Cardano Tax Guide

Crypto Tax Calculator is proud to introduce integrated tax support for Cardano. Cardano is a proof-of-stake blockchain network aiming to provide security and sustainability to decentralized applications, systems, and societies. Please note - Cardano integration does not currently support Cardano native tokens

Quick Start

With the increase in adoption of the Cardano blockchain, a common issue that Cardano users encounter is determining their tax obligations for Cardano transactions. To help address this problem and streamline the process of determining tax obligations for Cardano users, integrated Cardano blockchain support is now available on Crypto Tax Calculator. Simply follow these steps to automatically import and categorize all your transactions.

- In Crypto Tax Calculator, enter 'Cardano' into the search field or scroll down to find it manually, and right-click to display drop down fields.

-

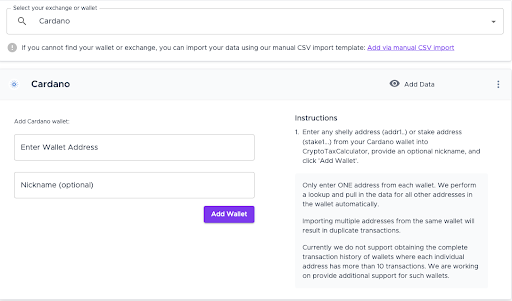

The first field requires your wallet address. Locate and copy the address associated with your cardano account, which is generally found in your wallet manager. This may either be a shelley address starting with 'addr1', which is used to hold, send and receive ADA. Alternatively, this could be a staking address starting with 'stake1', which is used to stake your ADA and receive staking rewards. Only one address, either a shelley or staking address, is required for Crypto Tax Calculator.

-

Enter your Cardano wallet address into the required field. You can provide a nickname to help you differentiate between wallet addresses (optional) and click 'Add Wallet'. Keep in mind that you only need to enter ONE address from each wallet, as our platform will perform a lookup and pull in the data for all other addresses in the wallet automatically.

- Once your Wallet has synced, Crypto Tax Calculator will have successfully pulled in your complete transaction history associated with this wallet from the Cardano chain.

Categorising Cardano Transactions

Once you've imported your Cardano wallet, you will see that your transactions on Cardano have been pulled in, and some have already been auto-categorized. If Crypto Tax Calculator has not been able to automatically determine the type of the transaction, you may need to manually adjust and/or categorise some transactions. To determine what transaction falls into which category, please refer to our guide How to correctly categorise transactions.

How Cardano Wallets Work

Cardano aims to be a decentralized app with a multi-asset ledger and verifiable smart contracts. It runs on the proof-of-stake Ouroboros consensus protocol. To learn more about this, you can visit Cardano, but it essentially works by using cryptography, combinatorics, and mathematical game theory to maximise security for the Cardano blockchain.

The Cardano Wallet itself provides an interface between users and the Cardano blockchain. It basically acts as a tool to allow you to receive, send, store and stake Cardano's cryptocurrency (ADA). You can set up a new Cardano wallet, which involves creating a public and private key. This public key can be used to receive ADA. However, as its name suggests, the private key is something that should be kept secret, and is only used for digital signatures in transactions that are added to Cardano's ledger. A Cardano wallet can have multiple addresses for different transactions, but only one unique address for staking. You only need to import one address for the non-staking transactions and Crypto Tax Calculator will be able to pull in the others associated with your wallet.

Cardano's Transaction Model

Cardano uses the idea of Unspent Transaction Output (UTXO) similar to Bitcoin. In the UTXO model, a transaction has inputs and outputs, where the inputs are the outputs from previous transactions. When an output is used as an input in a transaction, it is represented by an address (public key) and a value (ADA amount). The address basically decides which transactions can unlock the output, and use it as an input. This means that when you have multiple addresses, you can spend ADA from any, and the leftover will then go to one of the other addresses. You can see this image from the Cardano website for a visual depiction of how the UTXO model works.

Normal Transactions

Crypto Tax Calculator handles Cardano's UTXO model by accounting for multiple input and output addresses as well any transaction fee involved, to ensure that your Cardano transactions are accurately and logically categorized. We have undertaken comprehensive measures to consider different possible transactions, so that even if you transfer funds internally (between separate addresses), this is recognized in our calculations.

Staking

Cardano uses a proof-of-stake consensus mechanism, allowing ADA owners to 'delegate' ADA into a staking pool. When you do this you delegate your ADA to a validator in the Cardano ecosystem, essentially locking, but not disposing of, your ADA into a validator pool. In return for delegating your ADA to a validator, you will receive a percentage of the transactions fees accrued by your chosen validator, paid back to you in ADA. This percentage corresponds to the amount of ADA you have delegated to the specific validator pool.

Crypto Tax Calculator automatically recognizes staking rewards and categorizes these transactions separately to other transactions, because we understand that tax authorities treat staking in a different manner to other 'CGT only' transactions. Crypto Tax Calculator has been developed to provide crypto users with a streamlined process to accurately determine tax obligations for complex crypto transactions, such as staking on Cardano.