Bittrex Tax Guide

Last Updated: 3 years ago

Crypto Tax Calculator allows you to easily calculate your taxes when trading on Bittrex. All you have to do is import your trading data via CSV or the API, and we will automatically normalize these transactions back to your local currency. You can then easily calculate your financial year short term and long term gains using various in-app inventory methods.

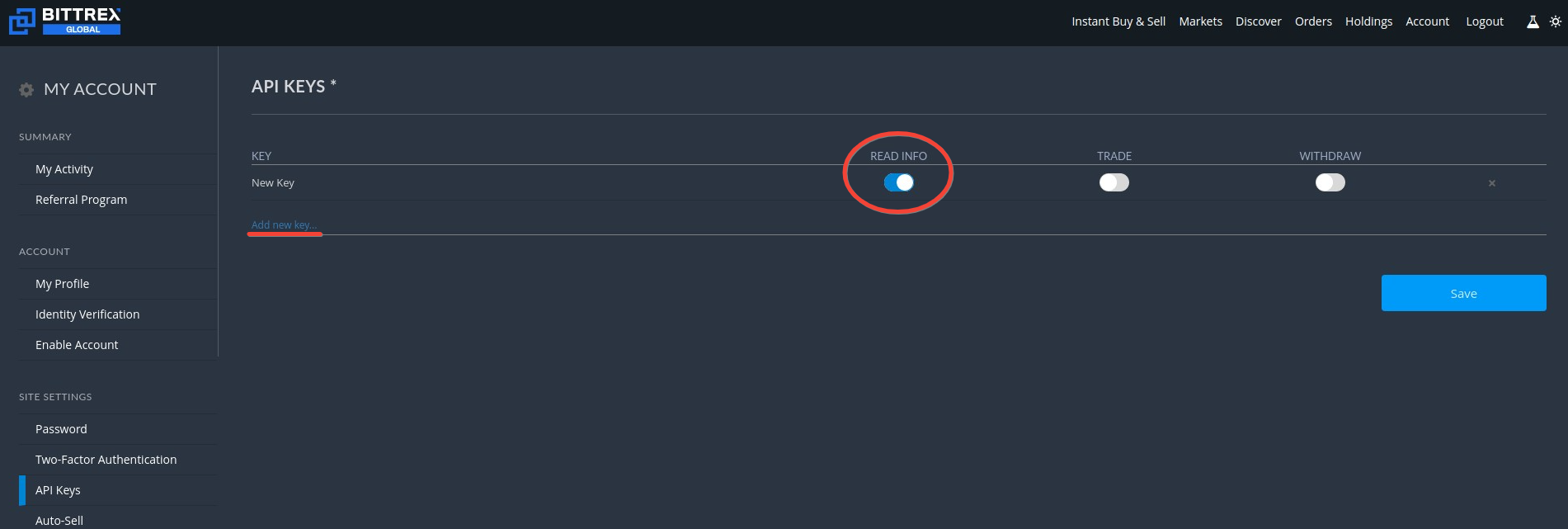

Import via API Keys

- Log in to Bittrex and navigate to the API keys page https://global.bittrex.com/Manage?view=api.

- Click 'Add new key...'

- Make sure only 'READ INFO' is selected

- Copy and paste the API key and secret into Crypto Tax Calculator and click sync

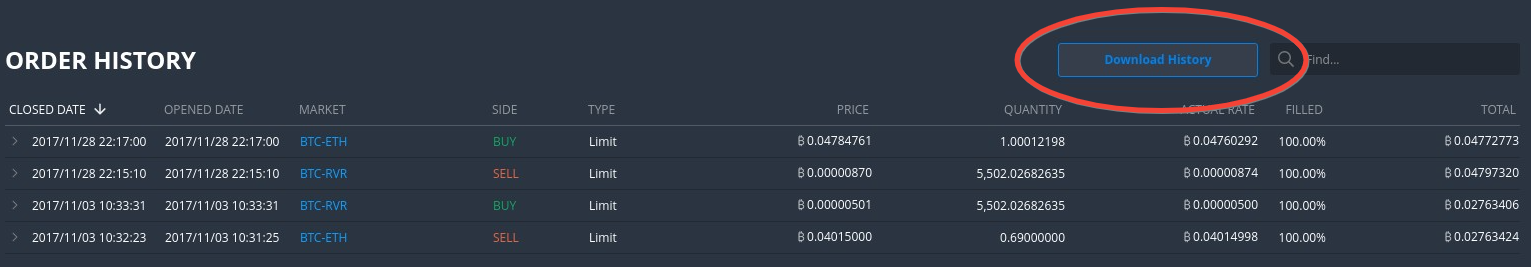

Import via Order History CSV File

- Login to Bittrex, navigate to 'Orders' in top corner, and scroll down to Order History.

- Click on ‘Download History’ button and select the year you traded and click on 'Download'.

- You can only download one year at a time, but you should add each year that you traded to Crypto Tax Calculator.

- Make sure you do not open or resave the file before importing because you might affect the format of the CSV.

- We also support imports of the deposit withdrawal CSV data, however you will need to file a support ticket with Bittrex. Once you receive these CSVs you can upload them to Crypto Tax Calculator. See more details here.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Cryptotaxcalculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.