Preparing Your CoinList Pro Taxes

Crypto Tax Calculator supports two main options for uploading data from CoinList Pro so you can calculate your CoinList Pro taxes. CoinList Pro has an easy-to-use API that allows you to automatically upload your trading data. They also offer CSV history downloads allowing you to upload the files manually.

Import via CSV

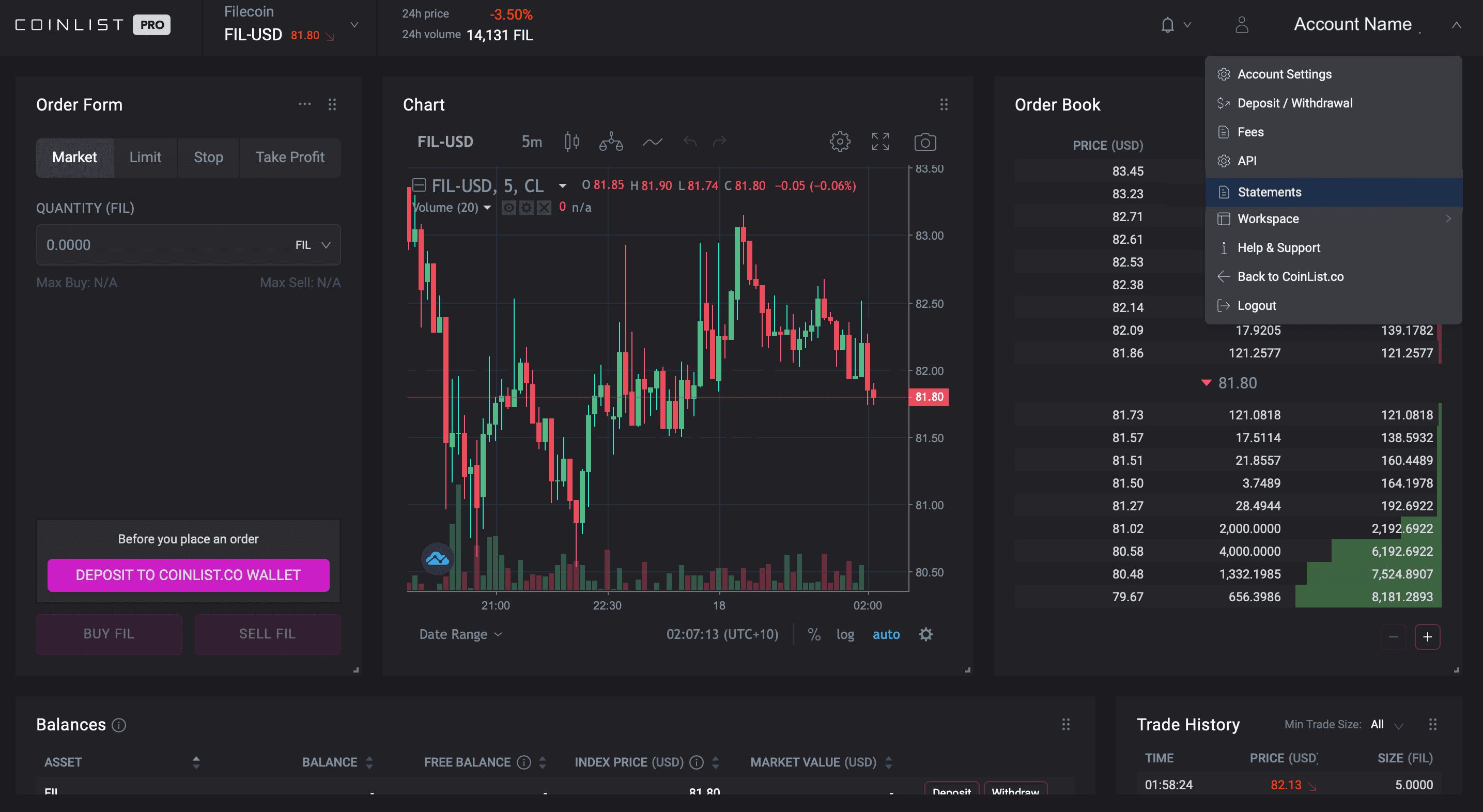

- Log in to your CoinList Pro account

- Click on the dropdown menu in the upper right of the CoinList Pro platform

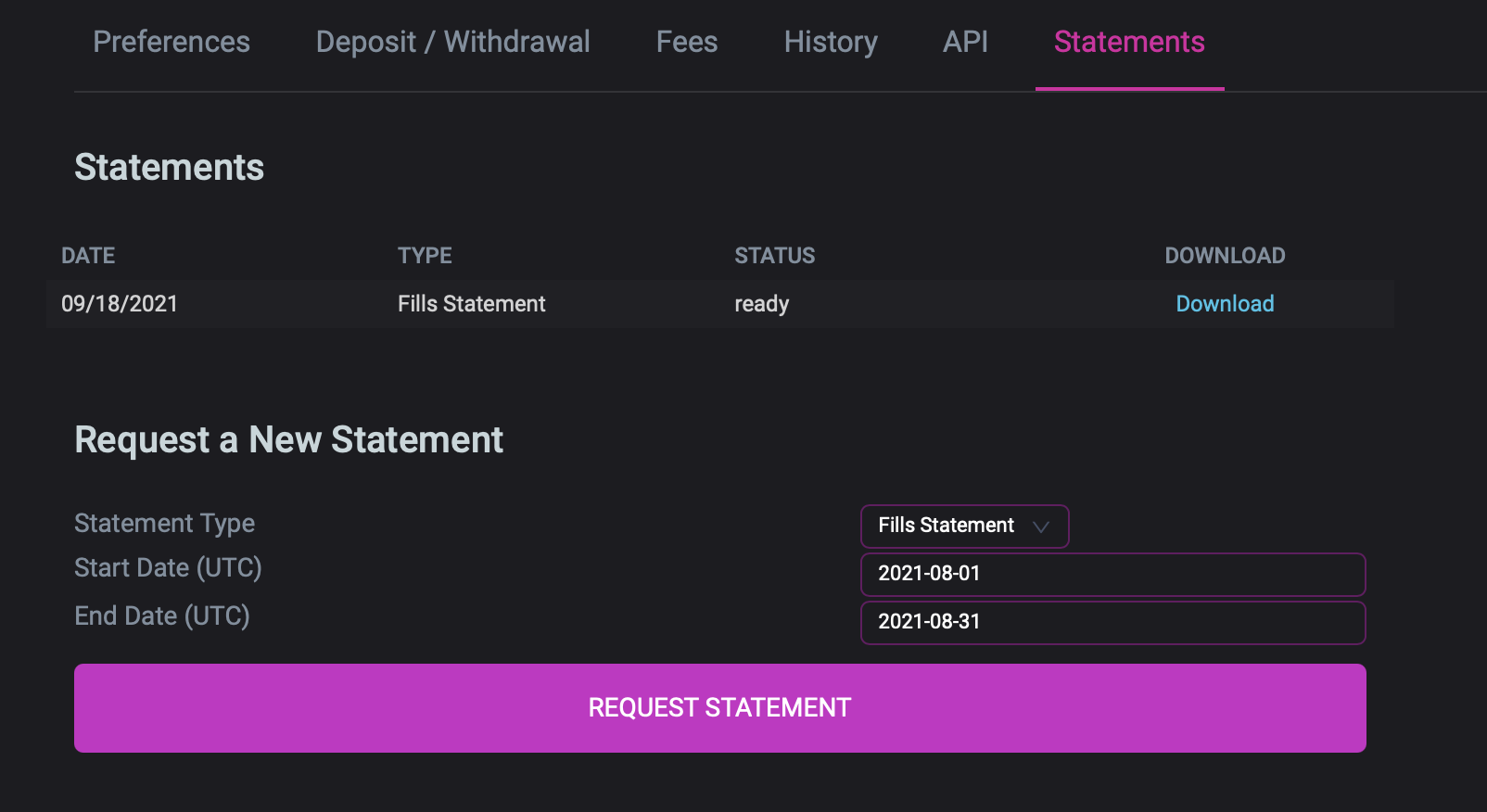

- Select Statements and set 'Statement Type', 'Start Date' and 'End Date' and click 'Request statement'

- Upload BOTH fills CSV and account CSV into Crypto Tax Calculator

Create and add API keys

- Log in to your CoinList Pro account

- Click on the dropdown menu in the upper right of the CoinList Pro platform

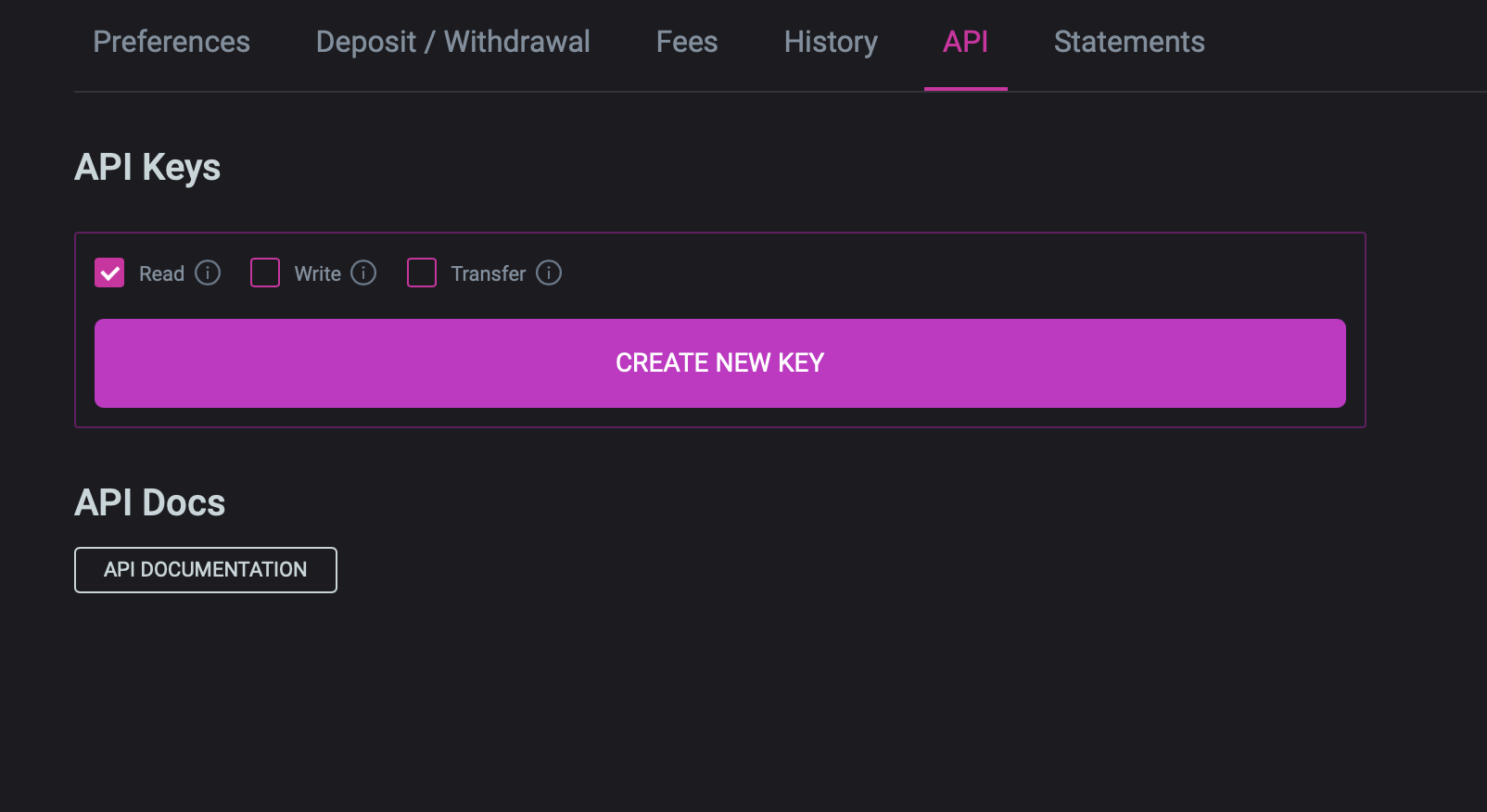

- Select 'API'

- Ensure only 'Read' permissions are selected and then click 'Create New Key'

- Copy the generated 'API Key' and 'API Secret' here into Crypto Tax Calculator, enter an optional nickname, and then click 'Add API' to sync your API

Wrapping Up

That's it! From these two options, you can upload your transactions from CoinList Pro to calculate your taxes using Crypto Tax Calculator. If you find that you are missing some transactions, you can upload these manually using our Simple or Advanced manual CSV import.