How Crypto Margin Trading Is Taxed: 2025 Guide

Key takeaways

- Margin trading activities such as selling, trading and liquidating positions trigger capital gains or losses.

- The IRS allows investment interest deductions in certain cases, but they are subject to limitations.

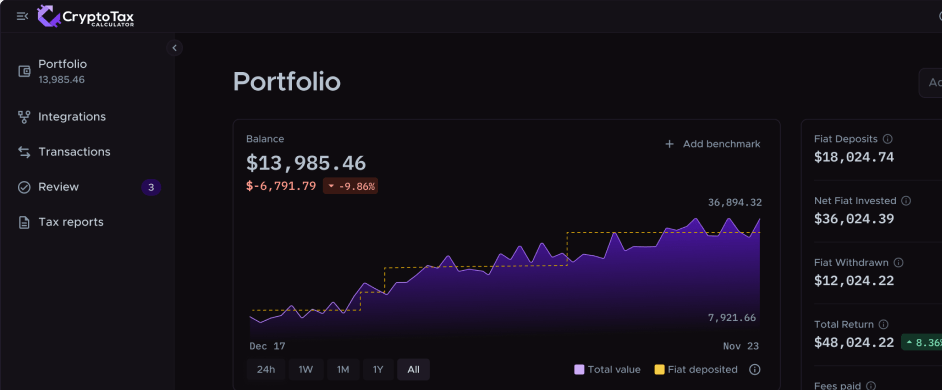

- Tools like Crypto Tax Calculator automate transaction tracking and help generate IRS-compliant reports.

Cryptocurrency margin trading allows traders to amplify returns by borrowing funds to trade larger positions. While this can yield significant profits, it also introduces complexity when it comes to taxes.

The IRS classifies cryptocurrencies as property, which means that dispositions (eg, selling, trading, or liquidating) trigger taxable events that must be reported accurately. While there are no specific rules for margin trading as it applies to crypto, we can use general tax principles for margin trading as guidance.

In this guide, we’ll explore how crypto margin trading is taxed in the U.S., including key taxable events, IRS reporting requirements, and how tools like Crypto Tax Calculator can simplify the process.

Key tax differences between margin trading vs. spot trading

Unlike spot trading, margin trading introduces complexities such as interest payments, forced liquidations, and borrowed funds.

-

Spot trading: You buy crypto with your own money. Selling, trading, or disposing of assets triggers a taxable event.

-

Margin trading: You buy crypto with borrowed money. Selling, trading, or disposing of assets triggers a taxable event. Additionally, liquidation of a margin position or margin loan triggers a taxable event.

Taxable events in crypto margin trading

Capital gains and losses from selling

When trading on margin, each sale or disposal of cryptocurrency is treated as a taxable event. The IRS requires you to calculate gains or losses using the adjusted cost basis, which includes the original purchase price and fees.

How to calculate gains and losses:

- Determine proceeds from the disposal (eg, sale): This is the fair market value (FMV) of the asset when sold or exchanged, in US dollars (USD).

- Subtract the adjusted cost basis from the proceeds: This is the original purchase price, including fees, in USD.

- Result: If the proceeds exceed the cost basis, it’s a gain. If not, it’s a loss.

Crypto-to-crypto trades

Exchanging one cryptocurrency for another using margin is considered a taxable event. The IRS views this as a disposition of the asset you used to open the long-trade, requiring you to calculate gains or losses based on the FMV of the acquired cryptocurrency.

Example: You deposit $50,000 USDC as collateral to open a margin trade to go long on BTC/ETH. Your trade is successful, and you swap 1 BTC for 20 ETH. This is treated as a sale of BTC and a purchase of ETH, and you must calculate the gain or loss on the BTC based on its FMV in USD at the time of the trade.

Short selling

In a short sale, you borrow an asset (e.g., Bitcoin) to sell it, with the intention of buying it back later at a lower price. When you initially borrow and sell the asset, this is considered a taxable event because you are disposing of the borrowed asset.

Example: You borrow 1 BTC when it’s FMV is $30,000 and immediately open a short, selling the 1 BTC for $30,000. This is your first taxable event and needs to be reported, even if there was no gain or loss.

You later close the short when BTC has decreased to a FMV of $27,000, and rebuy the 1 BTC. You make a capital gain of $3,000 and return the 1 BTC you borrowed. This is your second taxable event, and you report a capital gain of $3000.

Note that you will also need to factor in any fees at each stage of the trade, which will affect the overall gain or loss at each stage.

Automate your record keeping with Crypto Tax Calculator

No credit card required

Liquidation of margin loans secured by crypto

Liquidations occur when the value of your position falls below the required maintenance margin. To cover the shortfall, the platform may automatically sell your assets.

These liquidations are considered taxable events by the IRS because they involve the disposal of crypto.

A liquidation may trigger several taxable events. The first is the forced sale of your open position. If this is not enough to cover the oustanding margin loan amount, then your collateral will also be forcibly sold – either partially or in full. The specifics of this will depend on if you are using an isolated margin or cross margin account.

Isolated margin vs cross margin

- Isolated margin: During a liquidation, only the collateral for that trade is used to cover the loss.

- Cross margin: During a liquidation, the exchange will use all available funds in the account to cover the loss. This may mean that several different cryptocurrencies are sold during a liquidation event and can complicate your tax calculations significiantly.

As you can imagine this can get a bit complicated, so here is how to determine the tax owed from a liquidation event using an isolated margin account.

1. Calculate the gain or loss from the liquidated position

To determine the gain or loss from liquidation, you need to calculate the cost basis of the liquidated assets and compare it to the fair market value (FMV) in USD at the time of liquidation. Here’s the step-by-step process:

-

Identify the cost basis of the liquidated position:

- The cost basis is the original purchase price of the cryptocurrency, including any fees associated with acquiring it.

- Example: You bought 1 BTC for $20,000 and paid $100 in fees. Your cost basis is $20,100.

-

Determine the FMV at liquidation:

- The FMV is the price at which the cryptocurrency was sold during the liquidation.

- Example: Your BTC was liquidated at $18,000.

-

Calculate the gain or loss:

- Subtract the cost basis from the FMV to determine the gain or loss.

- Formula: Gain/Loss = FMV at Liquidation - Cost Basis

- Example: $18,000 (FMV) - $20,100 (Cost Basis) = -$2,100 (Loss).

Closing a position at a loss

If your position closes at a loss (i.e., the FMV at liquidation is less than your cost basis), you can use this loss to offset other capital gains. Or, if losses exceed gains, deduct up to $3,000 against ordinary income for the tax year.

Any remaining losses can be carried forward to future tax years.

2. Calculate the gain or loss from the collateral used to secure the margin loan

If the liquidation of your open position isn’t enough to cover your margin loan, then you the exchange will forcibly sell off your collateral partially or in full until the loan is repaid.

The liquidation of that collateral is treated as a disposition of property.

You must calculate the gain or loss on the liquidated collateral using the same method described above:

- Determine the cost basis of the collateral (the original purchase price + fees).

- Calculate the FMV at the time of liquidation.

- Subtract the cost basis from the FMV to determine the gain or loss.

Example:

- You used 1 BTC (purchased for $20,000) as collateral for a margin loan.

- The BTC was liquidated at $18,000 to cover the loan.

- Your loss is $18,000 (FMV) - $20,000 (Cost Basis) = -$2,000.

This loss can be used to offset other gains or deducted against ordinary income, as described earlier.

3. Report the liquidation on your tax return

Liquidations must be reported to the IRS using Form 8949 and Schedule D. Here’s how:

- Form 8949: Report each liquidation as a separate transaction, including the date, cost basis, FMV, and gain/loss.

- Schedule D: Summarize your total capital gains and losses from all transactions, including liquidations.

What if the liquidation doesn’t cover the full loan amount?

If the liquidation doesn’t fully cover the margin loan, you may still owe the remaining balance to the platform. However, this outstanding debt is not a taxable event. It’s simply a liability you need to repay.

Are margin loans secured with USD taxable when liquidated?

If you used USD (or another fiat currency) as collateral for the margin loan, the liquidation of your collateral does not trigger a taxable event. However, if the position you held in crypto was also liquidated to cover the loan, then that sale of crypto is a taxable event.

How interest paid on margin loans is taxed

Interest paid on margin loans can sometimes be deducted as an investment expense.

However, it is not clear whether the IRS applies these rules to cryptocurrency.

As such, you should consult an accountant or tax professional if you want to claim interest as an investment expense.

Reporting crypto margin trading on your taxes

Forms required for margin trading taxes

Crypto margin traders typically need the following forms:

- Form 8949: Used to report individual transactions, including gains, losses, and adjustments.

- Schedule D: Summarizes your total capital gains and losses for the year.

Keeping accurate records

Maintaining comprehensive records is critical for compliance. The IRS expects you to document all margin trading activities, including:

- Transaction timestamps, including date, time and type (e.g., buy, sell, liquidation).

- Asset quantities and FMV at the time of each transaction.

- Fees, including interest paid on margin loans.

Track all of your trades and get a tax report in minutes with Crypto Tax Calculator

Common mistakes made with crypto margin trading and taxes

- Misreporting leveraged trades: Failing to account for the complexities of margin trading – such as adjusted cost basis and interest deductions – can lead to errors in tax reporting.

- Ignoring taxable events from liquidations: Many traders overlook forced liquidations as taxable events, potentially underreporting their liabilities.

- Inadequate record keeping: Without detailed records, it’s nearly impossible to accurately calculate gains, losses, and deductions.

Consider using specialised software like Crypto Tax Calculator to accurately handle your margin trading tax reporting.