CoinMetro Tax Guide

Crypto Tax Calculator supports data uploads from CoinMetro so you can calculate your CoinMetro taxes. CoinMetro offers CSV history downloads allowing you to upload the files manually into Crypto Tax Calculator.

Import CoinMetro data into Crypto Tax Calculator via CSV

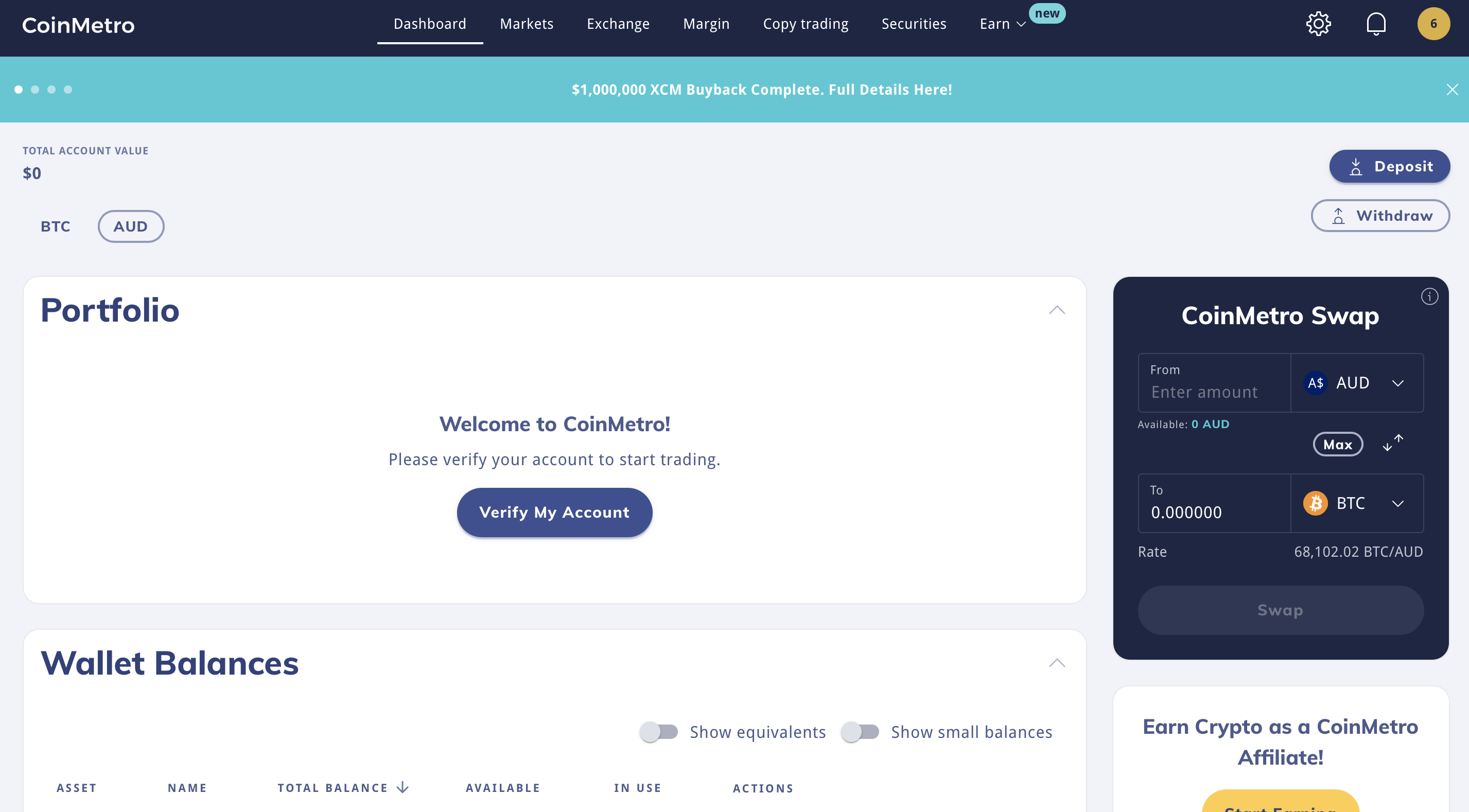

- Login to CoinMetro

- Navigate to your Dashboard

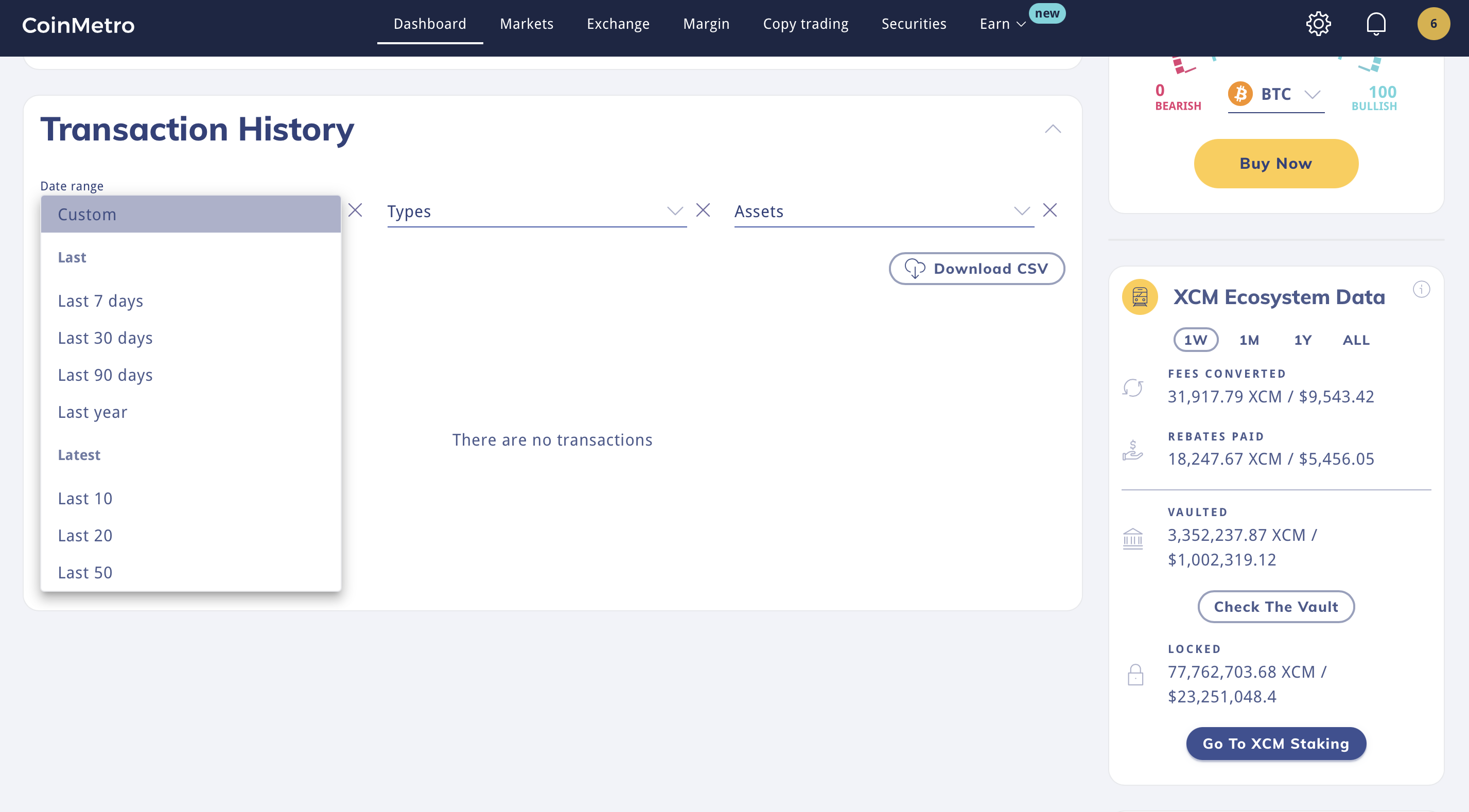

- Scroll down to your Transaction History

- Select the date range corresponding to the start of your trading period or the period of interest using the 'Date range' dropdown menu

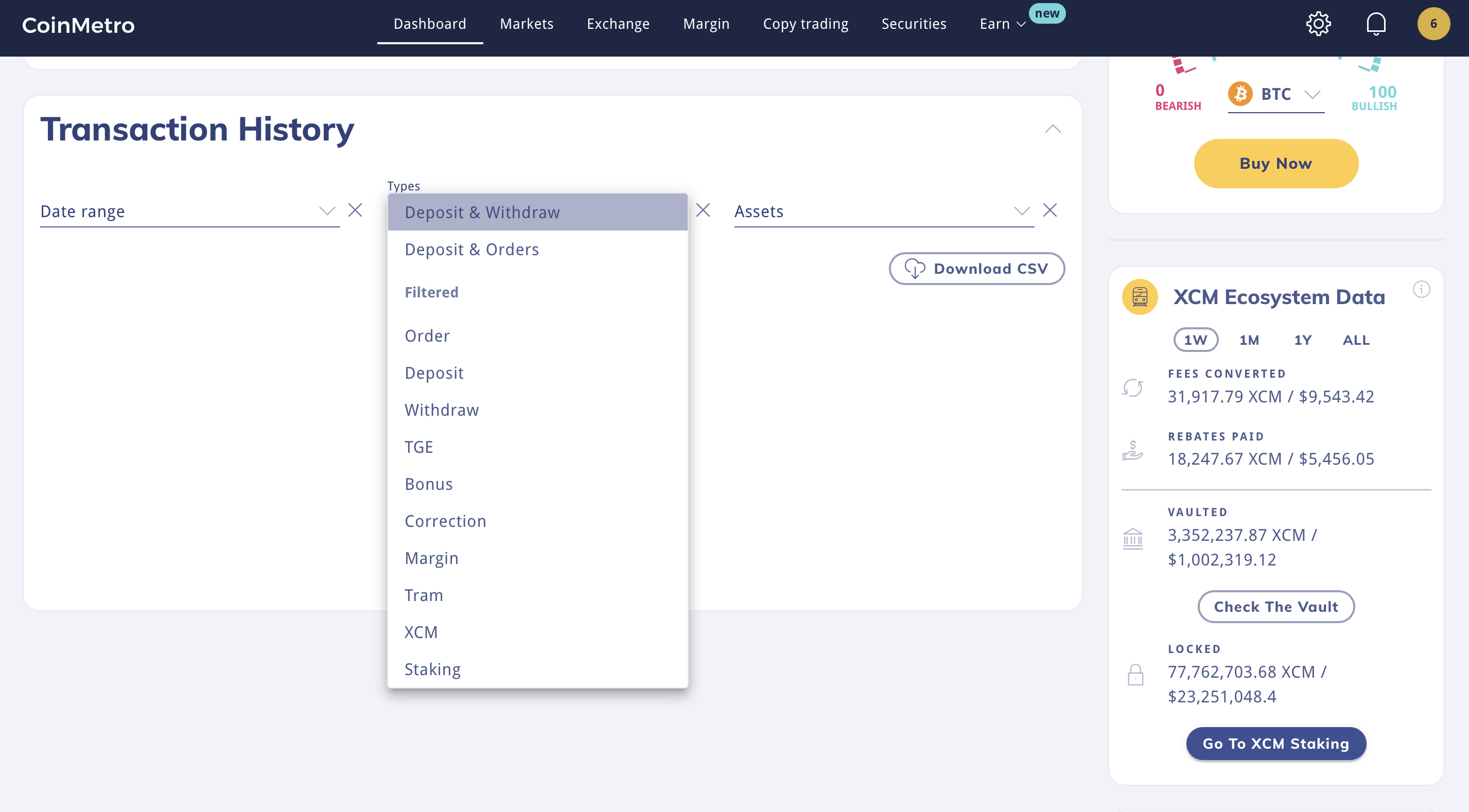

- Select 'Deposit & Withdraw' in the 'Types' dropdown menu

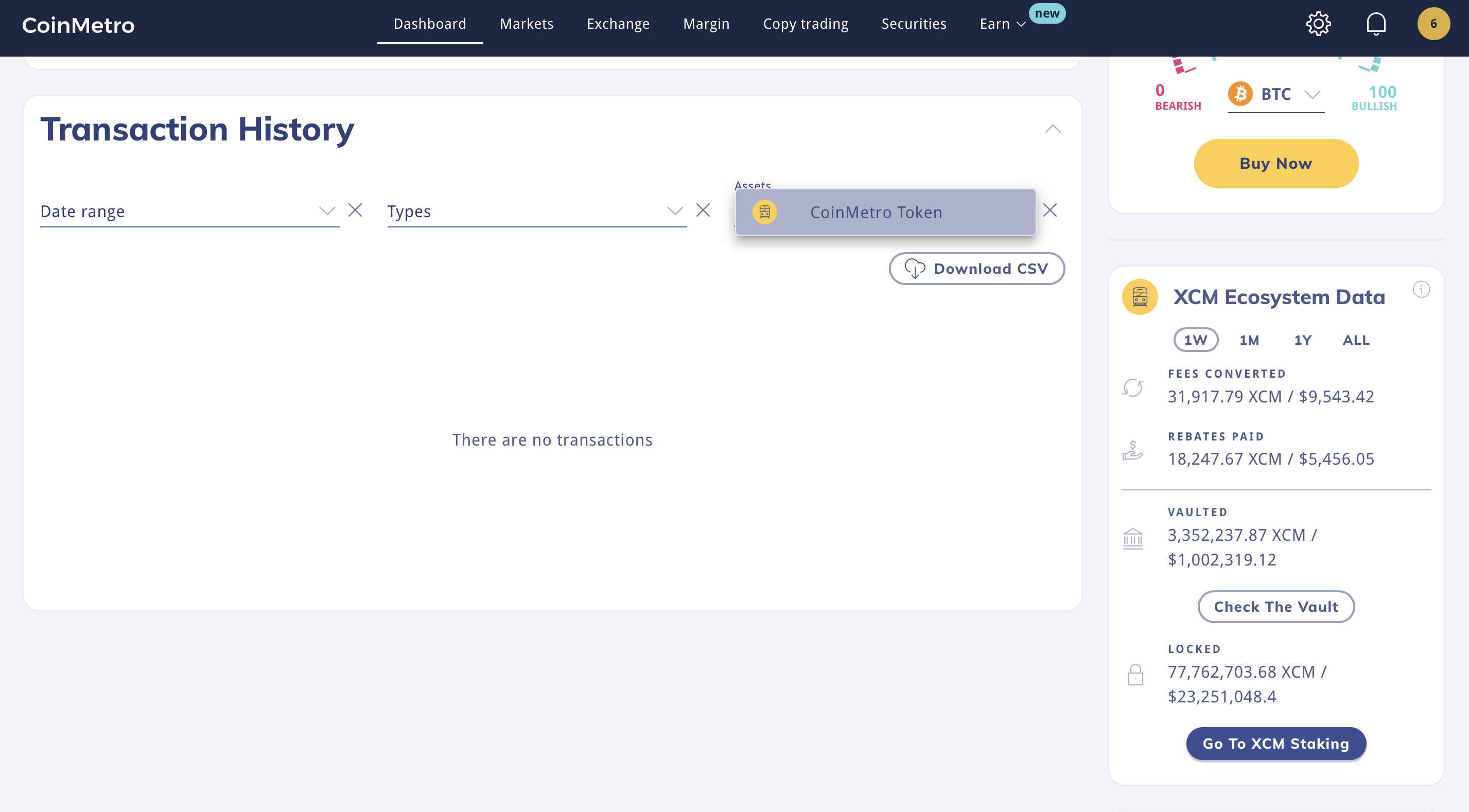

- Click 'Download CSV' to download your transaction history

- Ensure you repeat this with all your traded assets, which can be selected in the Asset dropdown menu.

- Sign up to Crypto Tax Calculator

- In the dropdown menu search for CoinMetro

- Click the Import button and select the CSV file downloaded from CoinMetro

- Click the upload button

- You can also append the 'Deposits and Withdrawals' CSV (optional)

- Navigate to the review transactions tab and verify you can see all your crypto transactions

- Navigate to the generate report tab and select the financial year you want the report for.

- Download the report and send to your accountant.

Wrapping Up

That's it! Using the CSV option, you can upload your transactions from CoinMetro to calculate your taxes using Crypto Tax Calculator. If you find that you are missing some transactions, you can upload these manually using our Simple or Advanced manual CSV import.