DeFi Taxes in the US: Your Complete Guide for 2025

Key takeaways

- The IRS is aware of your DeFi trading and requires you to report any income and gains from your DeFi transactions. Failure to do so may result in severe penalties and fines.

- Common DeFi transactions like staking, lending, liquidity pools, yield farming, and more can also result in tax liability, which you’ll report on your taxes.

- Depending on the transaction, you’ll report your DeFi transactions as either ordinary income or capital gains using several different IRS tax forms.

Decentralized finance (DeFi) creates plenty of income opportunities for cryptocurrency users and investors. However, those opportunities also come complex tax implications, including taxable income and capital gains.

While the IRS hasn’t issued tax guidance on every type of DeFi transaction, it has made it very clear that you’re required to pay taxes on DeFi transactions. Starting in 2025, crypto exchanges are required to share more transaction data with the IRS, meaning the chances of getting caught if you’re not reporting your income and gains are much higher.

This guide will help you understand how the IRS treats cryptocurrency and DeFi in general, as well as the potential tax implications of some common types of DeFi transactions.

Read on to start with an overview of how the IRS treats crypto in the US, or skip ahead to one of the following sections if you’re looking for something specific:

Why you can trust this guide

There is no one clear rule that says how every single one of your cryptocurrency transactions should be taxed. Instead, the IRS periodically releases guidelines to help you understand your obligations.

Our Head of Tax, Nick Waytula, reviewed these guidelines alongside our expert writing team to help produce this comprehensive guide to DeFi taxes in the US.

How the IRS treats cryptocurrency and DeFi

According to the IRS, cryptocurrency is treated as property rather than currency, which means that general tax rules applicable to property transactions also apply to all crypto transactions. This classification has significant implications — you're likely triggering a taxable event every time you spend, sell, or exchange cryptocurrency.

Although the IRS has issued some guidance on cryptocurrencies through Notice 2014-21, Rev. Rule 2019-24, and its FAQs page, none specifically address DeFi activities. However, the lack of direct guidance doesn't exempt users from reporting their DeFi-related taxes.

The general principles outlined in existing IRS documentation provide enough foundation to infer the tax implications of various DeFi and yield farming transactions. Unfortunately, the guidelines are often a bit murky, and users must decide how to report these activities based on their understanding of the rules and risk tolerance.

The more aggressive your tax position — that is, interpreting the rules in a way that minimizes your tax liability — the higher your potential risk for audit and penalties for underreporting. Conversely, a conservative approach means you'll likely pay taxes sooner and possibly more, but it reduces the risk of conflict with the IRS.

Choosing the right tax position is a delicate balance between minimizing your obligations and staying within the boundaries of legal compliance. Given the complexity and the evolving nature of DeFi, it's advisable to consult with a tax professional who can provide guidance tailored to your specific situation and help navigate the murky waters of DeFi taxation.

As the IRS continues to develop its understanding and guidance of DeFi activities, staying informed and prepared is the best strategy for any DeFi participant.

DeFi tax is complicated. Let us do the hard work for you.

How events in DeFi are taxed

The tax treatment of your DeFi activities varies depending on the type of transaction. Below, you will learn about the tax implications of common transactions in DeFi, including examples.

How token swaps are taxed

Swapping one cryptocurrency for another using a platform like Uniswap involves two taxable events.

The first is the capital gains event for selling your crypto. You will need to pay capital gains tax on any increase in the price of the asset you are selling compared to its cost basis.

On the other hand, if your assets depreciate by the time of the sale, you’ll have a capital loss. You could use that loss to offset some of your other crypto gains and reduce your overall tax liability.

This follows the same rules as any crypto-to-crypto swap, or sale of crypto, regardless of whether it’s on a centralized exchange or DEX.

The second taxable event is the use of gas.

When you use gas, you need to treat it as a disposal of the coin used for gas, which means you will owe capital gains tax if the coin appreciated in price since you first purchased it.

You may also subtract the gas fee from the taxable amount of the crypto you sold.

Example:

You swap 1 ETH for 500 USDC on Uniswap.

You originally paid $300 for the ETH, so you report a capital gain of $200.

The total gas fees for the trade (including the blockchain and Uniswap fees paid in gas) was $20 ETH.

You originally purchased the ETH for $300, but the price is now $500. So, you report a capital gain of $8 on the $20 worth of gas used.

You subtract the $20 from the capital gain of $200 from the original sale ($180), bringing the total taxable capital gain down to $188 ($180 + $8).

Learn more in our dedicated Crypto Swaps Tax Guide

How token rewards are taxed

Many DeFi activities that you come across in this involve token rewards. These may be the result of activities such as staking, lending, airdrops, or yield farming. Learning how token rewards are taxed is essential for understanding how various other aspects of DeFi taxation works.

Income tax for receiving a token reward

Tokens rewarded through activities such as staking, airdrops or yield farming are treated as income by the IRS. This means that they will be taxed at income tax rates.

To determine the amount of income you received, you need to calculate the fair market value (FMV) of the token in USD at the time you received dominion and control over it.

This USD value then forms the cost basis of the token if you later sell it and need to calculate a capital gain or loss.

Example: You receive 1000 tokens from an airdrop. At the time you claim them, they are worth $0.50 each. You report an income of $500.

Capital gains tax for selling a token reward

If you later sell a token reward, then you will need to calculate whether you made a capital gain or loss, and add this to your tax return accordingly.

To do this, you need to calculate the asset's FMV in USD when you sold it and then subtract the cost basis from this amount.

The result is your capital gain or loss, which you must report on your taxes.

If you held the asset for more than a year before selling it, any gains will be taxed at the capital gains tax rate. If you sold it earlier than that, it will be added to your income and taxed at your income tax rate.

Example: You sell all the tokens you received from an airdrop for $750. The cost basis of the airdrop is $500. You report a capital gain of $250.

See our guide on US Crypto Tax for a full explanation of how capital gains and income tax are applied to cryptocurrency, and learn how you can use losses or long-term holding to potentially reduce your overall tax liability.

How staking is taxed

Staking in the context of DeFi involves locking up a certain amount of cryptocurrency to participate in maintaining the operations of a blockchain system. It's akin to depositing money in a bank to earn interest; here, you're depositing crypto to earn rewards, often in the form of additional tokens.

Staking rewards are generally taxed as ordinary income, just like the wages you earn from your job or the interest you earn in your savings accounts.

Example:

Imagine you own $10,000 of Ethereum (ETH) and decide to stake it in a DeFi protocol. This move is strategic to earn staking rewards, enhance the security and efficiency of the blockchain network, or both.

Once your staked ETH begins generating returns (paid in additional ETH), the IRS will likely treat these earnings as income, and you’ll have to report it on your income tax return.

You’ll trigger another taxable transaction if you sell any crypto you earned from staking. When you sell this crypto, you’ll pay capital gains taxes on the difference between your cost basis ( its fair market value when you received it) and the amount you sell it for.

How DeFi lending and borrowing is taxed

DeFi allows you to lend and borrow crypto assets in a matter of seconds from anyone, anywhere in the world, in an entirely peer-to-peer and trustless manner. Trustless lending and borrowing is one of DeFi's major financial breakthroughs; however, if you engage in these activities, you must beware of the potential tax consequences.

DeFi loans have different tax implications for the borrower and the lender. They will vary depending on the exact platforms you use and how you manage your funds. Let’s take a look at some of the more common scenarios.

Borrowing crypto

Borrowing a crypto loan isn’t taxable, as the funds or tokens received aren’t income.

“Repayment of loans is not taxable, but any rewards received during the process must be reported,” says Wesley Barton (CBP), Director of The Network Firm, a leading crypto accounting firm.

This is because some platforms may incentivize you to take out a loan by rewarding you with tokens. In this case, any tokens you earned would be subject to income tax, and capital gains tax if sold for a profit.

Selling borrowed crypto

If you borrow crypto and go on to sell it, you will create a taxable event. You will need to calculate a capital gain or loss, based on the difference between the cost basis of the borrowed asset and the price you sold it for. The cost basis is the fair market value (FMV) in USD at the time you borrowed the asset.

Collateral and liquidations

An important feature of DeFi lending is that loans must be collateralised. This means that you need to deposit funds to secure the loan. These funds are returned (minus interest and fees) once you repay the loan.

However, if your Loan-To-Value ratio (LTV) drops below a certain threshold, the platform may liquidate (sell) your collateral to cover the loan and protect the lender.

If this occurs, then the IRS treats the liquidated assets as if you sold it.

As such, you will incur a capital gain or loss depending on the value of the collateral at the time of liquidation compared to its cost basis.

Lending

Lending your crypto results in taxable income generated by interest payments.

This is because you are paid interest to lend your crypto via a lending platform such as Aave. It typically involves you depositing your assets into a smart contract, which are then loaned on your behalf.

For doing so, you are rewarded with interest payments. The interest may be paid in kind (using the same asset you loaned), using a stablecoin, or using the platform's own token.

Rewards are treated as income tax when you receive them. You must pay capital gains tax on any profits if you sell them later.

Note: Another taxable event may occur if the lending platform issues a Liquidity Pool Token (LPT) in return for your deposit. This may be viewed as a crypto-to-crypto swap, triggering a taxable event when you deposit and withdraw your funds for the loan.

📌 DeFi Borrowing – Taxable events

| Action | Taxable? | Tax Implication |

|---|---|---|

| Borrowing crypto from DeFi | ❌ No | Loans are not taxable income |

| Selling borrowed crypto | ✅ Yes | Taxable disposal of collateral (capital gain/loss based on cost basis) |

| Repaying loan | ❌ No | No tax event (just settling debt) |

| Providing crypto as collateral for a loan | ❓ Maybe | Taxable even if you exchange your collateral for an LPT |

| Forced sale due to collateral liquidation (margin call) | ✅ Yes | Taxable disposal of collateral (capital gain/loss based on cost basis) |

📌 DeFi Lending – Taxable events

| Action | Taxable? | Tax Implication |

|---|---|---|

| Lending crypto on a DeFi platform | ❓ Maybe | Taxable event if you exchange your funds for an LPT |

| Receiving interest/yield from lending | ✅ Yes | Taxed as ordinary income at FMV when received |

| Withdrawing loaned crypto | ❓ Maybe | Taxable even if you exchange an LPT for your funds |

| Earning governance tokens as a lender (e.g., COMP, AAVE) | ✅ Yes | Taxed as income at FMV when received |

| Receiving airdropped yield-bearing tokens (e.g., cDAI, aETH) | ✅ Yes | Taxable income at FMV when received |

| Swapping loaned crypto for another asset | ✅ Yes | Taxable event (capital gain/loss on the based on the swapped asset’s cost basis) |

Let us analyse your DeFi activity and receive a tax report ready for the IRS or TurboTax

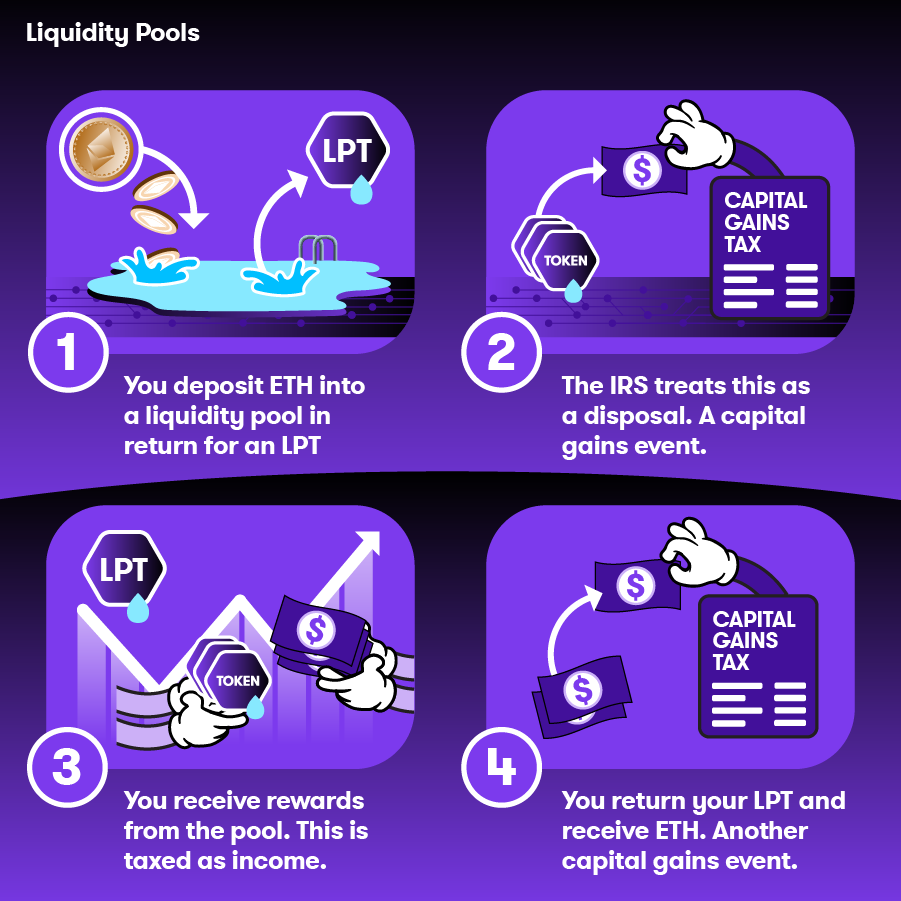

How liquidity pools are taxed

Liquidity pools are a foundational component of many DeFi protocols, allowing users to pool their resources to facilitate trading, lending, and other activities. Users deposit their crypto assets into a shared pool, which is used to execute trades or loans on the platform. In return, they often receive fees or rewards based on their contribution.

Participating in a liquidity pool could result in both capital gains and income taxes, depending on the mechanics of the protocol.

Example: You contribute 1 ETH, worth $2,500 to a liquidity pool on a DeFi platform to earn trading fees or other rewards. In return for this deposit, you receive a Liquidity Pool Token (LPT) representing your share of assets in the pool.

Because you receive a token in return for handing over your assets, it may be viewed that you are performing a crypto-to-crypto swap, a capital gains tax event.

You'd calculate your capital gain based on the difference between the cost basis ($2,000) and the market value at the time of the deposit ($2,500). This results in a capital gain of $500, which would be subject to taxes.

Some may also view depositing assets into a pool – even without receiving an LPT in return, as a taxable event as you have effectively disposed of them.

When you withdraw your assets from the liquidity pool, the disposal of any LP or receipt tokens could trigger another capital gain or loss event.

For instance, if the value of the withdrawn assets is less than the value at the time of depositing (say you receive assets worth $2,300 back from an initial $2,500), you would incur a capital loss of $200. For instance, upon withdrawing your original 1 ETH from the liquidity pool, it may only have a FMV of $2,300. Therefore, you incur a loss on the sale of the LPT ($200).

Furthermore, any additional token rewards or interest earned from the liquidity pool are viewed as income, and you’ll have to report it on your income tax return. Finally, when you sell these reward tokens, you'll need to account for any capital gain or loss from the sale.

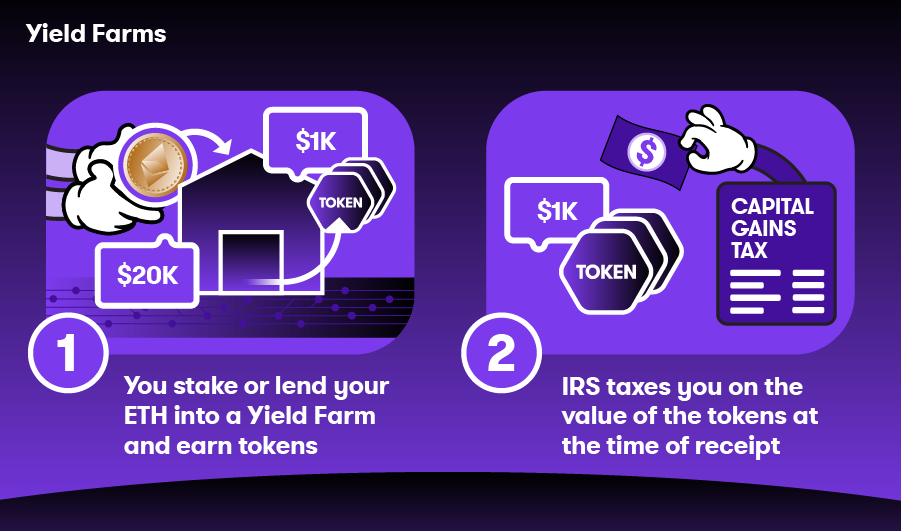

How yield farming is taxed

Yield farming is a DeFi strategy where users stake or lend their crypto assets to earn rewards. It often involves navigating multiple liquidity pools and protocols to maximize returns.

Because yield farming involves the same processes as staking and providing liquidity, the tax implications are also the same. Generally, you’ll pay income taxes on any staking reward you earn.

Example:

You deposit $20,000 of ETH into a yield farm. In exchange, you receive one token valued at $1,000 at the time of receipt. The token you earn — or its value when you receive it — is considered taxable income, and you’ll report it on your income tax return.

You’ll also pay capital gains taxes on the token when you decide to sell it. For example, if it was valued at $1,000 when you received it and you ultimately sell it for $1,500, you’ll pay capital gains taxes on the $500 increase in value.

You may also be liable for capital gain when you deposit and withdraw assets from a farm if the event meets the conditions to be considered a disposal.

How airdrops are taxed

An airdrop is a marketing tactic that’s become popular in cryptocurrency. An airdrop is when coins or tokens are distributed to users, sometimes for free and sometimes in exchange for completing certain actions.

The IRS requires that you pay taxes on airdrops. The value of the cryptocurrency at the time it airdropped to you is considered income, and you’ll have to report it on your income tax return.

“If you later sell the tokens, any gain or loss is subject to capital gains tax under IRC Section 1001,” says Wesley Barton (CBP), Director of The Network Firm, a leading crypto accounting firm. “Always report airdrops on your taxes, even if you didn’t request or use them.”

For example, suppose you receive $100 of ETH in an airdrop. You would report $100 as income on your tax return, which would be taxed at your ordinary income tax rate. Suppose you later sell your ETH, but it’s now worth $150. You’ll pay capital gains taxes on your $50 profit — the difference between the value of the crypto when you received it and its value when you sold it.

On the other hand, if the ETH had decreased in value by the time you sold it, you could claim a loss for the difference between its $100 value when you received it and its value when you sold it.

How wrapping tokens is taxed

Wrapping tokens is a process used in DeFi to make various cryptocurrencies compatible with smart contracts or decentralized applications. Wrapping is especially common when a blockchain's native token, such as Ethereum's ETH, must be wrapped into a different token standard that makes it compatible with smart contracts. For instance, ETH can be wrapped into WETH, an ERC-20 token, allowing it to interact with Ethereum's DeFi ecosystem.

There are two different tax approaches to wrapped tokens. The more conservative approach treats wrapping as a crypto-to-crypto exchange, meaning you’d have a capital gain (or loss) based on how the price has changed since you purchased it.

A more aggressive approach argues that there is no market price difference between wrapped tokens and that wrapping tokens is not intended to be a disposal. Under that approach, you wouldn’t treat wrapping as a taxable event. However, the IRS may disagree with this, and you should seek legal advice before applying for this view.

“However, if wrapping is seen as a technical transformation with no change in ownership or value, it may not trigger taxes, and the original cost basis carries over,” says Barton.

“Since the IRS has not issued explicit guidance on wrapping, consult a tax professional for clarity.”

Example:

You own $1,000 of ETH and want to engage with a DeFi protocol on the Ethereum network. Since smart contracts on Ethereum require the ERC-20 version of ETH, you decide to use a service like Uniswap to wrap your ETH into WETH.

If the ETH were worth $850 when you purchased it and chose the more conservative tax approach, you would incur a taxable capital gain of $150.

How bridging tokens is taxed

Bridging tokens involves transferring assets from one blockchain to another. It is necessary when users want to use the functionalities of different blockchain platforms that aren't natively compatible. A bridge locks the tokens on the original blockchain and creates a corresponding representation on the target blockchain.

Bridging is similar to wrapping in that competing arguments about its tax implications exist. Some tax experts believe bridging has no tax implications. After all, you aren’t swapping assets — you’re just moving them from one blockchain to another, similar to moving the money in your savings account from one bank to another.

However, a more conservative approach would view bridging as a taxable event akin to a crypto-to-crypto trade, especially in circumstances where the original asset isn’t available on the destination network.

Example: You own Bitcoin (BTC) and want to engage with a DeFi protocol on the Ethereum network. Since BTC doesn’t operate natively on Ethereum, you decide to bridge your BTC onto Ethereum. From this conservative approach, bridging your BTC is seen as disposing of your original BTC and acquiring a new, different asset (wBTC).

This transaction likelytriggers a capital gains tax, calculated based on the difference between the cost basis of the BTC and its market value at the time of the bridge. This position aligns with a cautious interpretation of IRS guidelines, which generally consider the disposal of one cryptocurrency for another as a taxable event.

How gas fees are taxed

In the world of DeFi, almost every transaction you make requires the payment of a network transaction fee known as a gas. Gas fees can fluctuate significantly, and big spikes typically appear during heavy usage of the underlying blockchain.

The tax treatment of gas is more complicated than that of other trading fees. This is because you dispose of a cryptocurrency to pay the fee, which incurs a capital gain/loss.

The easiest way to get your head around gas fees and taxes is by breaking it up into several stages. Let’s take a look:

How gas is taxed every time it is spent

Any time you spend gas – like ETH – to transact on a blockchain is treated as a disposal and, therefore, subject to capital gains tax. You are taxed as though the gas that was spent was traded for US Dollars at the time of the sale. So, the amount subject to capital gains tax is the value of the gas at the time of the disposal, minus its cost basis.

This applies regardless of the type of transaction you are performing, including non-trading-related activities like transfers to and from your own wallets, use in social media, or gaming applications.

Example:

You transfer 50 USDC from one wallet you own to another and pay .01 in gas using ETH.

You originally purchased the ETH for $2.

At the time of the transfer, the ETH is worth $5. This means that you pay capital gains tax on the $3 gain. How gas is taxed when you make a purchase

Gas fees are be added to the cost basis when you purchase crypto

Example:

You purchase $1000 worth of USDC via Uniswap on Ethereum and pay a $5 gas fee and a $1 platform fee to Uniswap, both of which are charged in ETH.

The total fees of $6 are added to your cost basis, bringing it to $1006.

Remember that you must also pay capital gains tax on the $6 of ETH used for gas.

How gas is taxed when you make a sale

Gas fees are subtracted from the taxable amount when you make a sale.

Example:

You later sell your USDC for $1050.

This time when you make the sale the gas fee is $10 the Uniswap platform fee remains at $1. Both are in ETH.

This total fee of $11 is removed from your net proceeds, resulting in a net capital gain of $33 ($1039 - $1006).

Again, you must also pay capital gains tax on the $11 of ETH used for gas.

Given that gas fees on blockchains such as Ethereum and Bitcoin can be quite high, it is important to capture them accurately when filing your taxes. They can have a substantial impact on your net capital gains over the course of a tax year.

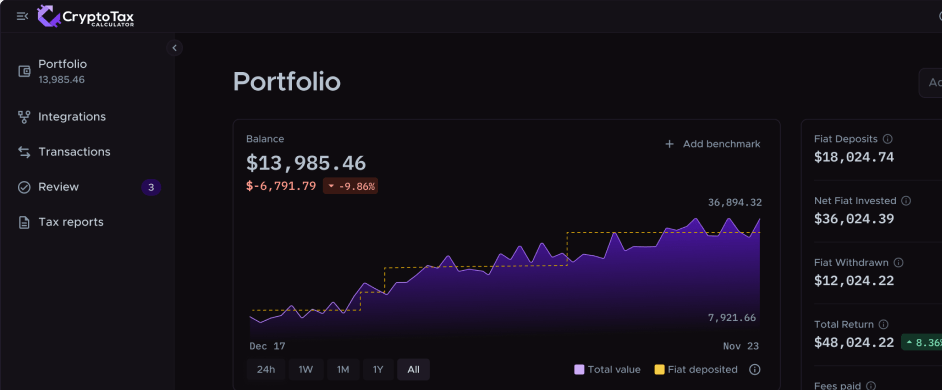

How to do your DeFi taxes with Crypto Tax Calculator

Using specialised tax software like Crypto Tax Calculator to calculate your DeFi taxes is much easier than doing it manually.

Crypto Tax Calculator will automatically categorise your DeFi transactions, meaning that it can identify liquidity pools, bridging, gas fees, and staking in addition to all of your buy-and-sell activity.

It will then produce an accurate report that can be exported in multiple formats, including those that meet the specific standards of the IRS and TurboTax.

Here’s how to get started:

- Import your transaction data: Connect all of your exchanges, wallets, and platforms to import your transaction history. Include all of your transactions and trading history beyond just your DeFi activity to accurately establish the cost-basis of assets and ensure you receive an accurate tax report.

- Review for accuracy: While Crypto Tax Calculator does the hard work for you, it may flag some missing data or errors, which you will need to review to ensure accuracy.

- Get your tax report: Generate a comprehensive tax report ready to submit to the IRS, upload to TurboTax or hand it to your tax agent.

If you're new to Crypto Tax Calculator, begin with our Getting Started Guide for an overview of how the platform works.

How to report DeFi transactions to the IRS

You must report your DeFi transactions to the IRS when you file your income tax return.

Depending on the type of translations you have, you could have to complete multiple forms. DeFi transactions generally fall into two categories for tax purposes.

Reporting DeFi income

Many types of DeFi transactions are considered income. You’ll report these on your tax return like you would income from your job or interest on your savings account. DeFi transactions that could result in taxable income include:

-

Staking

-

Lending

-

Liquidity pools

-

Yield farming

-

Airdrops

You’ll report your DeFi income on Schedule 1 of Form 1040, line 8z based on the value of any coins when you receive them, not when you’re filing your taxes. Because the U.S. has marginal tax brackets, any additional income is taxed at the tax rate corresponding to your net annual income.

Reporting DeFi capital gains

Some of your DeFi transactions could result in capital gains instead of income. Examples of transactions that could result in capital gains include:

-

Liquidity pools

-

Yield farming

-

Swaps and trades

-

Wrapping tokens

-

Bridging tokens

-

Gas fees

A capital gain occurs when you dispose of an asset, and it’s the difference between your cost basis (usually its value when you buy or receive it) and the amount you dispose of it for. You’ll report your capital gains on two forms: IRS Form 8949 and Schedule D of Form 1040.

The amount you’ll pay in capital gains taxes depends on [two factors](https://www.irs.gov/taxtopics/tc409#:~:text=Short-term or,graduated tax rates): how long you held the asset before you disposed of it and your overall taxable income. Short-term capital gains are those from assets you held for one year or less. On these gains, you’ll pay your ordinary income tax rate. Long-term capital gains apply to assets you held for more than one year, and they’re subject to more favorable tax rates of either 0%, 15%, or 20%, depending on your income.

The good news is that, just like you’ll pay taxes on your capital gains, you can reduce your tax liability with any capital losses. Capital losses can offset any capital gains you have. And if your capital losses exceed your capital gains, you can deduct up to $3,000 (or $1,500 if you’re married filing separately). Anything that exceeds $3,000, you can [carry forward](https://www.irs.gov/taxtopics/tc409#:~:text=Limit on the,can carry forward) to later years.

How to report your crypto taxes to the IRS

Penalties and fines for failing to report DeFi taxes to the IRS

If you don’t report your taxable DeFi transactions to the IRS, it could end up costing you a lot more in the long run. The IRS imposes an accuracy-related penalty if you don’t report all of your income and, therefore, underpay your taxes.

First, you could pay a negligence penalty if you don’t make a reasonable attempt to follow the tax laws when filing your income tax returns. Examples of this type of negligence include not keeping proper records and not reporting income that was shown on a tax form, such as a Form 1099. According to the IRS, this penalty applies if your disregard for the tax rules is either careless, reckless, or intentional.

You could also pay a tax penalty for substantial understatement of tax. This applies if you understate your tax liability by 10% or more of your required tax or $5,000, whichever is greater. The penalty for both negligence and substantial understatement is 20% of the portion of the underpayment.

In addition to your tax penalty, you’ll also pay interest on both your underpayment and the penalty itself. Interest starts accruing on the date income taxes are due — usually April 15 — and continues accruing until you pay what you owe.

Does the IRS know about my DeFi trading?

The belief that crypto transactions are 'untraceable' and invisible to the IRS is a myth. The blockchain is a transparent ledger, open to anyone, making it a poor choice for evading taxes. It's the opposite of a hiding spot; it's a spotlight on every transaction you've ever made.

Crypto mixers, like Tornado Cash, are smart contracts that pool and scramble cryptocurrencies from multiple sources to obscure their origin and enhance privacy. Many people mistake these as a route to avoid tax, but they're not. The IRS is aware of these platforms and has ways of dealing with this type of tax evasion. Using mixers isn't just risky — it could lead you straight into legal hot water.

Crypto exchanges are also subject to Know Your Customer (KYC) requirements. Both domestic and international crypto exchanges collaborate with tax authorities around the world, and have data-sharing agreements, which means they must report your activities to the IRS. They keep detailed records of your transactions, making it easier for the IRS to follow the money trail, even if it's been through a mixer.

Finally, new rules announced in December 2024 by the U.S. Department of the Treasury and the IRS require crypto platforms to report digital asset transactions on Form 1099-DA. Exchanges submit this form both to investors and to the IRS. In other words, even if you don’t report your income to the IRS, they likely already know about it.

In short, yes, the IRS likely knows about your crypto, or at least has the means to find out. The blockchain's transparency, combined with the IRS's growing tech-savviness and the reporting duties of exchanges, makes your crypto activities more visible than you might think. It's safer to assume the IRS is in the know and report your crypto transactions accordingly. Compliance is your best strategy when it comes to crypto tax.

How to reduce your taxes when using DeFi

While most DeFi activities trigger taxable events, you can still employ some strategies to reduce the number of taxable events or minimise your tax. If you plan ahead, you may be able to stick with mostly non-taxable transactions so that you don’t end up with a large tax bill.

| Strategy | How it helps | Example |

|---|---|---|

| Use loans instead of selling crypto | Selling crypto triggers capital gains tax, but borrowing against your crypto typically does not. | Instead of selling 1 BTC for 40,000 USDC (triggering capital gains), you can borrow the USDC using BTC as collateral. |

| Use liquid staking tokens to earn staking rewards | Instead of having to claim staking rewards and spend gas and trigger taxable events, liquid staking tokens appreciate in value over time. You can then sell them when you are ready to trigger a taxable event. | You swap 1 ETH for 0.97 stETH instead of staking the ETH. Over time, your stETH appreciates to 1.2 stETH. Instead of having to claim your rewards, the balance of your token grows over time without the need to make transactions or incur fees. |

| Tax Loss Harvesting to offset gains | If your crypto drops in value, you can sell at a loss to offset gains from other taxable events. | You sell ETH at a $5,000 loss. This offsets $5,000 worth of gain from other trades. |

| Hold crypto long-term before selling it | Crypto sold after being held for more than a year may be subject to a lower tax rate than crypto sold within a year. | You sell BTC after holding it for 2 years. You receive a $1000 capital gain, which is taxed at 15%. If you had sold after 6 months it would have been taxed at your income tax rate, of 22%. |

Tax software built for DeFi

No credit card required

Sources

- IRS Notice 2014-21: Guidance on Virtual Currency, Internal Revenue Service, 2014

- Frequently Asked Questions on Virtual Currency Transactions, Internal Revenue Service, 2021

- Revenue Ruling 2019-24, Internal Revenue Service, 2019

- About Form 8949: Sales and Other Dispositions of Capital Assets, Internal Revenue Service, 2022

- Instructions for Form 8949, Internal Revenue Service, 2022

- About Schedule D (Form 1040): Capital Gains and Losses, Internal Revenue Service, 2022

- About Form 1099-MISC: Miscellaneous Income, Internal Revenue Service, 2022

- Instructions for Form 1099-MISC, Internal Revenue Service, 2022

- Topic No. 409: Capital Gains and Losses, Internal Revenue Service, 2021

- Publication 544: Sales and Other Dispositions of Assets, Internal Revenue Service, 2021

- Publication 551: Basis of Assets, Internal Revenue Service, 2021

- IRS News Release IR-2018-71: IRS Reminds Taxpayers to Report Virtual Currency Transactions, Internal Revenue Service, 2018

- IRS Publication 550: Investment Income and Expenses, Internal Revenue Service, 2021

- 26 U.S. Code § 7701(o): Economic Substance Doctrine, U.S. Code, 2010

- Economic Substance Doctrine and Related Penalties, Internal Revenue Service, 2014

US Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in US.

Learn about US crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in US so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in US so you can file with confidence.

Learn about NFT taxes