Digital Surge Tax Guide

Crypto Tax Calculator allows you to calculate your taxes arising from any trading activity on Digital Surge. All you have to do is import your trading data via CSV or the API, and we will automatically normalize these transactions back to your local currency. You can then easily calculate your financial year's short and long-term gains using various in-app inventory methods.

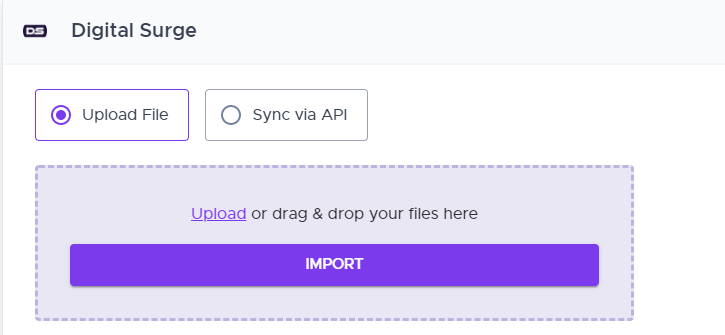

Import via CSV

-

Open Digital Surge in your web browser and log in to your account

-

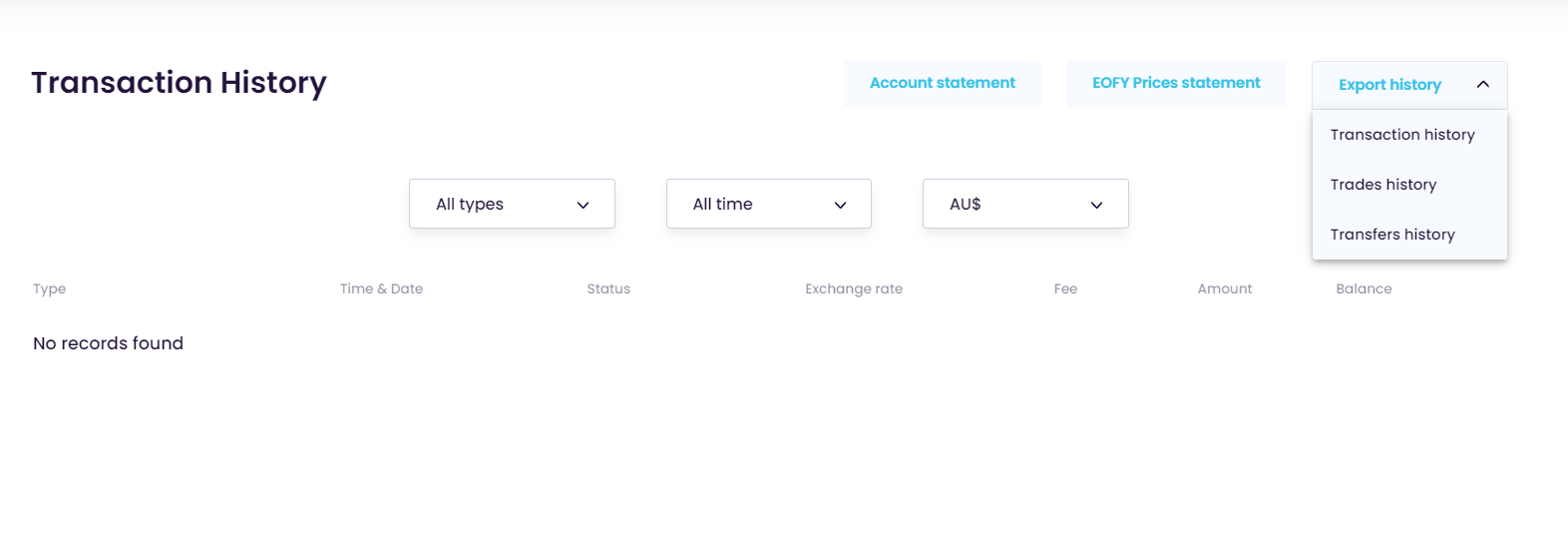

Click on the hamburger menu at the top right of the page. In the dropdown popover select 'Transaction history' to navigate to the Transaction History page (https://digitalsurge.com.au/account-settings/transactions-history)

-

On the Transaction History page, click on the 'Export history' button (for mobile, click on the three dots to the right of the Transaction History title)

-

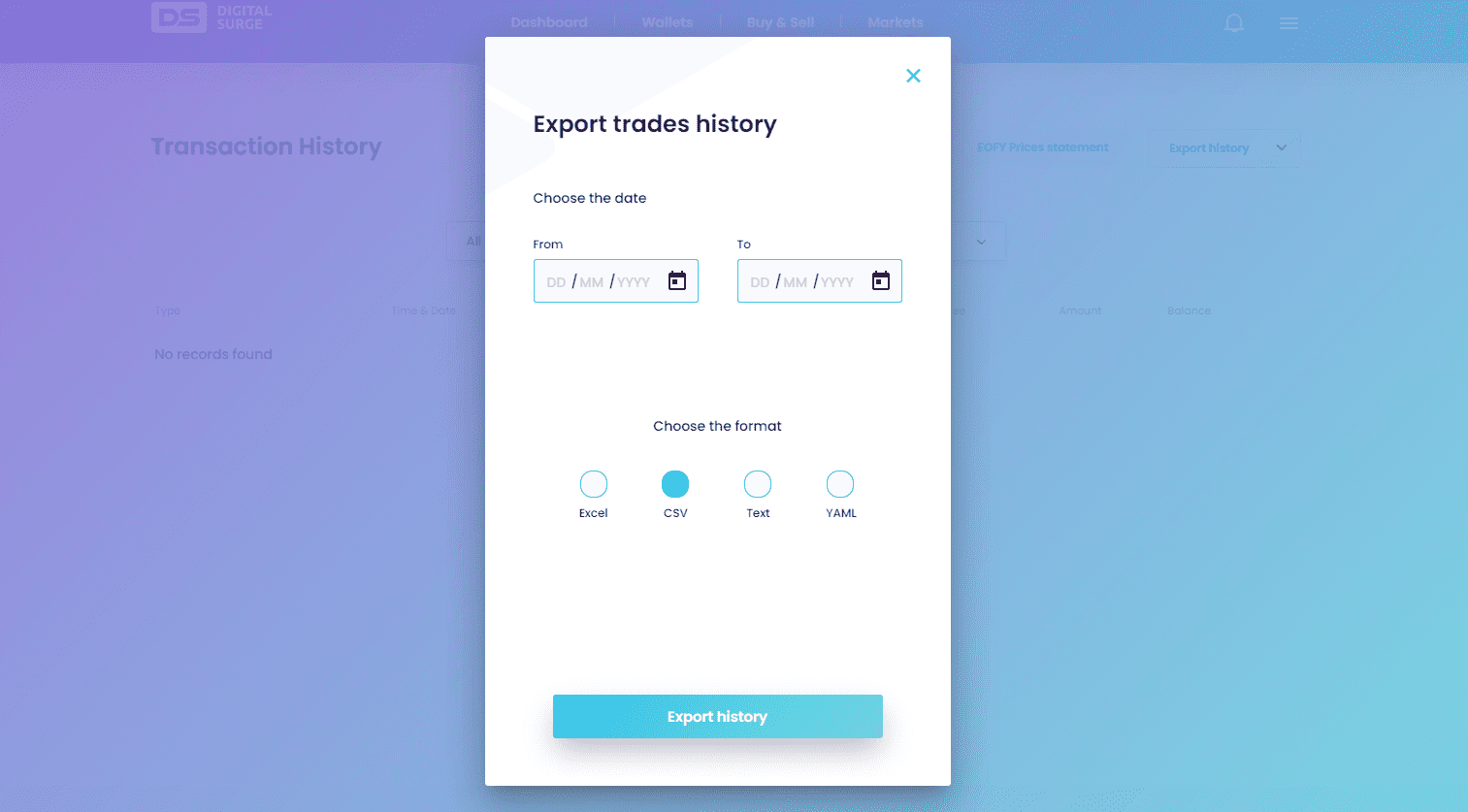

In the dropdown, select the 'Trades history' option to open the 'Export trades history' popup. In this popup, leave the date selection empty (this covers your complete trading history), and choose the format as 'CSV'. Once selected, click the 'Export history' button to download your 'trades.csv' file

-

Repeat step 3, and then, in the dropdown, select the 'Transfers history' option to open the 'Export transfers history' popup. In this popup, leave the date selection empty, and choose the format as 'CSV'. Once selected, click the 'Export history' button to download your 'transfers.csv' file

-

Upload both the 'trades.csv' and the 'transfers.csv' files into Crypto Tax Calculator

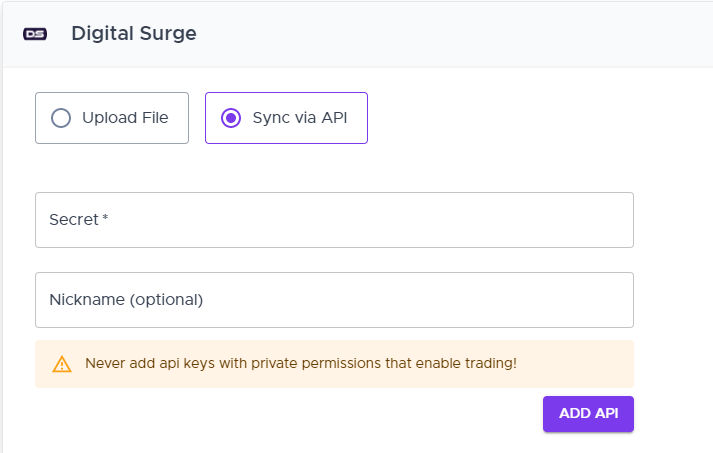

Import via API

-

Log in to your Digital Surge account

-

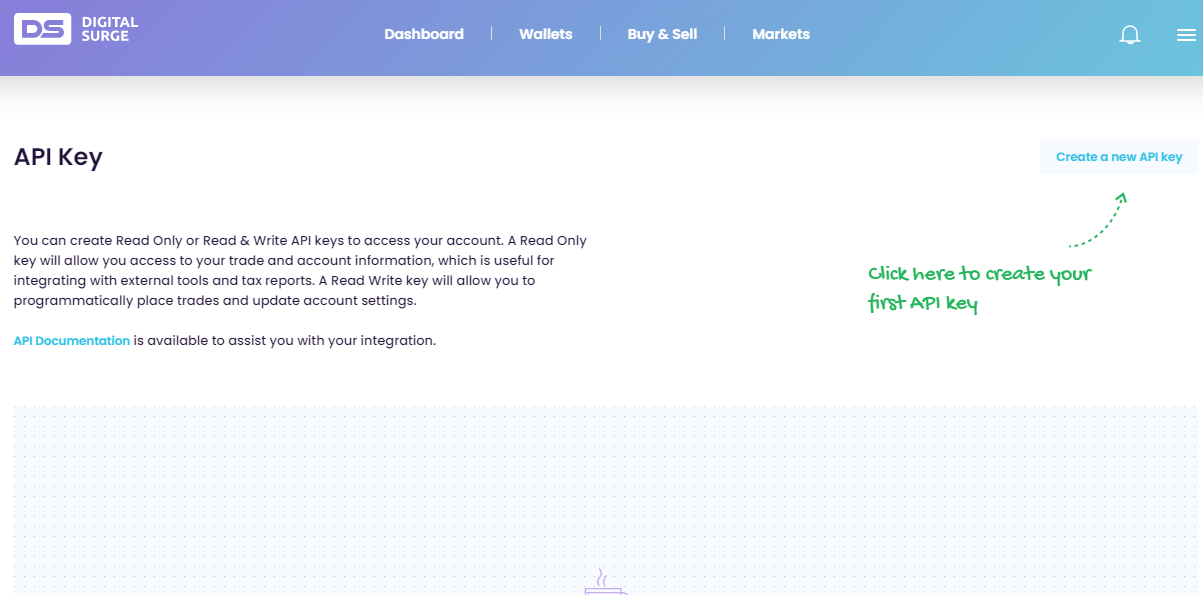

Click on the hamburger menu at the top right of the page. In the dropdown popover, select 'API key' to navigate to the API Key page (https://digitalsurge.com.au/account-settings/api-keys)

-

On the top right of the page, click on the 'Create a new API key' button

-

In the popup, make sure you select 'Read only' and then click 'Next'

-

Enter the 2FA confirmation code and then click 'Generate the API key'

-

Copy the displayed API key, paste it into the 'Secret' field here on Crypto Tax Calculator, enter an optional nickname, and then click 'Add API' to sync your API