Preparing your Bitstamp Taxes

Crypto Tax Calculator allows you to upload Bitstamp data by two methods: an API or CSV upload. Uploading your transactions allows Crypto Tax Calculator to calculate your Bitstamp tax obligation.

Uploading your crypto transactions with an API

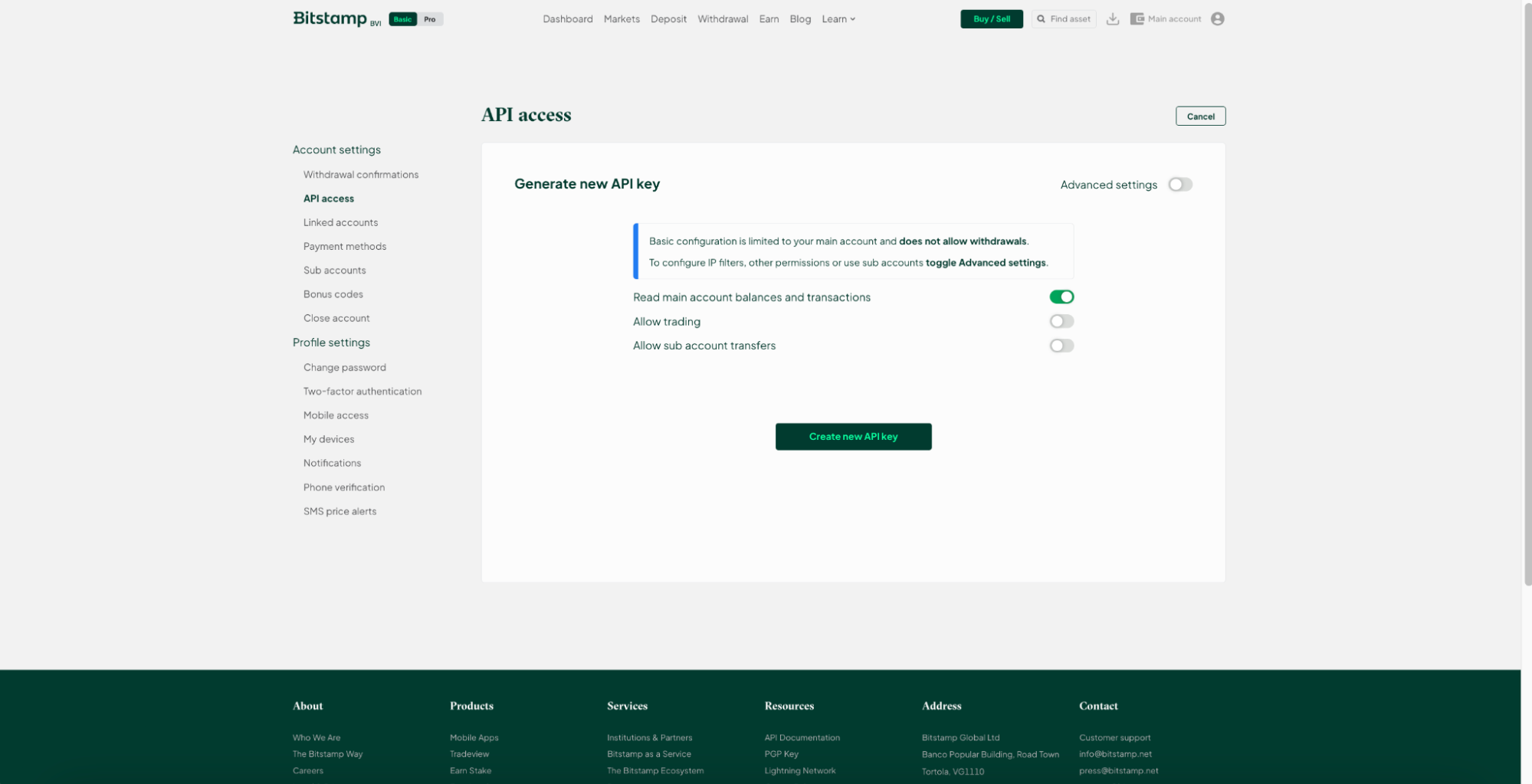

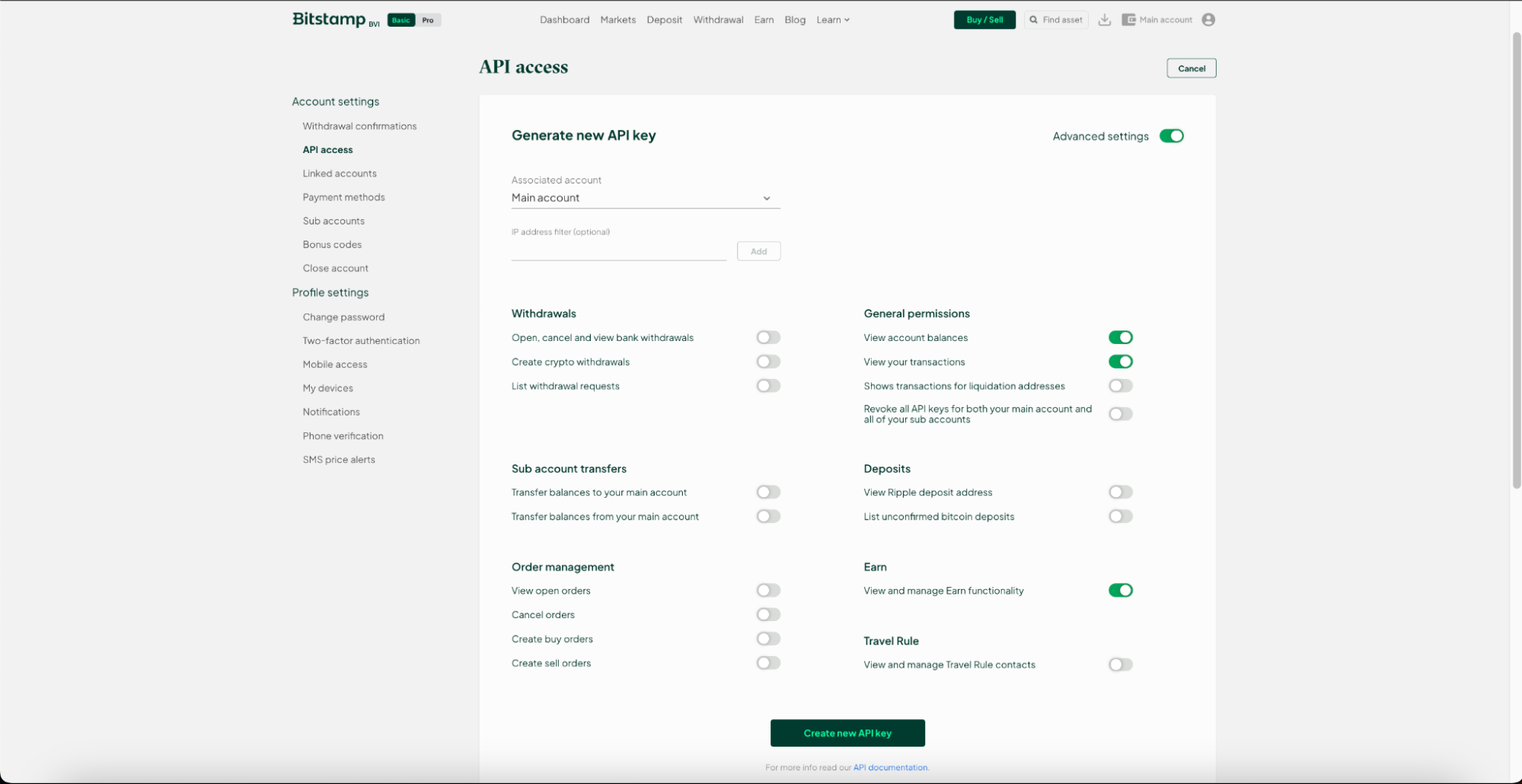

On Bitstamp:

- Login to your account and navigate to the API section under Account settings.

- Create a new API key.

- Under General permissions select 'View account balances' and 'View your transactions'

- Under Earn select 'View and manage Earn functionality'.

- Enter your password if required.

- Copy and save the API + Secret keys provided;

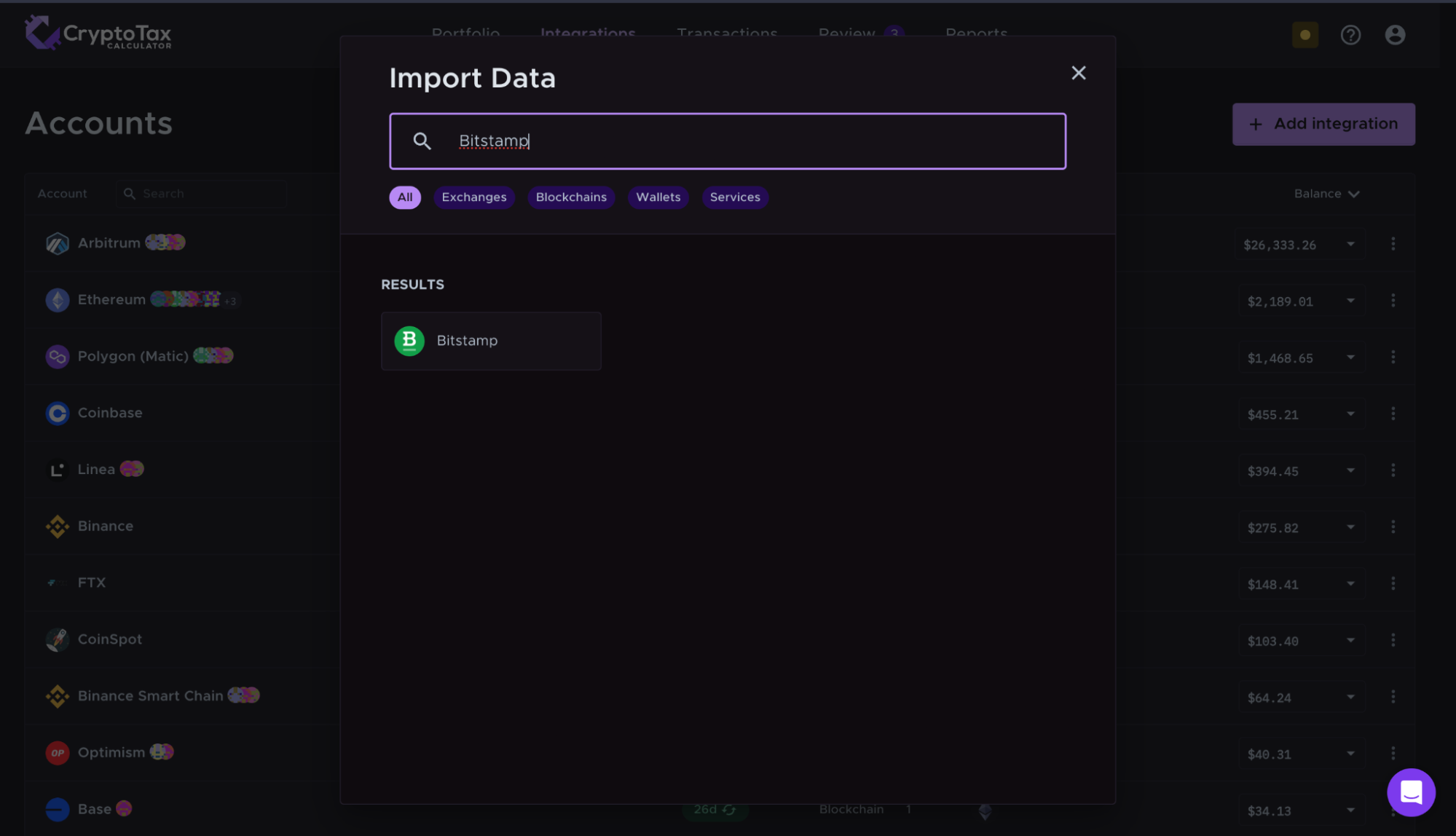

On Crypto Tax Calculator:

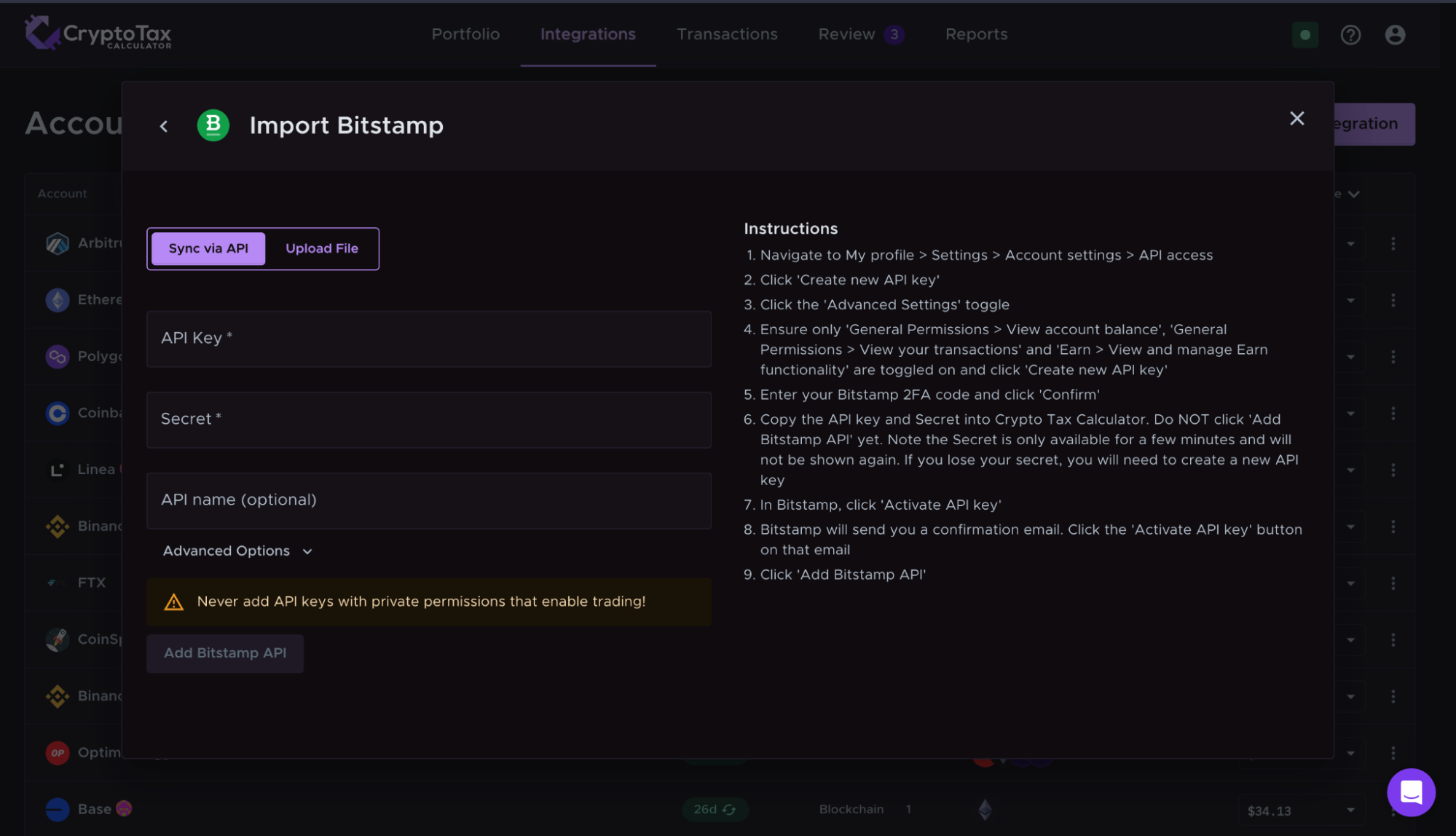

- Login and navigate to the integrations page.

- Select 'Add integration' and find Bitstamp.

- Import Bitstamp API

- Paste your API key and secret key and press Import.

- The process might take a few minutes to upload all your data but in the meantime, you can work on uploading your other exchange data.

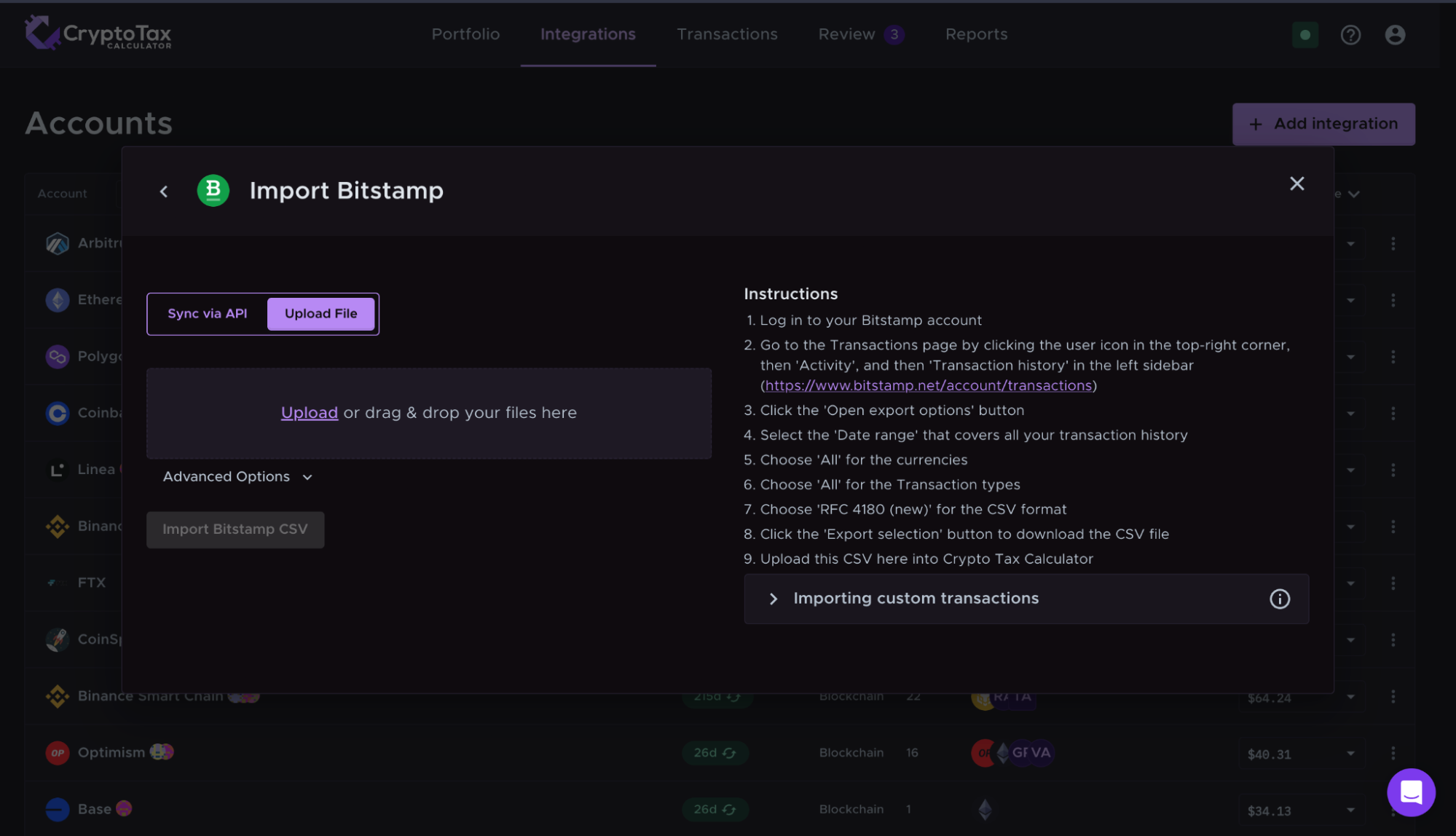

Uploading your crypto transactions with a CSV upload

On Bitstamp:

- Log in to your Bitstamp account.

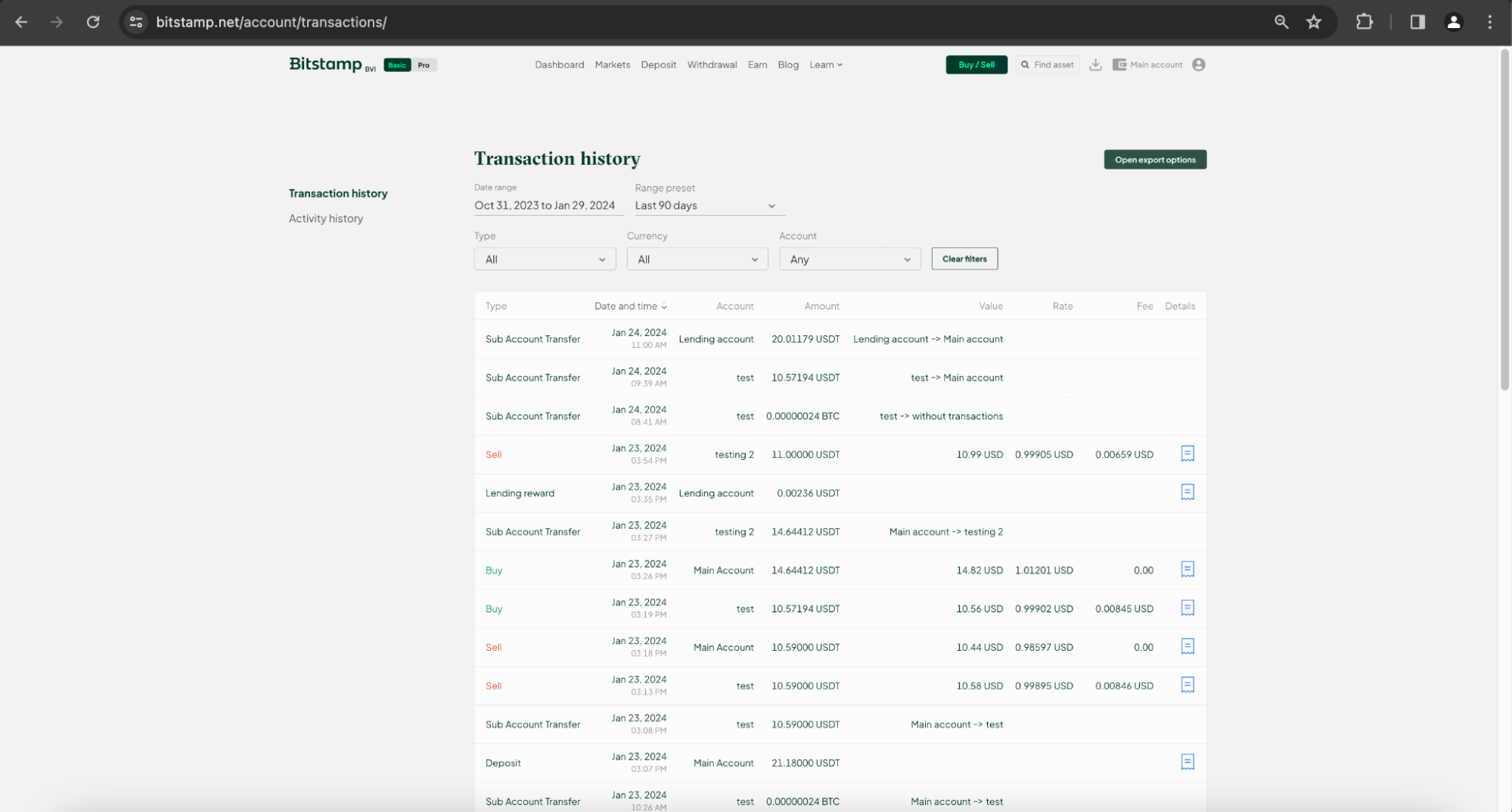

- Go to the Transactions page by clicking the user icon in the top-right corner, then 'Activity', and then 'Transaction history' in the left sidebar (https://www.bitstamp.net/account/transactions).

- Click the 'Open export options' button.

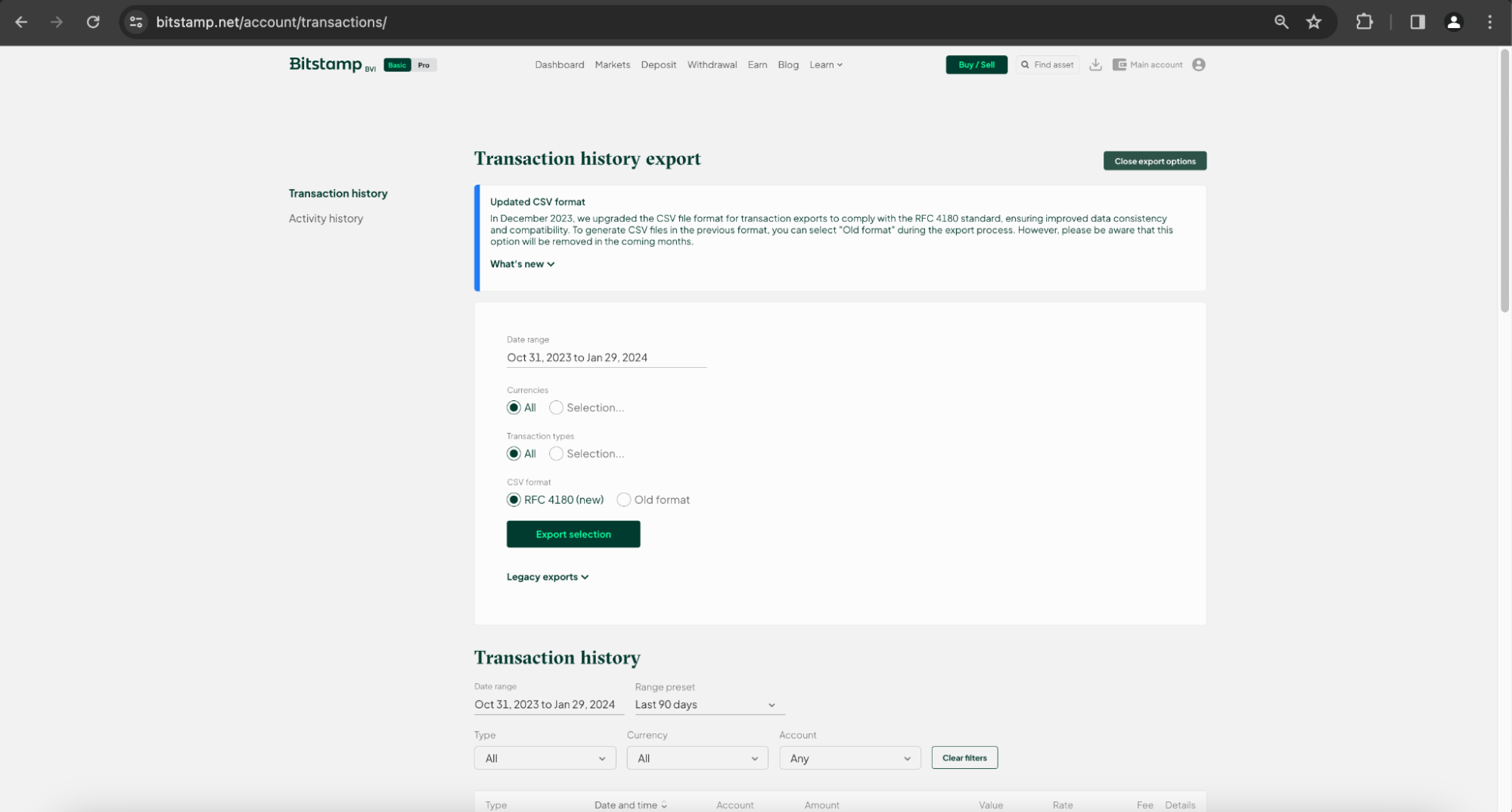

- Select the 'Date range' that covers all your transaction history.

- Choose 'All' for the currencies.

- Choose 'All' for the Transaction types.

- Choose 'RFC 4180 (new)' for the CSV format.

- Click the 'Export selection' button to download the CSV file.

On Crypto Tax Calculator:

- Login and navigate to the integrations page.

- Select ‘Add integration’ and find Bitstamp.

- Drag and drop the CSV to import your Bitstamp transactions.

- The process might take a few minutes to upload all your data but in the meantime, you can work on uploading your other exchange data.

Wrapping Up

These two options are all you need to get started on your Bitstamp and other crypto taxes. If for whatever reason you are missing some transactions that can’t be uploaded you can manually add them in the review transactions page.