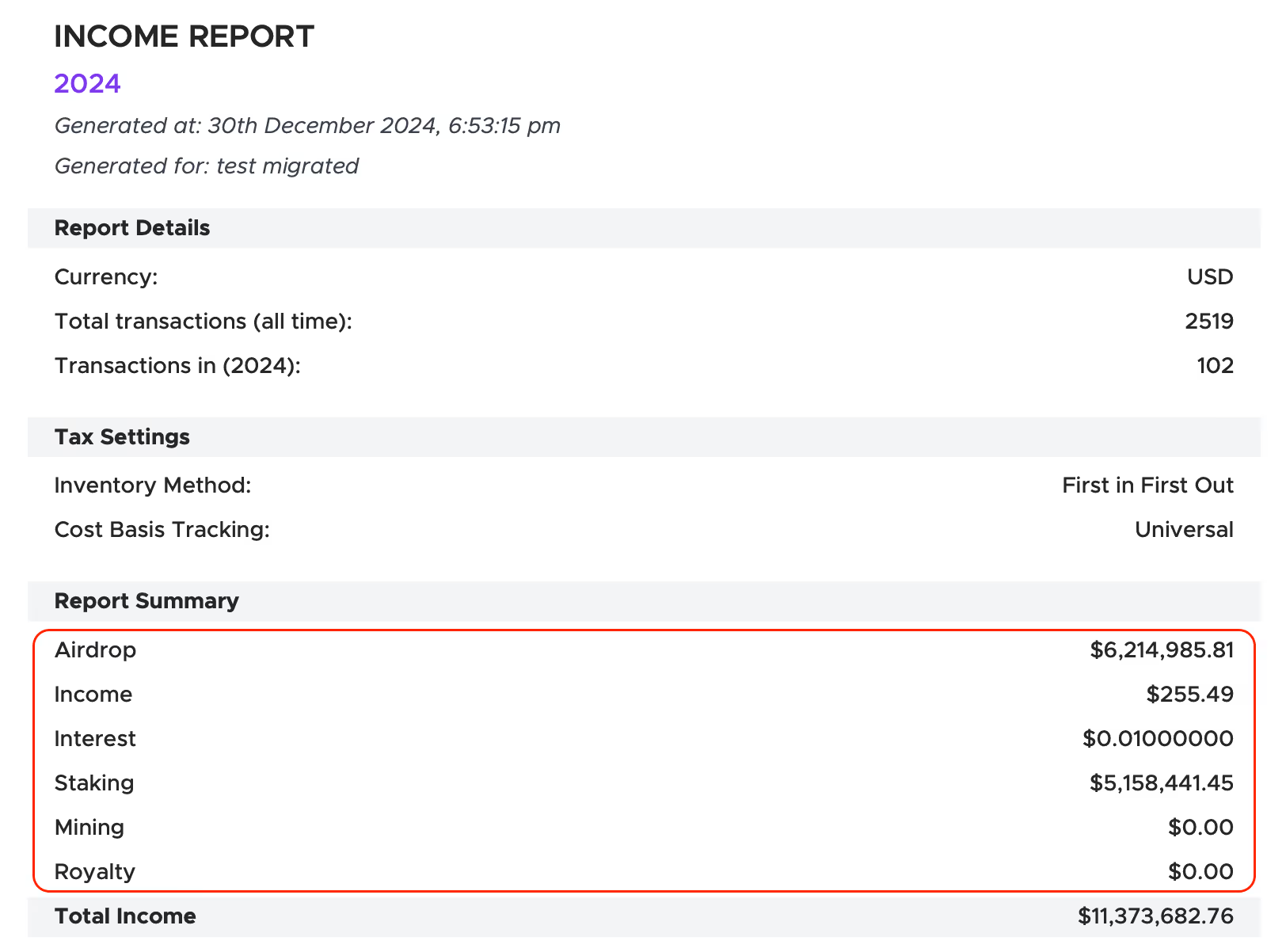

Go to the Reports page and select Download Reports. From the tax report menu, download the Income Report PDF.

As explained above.

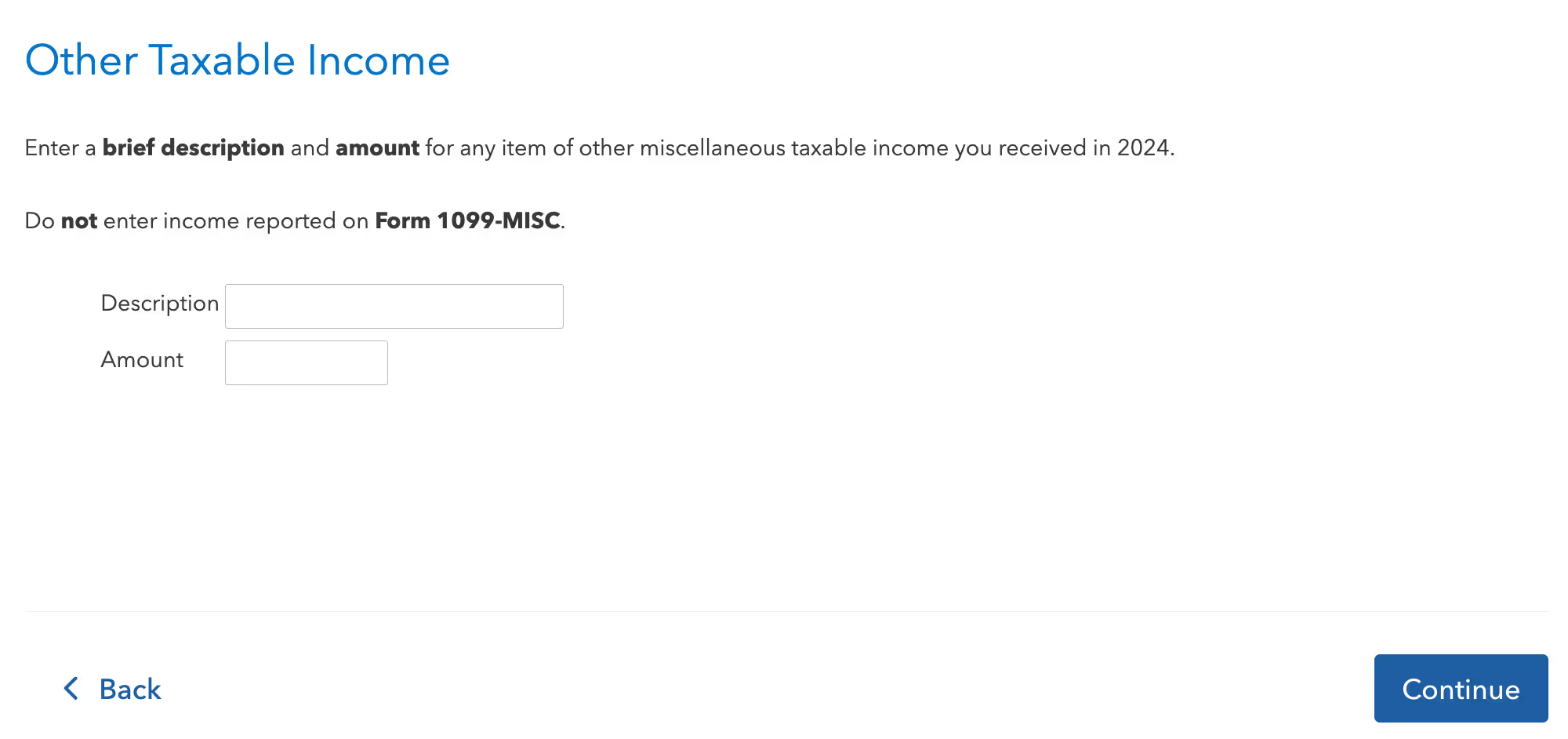

Enter the amount and income type (e.g., Crypto staking income, Crypto airdrop income) from your CTC Income Report. For multiple income items, add a new entry for each one.

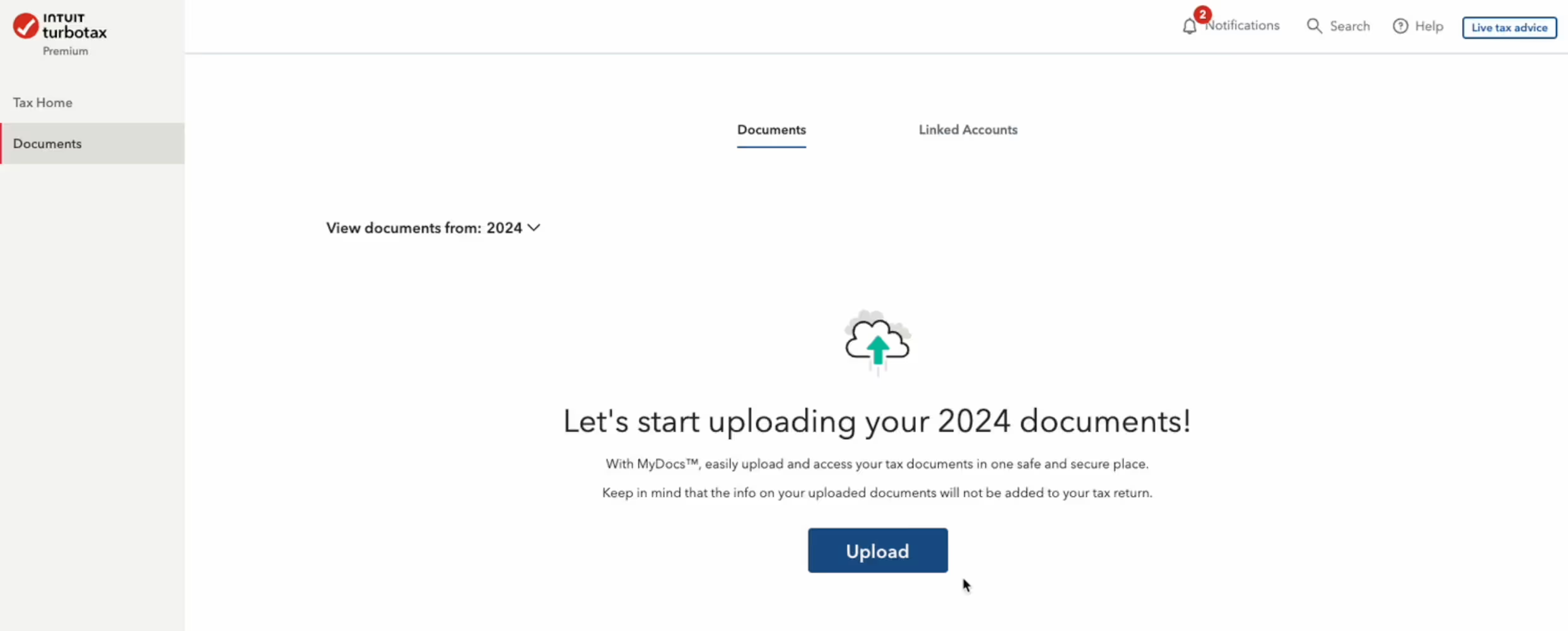

Click on Documents in the left-side menu bar.

Upload your CTC Income Report.

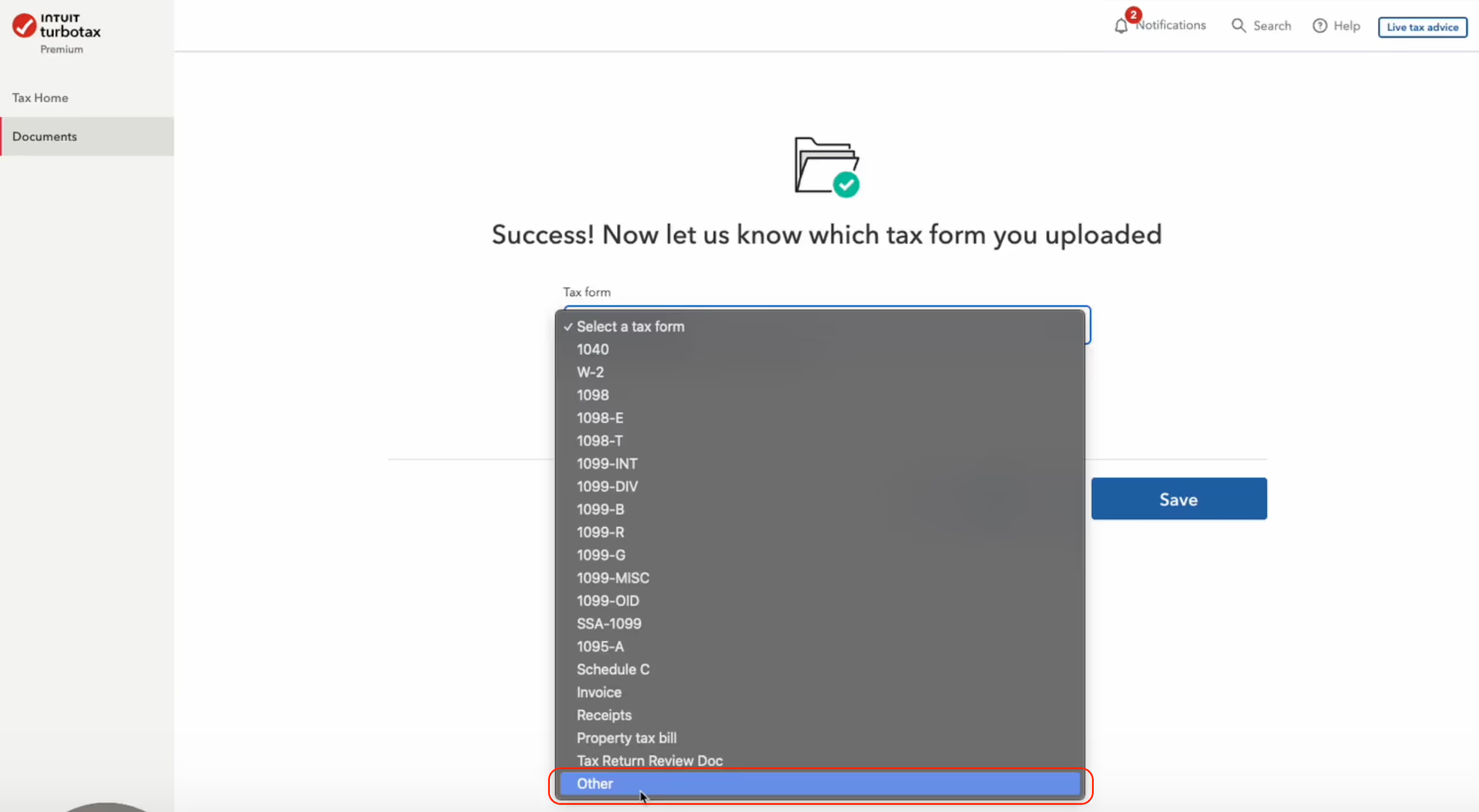

In the Tax Form dropdown menu, select Other for the CTC Income Report you just uploaded.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Crypto Tax Calculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.

TurboTax is limited to 2251 transactions. If you have more than this, we will consolidate your transaction history so it fits into the TurboTax software. You will also need to mail your complete 8949 form to the IRS.

No, TurboTax does not automatically send the CTC Income Report to the IRS because the IRS e-file system cannot accept additional files. If the IRS needs it, they will request it from you directly.

If you want to include the report voluntarily, you can print your tax return, attach the income report to the back, and mail it to the IRS.

If your report fails to upload, ensure you are importing it under the Federal section, not the Documents section. These sections serve different purposes, and uploading to the wrong one can cause errors.

.jpg)

Received an HMRC nudge letter about your crypto? Ignoring it could mean penalties up to 200%. Here’s how to prevent that from happening.

Learn how Bitcoin is taxed in the U.S., the difference between short and long-term capital gains, and how timing your sale can cut your crypto tax bill.

Import your transactions and generate a free report preview.