Preparing Your NiceHash Taxes

Crypto Tax Calculator supports two main options for uploading data from NiceHash so you can calculate your NiceHash taxes. NiceHash has an easy-to-use API that allows you to automatically upload data. They also offer CSV history downloads allowing you to upload the files manually.

Import via CSV

- Log in to your NiceHash account

- On the top right-hand corner of the navbar, click on your profile icon, and then click the orange 'My Settings' button to navigate to the settings page (https://www.nicehash.com/my/settings/)

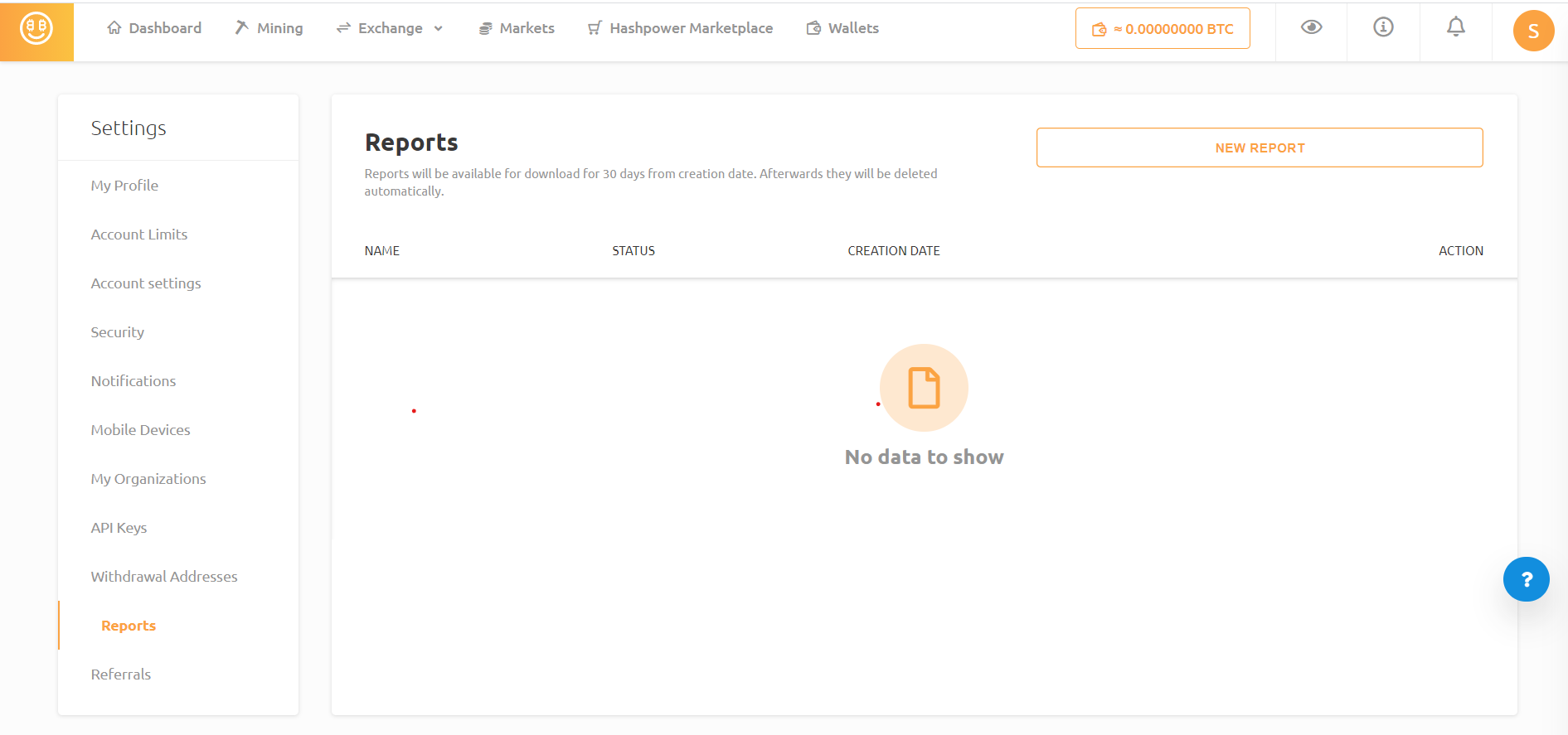

- On the left-hand nav, click on 'Reports' (https://www.nicehash.com/my/settings/reports)

- Click on the 'New Report' to open the report creation dialogue

- You will now have to select the cryptocurrency for the report, as well as the 'FIAT' currency. Make sure the 'FIAT' currency is in your local currency and the same as you have in Crypto Tax Calculator. Ensure the 'Time-aggregation' is 'NONE'. Select the from/to date range which includes all your activity. Ensure the time zone is 'GMT'

- Once the form is filled, click on 'Create' to generate the report. The report will take some time to process. Once processed, the status will turn to 'ready'

- Download the report by clicking on the three dots under 'Action' and select 'Download Report' from the dropdown. This will download the report as a CSV file

- You can now upload this CSV into Crypto Tax Calculator

Import via API keys

On NiceHash:

- Log in to your NiceHash account

- On the top right-hand corner of the navbar, click on your profile icon, and then click the orange 'My Settings' button to navigate to the settings page (https://www.nicehash.com/my/settings/)

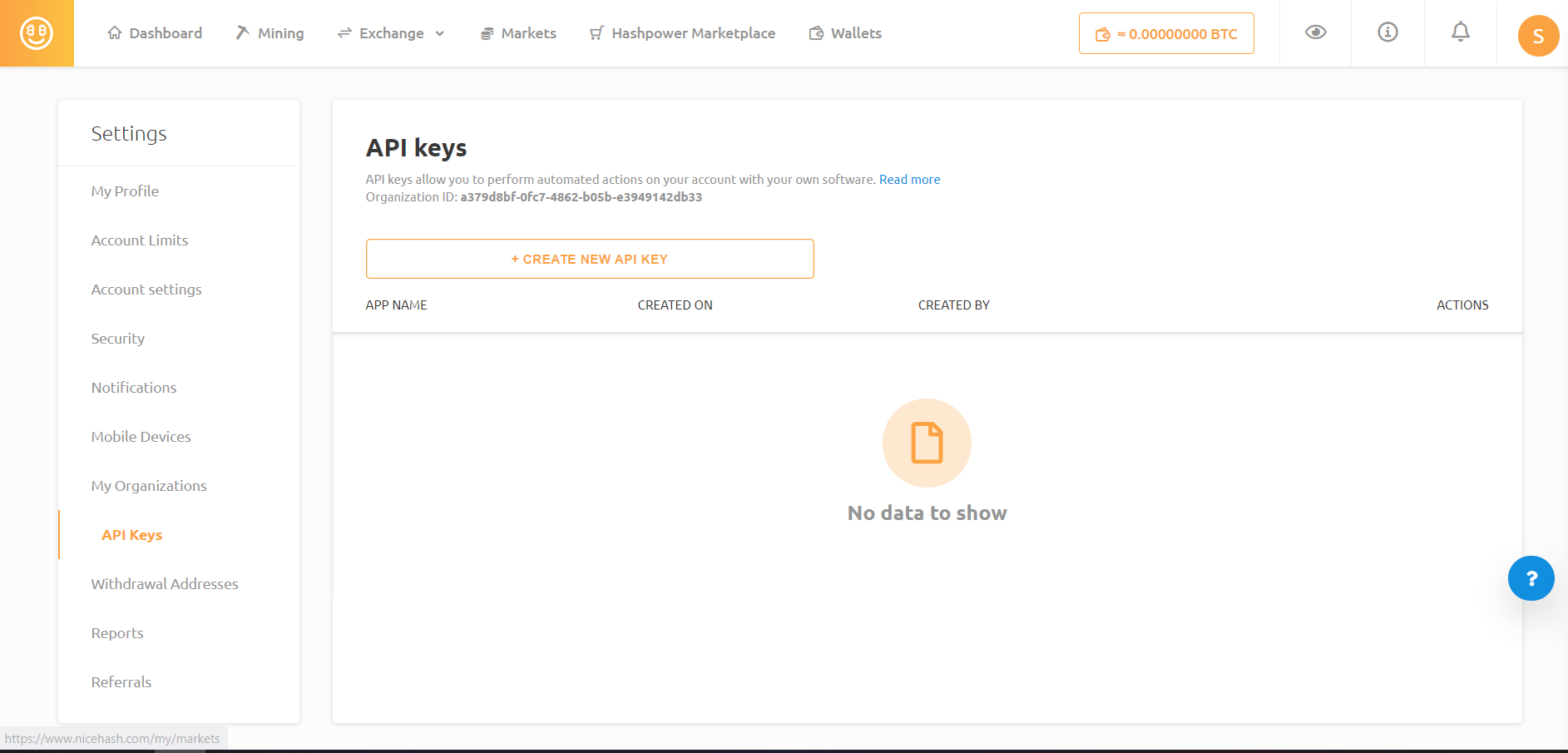

- On the left-hand nav, click on 'API Keys' (https://www.nicehash.com/my/settings/keys)

- Click on 'Create New API Key' to open the API Key creation dialogue

- On 'Wallet Permissions', allow permission to 'View balances, wallet activities and deposit addresses'

- On 'Market place Permissions', allow permission to 'View hashpower orders'

- On 'Exchange Permissions', allow permission to 'View exchange orders'

- On 'Mining Permissions', allow permission to 'View mining data and statistics'

- You will be prompted to provide some additional authentication

- Copy the API Key, Secret and Organisation ID of your account, and paste here in Crypto Tax Calculator as the 'API Key', 'Secret' and 'UID' respectively

Wrapping Up

That's it, from the two options you can upload your transactions from NiceHash to calculate your taxes using Crypto Tax Calculator. If you find that you are missing some transactions you can upload these transactions manually using our Simple or Advanced manual CSV import.