Preparing Your BinanceUS Taxes

Crypto Tax Calculator allows you to calculate your taxes arising from any trading activity on BinanceUS. You can import your trading data using API keys. You can then easily calculate your financial year's short and long-term gains using various in-app inventory methods.

Import via API keys

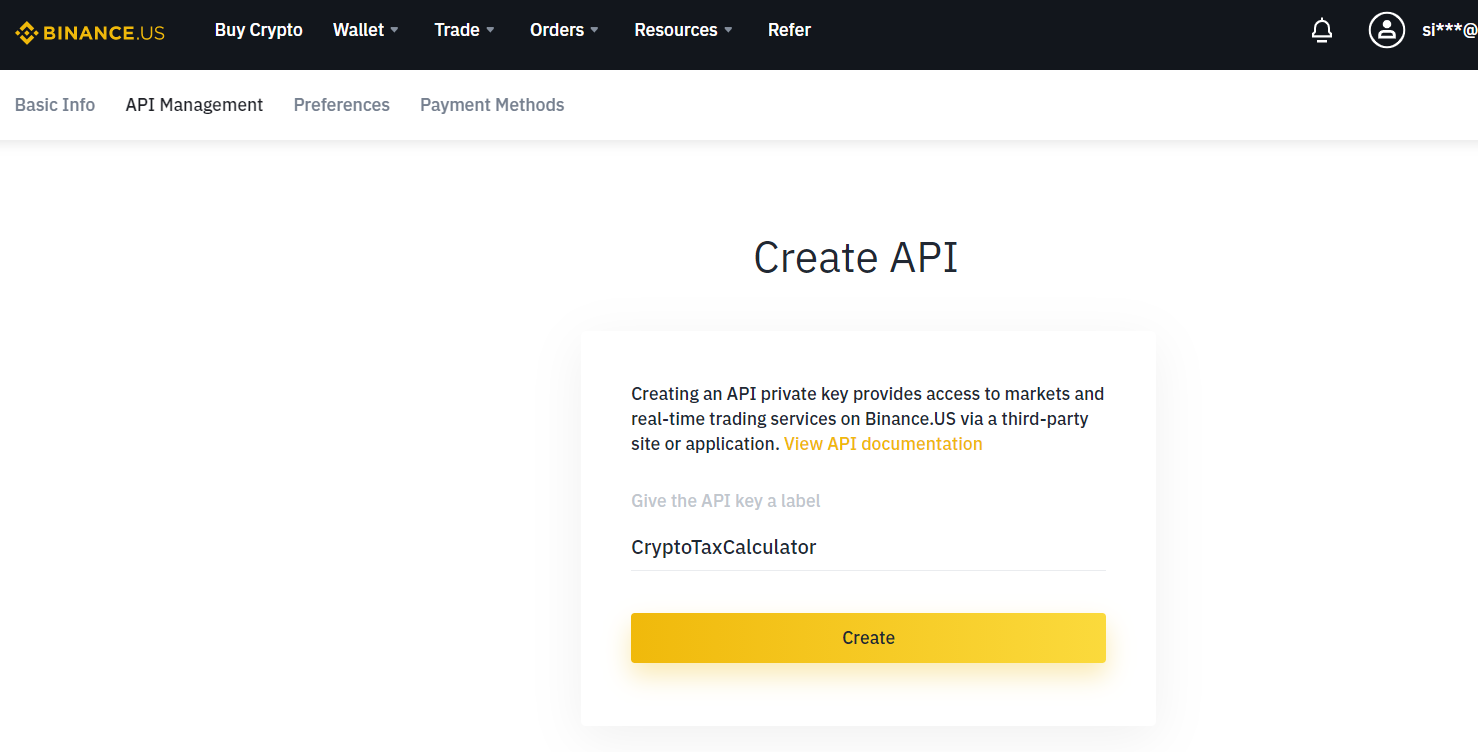

- Sign in to your BinanceUS account

- On the top right of the navbar hover over the 'Profile' icon and click on 'API Management' from the dropdown (https://www.binance.com/en/my/settings/api-management)

- Enter the label for a new API as 'Crypto Tax Calculator' and click on ‘Create API’ (yellow button)

- You may have to enter some verification information

- Once created, copy the 'API Key' and 'Secret Key'

- Click Edit restrictions and uncheck 'Enable Spot Trading'. Also, be sure that 'Enable Withdrawals' is unchecked

- Double check that 'Can Read' is the only option checked!

- Leave the IP access restriction selection as 'Unrestricted'

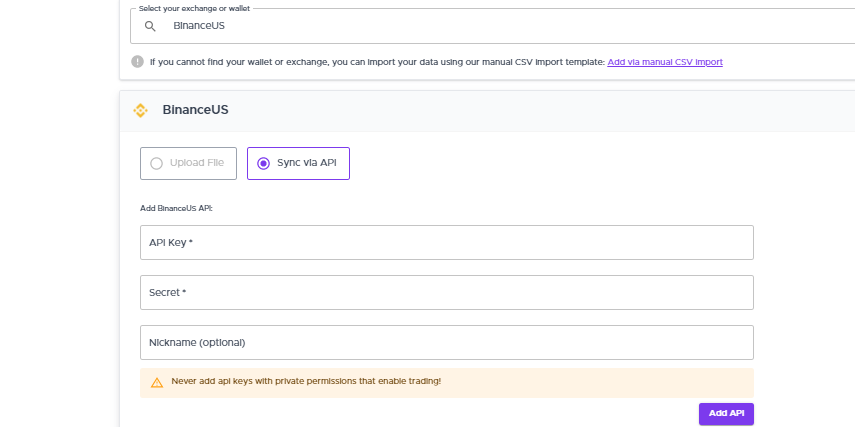

- Paste the copied 'API Key' and 'Secret Key' here into Crypto Tax Calculator and click 'Add API'. Syncing may take about 20 minutes due to restrictions on BinanceUS's side

Wrapping up

That's it! Using the API option, you can upload your transactions from BinanceUS to calculate your taxes using Crypto Tax Calculator. If you find that you are missing some transactions, you can upload these manually using our Simple or Advanced manual CSV import.