We are proud to announce that our integration with Avalanche is now live, helping users calculate their tax obligations for Avalanche transactions!

Avalanche is an organization whose goal is to empower their users to easily and freely digitize all the world’s assets on one open, programmable blockchain platform. We wanted to help those same users find ease of use throughout the entirety of their Avalanche experience.

Crypto Tax Calculator has developed an integration that allows for automatic importing and categorization of users’ Avalanche transaction activity, meaning they have more time to focus on the exciting things being built and shared on Avalanche, and less on the nuances of taxes.

Quick Start

An avid Avalanche user and keen to get started? Here’s a quick and easy dive into how to import your Avalanche transaction history into Crypto Tax Calculator:

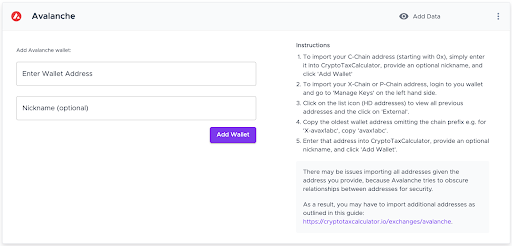

- Locate and copy the wallet address associated with your Avalanche account. This is found on the mainpage of your Avalanche wallet, in the top right hand corner. The C-Chain wallet address should start with '0x', the X-Chain wallet address should start with ‘X-avax’ and the P-Chain wallet address should start with ‘P-avax’

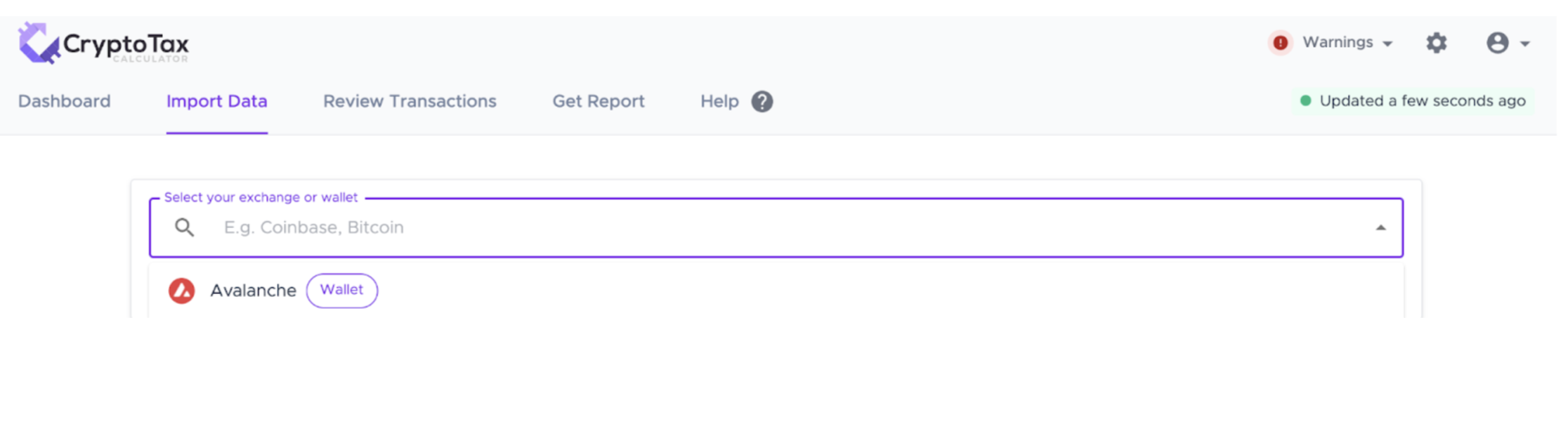

- In Crypto Tax Calculator enter Avalanche into the search field or scroll down and select from the list.

- Enter your Avalanche C-Chain wallet address into Crypto Tax Calculator, provide an optional nickname, and click Add Wallet. It is possible to add multiple wallet addresses after you add the first.

- Repeat this process for each of your wallets on Avalanche’s C-Chain, X-Chain and P-Chain.

- Your wallets will now sync and Crypto Tax Calculator will pull in all the transactions associated with your Avalanche activity.

Tax Guide for Avalanche

Whether you’ve been building bridging tools, dApps, NFT Marketplaces (or anything for that matter!) on Avalanche, or maybe you’re just a user enjoying the fruits of Avalanche’s ecosystem - Crypto Tax Calculator is the solution for you to correctly manage your transaction history going into tax season.

Once you’ve imported your Avalanche wallets into Crypto Tax Calculator, you’ll be able to see that your transactions on Avalanche-hosted products have been pulled in. The large majority of these will have been auto-categorized by our handy algorithm, but if there’s a few outliers, never fear. If Crypto Tax Calculator hasn’t been able to identify and categorize any transactions, you may need to manually adjust and/or re-categorize some. For more information on how to correctly do so, please refer to our tax categorization guide.

What’s the difference between Avalanche’s C-Chain, P-Chain and X-Chain?

You might be wondering what the difference is between Avalanche’s C-Chain, X-Chain and P-Chain, and by virtue, what the different tax implications are. If so, this is the section for you!

-

C-Chain

The ‘C’ in C-Chain stands for ‘contract’, meaning that this particular chain allows for the creation of any Ethereum-compatible smart contracts using the C-Chain’s API. If you’ve been using the Avalanche network for DeFi, then this is the particular chain you’ve been interacting with. -

P-Chain

Following on from the acronym trend in the previous paragraph, the ‘P’ in P-Chain stands for ‘platform’. The primary function of this chain within the Avalanche ecosystem is to stake AVAX and serve as a validator. -

X-Chain

Last but not least, you have Avalanche’s X-Chain, representing the majority of the exchange functionality on their protocol. While you’re still able to send and receive funds on the C-Chain, the X-Chain has a fixed transfer fee so you aren’t hit with any unexpectedly hefty fees.

Avalanche Bridge

Bridging from Ethereum Network to Avalanche

- If you bridge an existing, supported token (such as WETH) into Avalanche via the Avalanche Bridge, this conversion is likely to be considered a transfer event and only the fees incurred are taxable. As bridging occurs between two chains, you will need to import both your Ethereum Wallet and your Avalanche Wallet to obtain the complete transaction history between the two chains.

Bridging from Avalanche to Ethereum Network

-

Currently, the Avalanche Bridge only supports the transfer of ERC20 tokens created on Ethereum to Avalanche and back. As an example; if you’ve got AVAX in your Avalanche wallet that you then send back to the Ethereum Network, this is likely considered a transfer event and only the fees incurred are taxable. Crypto Tax Calculator can automatically determine the transfer of the AVAX when it is sent via the Avalanche Bridge, and can also determine the fees charged to do so. There are two sides of this transaction; the Avalanche side, and the Ethereum Network side. This means that two instances of transfer fees will be taxable.

-

Avalanche: Once your Avalanche wallets are imported into Crypto Tax Calculator, you will be able to see the transfer of the relevant tokens when they are sent to Avalanche via the Avalanche Bridge. You will also be able to see the transfer cost associated with this action.

-

Ethereum Network: To correctly determine the transfer fee of the bridged token, you will need to import your associated Ethereum wallet where you received the token from the Avalanche Bridge. Crypto Tax Calculator will then automatically categorize this transfer and associated fee.

Bridging between Avalanche's C-Chain and X-Chain

- Users can transfer AVAX between Avalanche chains, an example of which would be moving AVAX from the C-Chain to the X-Chain to capitalize on the minimal transfer fees. These transactions are cross-chain, and are therefore similar to the movement of funds from Avalanche to Ethereum mainnet as detailed earlier. As before, there are two sides to this transfer; the C-Chain side and the X-Chain side. This means that two instances of transfer fees will be taxable. For Crypto Tax Calculator to be able to identify and categorize these transactions, you’ll need to import both your C-Chain and X-Chain wallet addresses.

Staking

While the Avalanche P-Chain is the place where validation happens, staking can also occur within dApps on Avalanche’s C-Chain. An example of this is the staking program within the DEX “Pangolin”. With staking on a DEX like Pangolin, you’re passing ownership of your asset into the exchange’s custody in exchange for another token, which incurs a disposal event. This is different to staking protocols (such as those on Avalanche’s P-Chain) which are locked and incur interest at regular intervals. On the C-Chain at the point of claiming from the exchange, you’ll be participating in a crypto-to-crypto transfer, which is also a taxable event. Our calculator will be able to recognize these transactions as their relevant categories.

In regards to validators on Avalanche’s P-Chain, in most jurisdictions any gain from acting as a validator is taxable as ordinary income at its market value on the date you receive it. Depending on the length of time the validation period is set will affect how often these taxable events occur. If at a later date, the validator sells the crypto received as a reward from acting as a validator, this sale will be subject to capital gains tax.

Yield Farming

First up, let’s go into the difference between yield farming and staking. Both are passive income streams that are quite similar in concept, but have a few key differences. Staking offers increased returns (APY) when a user chooses to lock in their funds for prolonged periods of time. Yield farming on the other hand doesn’t require users to lock in their funds. Yield farming also incurs more transaction fees as a result of switching between liquidity pools. These and other factors come into play when tax time comes around.

If you’ve been yield farming using Avalanche platforms and earning income, this income will likely be subject to income tax. If you’ve been making a gain through yield farming (by selling, swapping or spending crypto in the process of yield farming), this will likely be subject to capital gains tax.

Swap / Trade / Borrow

Whether you’re swapping a token on Avalanche for another, sending and receiving funds from X-Chain to C-Chain, trading tokens in return for other assets, or borrowing tokens through a lending platform like Aave, all these actions are likely considered a ‘disposal’. In order to start trading on Avalanche, you will need to have some amount of their native token, AVAX. An example of a typical taxable event for Avalanche users would be swapping your bridged WETH to AVAX within a DEX such as Pangolin to then use your AVAX in an Avalanche dApp. This would be considered a ‘disposal’ event. Like any disposal event, transactions of this kind will be taxed with Capital Gains Tax. Crypto Tax Calculator recognizes these transactions and after you import your data into our platform, it will automatically categorize them for you according to the current legislation in your tax jurisdiction.

DApps

A large proportion of Avalanche’s C-Chain is dedicated to supporting dApps (decentralized applications). If you’re curious as to what products are currently Avalanche’s most popular dApps, you can check out this page. There’s a whole range of dApps being built on the protocol; from games, to DeFi products, marketplaces, exchanges, and more. The taxable events and type of tax incurred will depend on the dApp in question at the time, but the different types of actions (e.g. mint, income, borrow) are all covered in our platform’s categorization options.

Please note:

This Avalanche integration can seamlessly import all your transactions on a single wallet address. To get around the difficulties of tracking transactions across Avalanche’s C-Chain, X-Chain and P-Chain, we have implemented a system where when a user provides an Avalanche address, the algorithm looks up related transactions. The software then determines which addresses in the newly found transactions are associated with the original you provided. This search is repeated multiple times, resulting in a graph-like structure encompassing all of your addresses and transactions. In some cases, gaining a list of exports from the C-Chain is quite difficult for the algorithm. If this occurs and any transactions are not being detected, please follow this workaround:

Look through your X-Chain and P-Chain for imports from the C-Chain, and wherever there is an address missing, import that missing address into Crypto Tax Calculator.

Shane Brunette founded CTC back in 2018 after dealing with his own crypto tax nightmare. He has worked closely with accountants and tax lawyers to make it easy for fellow cryptocurrency users to be tax compliant.