Honeyswap Tax Guide

As part of our official xDai Chain integration, you can import your Honeyswap trading activity into Crypto Tax Calculator to calculate your tax obligations.

Quick Start

Crypto Tax Calculator automatically detects and categorises Honeyswap DEX trading activity. To get started, simple follow the below steps:

-

Locate and copy the wallet address associated with your xDai Chain account that you used to trade on Honeyswap. This is typically found on your wallet manager (e.g. MetaMask). The wallet address should start with '0x'.

-

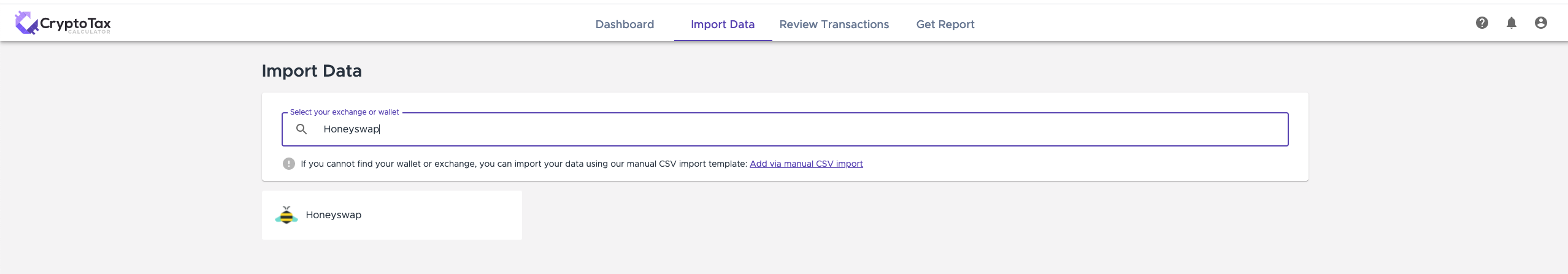

In Crypto Tax Calculator enter Honeyswap into the search field or scroll down and select from the list.

-

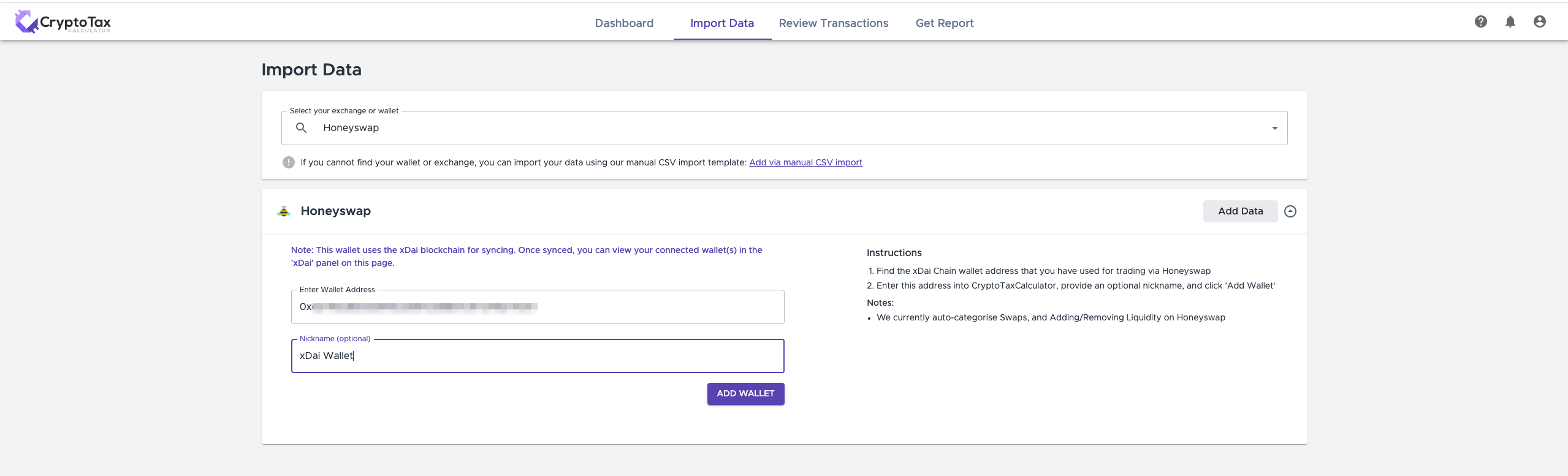

Enter this xDai wallet address into Crypto Tax Calculator, provide an optional nickname, and click Add Wallet. It is possible to add multiple wallet addresses after you add the first.

-

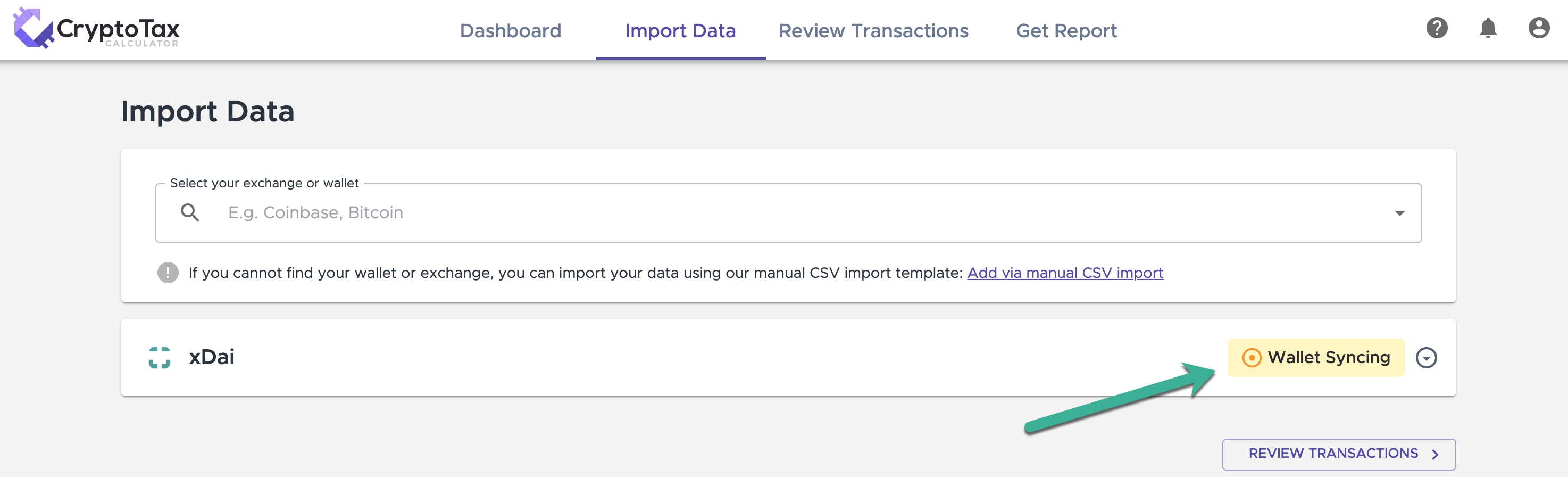

Your wallet will now sync under the 'xDai' import option and Crypto Tax Calculator will pull in all the transactions associated with this wallet from the xDai blockchain. Any transactions associated with Honeyswap will be automatically categorized where possible.

Tax Guide For Honeyswap

We support and auto categorise the following types of transactions on Honeyswap DEX:

- XDAI to token swaps.

- Token to token swaps.

- Wrapping and unwrapping XDAI.

- Adding liquidity to a pool (V2 Liquidity)

- Removing liquidity from a pool (V2 Liquidity)

Each of these types of transactions have unique tax consequences which are important to consider and understand. In generally, these types of transactions trigger Capital Gains Tax (CGT) event(s) associated with the asset(s) which are disposed of.

Token to Token & XDAI to Token Swaps

When you perform swaps on Honeyswap, you are actually disposing (selling) one asset, and acquiring (buying) another asset. When you dispose of an asset, this triggers a CGT event. Any fees paid (e.g. gas fees for executing the transaction) are taken into account when calculating the cost base of the asset.

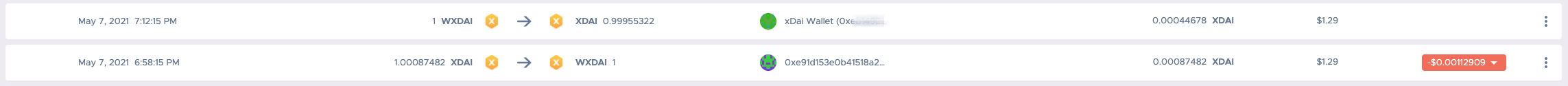

Wrapping and Unwrapping XDAI

Wrapping from XDAI to WXDAI is similar to performing an XDAI to token swap. When you wrap XDAI, you dispose of the XDAI (triggering a CGT event) and acquire the WXDAI. When you unwrap WXDAI, you dispose of the WXDAI (triggering a CGT event) and acquire the WXDAI.

Liquidity Pools

A liquidity pool is a collection of funds locked in a smart contract that can be used to facilitate a range of DeFi trading activity. Honeyswap utilises the concept of liquidity pools to facilitate trading (swaps) between different tokens (and XDAI). As a user of Honeyswap, you are able to contribute your own assets to a pool, and in return earn a percentage of the trading fees from that particular asset pair.

In order to provide or 'add' liquidity to a pool, you must contribute both of the underlying assets which constitute the pool. For example, if you wished to add liquidity to the AGVE-HNY pool, they must supply equal proportions of both AGVE and HNY tokens. Once the liquidity is added, you will receive a representation of your share of the pool in the form of an Liquidity Provider (LP) Token.

Honeyswap also provides the ability for you to remove your liquidity from the pool at any time and claim back the underlying assets (i.e. claim back AGVE and HNY tokens). The quantity of the assets which are returned may be different to the quantity which was supplied, as a result of accrued fees and/or impermanent loss due to differences in the market price of the two assets from when they were added to the pool.

Adding Liquidity

When you add liquidity to a pool, you dispose of the two underlying assets (the two assets which make up the pair of the pool) to acquire a new asset (the LP token representing your share in the pool). As a result, two CGT events are triggered, once for each of the disposed assets. For example:

For example, you provide AGVE-HNY liquidity to the pool in the form of 10 AVGE and 50 HNY tokens. The current price of 1 AVGE is $10 and the current price of 1 HNY is $2. As a recognition of your share in the pool, you receive 5 AGVE-HNY LP Tokens.

- You have sold 10 AVGE tokens, triggering a CGT event on these tokens. You have disposed of these assets for a total value of 10 x $10 = $100.

- You have also sold 50 HNY tokens, triggering a CGT event these tokens. You have disposed of these tokens for a total value of 50 x $2 = $100.

- You have acquired 5 AGVE-HNY LP Tokens which have a total cost base of $200. This is equal to the combined value of the tokens which were disposed of (10 x $10 + 50 x $2 = $200). The cost base for each LP token is thus $200 / 5 = $40.

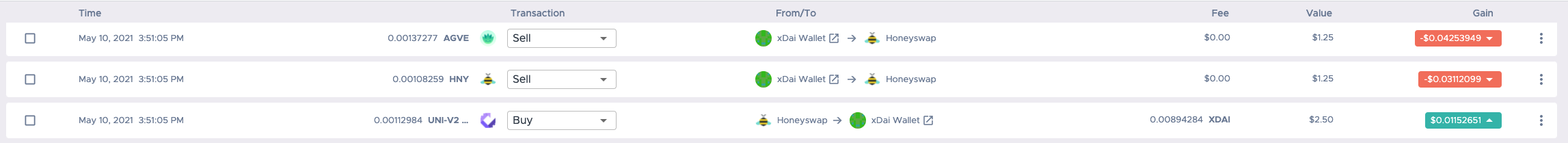

Below is a screenshot of how this will look once you've imported your data into Crypto Tax Calculator. While the quantities and prices are different, the same concepts apply:

Removing Liquidity

When you removing liquidity from a pool, you are disposing of the LP token and acquiring the two underlying tokens which make up the pool. It is important to note that while it may seem like your are getting the same tokens back, you are actually acquiring a different 'parcel' of the tokens. As a result, a CGT event is triggered when you dispose of the LP token. As the LP tokens themselves aren't traded on exchanges and thus do not have a tangible 'market value' the value of the LP token at the time of disposal can be derived from the combined value of the two tokens which are acquired.

Following on from the previous example, you decide to remove your AVGE-HNY liquidity from the pool after having provided liquidity for several weeks. You trade your 5 AGVE-HNY LP Tokens back for 5 AVGE and 125 HNY. The current price of 1 AVGE is $50 and the current price of 1 HNY is $2.

- You have sold 5 AGVE-HNY LP Tokens, trigger a CGT event on these tokens. Since you have received 5 AVGE and 125 HNY tokens as a result of selling these LP tokens, you have disposed of the LP Tokens for a total value of 5 x $50 + 125 x $2 = $500.

- You have acquired 5 AGVE tokens which have a total cost base of 5 x $50 = $250.

- You have acquired 125 HNY tokens which have a total cost base of 125 x $2 = $250.

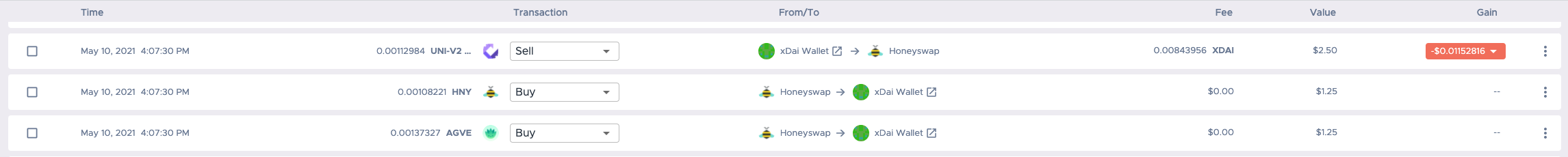

Below is a screenshot of how this will look once you've imported your data into Crypto Tax Calculator. While the quantities and prices are different, the same concepts apply:

Summary: From the previous two examples, from the perspective of the LP token asset only, you have realized a capital gain of $500 - $200 = $300 (the proceeds from the LP tokens - the cost base of the LP tokens) as a result of adding and then removing liquidity to the AVGE-HNY pool. Please note, while above examples doesn't take into the fees paid to execute the associated transactions, Crypto Tax Calculator does take into account these fees when determining the cost base of the tokens.