CoinSpot Crypto Tax Guide

Crypto Tax Calculator has partnered with leading Australian cryptocurrency exchange CoinSpot, offering seamless integration between the two products. Being one of the earliest fully featured trading platforms that facilitate crypto to crypto transactions, it exciting for us to offer complete support for CoinSpot users. It is now easier then ever for Australians to calculate their tax obligations.

What are the benefits of using Coinspot?

- Exceptional support

- Friendly and local SMSF support team to assist with onboarding and customer inquiries.

- Over 360 cryptocurrencies

- Have direct access to Australia's largest variety of cryptocurrencies

- Easy EOFY reporting

- Easily manage your tax and audit obligations with EOFY reporting.

- Track your portfolio

- Read-only API interface for accountant and fund managers to track your portfolio.

- OTC access

- OTC (Over The Counter) services available for high volume trading.

- Trade & swap

- Trade from asset-to-asset (coin-to-coin) with any currency on the platform.

How do crypto taxes work?

Investing in cryptocurrency incurs different tax liabilities and these might be in the form of Capital Gains Tax (CGT) or Income Tax. However, the type of tax payable and the quantity will depend on the specific features of the transaction such as the type of transaction made, as well as the entity making the transaction (i.e. business vs. individual).

Capital Gains Tax refers to the tax paid on a capital gain made from the sale of a capital asset. Specifically, capital gain (or loss) = capital proceeds (price that the capital asset was disposed of for) – cost base (price it was purchased for).

Therefore, different transactions involving the disposal of cryptocurrency may give rise to a ‘Capital Gains Tax Event’ and result in some CGT payable to the ATO. Once taxable quantity is determined, the tax payable will be calculated according to your individual income tax bracket.

You can read more about how crypto taxes are calculated in our Crypto Tax Guide.

What records do you need to keep to do your Coinspot taxes?

Whether you are a business, investor or personal user of cryptocurrency, remember that crypto gains or losses are taxed. Therefore, to accurately calculate your tax liability – it is important to maintain records of all your cryptocurrency exchanges.

Records may be requested at the discretion of the ATO and generally need to be held for a period of 5 years after the cryptocurrency exchange.

As stated on the ATO website as of 9th July 2020

You need to keep the following records in relation to your cryptocurrency transactions:

- the date of the transactions

- the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be taken from a reputable online exchange)

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

The sorts of records you should keep include:

- receipts of purchase or transfer of cryptocurrency

- exchange records

- records of agent, accountant and legal costs

- digital wallet records and keys

- software costs related to managing your tax affairs

Keeping good records will make it easier to calculate and meet your tax obligations, and if you are in business, they will assist you to manage your cash flow and see how your business is doing.

You can use an accountant or third-party software to help meet your record-keeping obligations and working out your tax.

As you can see there is a lot of record keeping requirements, and this can be painful to manage. For example, if you traded Bitcoin for Ethereum you are required to record both sides of the transaction back to Australian dollars, and declare any applicable taxes. If you were to do this manually it can literally take days, but luckily Crypto Tax Calculator is here to help automate this for you.

How to import CoinSpot data into Crypto Tax Calculator

There are two ways you can import your CoinSpot data into Crypto Tax Calculator. You can follow the steps below to import your CoinSpot CSV file or alternatively you can connect via the API to automatically sync your transaction history in the future.

Upload via a CSV file

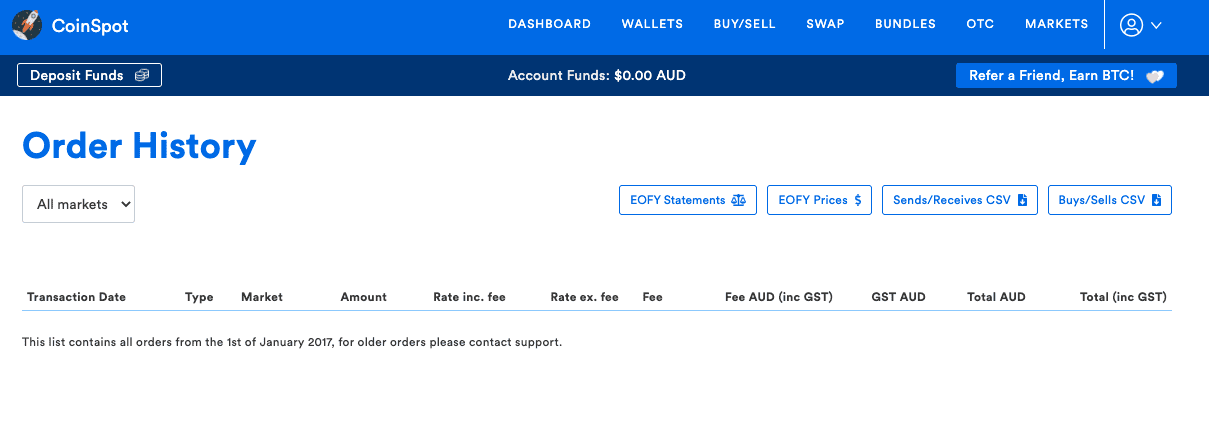

You can easily download a CSV file from CoinSpot and upload it into Crypto Tax Calculator. First log into CoinSpot and follow the below steps:

-

In the top right corner click the ‘my account’ button to activate a dropdown menu

-

From the menu select order history

-

Download the buy/sell CSV

-

You can also download the send/ receive CSV if you have transferred funds

Then signup to Crypto Tax Calculator:

-

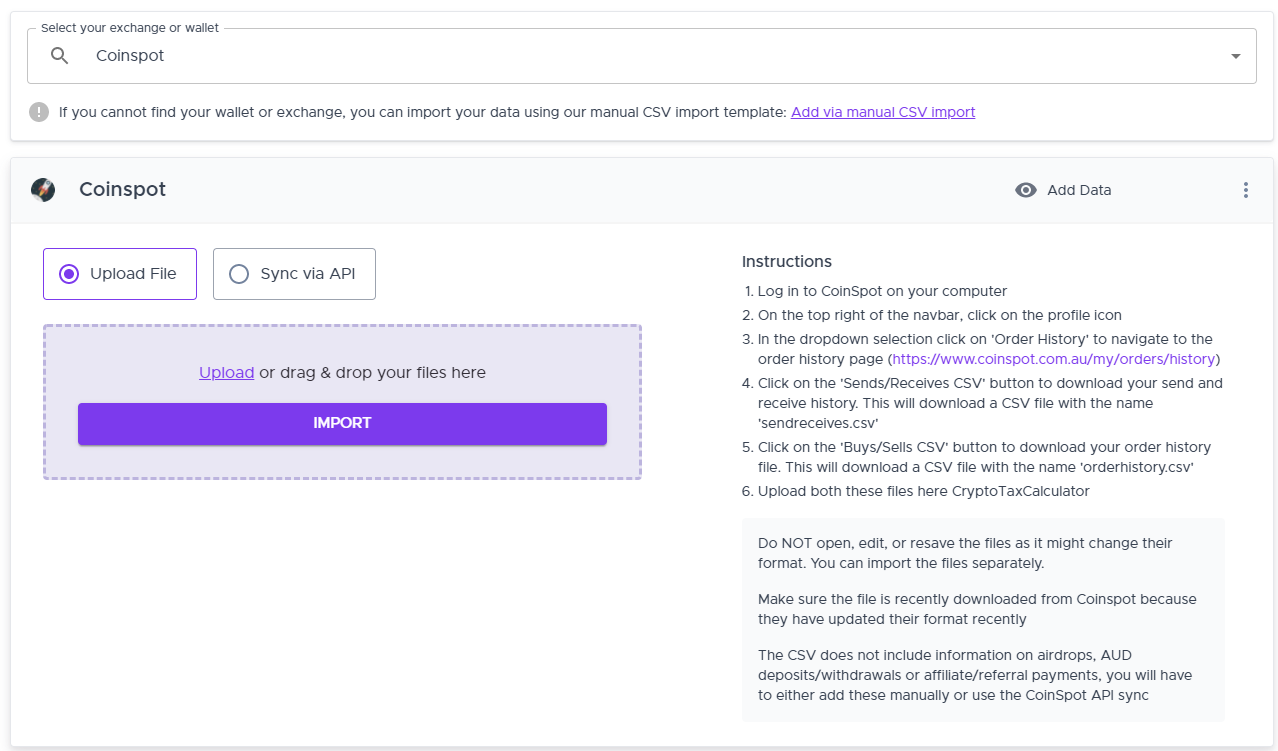

Once signed up navigate to the import page

-

Select CoinSpot from the dropdown menu

-

Upload the files you have downloaded previously

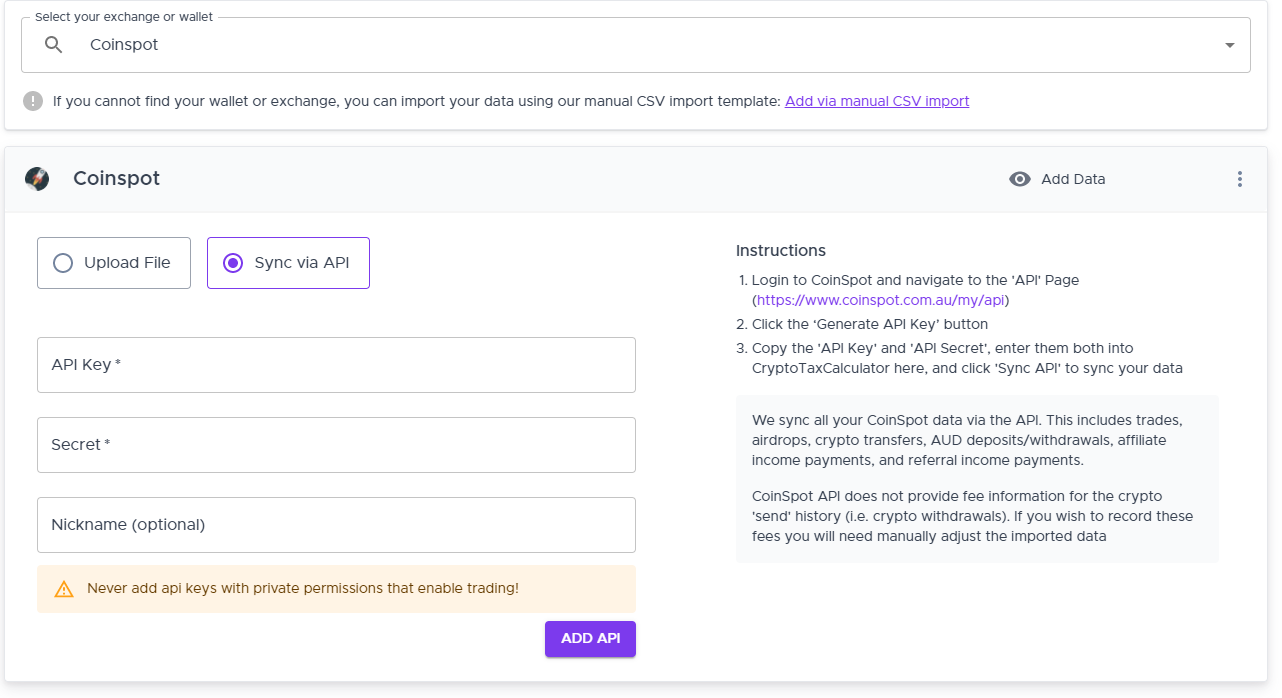

Upload via API keys

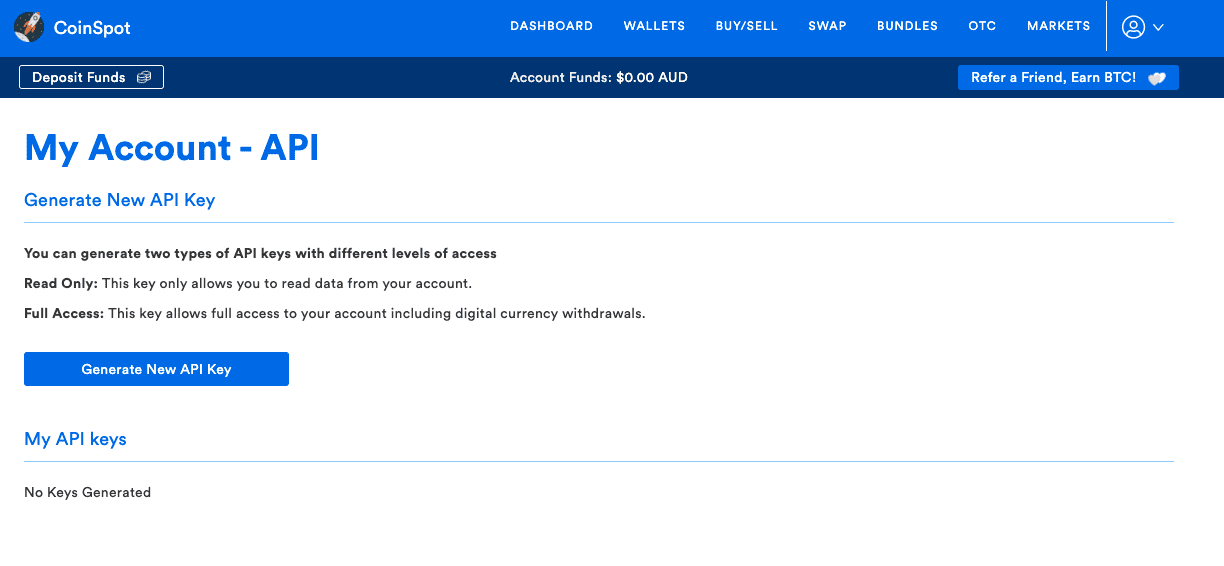

Once logged into your CoinSpot account follow the steps below to create and use an API to import data:

-

In the top right corner click the ‘my account’ button to activate a dropdown menu

-

From the menu select API

-

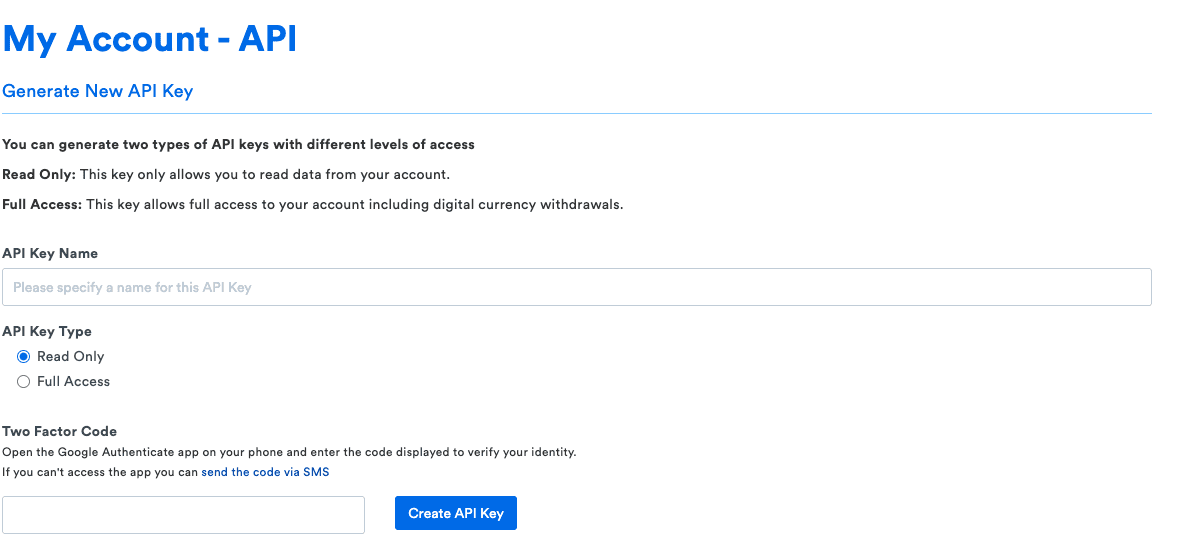

If you haven’t already you will have to enable 2FA security (this will involve downloading a two-factor authentication app on your phone and following the steps Coinspot provide)

-

To create a new API key generate key, give it a name and enter your 2FA code, you will get sent an email confirmation with a link to complete the process (make sure the API you create is read-only to protect your account)

-

Record your API key and secret key somewhere secure (you can only see the secret key once)

Once you have generated your API key head over to Crypto Tax Calculator to complete the process:

-

Once logged in navigate to the import data page

-

Select CoinSpot from the dropdown menu

-

Select the select autosync option and enter your API key and secret key

It could take a few minutes to upload the data but in the meantime, you can continue uploading any other transactions you have from different exchanges.