Preparing Your BlockFi Taxes

Crypto Tax Calculator allows you to calculate your taxes arising from any trading activity on BlockFi. You can import your trading data as a CSV file. You can then easily calculate your financial year's short and long-term gains using various in-app inventory methods.

Import via Order History CSV File

- Log into your BlockFi account and click your profile icon in the top right

- Select 'Reports' from the dropdown menu

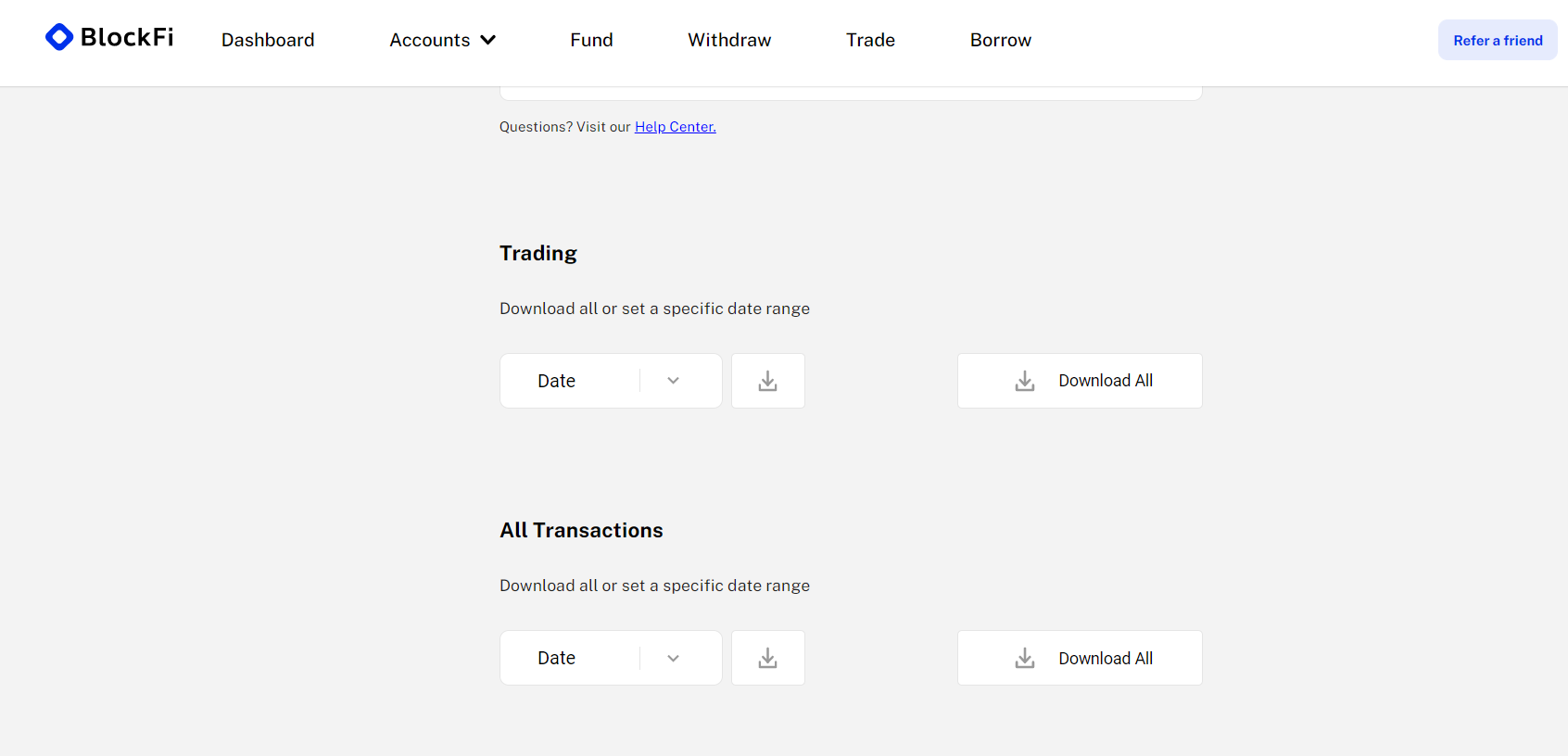

- At the bottom of the page, you will see 'Trading' and 'All Transactions'

- For 'Trading' select the date range you wish to export (or download all) and click the 'Download .csv' button - this will download all your detailed trading data

- For 'All Transactions' select the date range you wish to export (or download all) and click the 'Download .csv' button - this will download all your detailed transaction data such as deposits, withdrawals, interest payments, etc

- Upload both CSV files here to Crypto Tax Calculator

Wrapping Up

That's it! Using the CSV option, you can upload your transactions from BlockFi to calculate your taxes using Crypto Tax Calculator. If you find that you are missing some transactions, you can upload these manually using our Simple or Advanced manual CSV import.