Bybit Tax Guide

Crypto Tax Calculator offers in depth support for Bybit when calculating your crypto tax. Not only does Bybit offer standard spot trades, but they also have margin trading. Although these products can be profitable, they can add a lot of complexity to your tax return without the right software to do the job.

How to calculate tax on Bybit

Margin trading and income tax

In most countries you have both income and capital gains tax. Capital gains tax usually occurs when you dispose of cryptocurrency. However, with products like margin trading and derivatives, in many jurisdictions the profit or loss from trading these products follow separate rules to usual investment activity. Depending on the specifics of the contracts you are trading, in many cases it is classified as trading income, and is treated similar to income tax. In this scenario you will not be able to claim certain concessions usually available to capital gains tax, such as long term capital gains discounts.

What we do at Crypto Tax Calculator is break out the income earned on platforms like Bybit into a separate income category. You can then discuss with your accountant the best way to record this profit (or loss) on your tax return, based on your individual circumstances. It is important to understand the tax consequences of being classed as a trader, rather an investor, and if you can separate these two activities.

Capital gains when settling in crypto

Another thing to consider when trading on platforms like Bybit is what happens when you are settling in cryptocurrency. For example, if you are trading BTC on margin, and realize a profit, the profit is added to your balance in the form of Bitcoin. The market value at the time of receipt will form the cost basis for future sales (for example if you were to later sell Bitcoin for Ethereum). However, if you were to realize a loss, this loss will be settled in BTC. If you had previously bought this BTC at a cheaper price then the current market value, then you also need to consider the capital gain when "selling" the cryptocurrency to settle your loss.

An astute reader would observe, that realising a loss can actually ultimately trigger a capital gain that is greater then your loss, and you would be "in the green" and owe taxes. In short, it is very important to keep up to date with your tax obligations, and set aside enough money at the end of the year to pay your taxes.

Example 1: Realising a profit on BTC

| Date | Instrument | Side | Quantity | Realized PnL | Fee | Balance |

|---|---|---|---|---|---|---|

| 4th January | BTCUSDT | Short | 1 | 0.1 | 0.005 | 0.095 |

In example 1 we close a short and are rewarded with 0.1 BTC. After fees we receive 0.095 BTC. Crypto Tax Calculator will convert this value back into your local currency and record a profit. However we also create a second buy transaction, which can be used as the future cost basis for the sale of this BTC.

| Date | Currency | Type | Quantity | Value |

|---|---|---|---|---|

| 4th January | BTC | Realized Profit | 0.095 | $950 |

| 4th January | BTC | Buy | 0.095 | $950 |

Example 2: Realising a loss on BTC

| Date | Instrument | Side | Quantity | Realized PnL | Fee | Balance |

|---|---|---|---|---|---|---|

| 4th January | BTCUSDT | Short | 1 | -0.1 | 0.005 | -0.105 |

In example 2 we close a buy contract realising a loss of 0.105 after fees. Crypto Tax Calculator converts this value back to your local currency and records a realized loss. However we also need to consider settling the loss in BTC, and any capital gains or losses associated with this transaction.

| Date | Currency | Type | Quantity | Price of BTC | Profit (Loss) |

|---|---|---|---|---|---|

| 1st January | BTC | Buy | 1 | $800 | - |

| 4th January | BTC | Realized Loss | 0.105 | $1000 | ($105) |

| 4th January | BTC | Sell | 0.105 | $1000 | $21 |

In the table above, after considering the capital gains on the settlement, the actual overall position is down $84 (21 - 105).

Funding rewards and income tax

When you provide funding on Bybit, you are rewarded interest, often in the form of cryptocurrency. In the app this reward is categorized as income for tax purposes. When you later sell the cryptocurrency, the income received forms the cost basis of that sale.

Example: Receiving BTC as a funding reward

| Date | Currency | Type | Quantity | Price of BTC | Income | Cost Basis | Profit (Loss) |

|---|---|---|---|---|---|---|---|

| 1st January | BTC | Reward | 0.01 | $8000 | $80 | - | - |

| 1st January | BTC | Buy | 0.01 | $8000 | - | $80 | - |

| 4th November | BTC | Sell | 0.01 | $12000 | - | $40 |

In the above table, you receive 0.01 BTC on 1st January worth $80. This is recorded as income in the app, as well as a purchase of BTC. It is as though you were paid income your fiat currency, and then immediately purchased the cryptocurrency with this income. When you later sell the BTC on the 4th November, the profit calculations are similar to a normal buy/sell trade. An observant reader would notice that by holding the cryptocurrency after receiving income, and the price of the BTC drops, you will realize a capital loss, however your income is separate to this capital ledger and you can't discount the income with your loss. You need to verify with your accountant how this would work in your situation, as many jurisdictions have provisions around trading as a business, which mergers the capital ledger to the income ledger, thereby combining everything as income, and allowing you to negate this loss against your reward.

As you can see keeping track of all this is very difficult. Fortunately Crypto Tax Calculator is one of the few tools to actually consider all these scenarios in great detail.

How to Upload Your Bybit Data Into the Calculator

You can easily upload your Bybit data into the calculator by following the below steps:

Import via CSV

- We require you to upload your 'Derivative Closed P&L History' and 'Asset History' CSV files.

- You can generate the 'Derivative Closed P&L History' file via this link (https://www.bybit.com/user/assets/order/closed-pnl/inverse).

- Go to Orders > Derivatives Order > Close P&L > Click on the 'Export' button from the upper right corner.

- NOTE: Traders can export up to two years of data while the maximum data range exportable in a single batch is three months.

- You can generate your 'Asset History' file via this link (https://www.bybit.com/user/assets/exportStatment).

- NOTE: when exporting your 'Account Statement' within your Asset History, ensure that all the Account Types are selected (Spot, Funding, Unified Trading, USDC Derivatives).

- Importantly, we do not require the trade history CSV

- The Closed P&L report shows the gains/losses earned from trading futures etc.

- The Asset History report will allow you to import the deposit/withdrawals

Create and add API keys

- Login to Bybit.

- In the top right corner, hover over your name and select 'Account & Security'.

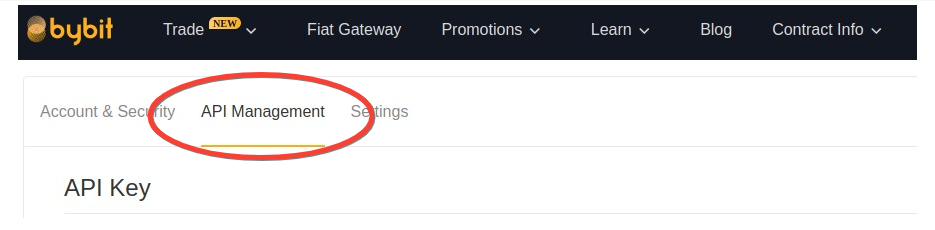

- Click the 'API Management tab' https://www.bybit.com/app/user/api-management.

- Click on the 'Create New Key' tab.

- Under API key permissions, ensure the 'Orders', 'Positions', and 'Trade' checkboxes are ticked.

- Double check the 'Read-Only' checkbox is ticked.

- You may have to enter your 2FA token if you have 2FA enabled.

- Click confirm and copy the 'API key' and 'API key secret' and enter them both into Crypto Tax Calculator.