Preparing your Kraken Taxes

Introduction

Crypto Tax Calculator supports two main options for uploading data from Kraken so you can calculate your Kraken taxes. Kraken has an easy-to-use API which allows you to automatically upload data, they also offer CSV history downloads allowing you to upload the files manually.

Uploading using a CSV import

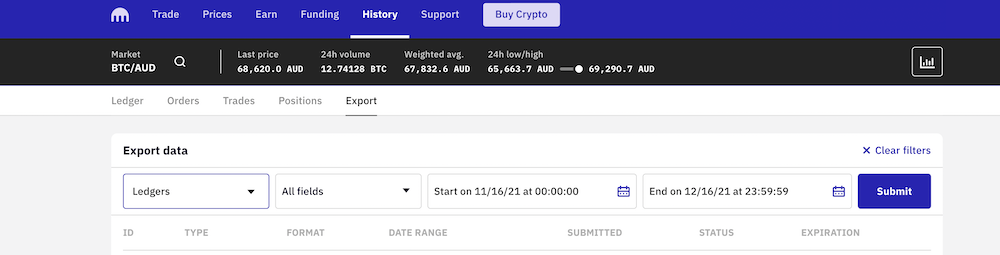

On Kraken:

- Login to Kraken.com

- Click on the History Tab once signed in

- Then click on the Export tab

- Select Ledgers from the drop-down menu

- Submit your request for the date range you have traded. Once your request goes from “Queued to “Processed”, you can download it to your computer

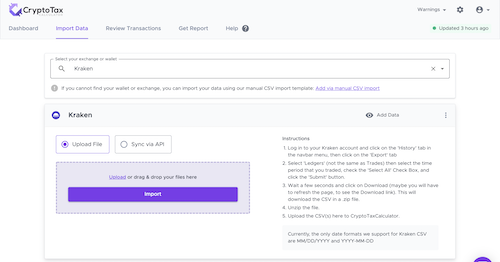

On Crypto Tax Calculator:

- Login to Crypto Tax Calculator and navigate to the import page

- From the drop-down menu select Kraken

- Import the file previously downloaded from Kraken

- While the file is uploading you can continue importing data from your other exchange accounts and wallets

Uploading using an API

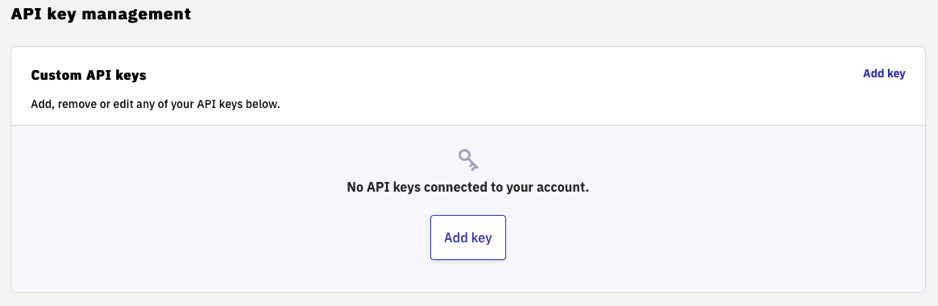

On Kraken:

- Once logged in navigate to the settings > API page

- Click on the “Generate new key” button

- Select the “Export data” and “Query Closed Orders & Trades” permissions

- Generate key for the date range you have traded

- Save and copy your API and secret key somewhere secure

On Crypto Tax Calculator:

- Login to Crypto Tax Calculator and navigate to the import page

- Select Kraken from the drop-down menu

- Enter your API and Secret Key and click Import.

- The process might take a few minutes, but in the meantime, you can continue adding other exchange data

Wrapping up

That’s it, from the two options you can upload all your transactions from Kraken to calculate your taxes using Crypto Tax Calculator. If you find for whatever reason you are missing some transactions you can upload transactions manually on the Review Transactions page.