Preparing your Coinbase taxes

Uploading Your Coinbase Transactions via OAuth

The easiest way to upload your Coinbase transactions is via our 1-click OAuth integration as seen below:

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link.

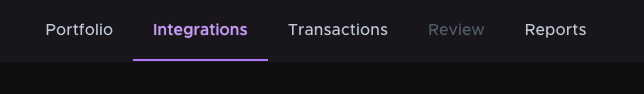

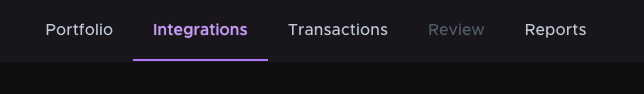

- Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Connect Coinbase: Select the connect coinbase option and then select the ‘Connect to Coinbase’ button.

-

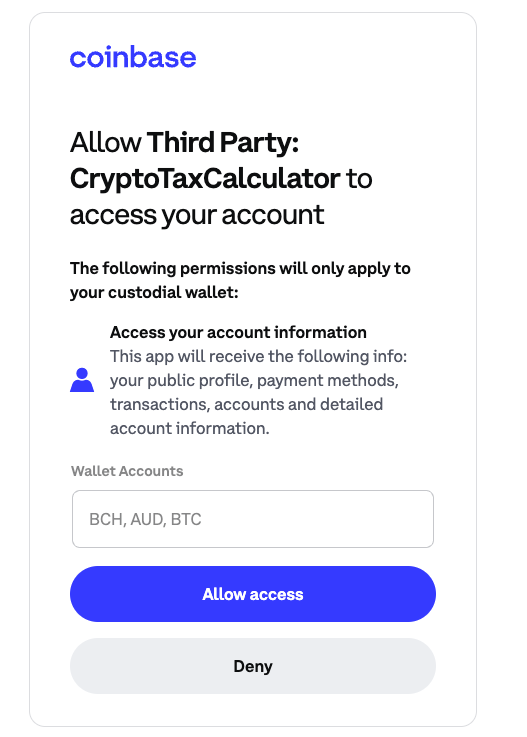

Set permissions: You will be taken to a coinbase page where you can allow access to your wallets.

- After selecting accept, Coinbase should now be attached to your CTC account.

Uploading Your Coinbase Transactions with an API

Using an API connection is a seamless way to import your Coinbase data. Here’s how to set it up:

On Coinbase:

-

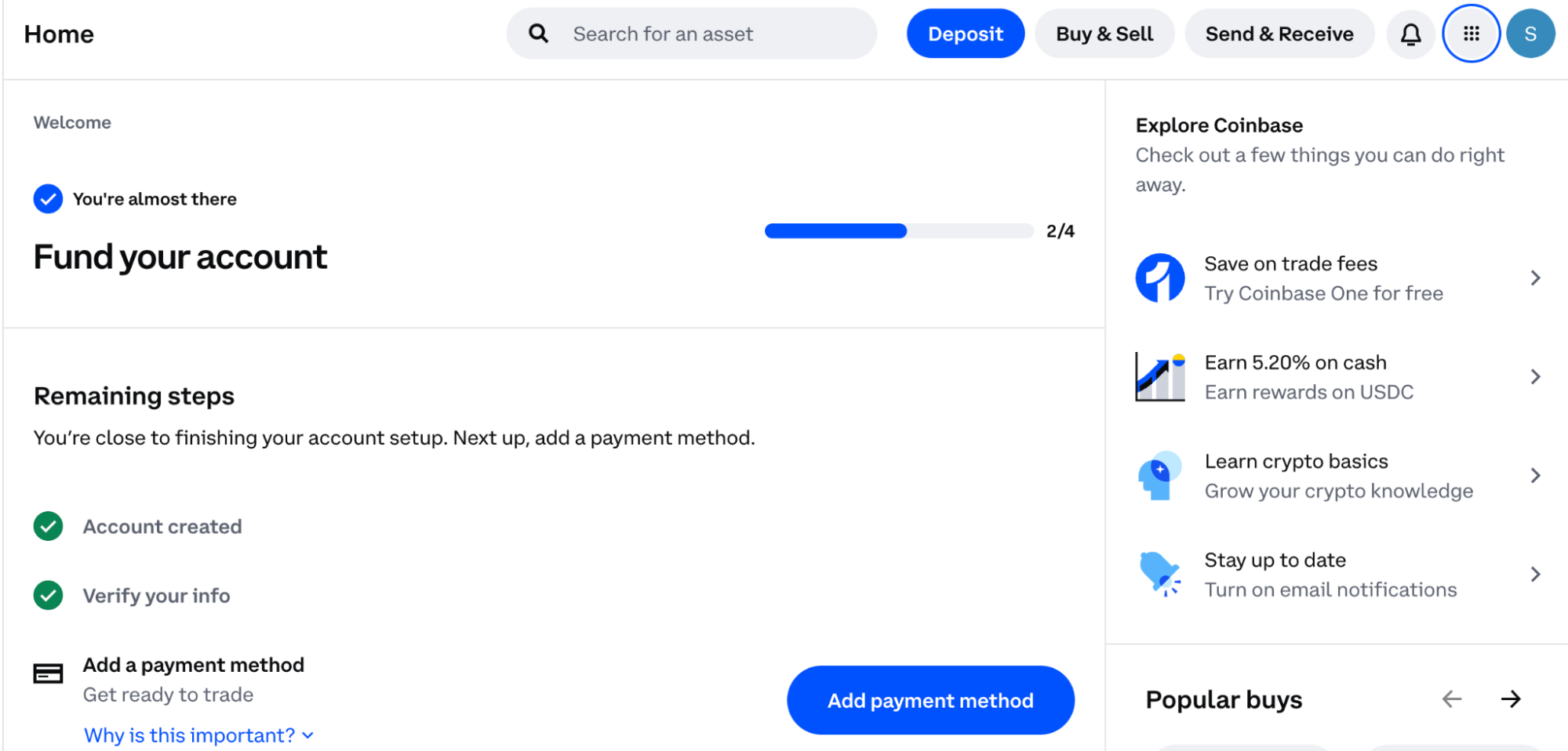

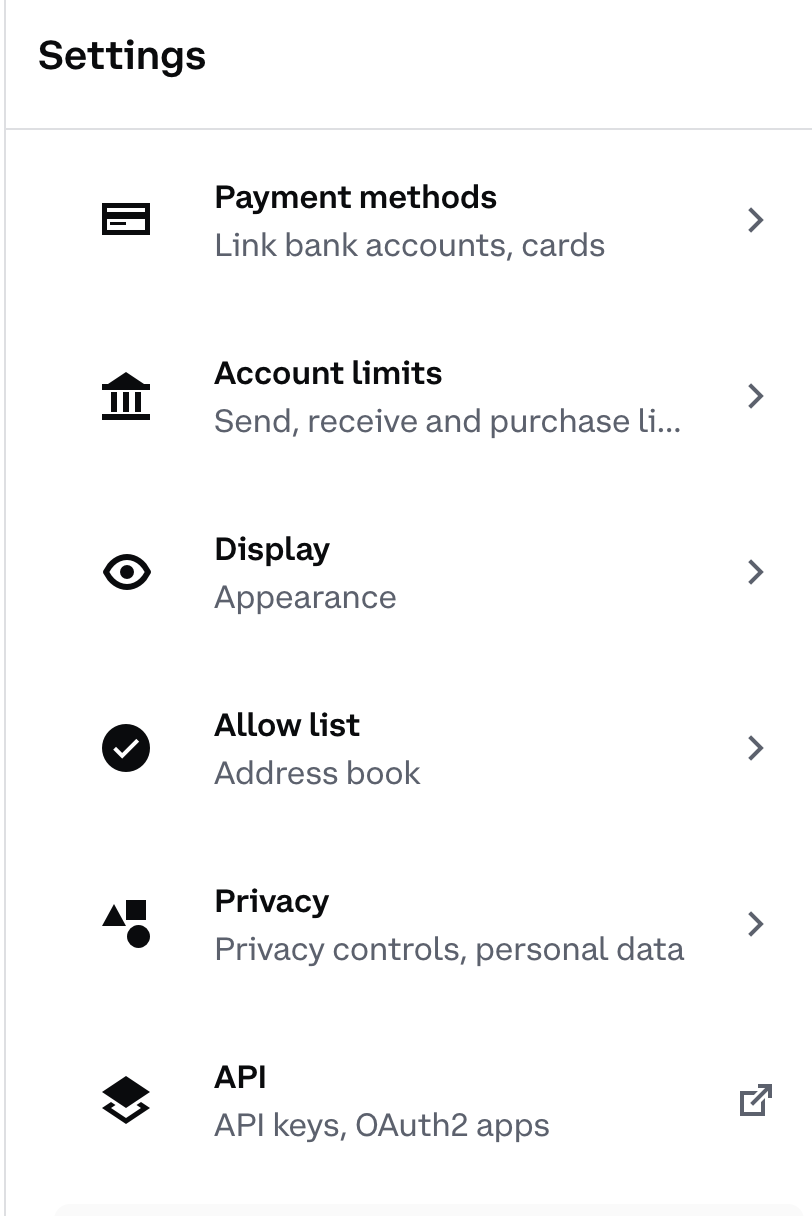

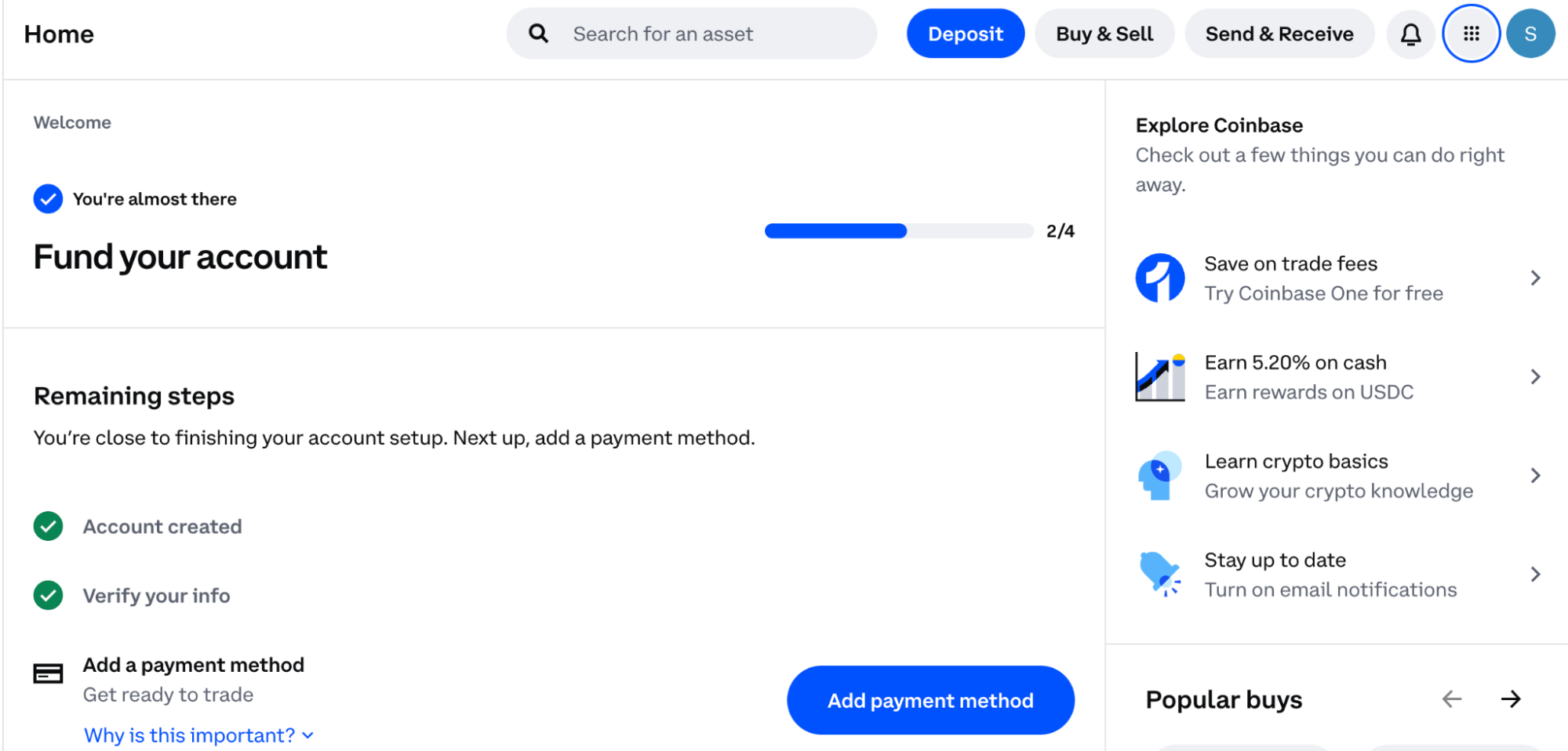

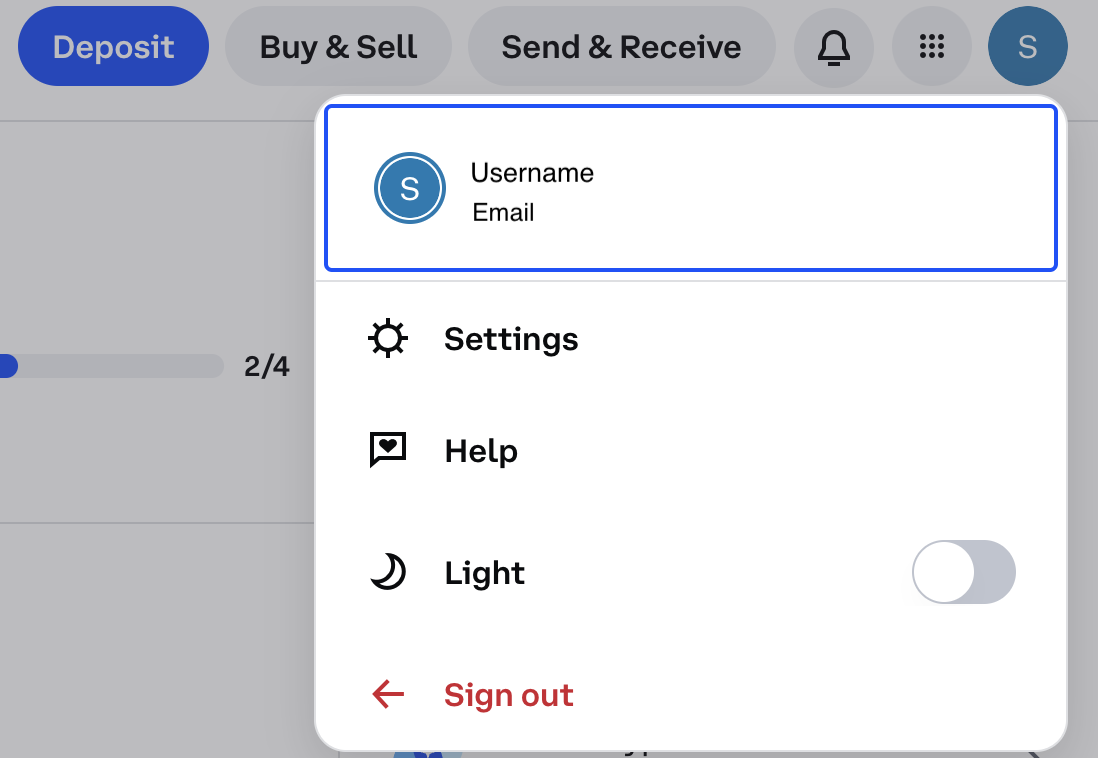

Log In: Access your Coinbase account and go to settings by clicking on your profile icon in the top right corner.

Shortcut: To quickly access the settings page where you can generate an API key on Coinbase, follow this link and skip to step 3.

-

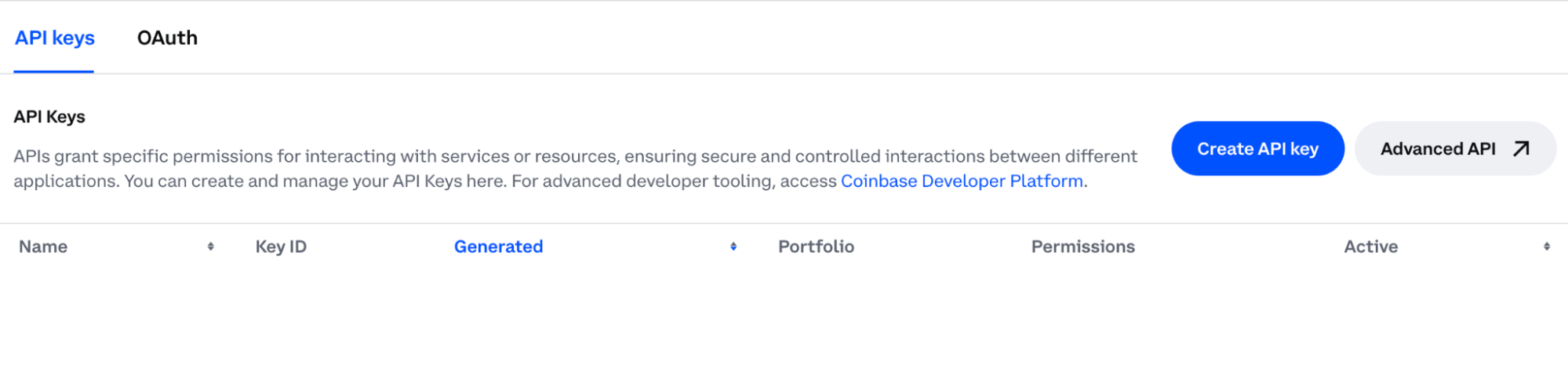

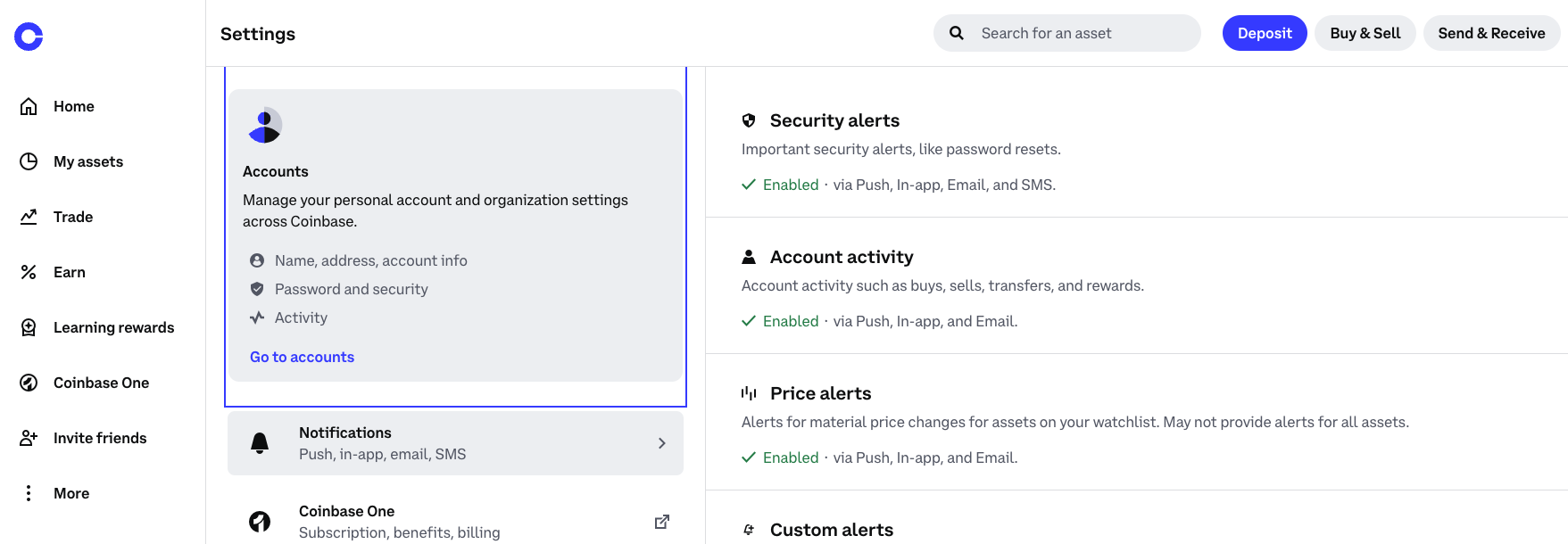

Navigate to API Settings: In the settings menu, find and select the ‘API’ section.

- Create a New API Key: Click on ‘Create New API Key’.

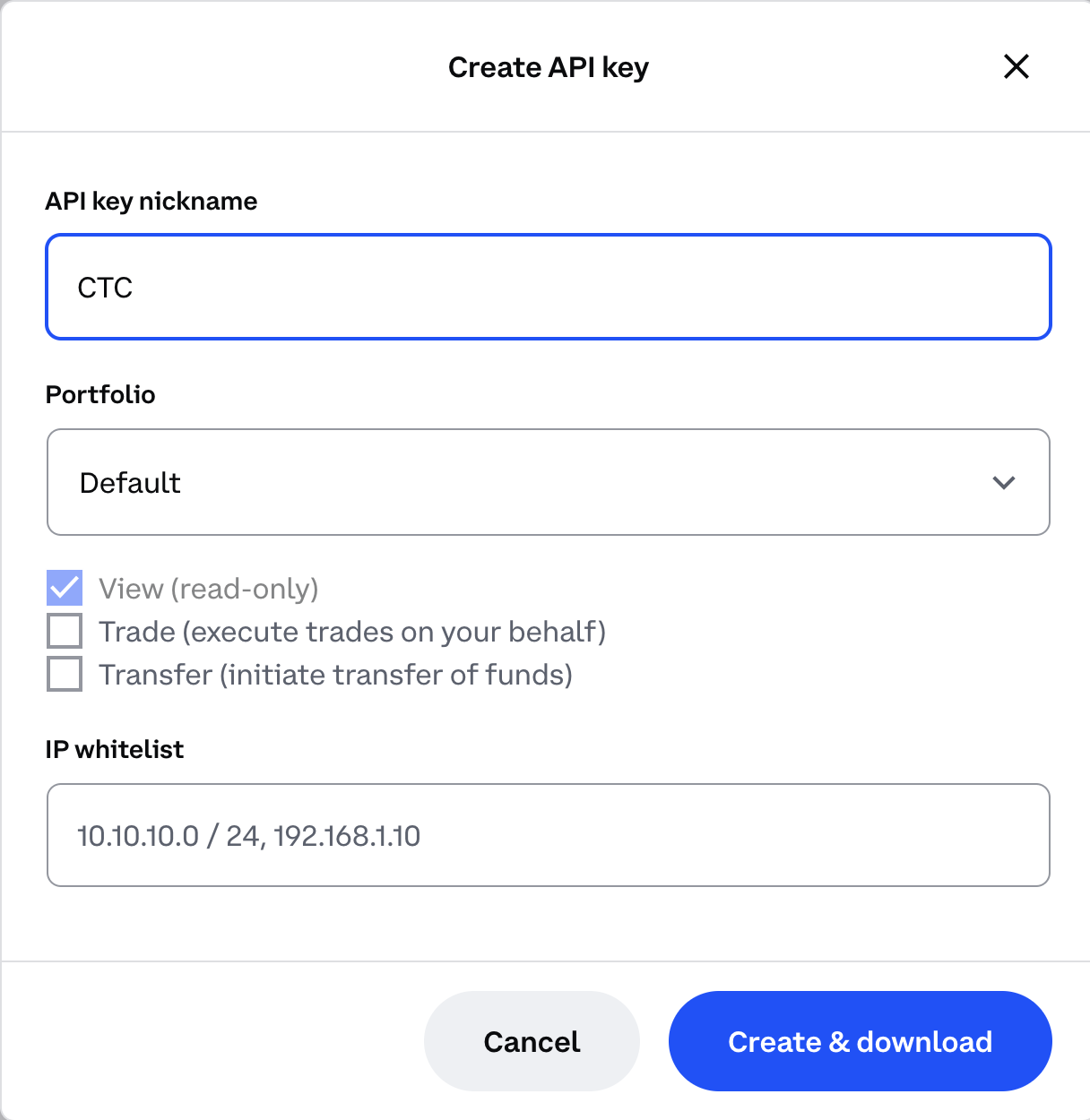

- Set Permissions: Choose the ‘Read-only’ permissions to ensure that the calculator can access your transaction data without modifying it.

- Generate API Key: Follow the prompts to generate your API key. You may be asked to enter your passphrase for security.

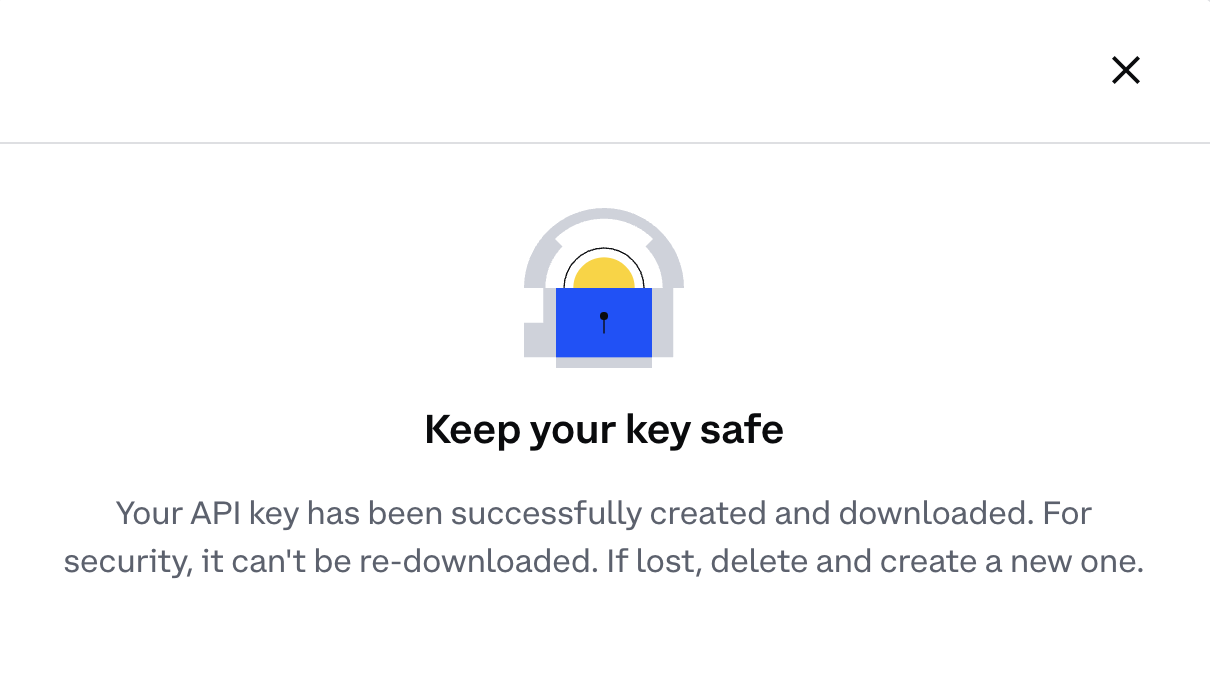

- Save Your Keys: Copy the API Key and Secret Key provided and store them in a secure location. You’ll need these for the import process.

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link and skip to step 5.

-

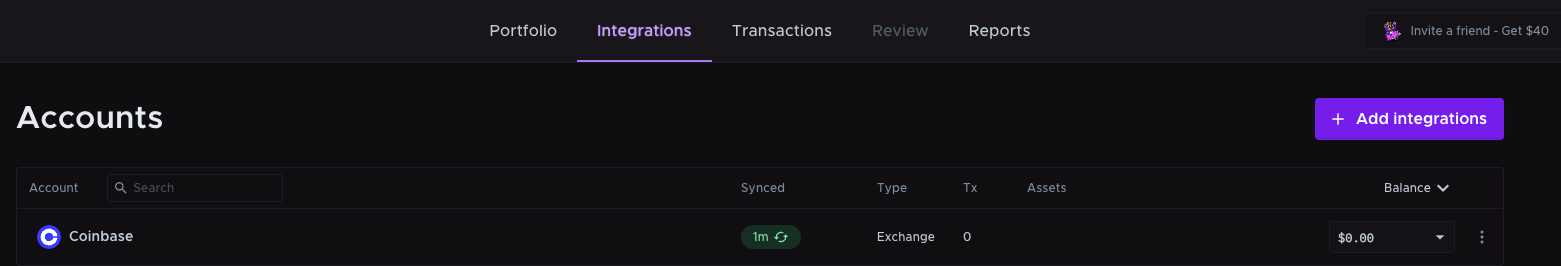

Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click the ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Paste API Keys: Enter the API Key and Secret Key you obtained from Coinbase and click ‘Import’.

-

Wait for Data Upload: The import process may take a few minutes. During this time, you can proceed with importing data from other exchanges or tasks.

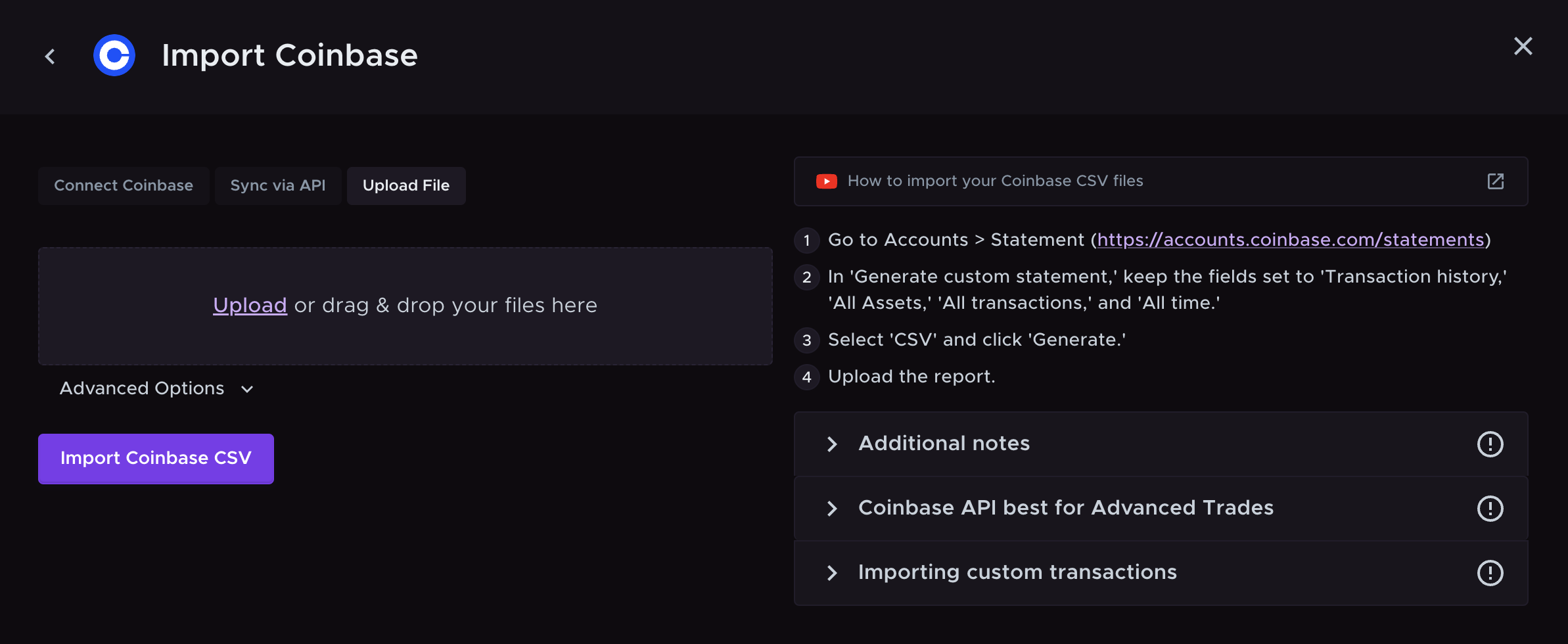

Uploading Your Coinbase Transactions with a CSV File

If you prefer or need to use a CSV file, follow these steps:

On Coinbase:

-

Log In: Access your Coinbase account.

Shortcut: To quickly access the settings page where you can generate a CSV report on Coinbase, follow this link and skip to step 4.

-

Navigate to settings: Go to the settings by clicking on your profile icon in the top right corner

- Go to accounts: Navigate to accounts overview by selecting ‘Go to accounts’.

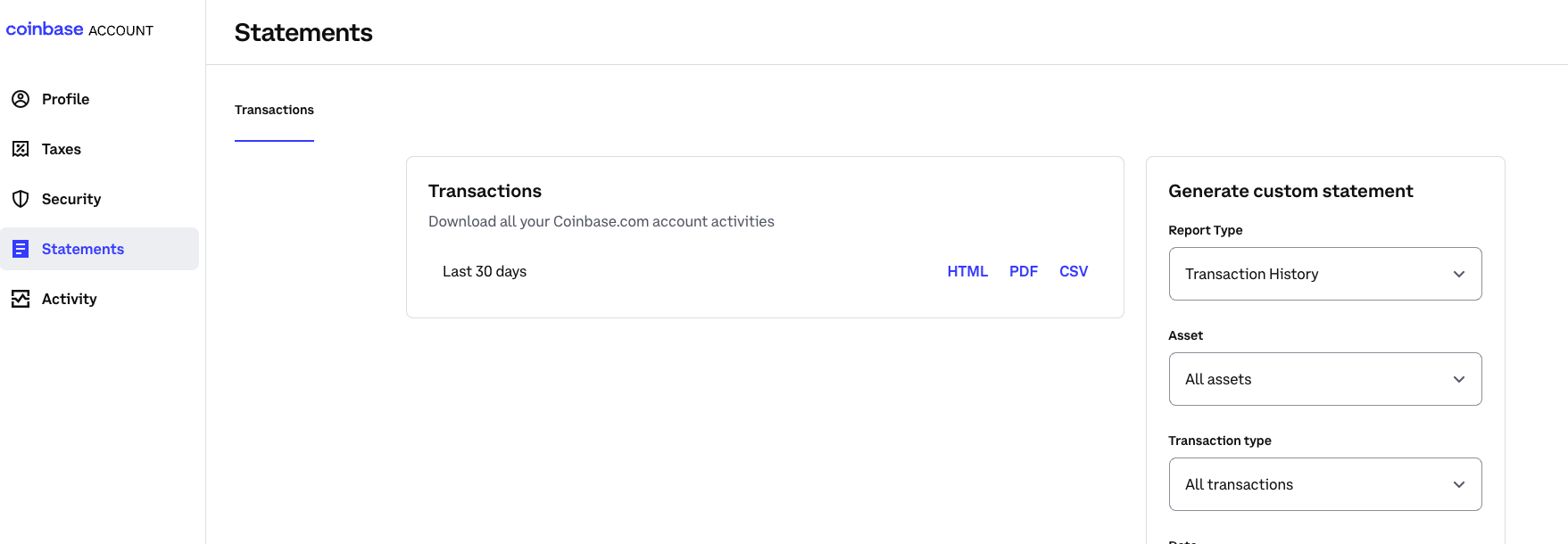

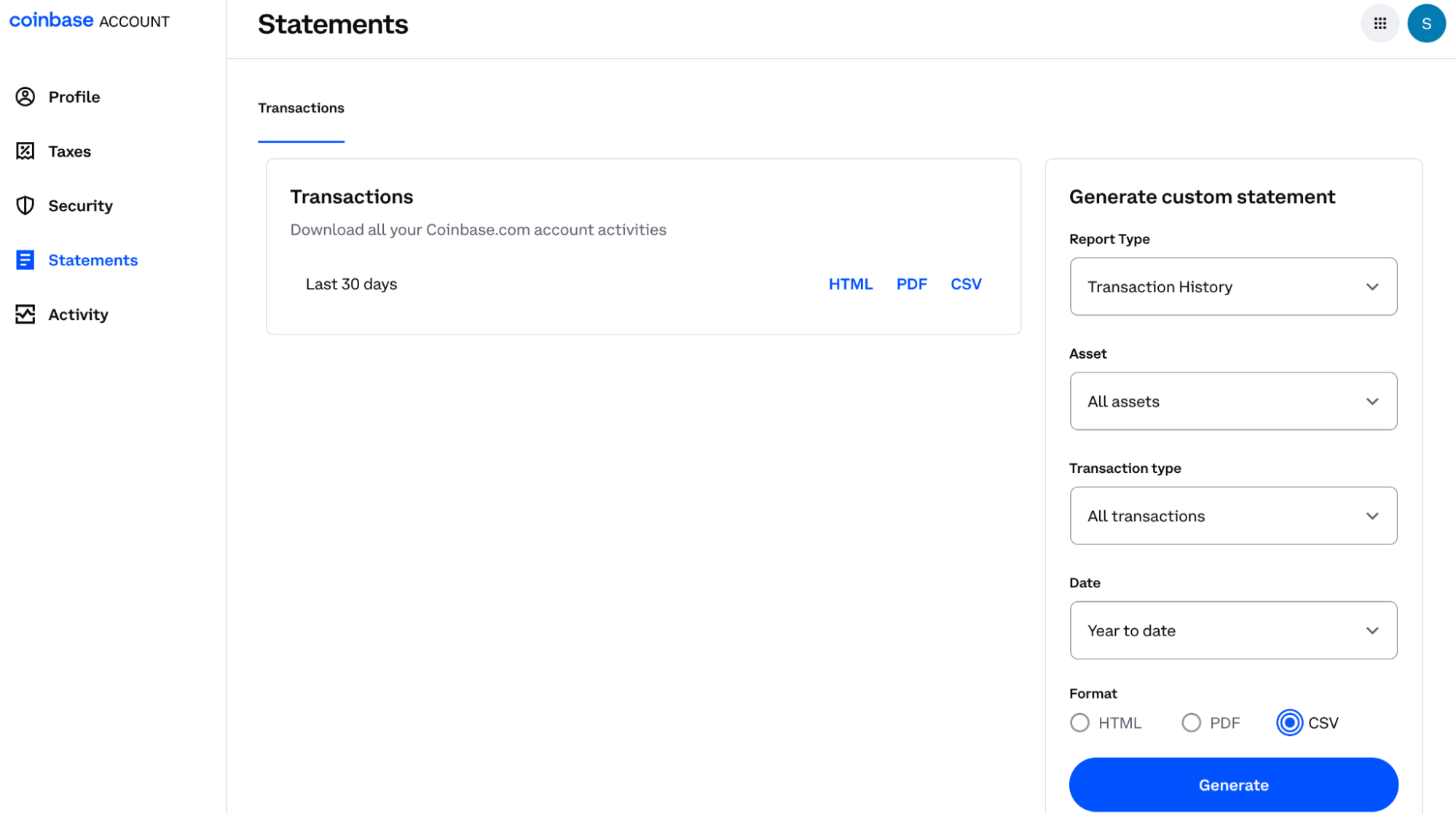

- Navigate to statements: Select Statements from the right hand menu.

- Create a report: by selecting the CSV file format. Download this file to your computer.

On Crypto Tax Calculator:

-

Log In: Access your account on the Crypto Tax Calculator platform.

Note: If you don’t yet have a Crypto Tax Calculator Account, you can set one up for free using your Coinbase account credentials.

Shortcut: To quickly access the integrations page where you can add Coinbase to your CTC account, follow this link and skip to step 5.

- Go to Integrations tab: Navigate to ‘Integrations’ from the tabs at the top of the page.

-

Add Integration: Click the ‘add integrations’ button.

-

Select Coinbase: choose Coinbase as your exchange from the available options.

-

Upload CSV File: Click on ‘Upload File’ and select the file you downloaded from Coinbase.

- Verify Data: Ensure that all transactions have been imported correctly and make any necessary adjustments.

Wrapping Up

You can choose to import your Coinbase transaction data into Crypto Tax Calculator using one of the 3 different methods (OAuth, API connection and CSV upload) based on your preference. By following these steps, you’ll streamline your tax preparation process, ensuring that your Coinbase and other cryptocurrency transactions are accurately reported.