Easy, accurate crypto tax reports

Manage your crypto clients’ taxes with confidence.

Integrates with Xero

4.8/5 TrustPilot

No credit card required

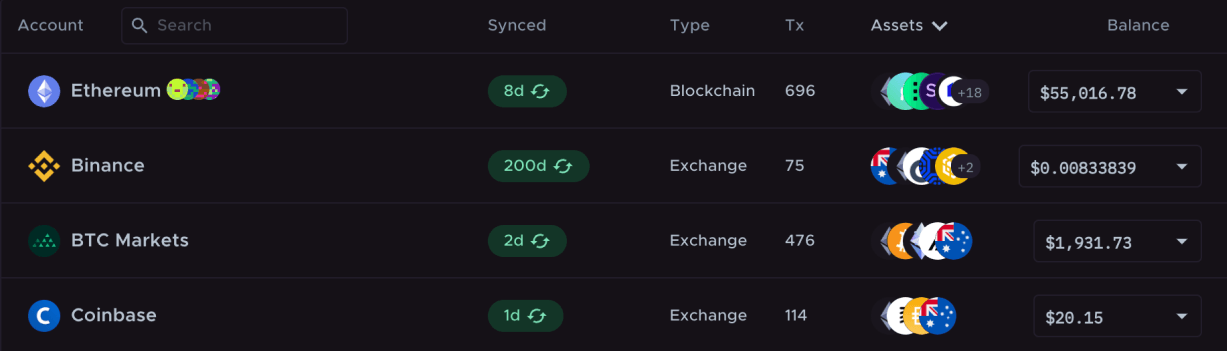

One view

View all of your clients in one view in our Accountant Portal.

Seamless collaboration

Invite in your clients and work in real-time alongside them.

Robust insights

Drill down into an individual level to view clients’ obligations, leave notes and reconcile transactions.

Trusted by industry leaders

We partner with leaders in the accounting industry to help demystify crypto compliance.

No credit card required

Confidently compliant

CTC adapts to the rapidly changing regulatory landscape, and generates audit-proof reports. Rest easy knowing your business is protected if the tax authorities come knocking.

Safe and secure

CTC adheres to world-class security protocols. Our platform is SOC 2 Type 2 certified and features single sign on to keep your confidential data protected.

Support for the most complex data

With support for over 300,000 cryptocurrencies and 600 direct integrations, as well as the ability to handle complex tax scenarios –such as DeFi loans, NFTs, DEX transactions, and much more–you can be confident you’re getting the whole picture.

Save time and avoid headaches with the guided reconciliation engine

Our guided reconciliation flow highlights discrepancies according to the level of potential impact, to save time and effort.

Import all client accounts

Categorise transactions

Resolve missing data

Generate tax reports

“Crypto Tax Calculator does the job spectacularly”

Joe David

Founder, Myna Accountants

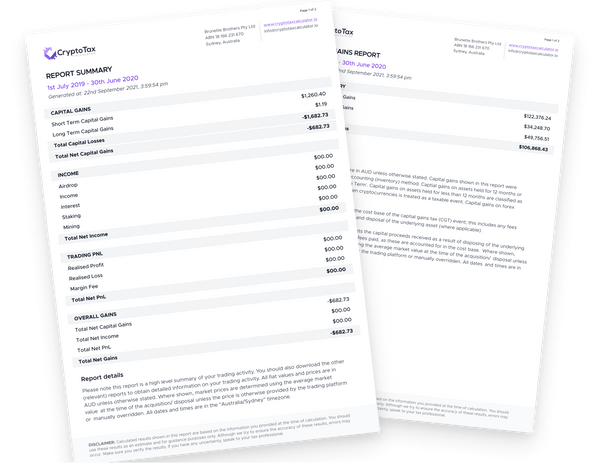

Every Tax Report You Need

No need to try and explain your degen trades, just give your accountant the reports. Or better yet, file them yourself directly via the ATO tax portal.

ATO MyTax

Capital gains

Income

Expenses

Audit report

+9 other detailed reports

Start with a free account

Join our exclusive, interactive crypto tax webinar

Our team of experts will run through, in detail, the most effective ways to manage your clients’ crypto taxes and answer your burning questions. Register for one of our sessions. Spots are limited.

Mathieu Mingant

Partnerships manager

Why tax professionals choose CTC

Unparalleled accuracy

Smart suggestions help make reconciliation and categorisation easy to ensure tax compliance and accuracy.

Trusted by local tax professionals

CTC’s ease and accuracy keeps industry leaders, across accounting, crypto and law, coming back for more.

5-star support

Our friendly crypto tax experts are always happy to help you get your clients’ taxes sorted.

No credit card required

Accountant pricing

Client Management Portal

Manage all of your crypto clients in one place.

Free

Client plans

Choose your plan

Pay the lowest tax and get the most accurate reports with CTC.

Rookie

A$

49

Annual subscription

Tax-deductible*

Hobbyist

A$

129

Annual subscription

Tax-deductible*

Investor

A$

249

Annual subscription

Tax-deductible*

Trader

A$

399

Annual subscription

Tax-deductible*

Transactions

100

1,000

10,000

100,000

Integrations

Unlimited

Unlimited

Unlimited

Unlimited

Portfolio tracking

Unlimited ATO Tax Reports (ALL tax years)

Automated on-chain transactions

Smart contract transactions

Tax minimisation algorithm

Multiple Inventory Methods

Advanced tax reports

Tax loss harvesting

Audit report

Trading stock report

Support

Email + Chat

Email + Chat

Email + Chat

Priority

rookie

hobbyist

investor

trader

Rookie

A$

49

Annual subscription

Tax-deductible*

100

Transactions

Unlimited

Integrations

Portfolio tracking

Unlimited ATO Tax Reports (ALL tax years)

Automated on-chain transactions

Smart contract transactions

Tax minimisation algorithm

Multiple Inventory Methods

Advanced tax reports

Tax loss harvesting

Audit report

Trading stock report

Email + Chat

Support

No credit card required.

Learn

Helpful guides to understand the numbers and breeze through tax season.

AU Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in Australia.

Learn about AU crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in Australia so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in Australia so you can file with confidence.

Learn about NFT taxesFrequently asked questions

What data do I need from the client?

We provide a detailed list of instructions for each exchange that you can share directly with your client. Once they complete the instructions, you can then import that data into the app.

Can I invite clients to the portal?

Yes, we have an optional feature that allows you to invite clients into the app, so that they can enter their data directly. You can then review the transactions with your client.

Do you separate short-term and long-term capital gains?

Yes, we separate capital gains to take into account long-term capital gains.

Do you separate by financial years?

The one accountant package covers all financial years for all clients. The report calculates taxes for each individual financial year.

Is the Accountant Portal free?

Yes, it is! You can add clients, import, review, and reconcile data before payment. Access to the reports page is charged annually per client based on their transaction volume. You can access example reports for free.

What is the 30-day money-back guarantee?

To give you confidence we offer a full 30-day money-back guarantee if you are unsatisfied with our product. During this period you can cancel your plan in the billing section and reach out to support for a refund. We do ask for feedback on the product before canceling. We take all feedback seriously and use this as an opportunity to improve the product.

What is the experience for clients?

Your client’s first experience with CTC will depend on whether or not they are an existing user or completely new to the platform.

How does billing work?

Your credit card is charged the first time you pay for access to a client's reports page. The second client onward is billed end-of-month, then annually. Clients who pay for the subscription before accepting an invite will hold the annual subscription.

Is my client's data safe?

Yes. Being SOC 2 Type 2 compliant, we have all the right tools and procedures to safeguard sensitive information, meaning customers can feel confident in entrusting us with their data. Learn more about CTC's security measures

What kind of support do you have?

Our Australian-based customer support team is highly skilled in resolving technical enquiries and can help you with all your questions via live chat, email and phone.

Complete your clients' taxes with ease and accuracy

No credit card required