US Report Guide - How to submit your cryptocurrency report using TurboTax?

TurboTax is a very popular tax reporting tool in the US and Canada. Crypto Tax Calculator supports both the Desktop and online versions of the TurboTax app. Below are the instructions for reporting your cryptocurrency taxes using TurboTax.

1. Visit the TurboTax Website

Create an account below the sign-in option, or simply sign in if you already have an account

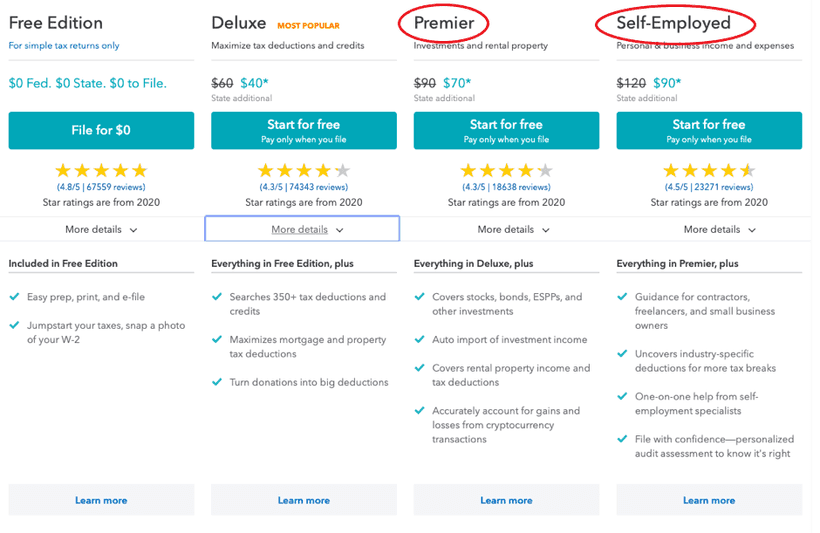

2. Choose your package

TurboTax features four different packages, however, only two of these – Premier and Self Employed, include reporting for cryptocurrency.

Once you have chosen one of the two packages, click “Start for free” to get started.

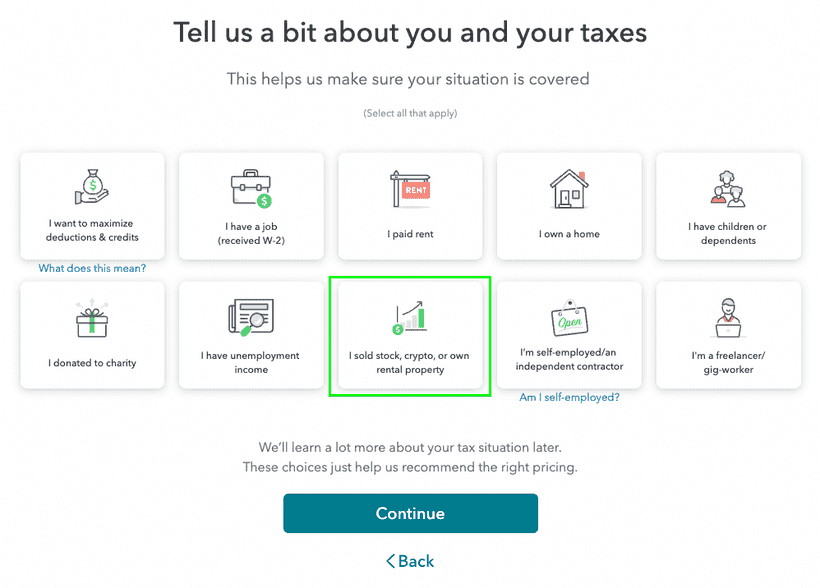

3. Provide your details

You will be required some personal information that helps with your filing status. When prompted about your ‘financial picture,’ choose “I sold stock, crypto, or own rental property”

Navigate through the quick guide by clicking 'Continue'.

Once you have proceeded and provided your details, you will then be taken to the TurboTax home page. If you are not automatically directed here, click 'Home' in the top left corner.

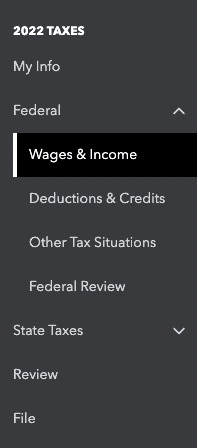

4. Navigate to the “Wages & Income” section

You can do this by clicking on the “Federal” Tab on the side, once you have completed the “My info” section. Once again, you may be required to answer some questions about your income for the year.

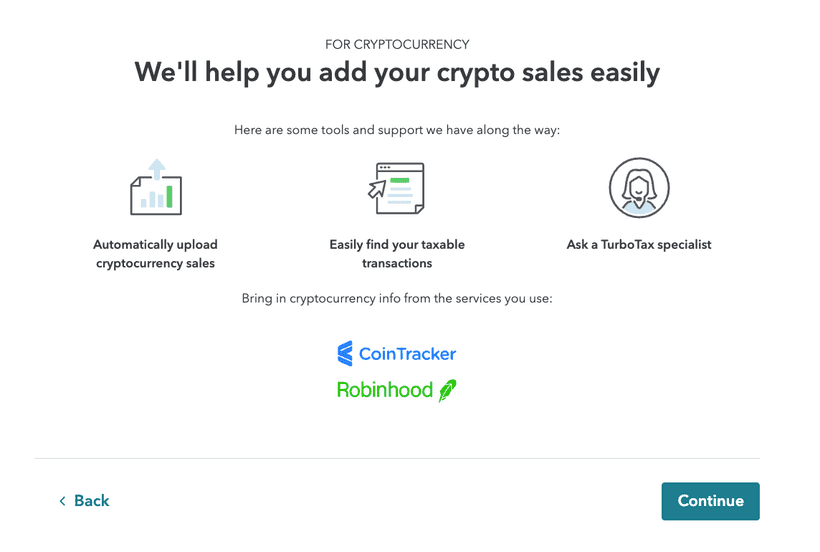

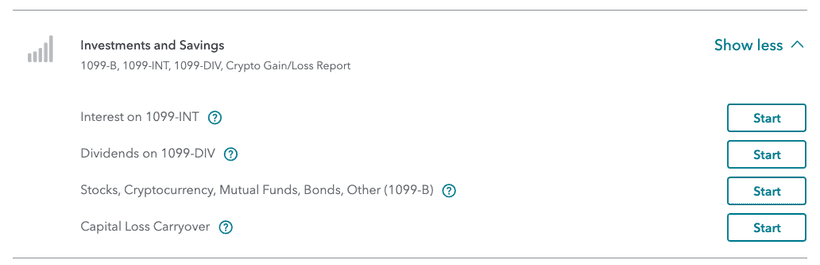

5. Select Cryptocurrency in the income section

Turbotax might update its website from time to time. Generally, this should open a new page where you will be able to find the Cryptocurrency option in the 'Investments and Savings' section. Click 'Start' on the right. Answer the questions accordingly.

6. Upload your crypto trading reports

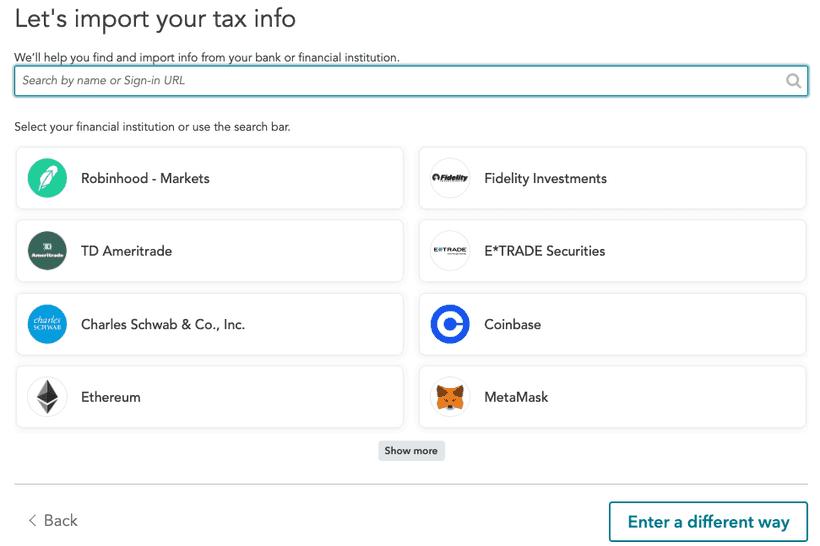

You will be prompted to choose which cryptocurrency service to import your information. Select 'Enter a different way'.

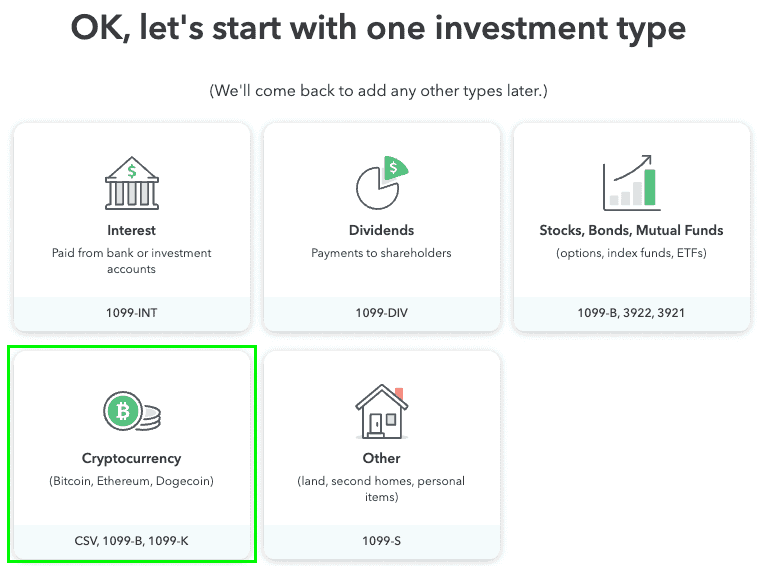

Then select 'Cryptocurrency'.

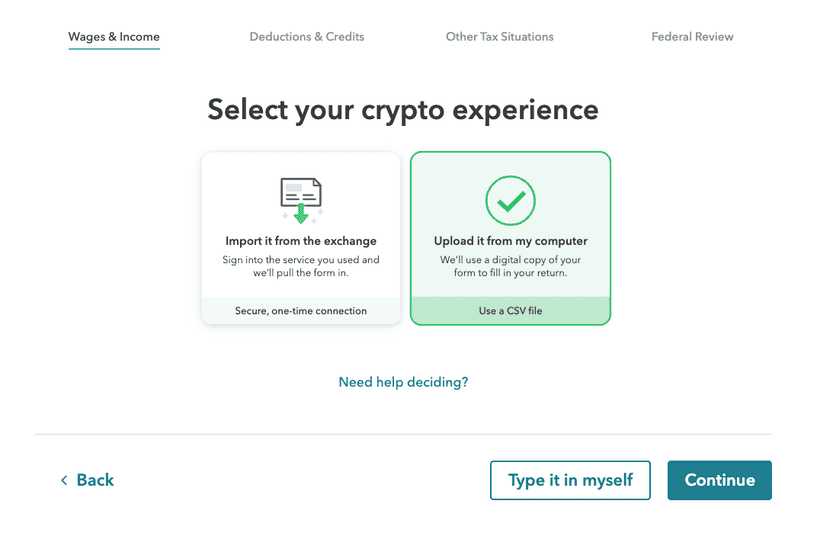

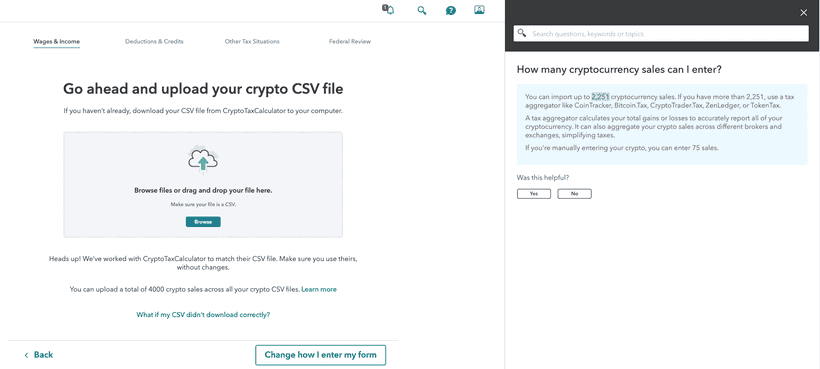

Then select 'Upload it from my computer'.

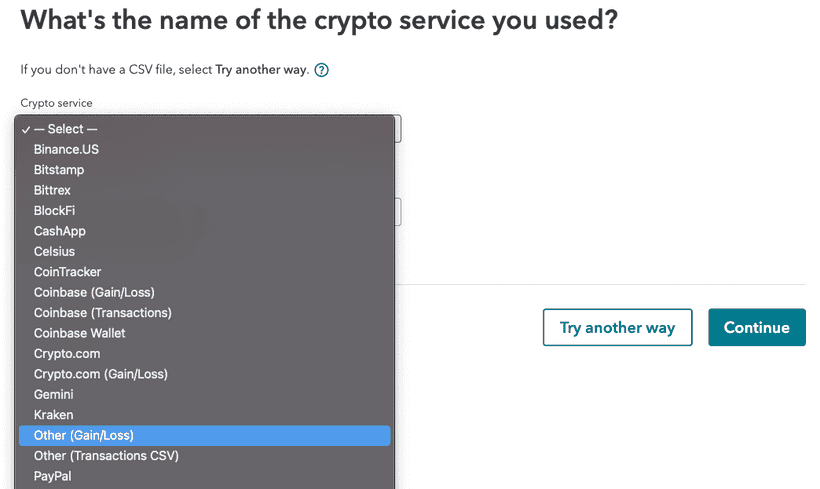

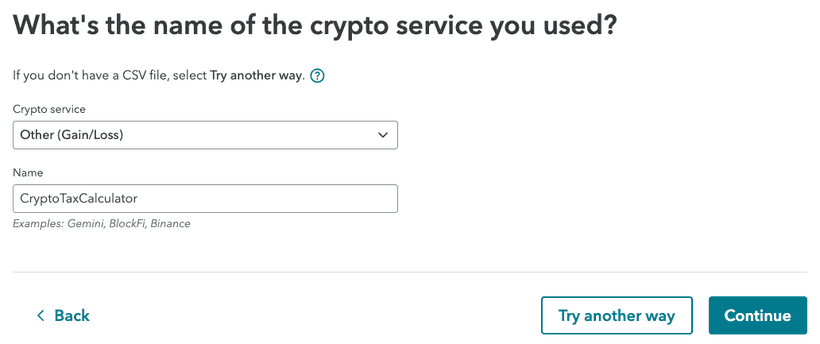

Select 'Other (Gain/Loss)'.

Fill the 'Crypto service' field with "Crypto Tax Calculator".

If you have already downloaded the TurboTax file from Crypto Tax Calculator onto your computer, you can now upload it to TurboTax.

If you have not downloaded this form yet, follow Step 7.

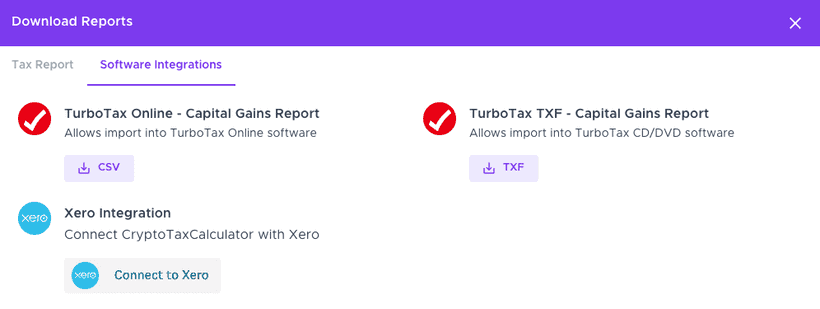

7. Download your crypto trading reports from Crypto Tax Calculator

After logging in on Crypto Tax Calculator, head to the 'Reports' page then click 'View All' on the right-hand side next to where it says 'Tax Reports' and under the tab Software integrations, you will see this:

Once you have downloaded the file from Crypto Tax Calculator, you can then import it directly on TurboTax.

8. Review Taxable Transactions

Only taxable transactions are imported from your CTC file, so you can simply review the transactions to ensure they are correct. Some tokens may have two entries (one for short-term gains and one for long-term gains). You can edit and add transactions if necessary.

Once you are happy everything is correct, hit continue, and follow the prompts to check the Capital gains before submitting the form.

What If You Have More Than 2251 Transactions?

TurboTax is limited to 2251 transactions. If you have more than this, we will consolidate your transaction history so it fits into the TurboTax software. You will also need to mail your complete 8949 form to the IRS.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Cryptotaxcalculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.