Bitfinex Tax Guide

Crypto Tax Calculator offers in depth support for Bitfinex when calculating your crypto tax. Not only does Bitfinex offer standard spot trades, but they also have margin and futures trading, as well as the ability to receive income from funding. Although these products can be profitable, they add a lot of complexity to your tax return. Fortunately we have you covered.

How to calculate tax on Bitfinex

Margin trading, futures, derivatives and income tax

In most countries you have both income and capital gains tax. Capital gains tax usually occurs when you dispose of cryptocurrency. However, with products like margin trading and derivatives, in many jurisdictions the profit or loss from trading these products follow separate rules to usual investment activity. Depending on the specifics of the contracts you are trading, in many cases it is classified as trading income, and is treated similar to income tax. In this scenario you will not be able to claim certain concessions usually available to capital gains tax, such as long term capital gains discounts.

What we do at Crypto Tax Calculator is break out the income earned on platforms like Bitfinex into a separate income category. You can then discuss with your accountant the best way to record this profit (or loss) on your tax return, based on your individual circumstances.

Capital gains when settling in crypto

Another thing to consider when trading on platforms like Bitfinex is what happens when you are settling in cryptocurrency. When you are trading margin on Bitfinex, and realized a profit, the profit is added to your balance in the form of Bitcoin. The market value at the time of receipt will form the cost basis for future sales (for example if you were to later sell Bitcoin for Ethereum). However, if you were to realized a loss, this loss will be settled in BTC. If you had previously bought this BTC at a cheaper price then the current market value, then you also need to consider the capital gain when "selling" the cryptocurrency to settle your loss.

An astute reader would observe, that realizing a loss can actually ultimately trigger a capital gain that is greater then your loss, and you would be "in the green" and owe taxes. In short, it is very important to keep up to date with your tax obligations, and set aside enough money at the end of the year to pay your taxes.

Example 1: Realizing a profit on BTC

| Date | Instrument | Side | Quantity | Realized PnL | Fee | Balance |

|---|---|---|---|---|---|---|

| 4th January | BTCUSDT | Short | 1 | 0.1 | 0.005 | 0.095 |

In example 1 we close a short and rewarded with 0.1 BTC. After fees we receive 0.095 BTC. Crypto Tax Calculator will convert this value back into your local currency and record a profit. However we also create a second buy transaction, which can be used as the future cost basis for the sale of this BTC.

| Date | Currency | Type | Quantity | Value |

|---|---|---|---|---|

| 4th January | BTC | Realized Profit | 0.095 | $950 |

| 4th January | BTC | Buy | 0.095 | $950 |

Example 2: Realizing a loss on BTC

| Date | Instrument | Side | Quantity | Realized PnL | Fee | Balance |

|---|---|---|---|---|---|---|

| 4th January | BTCUSDT | Short | 1 | -0.1 | 0.005 | -0.105 |

In example 2 we close a buy contract realizing a loss of 0.105 after fees. Crypto Tax Calculator converts this value back to your local currency and records a realized loss. However we also need to consider settling the loss in BTC, and any capital gains or losses associated with this transaction.

| Date | Currency | Type | Quantity | Price of BTC | Profit (Loss) |

|---|---|---|---|---|---|

| 1st January | BTC | Buy | 1 | $800 | - |

| 4th January | BTC | Realized Loss | 0.105 | $1000 | ($105) |

| 4th January | BTC | Sell | 0.105 | $1000 | $21 |

In the table above, after considering the capital gains on the settlement, the actual overall position is down $84 (21 - 105).

Funding rewards and income tax

When you provide funding on Bitfinex, you are rewarded interest, often in the form of cryptocurrency. In the app this reward is categorized as income for tax purposes. When you later sell the cryptocurrency, the income received forms the cost basis of that sale.

Example: Receiving BTC as a funding reward

| Date | Currency | Type | Quantity | Price of BTC | Income | Cost Basis | Profit (Loss) |

|---|---|---|---|---|---|---|---|

| 1st January | BTC | Reward | 0.01 | $8000 | $80 | - | - |

| 1st January | BTC | Buy | 0.01 | $8000 | - | $80 | - |

| 4th November | BTC | Sell | 0.01 | $12000 | - | $40 |

In the above table, you receive 0.01 BTC on 1st January worth $80. This is recorded as income in the app, as well as a purchase of BTC. It is as though you were paid income your fiat currency, and then immediately purchased the cryptocurrency with this income. When you later sell the BTC on the 4th November, the profit calculations are similar to a normal buy/sell trade. An observant reader would notice that by holding the cryptocurrency after receiving income, and the price of the BTC drops, you will Realized a capital loss, however your income is separate to this capital ledger and you can't discount the income with your loss. You need to verify with your accountant how this would work in your situation, as many jurisdictions have provisions around trading as a business, which mergers the capital ledger to the income ledger, thereby combining everything as income, and allowing you to negate this loss against your reward.

As you can see keeping track of all this is very difficult. Fortunately Crypto Tax Calculator is one of the few tools to actually consider all these scenarios in great detail.

How to Upload Your Bitfinex Data Into the Calculator

You can easily upload your Bitfinex data into the calculator by following the below steps:

Import via CSV

- Login to Bitfinex.

- In the top right corner, hover over 'Wallet' and select 'Reports' from the dropdown. This should navigate you to https://report.bitfinex.com.

- Click on the calendar icon at the top of the page.

- Select a custom range of dates that include your entire trading history.

- Click on the 'Export' button, a popup should appear.

- In the 'Data to Export' field select 'Ledgers' and 'Movements' only. Select the 'Date Format' to be 'DD-MM-YY'. Check the box which says 'Display Milliseconds'

- Click the 'Export' button at the bottom of the popup. This will generate CSV files which will be sent to your EMAIL.

- In your email client, open the email and click 'Download CSV'. This will download a .zip file containing two CSVs (one for ledgers and one for movements).

- Extract and upload BOTH CSV to Crypto Tax Calculator.

Create and add API keys

- Login to Bitfinex.

- In the top right corner, hover over the person icon, and select 'API keys' from the dropdown. This should navigate you to https://www.bitfinex.com/api.

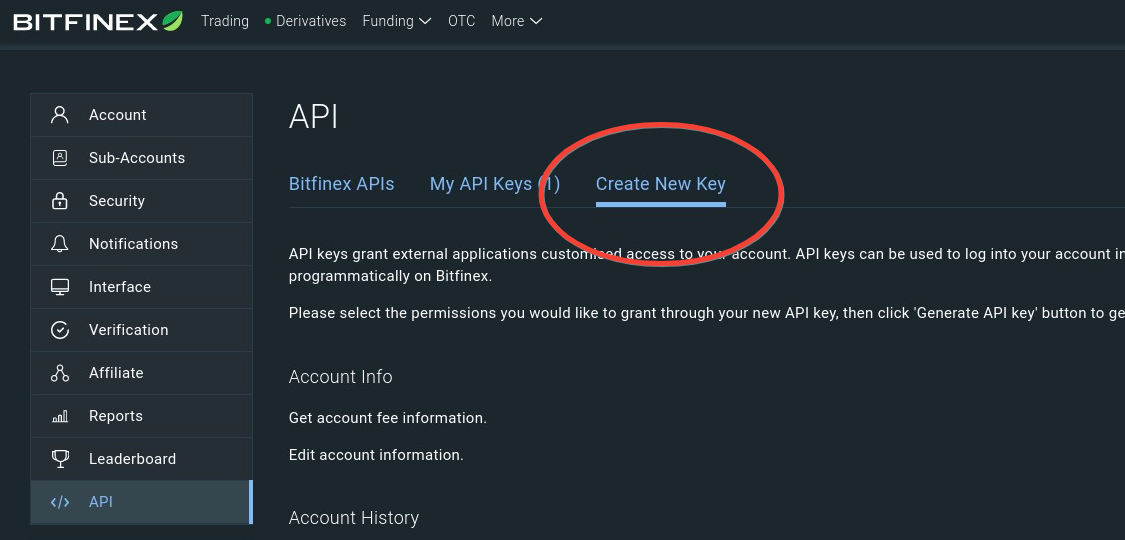

- Click on the 'Create New Key' tab.

- Ensure default permissions are unchanged and all ‘Read’ permissions have been enabled.

- At the bottom of the page, enter a name for the API key (e.g. Crypto Tax Calculator) in the 'Label Your API Key' field, and then click the 'Generate API key' button.

- You may have to enter your 2FA token if you have 2FA enabled.

- Once you receive a verification email from Bitfinex, confirm the new API key.

- Copy the 'API key' and 'API key secret' and enter them both into Crypto Tax Calculator.