Crypto tax shouldn't be hard

Turn complex blockchain data into CPA approved tax reports

Follows ATO tax guidelines

Australian made and owned

4.8/5 TrustPilot

Built to support ATO Tax Guidelines

Full support for the unique ATO reporting requirements, including Australian specific rules around personal-use, mining, staking, and airdrops.

Pay the least tax possible

Least Tax First Out is an exclusive algorithm that optimises your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a disposal event.

Be confident in the numbers

Easily see what's going on across all your wallets and exchanges so you can make the best decisions at all times.

Make compliance a breeze

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow and get your audit-proof tax reports with ease.

No credit card required

Official Partners

Backed by Coinbase Ventures, we’re proud to offer best-in-class support for the Coinbase ecosystem.

Learn moreWe're thrilled to partner with METAMASK, the leading self-custodial wallet, to make crypto taxes a breeze.

Learn more5-Star Support

Our team actually cares about helping you do your crypto tax. Get real help from real people, whenever you need it.

Tailored Support ForNFTsDeFi ProtocolsExchangesBlockchains

Fallen down the crypto rabbit hole? Don’t waste hours scouring block explorers and drowning in spreadsheets—import transactions automatically from over 1000 sources.

Find your integrations

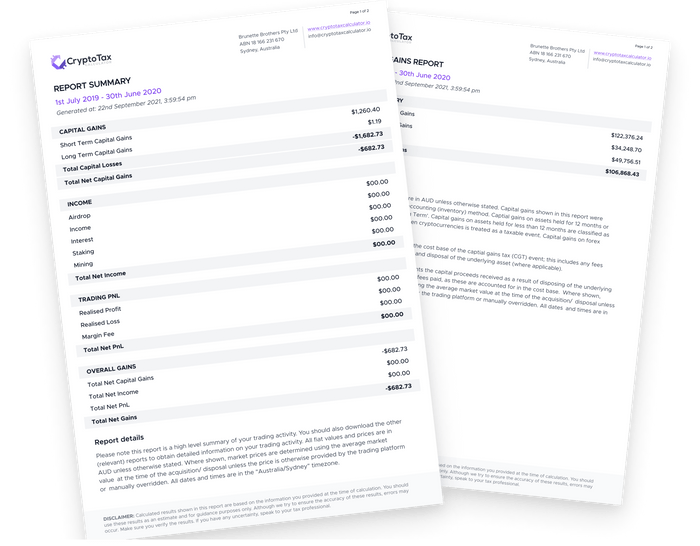

Every Tax Report You Need

No need to try and explain your degen trades, just give your accountant the reports. Or better yet, file them yourself directly via the ATO tax portal.

ATO MyTax

Capital gains

Income

Expenses

Audit report

+9 other detailed reports

Start with a free account

Learn

Helpful guides to understand the numbers and breeze through tax season.

AU Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in Australia.

Learn about AU crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in Australia so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in Australia so you can file with confidence.

Learn about NFT taxesAll in one portfolio tracker

Track your entire portfolio, PnL and tax liability all in the same place.

portfolio value:

$89,436.20

Built for speed

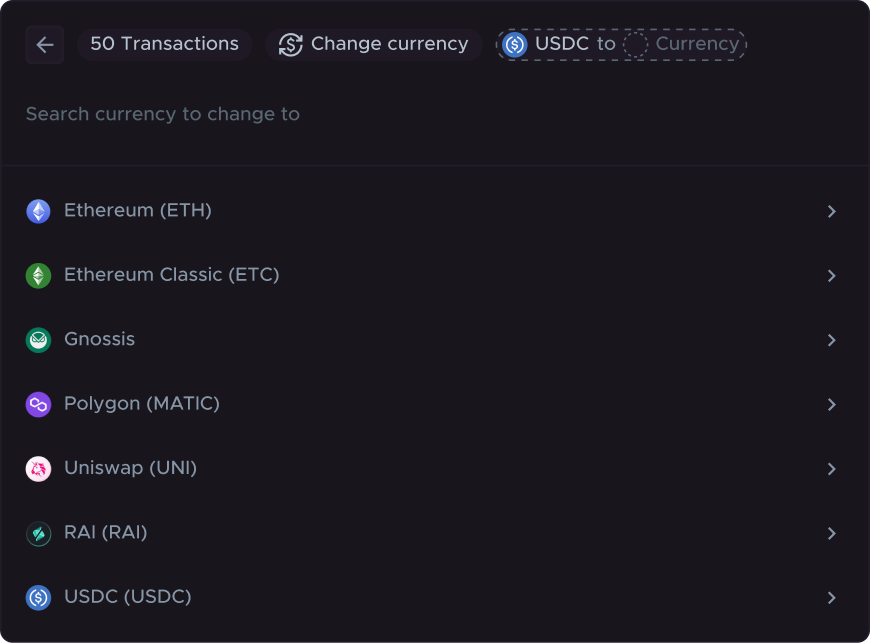

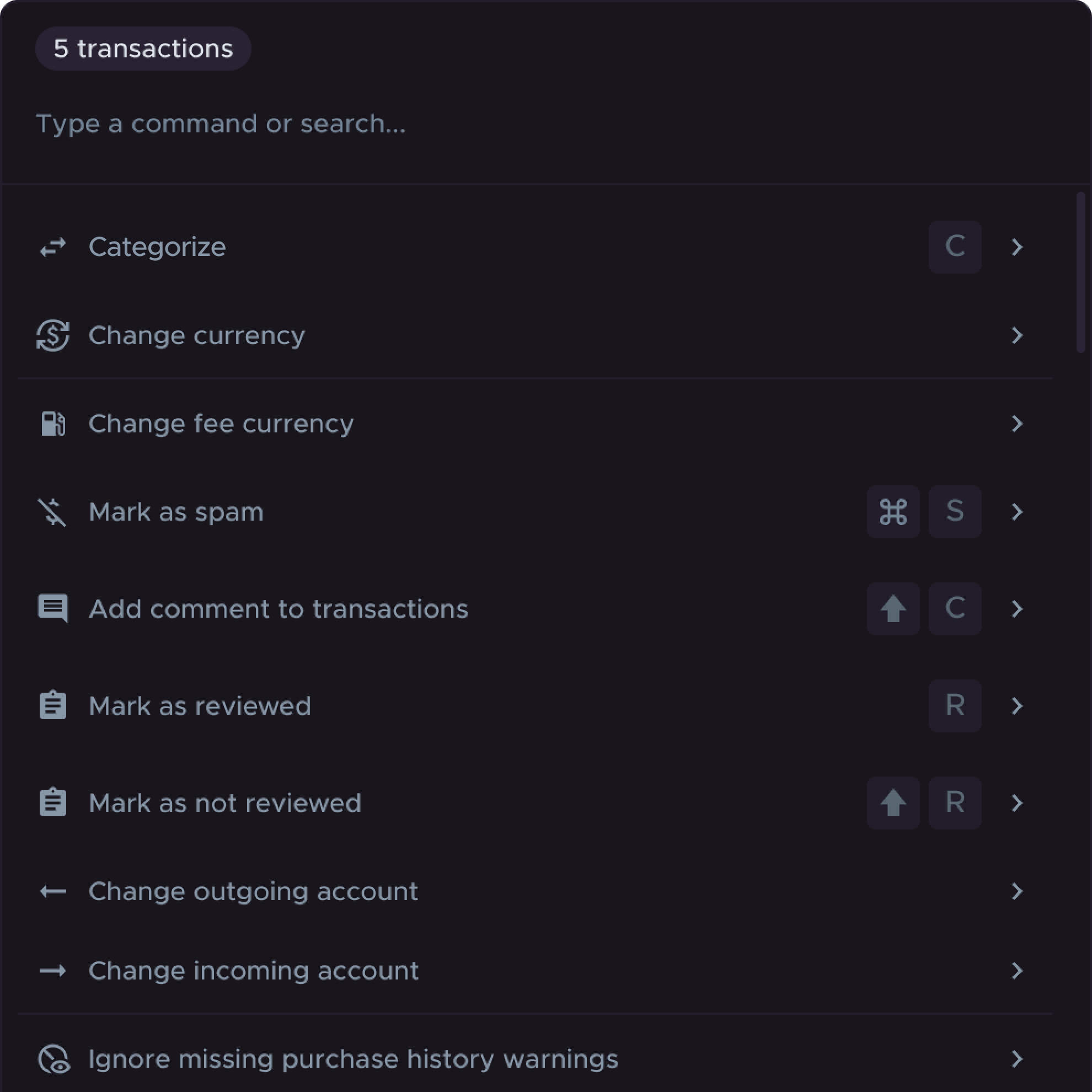

Optimised interface for bulk operations with keyboard shortcuts

Automatically identified tax saving opportunity

All your transactions clearly grouped by their tax impact with your potential savings opportunity highlighted.

Full tax calculation transparency

See the exact breakdown of how each transaction is calculated. Understand the `why` and `how` behind your tax figures.

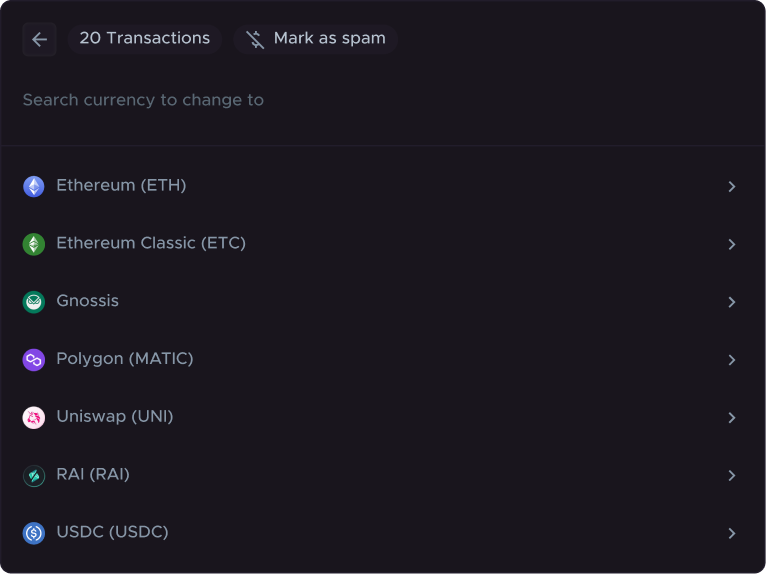

Altcoin pricing oracle

300k+ currencies priced accurately on import. Historical prices for all micro-cap memecoins.

Complete DeFi support

Unified tracking and tax reporting for all your crypto assets across all your exchanges and wallets.

No credit card required

Aussies Really Love Us

Unified tracking and tax reporting for all your crypto assets across all your exchanges and wallets

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

Best Crypto tax Software? after importing data onto @koinly @CryptoTaxHQ and @ZenLedgerIO the clear winner had the best UI Crypto Tax Calculator is the winner - detailed thread tomorrow

CTC has a really good Reconcilliation section where it flags up issues and presents them in logical order so you can tick them off one by one. It's still work but it's just more intuitive I found

Just did my crypto taxes with @CryptoTaxHQ and got my report summary. Overall, very pleased with the process! Highly recommend if you have not yet decided on what crypto software to use. Did my taxes in a few hours and going to my tax guy tomorrow.

I’ve used a few but the best I found was https://cryptotaxcalculator.io . I’m in UK (I think they’re in Aus) so YMMV. GL

Unlike other tax items where you have to wait for 1099s' or bank statements, you can code all of your Crypto and Defi as soon as the ball drops on new years and get a good estimate of where your taxes lie. @CryptoTaxHQ is still my first recommendation for tools.

2021/2022 taxes completed and paid. Use your bear market time wisely. Big shoutout to @CryptoTaxHQ, second year running I've used them. I've tried a few of these calculators and CTC blow their competitors out the water.

A cryptid is tentatively back from hiatus but will be keeping update frequency low rn. Uncle Sam unretired me 4 a mission to JPN so had to finish taxes early. Got it done thx to #CryptoTaxCalculator (@CryptoTaxHQ). I have no affiliation w/ them. Pls just keep it alive🙏

@CryptoTaxHQ I literally could not function without ctc. I've got multiple assets on multiple blockchains doing 5-10k transactions a year. Doing that by hand would be pure insanity.

Called my tax accountant to warn him there will be some crypto and NFT stuff this year. His reply wasn’t what I expected: “No worries, know all about them! My 13 yo daughter creates NFTs and sells them on OpenSea. And we use @CryptoTaxHQ for our clients” Boom! I chose well💥💥

Not sponsored or anything but came across CryptoTaxCalculator.io @CryptoTaxHQ. Such an easy way to track and record your crypto taxes automatically. Made tracking my Binance spot/futures trades + Uniswap transactions a whole lot less daunting.

What Accountants Use

Our platform has been developed in deep collaboration with accountants and tax lawyers.

“Crypto Tax Calculator does the job spectacularly”

We’ve been looking for a product to help us manage our clients’ crypto tax returns, and Crypto Tax Calculator does the job spectacularly. Not only does the team keeps on top of all HMRC changes so we can have full confidence in the reports we produce, but their product is an efficient way to bring in a client’s data from a constantly growing multitude of exchanges, blockchains, and wallets. Couldn’t ask for anything better.

Joe David

Founder, Myna Accountants

“Crypto Tax Calculator’s software enables our team to tackle the most complex DeFi scenarios.”

...from liquidity protocols, to NFT ecosystems, and remain at the forefront of crypto tax reconciliation. As specialists in cryptocurrency reporting, accuracy is completely essential to us, our clients and our accounting partners, which is why we love CTC.

Oliver Woodbridge

Director, Tax On Chain

“Crypto Tax Calculator is a tool we couldn’t live without.”

As an accounting firm that specialises in crypto taxes, Crypto Tax Calculator is a tool we couldn’t live without. Being able to aggregate client’s transactions across all exchanges and blockchains into one data feed brings incredible efficiencies to the crypto tax compliance process.

Marc Phillis

Director, Cryptocate

“The most advanced and accurate crypto tax calculator on the market”

“The most advanced and accurate crypto tax calculator on the market”

Harrison Dell

Tax Lawyer & Web 3 Founder - Cadena Legal

Frequently Asked Questions

At CTC we design our product with security in mind, we follow industry standard best practices to keep your data safe.

How is crypto tax calculated in Australia?

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you might need to pay capital gains on profits from buying and selling cryptocurrency, or pay income tax on interest earned when holding crypto.

I lost money trading cryptocurrency. Do I still pay tax?

The way cryptocurrencies are taxed in Australia mean that investors might still need to pay tax, regardless of if they made an overall profit or loss. Depending on your circumstances, taxes are usually realised at the time of the transaction, and not on the overall position at the end of the financial year.

How do I calculate tax on crypto to crypto transactions?

In Australia you are required to record the value of the cryptocurrency in your local currency at the time of the transaction. This can be extremely time consuming to do by hand, since most exchange records do not have a reference price point, and records between exchanges are not easily compatible.

How can Crypto Tax Calculator help with crypto taxes?

You just need to import your transaction history and we will help you categorize your transactions and calculate realized profit and income. You can then generate the appropriate reports to send to your accountant and keep detailed records handy for audit purposes.

Can't I just get my accountant to do this for me?

We always recommend you work with your accountant to review your records. If you would like your accountant to help reconcile transactions, you can invite them to the product and collaborate within the app. We also have a complete accountant suite aimed at accountants.

Do you handle non-exchange activity?

We handle all non-exchange activity, such as onchain transactions like Airdrops, Staking, Mining, ICOs, and other DeFi activity. No matter what activity you have done in crypto, we have you covered with our easy to use categorization feature, similar to Expensify.

Do I have to pay for historical tax reports?

Our subscription pricing is per year not tax year, so with an annual subscription you can calculate your crypto taxes as far back as 2013. The process is the same, just upload your transaction history from these years and we can handle the rest.

How does payment work?

We have an annual subscription which covers all previous tax years. If you need to amend your tax return for previous years you will be covered under the one payment. We also offer a 30 day 100% money back guarantee, where if you contact our support team you can collect a full refund.

Can I use my own accountant?

Yes, Crypto Tax Calculator is designed to generate accountant friendly tax reports. You simply import all your transaction history and export your report. This means you can get your books up to date yourself, allowing you to save significant time, and reduce the bill charged by your accountant. You can discuss tax scenarios with your accountant, and have them review the report.

What if my exchange is not on the list of supported exchanges?

We cover hundreds of exchanges, wallets, and blockchains, but if you do not see your exchange on the supported list we are more than happy to work with you to get it supported. Just reach out to [email protected] or via the in-app chat support feature and we will get you sorted.

Do you support NFT transactions?

We do! We have integrations with many NFT marketplaces, as well as categorization options for any NFT related activity (minting, buying, selling, trading).

How does the free trial work?

The platform is free to use immediately upon signup, allowing you to import your transactions and take advantage of our smart suggestion and auto-categorization engine, portfolio tracking, DeFi and NFT support. For access to reports, the tax loss harvest tool or chat and priority support, you will need to upgrade to the appropriate paid plan.

Get started for free

Import your transactions and generate a free report preview

No credit card required