Is buying crypto taxable?

Is buying crypto with fiat currency taxable?

In most jurisdictions, cryptocurrency is viewed as property, a type of asset that is different to legal tender. As a result of this categorisation, purchasing crypto with fiat currency (such as AUD, USD, GBP, or EUR) is seen to be making an investment to purchase an asset. In most cases, this will not be subject to tax.

Australia

According to the ATO’s website, buying crypto with fiat currency is not considered a taxable event. You will however still need to track the details of the purchase transaction, as the cost basis will become relevant if/when you choose to dispose of the cryptocurrency you purchased.

United States

The IRS clarified in 2021 that buying crypto with fiat currency is not considered a taxable event. Similar to Australia however, you will need to track the details of the transaction for cost basis purposes.

United Kingdom

In the HMRC’s Cryptoassets Manual, there is clarification provided that buying crypto with fiat currency is not considered a taxable event. You will still need to track the cost basis of any assets for future tax purposes.

Note: If we haven’t directly referred to your region and its guidelines on the taxable implications of buying crypto with fiat currency, we recommend you reach out to a local tax professional to confirm what rules are in place for you.

Is buying crypto with crypto taxable?

Australia

According to the ATO website, “a disposal of cryptocurrency for capital gains tax purposes… occurs when you… exchange one cryptocurrency for another cryptocurrency”. This means that buying crypto with crypto is considered a capital gains tax event in Australia, and you will need to keep records of your purchasing transactions in order to calculate any capital gains or losses made.

United States

As stated in the IRS’ crypto FAQ, “if you exchange virtual currency held as a capital asset for other property, including for goods or for another virtual currency, you will recognize a capital gain or loss.” As an example, if you purchase 1 BTC for 10 ETH, this would be considered a disposal event and you will need to keep adequate records for tax time.

United Kingdom

The HMRC views buying crypto with another form of crypto to be two separate transactions - a trade, and as such, constitutes a disposal event.

Note: If we haven’t directly referred to your region and its guidelines on the taxable implications of buying crypto with crypto, we recommend you reach out to a local tax professional to confirm what rules are in place for you.

How can Crypto Tax Calculator help?

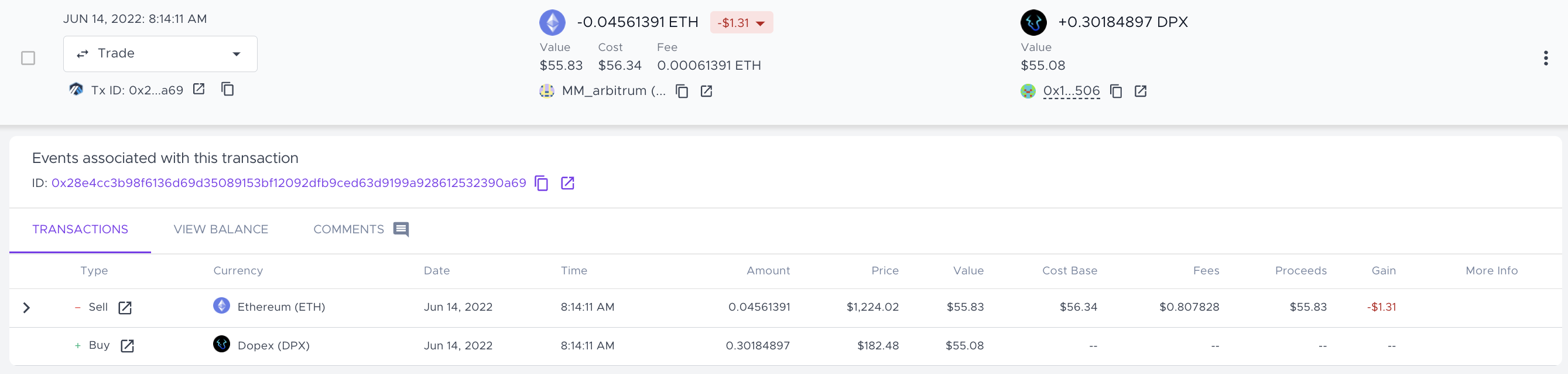

In our platform, we automatically classify purchases of crypto with another form of crypto, from two of your owned addresses as a ‘trade’. Once you’ve imported your data into the platform, our algorithm will automatically categorize transactions of this nature to be a trade. You also have the ability to manually categorize specific transactions as a trade, if they meet the necessary requirements. You can read more about how the Trade category functions here.

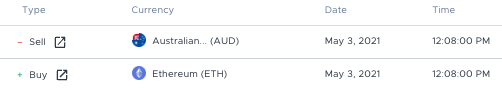

In regards to buying crypto with fiat, our platform will automatically recognize crypto purchases made with fiat via exchanges, as seen in the example below. The algorithm will not treat examples such as this as taxable events.

In a situation where you are unsure about the taxable implications of your crypto activity, we recommended to work with a local tax professional to determine what action is best for your personal circumstances.