Preparing Your Coinbase Pro Taxes

Crypto Tax Calculator allows you to calculate your taxes arising from any trading activity on Coinbase Pro. All you have to do is import your trading data via CSV or the API, and we will automatically normalize these transactions back to your local currency. You can then easily calculate your financial year's short and long-term gains using various in-app inventory methods.

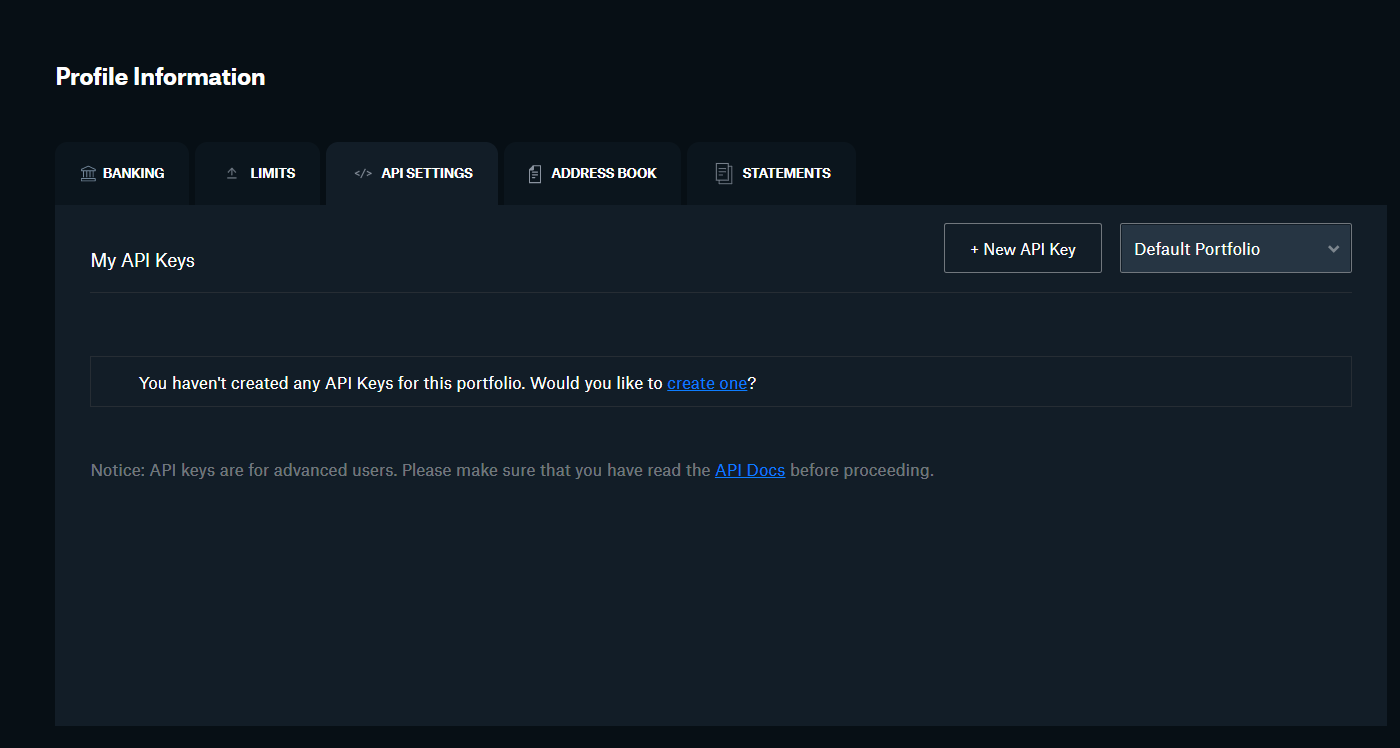

Import via API Keys

- Log in to Coinbase Pro

- Navigate to API Settings page by clicking on your Profile (https://pro.coinbase.com/profile/api)

- Click the ‘New API Key’ button

- For Permissions, tick 'View' only

- Copy your Passphrase into the ‘Api Password’ field in Crypto Tax Calculator

- Click ‘Create API Key’ button

- Copy your Passphrase, API Key and API Secret

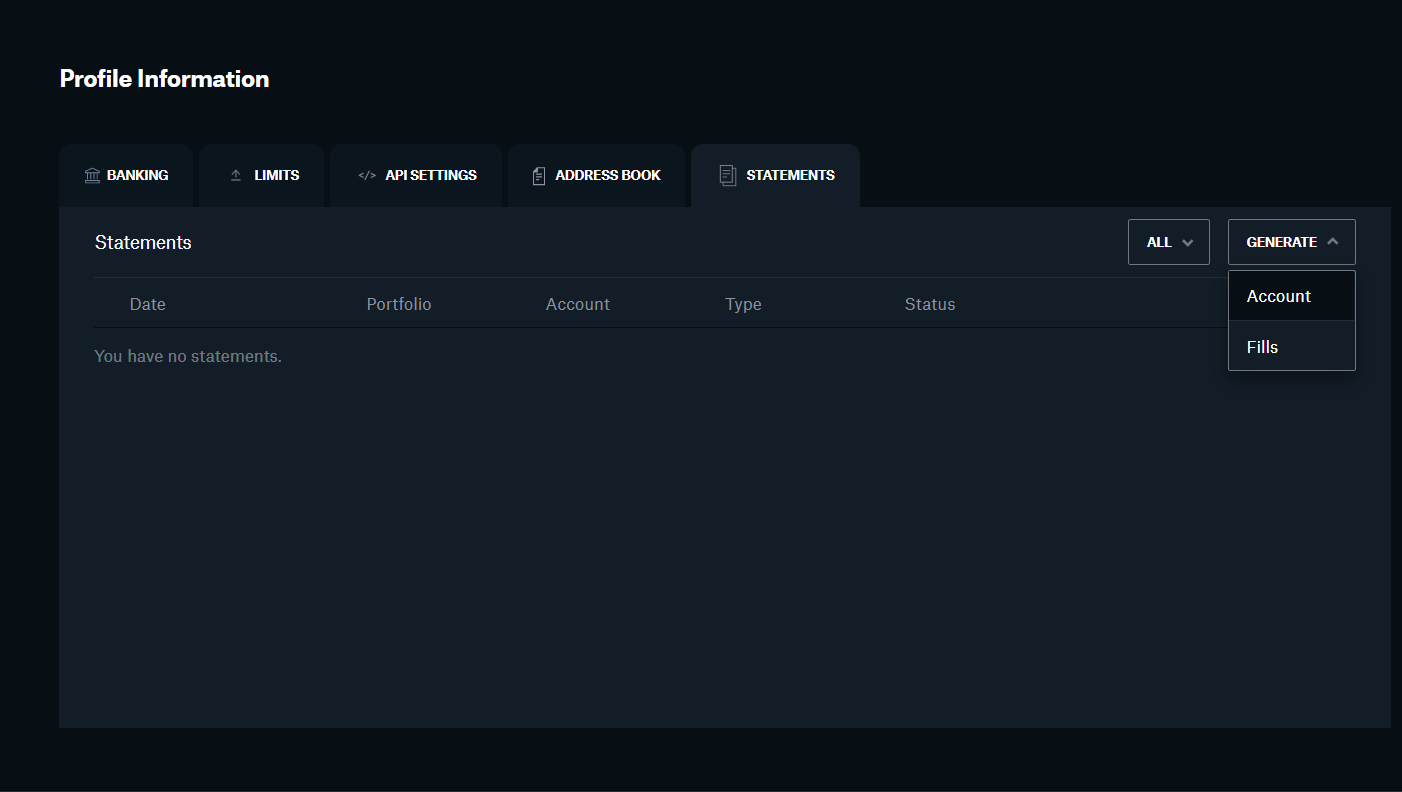

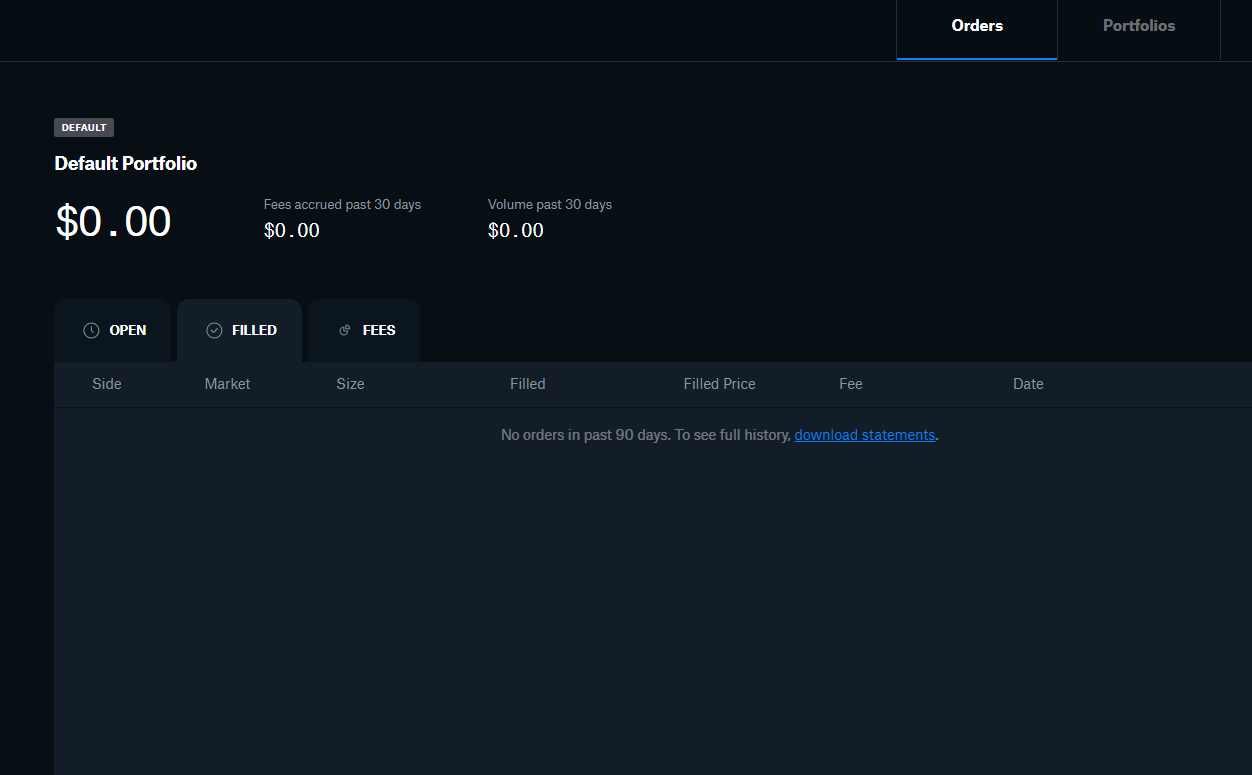

Import via Order History CSV File

Log in to Coinbase Pro and complete the following steps for Trade Data and Deposits/Withdrawals

Trade Data:

- Navigate to My Orders > Filled Orders (https://pro.coinbase.com/orders/filled)

- Click on the ‘Download Statement’ button

- Click Product > All

- For the date, set it the date of/or before you began trading

- For the format, select CSV instead of PDF

- Upload the 'Fill Statement' CSV to Crypto Tax Calculator to upload your trading data