Accurate crypto taxes. No guesswork.

Accountant-endorsed tax reports.

TurboTax and Form 8949

4.8/5 TrustPilot

Built to support IRS Tax Guidelines

Full support for the unique IRS reporting requirements, including US specific rules around personal-use, mining, staking, and airdrops.

Pay the least tax possible

Least Tax First Out is an exclusive algorithm that optimizes your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a disposal event.

Be confident in the numbers

Easily see what’s going on across all your wallets and exchanges so you can make the best decisions at all times.

Make compliance a breeze

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow and get your audit-proof tax reports with ease.

No credit card required

Official Partners

Backed by Coinbase Ventures, we’re proud to offer best-in-class support for the Coinbase ecosystem.

Learn more

We're thrilled to partner with MetaMask, the leading self-custodial wallet, to make crypto taxes a breeze.

Learn more

5-Star Support

Our team genuinely care about helping you do your crypto tax. Get real help from real people whenever you need it.

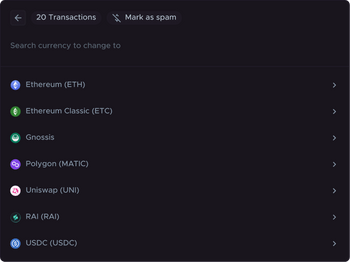

Tailored Support ForNFTsDeFi ProtocolsExchangesBlockchains

Fallen down the crypto rabbit hole? Don’t waste hours scouring block explorers and drowning in spreadsheets—import transactions automatically from over 1000 sources.

Find your integrations

Every Tax Report You Need

No need to try and explain your degen trades, just give your accountant the reports. Or better yet, file them directly with TurboTax.

Turbotax integration

Form 8949

Form 1040

Capital gains

Audit report

+9 other detailed reports

Start with a free account

Learn

Helpful guides to understand the numbers and breeze through tax season.

US Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in US.

Learn about US crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in US so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in US so you can file with confidence.

Learn about NFT taxesAll in one portfolio tracker

Track your entire portfolio, PnL and tax liability all in the same place.

portfolio value:

$89,436.20

Built for speed

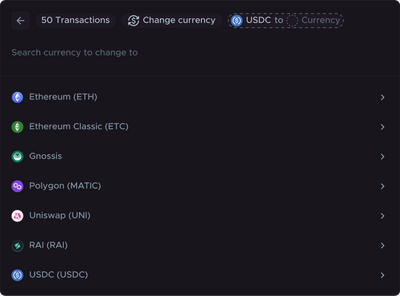

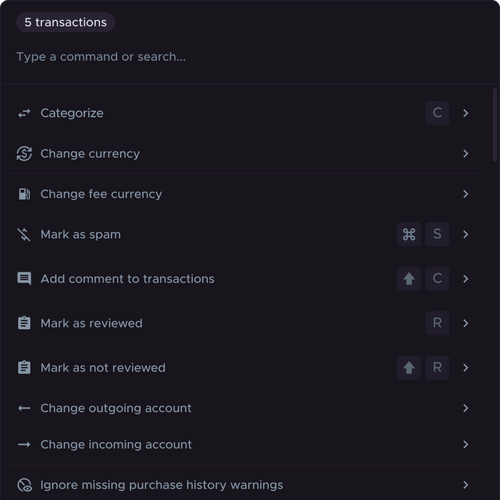

Optimized interface for bulk operations with keyboard shortcuts.

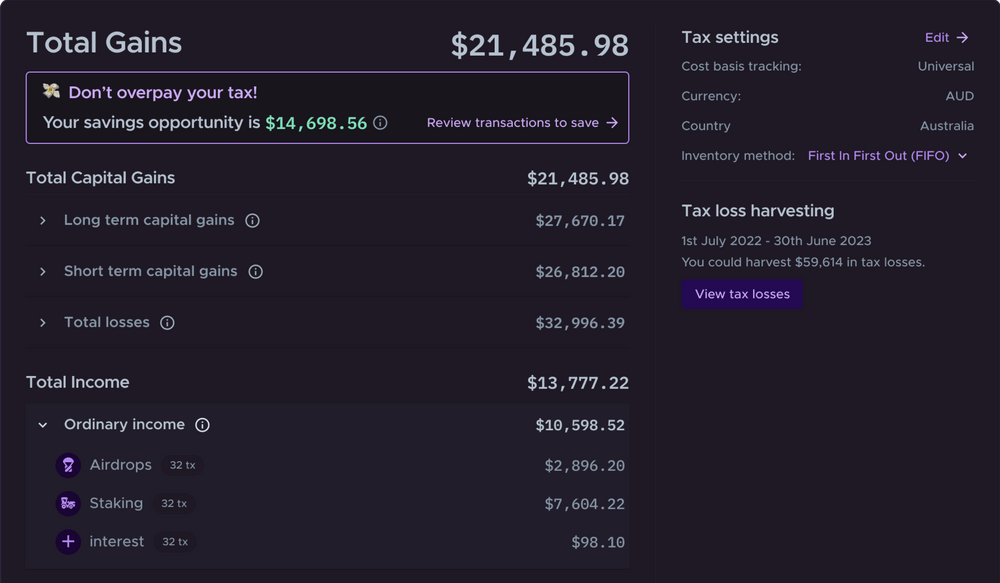

Automatically identified tax saving opportunity

All your transactions clearly grouped by their tax impact with your potential savings opportunity highlighted.

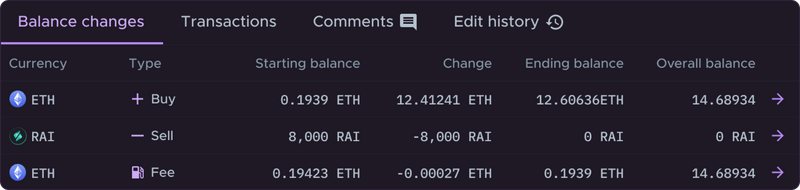

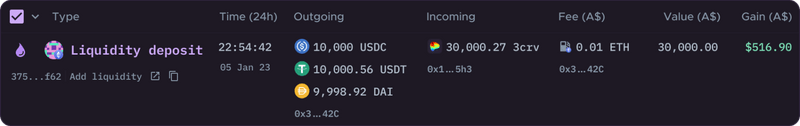

Full tax calculation transparency

See the exact breakdown of how each transaction is calculated. Understand the `why` and `how` behind your tax figures.

Altcoin pricing oracle

300k+ currencies priced accurately on import. Historical prices for all micro-cap memecoins.

Complete DeFi support

Unified tracking and tax reporting for all your crypto assets across all your exchanges and wallets.

No credit card required

Use What The Pros Use

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

Best Crypto tax Software? after importing data onto @koinly @CryptoTaxHQ and @ZenLedgerIO the clear winner had the best UI Crypto Tax Calculator is the winner - detailed thread tomorrow

CTC has a really good Reconcilliation section where it flags up issues and presents them in logical order so you can tick them off one by one. It's still work but it's just more intuitive I found

Just did my crypto taxes with @CryptoTaxHQ and got my report summary. Overall, very pleased with the process! Highly recommend if you have not yet decided on what crypto software to use. Did my taxes in a few hours and going to my tax guy tomorrow.

I’ve used a few but the best I found was https://cryptotaxcalculator.io . I’m in UK (I think they’re in Aus) so YMMV. GL

Unlike other tax items where you have to wait for 1099s' or bank statements, you can code all of your Crypto and Defi as soon as the ball drops on new years and get a good estimate of where your taxes lie. @CryptoTaxHQ is still my first recommendation for tools.

2021/2022 taxes completed and paid. Use your bear market time wisely. Big shoutout to @CryptoTaxHQ, second year running I've used them. I've tried a few of these calculators and CTC blow their competitors out the water.

A cryptid is tentatively back from hiatus but will be keeping update frequency low rn. Uncle Sam unretired me 4 a mission to JPN so had to finish taxes early. Got it done thx to #CryptoTaxCalculator (@CryptoTaxHQ). I have no affiliation w/ them. Pls just keep it alive🙏

@CryptoTaxHQ I literally could not function without ctc. I've got multiple assets on multiple blockchains doing 5-10k transactions a year. Doing that by hand would be pure insanity.

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

Trusted By Accountants

Our platform has been developed in deep collaboration with accountants and tax lawyers.

“Crypto Tax Calculator does the job spectacularly”

We’ve been looking for a product to help us manage our clients’ crypto tax returns, and Crypto Tax Calculator does the job spectacularly. Not only does the team keeps on top of all HMRC changes so we can have full confidence in the reports we produce, but their product is an efficient way to bring in a client’s data from a constantly growing multitude of exchanges, blockchains, and wallets. Couldn’t ask for anything better.

Joe David

Founder, Myna Accountants

“Crypto Tax Calculator’s software enables our team to tackle the most complex DeFi scenarios.”

...from liquidity protocols, to NFT ecosystems, and remain at the forefront of crypto tax reconciliation. As specialists in cryptocurrency reporting, accuracy is completely essential to us, our clients and our accounting partners, which is why we love CTC.

Oliver Woodbridge

Director, Tax On Chain

“Crypto Tax Calculator is a tool we couldn’t live without.”

As an accounting firm that specialises in crypto taxes, Crypto Tax Calculator is a tool we couldn’t live without. Being able to aggregate client’s transactions across all exchanges and blockchains into one data feed brings incredible efficiencies to the crypto tax compliance process.

Marc Phillis

Director, Cryptocate

“The most advanced and accurate crypto tax calculator on the market”

“The most advanced and accurate crypto tax calculator on the market”

Harrison Dell

Tax Lawyer & Web 3 Founder - Cadena Legal

Frequently Asked Questions

At CTC, we design our product with security in mind. We follow industry standard best practices to keep your data safe.

What is the best crypto tax software?

Crypto Tax Calculator is the official tax partner of Coinbase and Metamask and has a 4.8/5 rating on TrustPilot from hundreds of users. It focuses on providing highly accurate tax reports no matter how complicated your transactions are. Crypto Tax Calculator integrates seamlessly with over a thousand exchanges, wallets, blockchains and DeFi protocols. After you import your accounts or transactions it automatically calculates gains, losses, cost-basis, and can export data directly into TurboTax or IRS-ready forms like Form 8949, Schedule D. The software supports more than 20+ jurisdictions around the world, is updated regularly to stay aligned with changing tax laws, and has a number of tax professionals and lawyers on staff. The customer support team is highly active and willing to guide you through the process step-by-step as well as takes feature requests for new integrations, blockchains or exchanges.

How is crypto tax calculated in the United States?

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto.

Do you have to pay taxes on Bitcoin?

Yes, you must pay taxes on Bitcoin and other cryptocurrencies in the US. The IRS treats cryptocurrencies as property, which means they are subject to capital gains tax when sold. You may also have to pay income tax on Bitcoin if you received it as payment for work or as income from activities like staking mining.

How is bitcoin taxed by the IRS?

The IRS treats bitcoin as property, not currency. This means the IRS taxes Bitcoin as either capital gains or income, depending on the specific transaction involved. Capital gains tax events occur when you sell, trade, or exchange bitcoin for another asset. If you held your Bitcoin for more than a year before selling it, you will pay long-term capital gains tax rates. If you had it for less than 12 months before selling, your capital gains are taxed at your income tax rate. Income tax events occur when you receive Bitcoin as payment for work you have done or as a reward from activities like DeFi or Bitcoin mining.

How to report crypto on taxes?

To report crypto on your US taxes, first determine if your crypto-related activities produced capital gains or income (such as mining or staking rewards). For capital gains or losses, detail each transaction on Form 8949, then summarize on Schedule D. Keep records of purchase dates, sale dates, prices, and fees. Some crypto exchanges will let you download this information in a CSV file. To make this process easier, consider using crypto tax software such as Crypto Tax Calculator. This software analyses transactions, calculates capital gains, and produces an IRS-compliant report ready for TurboTax and Form 8949. For income, report the fair market value of the crypto you received as income on Schedule 1 (Form 1040), typically on line 8z. Make sure you follow IRS guidance, stay updated on rules, and file by the annual deadline. If unsure, consult a qualified tax professional for guidance.

How much is crypto taxed?

Crypto is taxed according to either capital gains tax or income tax brackets. The specific tax bracket will depend on your holding period, income level, and the type of transaction. If you hold crypto for more than one year, you pay long-term capital gains rates (0%, 15%, or 20%), based on your taxable income. If held for less than a year, gains are taxed as ordinary income at your income tax rate. Income from mining, staking, or receiving crypto as payment is treated as ordinary income.

Do you have to pay taxes on crypto?

Yes. In the US, the IRS treats cryptocurrency as property. You owe taxes on crypto whenever you sell, trade, or otherwise dispose of crypto at a gain. For income earned through mining, staking, airdrops, or receiving crypto as payment, you pay ordinary income tax. For capital gains, use Form 8949 and Schedule D to report profits or losses. Keep detailed records of transactions, dates, and amounts. Consider using crypto tax software, such as Crypto Tax Calculator, to streamline your calculations. If unsure, consult a qualified tax professional for guidance and ensure you comply with all IRS regulations.

What is the best app to track crypto taxes?

No single "best" app suits everyone for tracking taxes, as it depends largely on how you trade, what platforms you use, and whether you want a free tool or paid software. Look for an app that integrates with your preferred exchanges and prepares IRS-ready forms like Form 8949 and Schedule D. Ideally, your chosen app should auto-import transactions, detect potential deductions, and keep records in line with IRS guidance. Consider a web app like Crypto Tax Calculator, which helps simplify complex calculations, track cost basis, and ensure compliance with US tax laws.

I lost money trading cryptocurrency. Do I still pay tax?

The way cryptocurrencies are taxed in the United States means that investors might still need to pay tax, regardless of if they made an overall profit or loss. Depending on your circumstances, taxes are usually realized at the time of the transaction, and not on the overall position at the end of the financial year.

How do I calculate tax on crypto-to-crypto transactions?

In the United States, you are required to record the value of the cryptocurrency in your local currency at the time of the transaction. This can be extremely time-consuming to do by hand, since most exchange records do not have a reference price point, and records between exchanges are not easily compatible. Consider using tax software like Crypto Tax Calculator, which handles these sorts of calculations for you.

What is the best tax method for crypto?

The "best" tax method for crypto is the one that most accurately reflects your circumstances and trading behavior in the eyes of the IRS. The IRS allows methods like First-In, First-Out (FIFO), Last-In, First-Out (LIFO), or Specific Identification. Whichever method you choose, you will need to support it with accurate transaction logs and evidence. You should also be careful of switching inventory methods between different tax years. This could lead to an error in which the same transaction is counted twice across two separate tax years. Crypto Tax Calculator is tax software that offers several tax methods and lets you "lock" in a specific method for a given tax year to prevent transactions from being counted twice.

How can Crypto Tax Calculator help with crypto taxes?

You just need to import your transaction history and Crypto Tax Calculator will help you categorize your transactions and calculate realized profit and income. You can then generate the appropriate reports to send to your accountant and keep detailed records handy for audit purposes.

Can't I just get my accountant to do this for me?

We always recommend you work with your accountant to review your records. If you would like your accountant to help reconcile transactions, you can invite them to the product and collaborate within the Crypto Tax Calculator web app. We also have a complete accountant suite aimed at accountants.

Does Crypto Tax Calculator handle non-exchange activity?

Crypto Tax Calculator handles all non-exchange activity, such as onchain transactions like Airdrops, Staking, Mining, ICOs, and other DeFi activity. No matter what activity you have done in crypto, we have you covered with our easy to use categorization feature, similar to Expensify.

Do I have to pay for historical tax reports?

Our subscription pricing is per year not tax year, so with an annual subscription you can calculate your crypto taxes as far back as 2013. The process is the same, just upload your transaction history from these years and we can handle the rest.

How does payment work?

Crypto Tax Calculator has an annual subscription which covers all previous tax years. If you need to amend your tax return for previous years you will be covered under the one payment. We also offer a 30 day 100% money back guarantee, where if you contact our support team you can collect a full refund.

Can I use my own accountant?

Yes, Crypto Tax Calculator is designed to generate accountant-friendly tax reports. You simply import all your transaction history and export your report. This means you can get your books up to date yourself, allowing you to save significant time, and reduce the bill charged by your accountant. You can discuss tax scenarios with your accountant, and have them review the report.

What if my exchange is not on the list of supported exchanges?

Crypto Tax Calculator covers thousands of exchanges, wallets, and blockchains, and DeFi apps, but if you do not see your exchange on the supported list we are more than happy to work with you to get it supported. Just reach out to [email protected] or via the in-app chat support feature and we will get you sorted.

Does Crypto Tax Calculator support NFT transactions?

We do! Crypto Tax Calculator integrates with many NFT marketplaces and offers categorization options for any NFT-related activity (minting, buying, selling, trading).

How does the free trial work?

Crypto Tax Calculator is free to use immediately upon signup, allowing you to import your transactions and take advantage of our smart suggestion and auto-categorization engine, portfolio tracking, DeFi and NFT support. For access to reports, the tax loss harvest tool or chat and priority support, you will need to upgrade to the appropriate paid plan.

Get started for free

Import your transactions and generate a free report preview

No credit card required