How to Legally Reduce Your Cryptocurrency Taxes in the USA

You can’t avoid paying tax when it’s due, but you can reduce it with some strategic planning. Thinking ahead about how to structure your portfolio can reduce your crypto tax significantly later on.

According to our tax experts, here are 7 legal methods to help reduce your crypto tax bill without upsetting the IRS.

Tax Strategy Overview

| Tax Strategy | Overview |

|---|---|

| Inventory methods | Different approaches to calculating gains based on asset sale order, impacting the taxable amount. |

| Tax loss harvesting | Offsetting gains by selling underperforming assets, reducing taxable income. |

| Long-term capital gains | Lower tax rates for assets held over a year, encouraging longer-term investment. |

| Holding in an IRA | Tax-deferred or tax-free growth of crypto assets, using a self-directed IRA. |

| Gifting cryptocurrency | Gift up to $18,000 per person tax-free, transferring assets without immediate tax implications. |

| Borrowing against cryptocurrency | Borrow against your crypto to access liquid funds while delaying a capital gains event and potentially reduce your CGT tax rate. |

| Donating cryptocurrency | Donate appreciated crypto directly to charity to reduce your tax liability. |

Inventory methods (FIFO, LIFO, Specific Identification)

Choosing the right inventory accounting method can significantly impact your capital gains and, consequently, your tax liability.

The most common methods are First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Specific Identification.

FIFO vs LIFO

- First-In, First-Out (FIFO) assumes that the first coins you purchase are the first ones you sell. This straightforward method is the default for many investors.

- Last-In, First-Out (LIFO) assumes that the last coins you purchased are the first ones you sell.

The method you choose can substantially change the amount of capital gains owed.

You can use crypto tax software like Crypto Tax Calculator to switch between inventory methods and instantly see the difference in capital gains as a result.

Example:

You buy 2 Bitcoin (BTC) at $15,000 each in January, 2 BTC at $25,000 each in March, and 2 BTC at $35,000 each in June. You then sell 2 BTC in December for $40,000 each.

Here’s how your capital gains would look with FIFO vs LIFO:

| Method | Cost basis | Proceeds | Capital gain |

|---|---|---|---|

| FIFO | $15,000 × 2 = $30,000 | $40,000 × 2 = $80,000 | $80,000 - $30,000 = $50,000 |

| LIFO | $35,000 × 2 = $70,000 | $40,000 × 2 = $80,000 | $80,000 - $70,000 = $10,000 |

As you can see in the table above, using the LIFO inventory method results in a much lower capital gain than FIFO, which reduces the tax you have to pay on the proceeds of the sale.

Changes to LIFO vs FIFO in 2025

Beginning in the 2025 tax year, taxpayers will be required to calculate their crypto taxes on a per-wallet basis using FIFO or specific ID. LIFO may be considered a form of Specific Identification, so its use may continue in 2025 with sufficient record keeping. Speak with a tax agent if you are unsure how the changes will impact your portfolio.

Specific Identification

Specific Identification allows you to select exactly which coins you're selling, offering flexibility to minimize taxes. This method requires meticulous record-keeping to show each purchase and sale is directly linked.

Example:

You buy 1 BTC at $10,000 in January, 1 BTC at $20,000 in February, 1 BTC at $30,000 in March, and 1 BTC at $40,000 in April. You then sell 1 BTC in May for $45,000. You decide that the BTC you sold in May was the same one you purchased in March at $30,000.

This leaves you with a capital gain of $15,000 ($45,000 - $30,000).

By using Specific Identification, you chose to sell the coin with the highest cost basis to sell, thus minimizing your capital gain and tax liability.

Tax Loss Harvesting

Tax loss harvesting involves selling cryptocurrencies that have decreased in value to offset capital gains from your profitable investments.

You are effectively turning an unrealized loss into a realized loss.

This strategy helps reduce your overall crypto taxes by lowering your taxable income.

"Still hanging on to that worthless NFT you spent multiple ETH on? Selling assets at a loss can help reduce gains from other trades." – Nick Waytula, Head of Tax (Crypto Tax Calculator)

Keep in mind that you must sell any loss-making assets before the end of the tax year in order for them to offset your gains in the same tax year.

If you upload your portfolio to Crypto Tax Calculator, it can help you identify assets for tax loss harvesting so that you can prepare ahead of time.

Example:

- Gains: You sell Litecoin (LTC) for a profit of $8,000.

- Losses: You are holding Ripple (XRP) at an unrealized loss of $5,000.

- Action: You sell your XRP before the end of the tax year to realize the loss.

- Calculation: Capital Gain: $8,000 (LTC gain) - $5,000 (XRP loss) = $3,000 net gain.

By realizing the loss on XRP, you reduce your taxable capital gain from $8,000 to $3,000, effectively lowering your taxes on crypto gains.

Tax Loss Harvesting and Wash Sale rules

Cryptocurrency is currently not subject to the wash sale rule because the IRS classifies it as property, not a stock or security.

This means that you can sell your crypto at a loss and buy it back within 30 days and still record a capital loss.

However, you must also meet the IRS's “economic substance doctrine,” which means that a transaction must have an economic change for it to have a reportable tax loss.

So if you sell and immediately buy back, not letting any time or price fluctuation occur, then the IRS may say it lacks “economic substance” and disallow the loss.

Several efforts have been made in the US Congress to make cryptocurrency subject to the wash sale rule, so check with a tax professional before relying on this strategy.

Taking long-term capital gains instead of short-term gains

Holding your cryptocurrency investments for more than one year qualifies you for favorable long-term capital gains tax rates, which are lower than short-term rates.

Long-term capital gains tax rates range from 0% to 20%, depending on your income. Short-term capital gains, on the other hand, are subject to your regular income tax rate, which ranges from 10% to 37%.

Example:

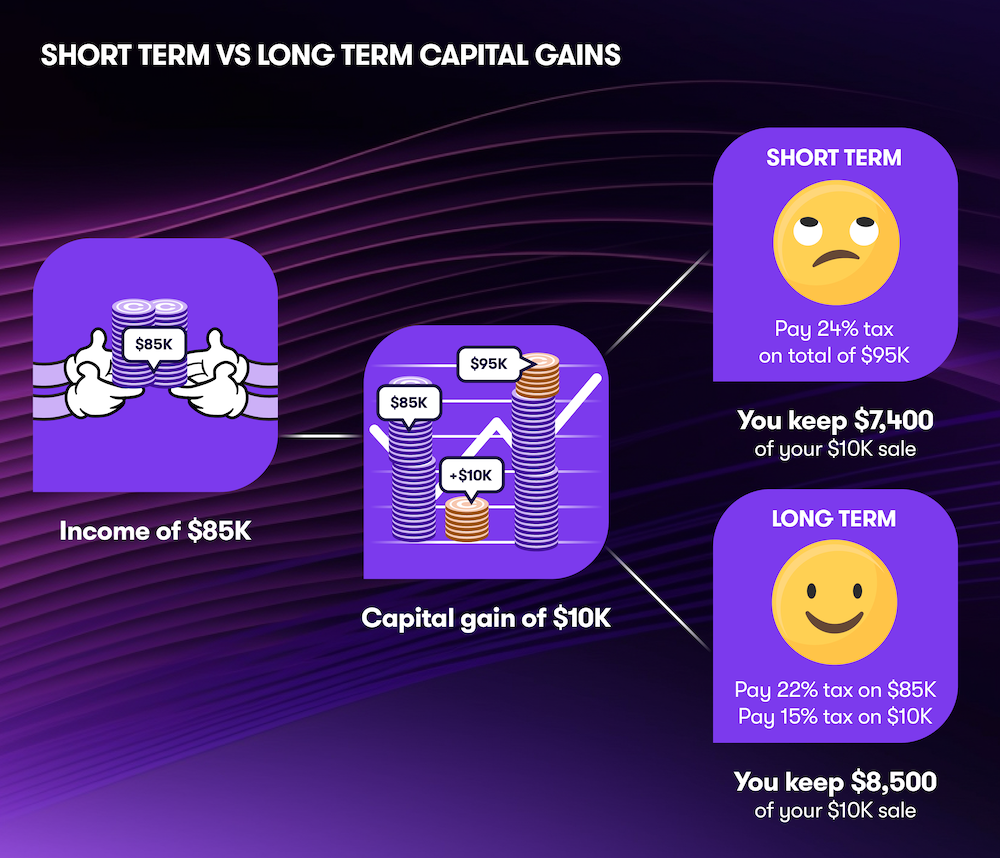

You earn an income of $85,000 for the tax year.

You make a capital gain of $10,000 from selling cryptocurrency.

If you sold this cryptocurrency within 12 months of buying it, your $10,000 capital gain would be taxed at the same rate as your income tax, which would be 24% for your income of $95,000 ($85,000 + $10,000).

If you instead waited to sell the crypto after 12 months, your $10,000 gain is taxed separately from your income at a rate of 15%.

By being patient and waiting for long-term capital gains, you keep $8,500 of your $10,000 sale, versus $7,400 if you had sold earlier.

Holding Cryptocurrency in an IRA

Holding cryptocurrency in a self-directed Individual Retirement Account (IRA) can offer significant tax advantages, which will depend on the type of IRA you use.

- Roth IRA contributions are taxed upfront, but withdrawals are tax-free.

- Traditional IRA contributions are tax-deductible, but withdrawals are taxed.

So, a Roth may be better suited if you expect the value of your crypto to grow substantially by retirement and want to minimize the tax you’ll pay on those gains.

If a portion of your crypto portfolio is allocated for truly long-term hodl’ing, then this method could be well worth exploring.

Example:

You invest $6,500 in a self-directed Roth IRA to purchase Bitcoin. Over 10 years, your investment grows to $65,000. You withdraw funds tax-free during retirement.

Gifting Cryptocurrency

You can gift cryptocurrency to family or friends without incurring gift tax. For the 2024 tax year, the tax-free threshold is $18k per person or $36k per person if you are married and filing jointly.

This allows you to transfer wealth without triggering tax liabilities, helping you reduce your taxable estate.

Keep in mind that the recipient inherits your cost basis, which will impact their capital gains calculation when they sell.

To ensure accurate record-keeping for the receiver, you must attach a qualified appraisal if the value of the donated crypto is over $5k.

So, if you gift crypto, make sure to provide your purchase history and a qualified appraisal along with the gift.

Example:

You give $10,000 worth of Bitcoin (BTC) to your sibling in 2024, which is under the annual exclusion limit of $18,000. There is no gift tax incurred by you or your sibling. Your sibling assumes your cost basis and holding period.

Borrowing against your crypto

As discussed earlier in this article, holding an asset for longer than 12 months reduces the capital gains tax owed.

What if you run into a scenario where you need some of your portfolio gains but don’t want to sell and owe tax?

One option is to borrow against the crypto as collateral. This way you can access funds without selling.

This gives you access to liquid capital (e.g., stablecoins or US dollars) in the short term while allowing your investment to mature into a long-term capital asset.

Doing so could mean that you wind up with a lower capital gains tax rate when you eventually sell it.

A downside of this strategy is that you will have to pay interest on the loan, which will need to be weighed up against any benefits.

Donating Cryptocurrency

Donating cryptocurrency to a qualified charitable organization not only supports a good cause but also provides a tax deduction. This strategy reduces your taxable income and avoids capital gains tax, effectively minimizing your tax obligation.

Ensure the charity is a qualified 501(c)(3) organization and obtain a receipt for donations over $500. For donations exceeding $5,000, you must file IRS Form 8283 and attach a qualified appraisal.

Example:

You own Bitcoin (BTC) purchased at $5,000, now worth $20,000. Donate the $20,000 of BTC directly to a charity. Deduct the fair market value of $20,000 from your taxable income and avoid paying capital gains tax on the $15,000 appreciation.