Preparing Your OKEX Taxes

The first step in using Crypto Tax Calculator is uploading your entire crypto transaction data so our software can classify the transactions by different tax types. For OKEX users there are two options to upload your data to the platform, an API or uploading a CSV transaction history.

Using an API

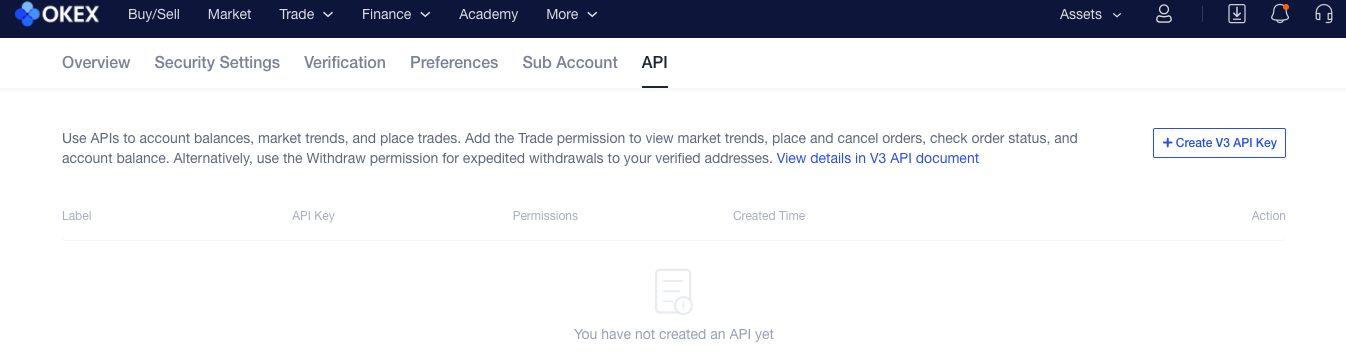

On OKEX:

- Once logged in hover over the account icon in the top right corner and from the dropdown menu select API

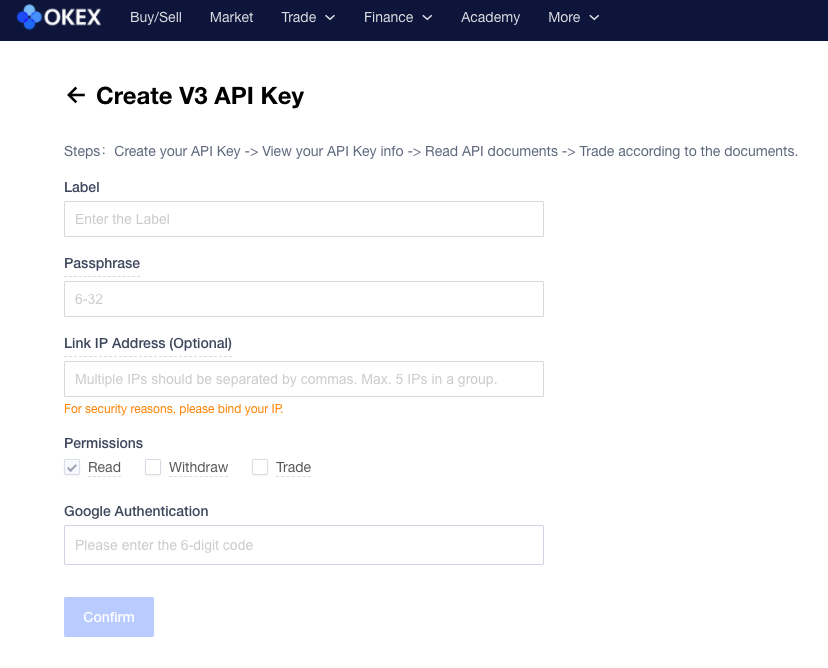

- Enter a name and passphrase for your API (make sure you create a read-only API)

- Once done click view API and copy your API key and Secret Key

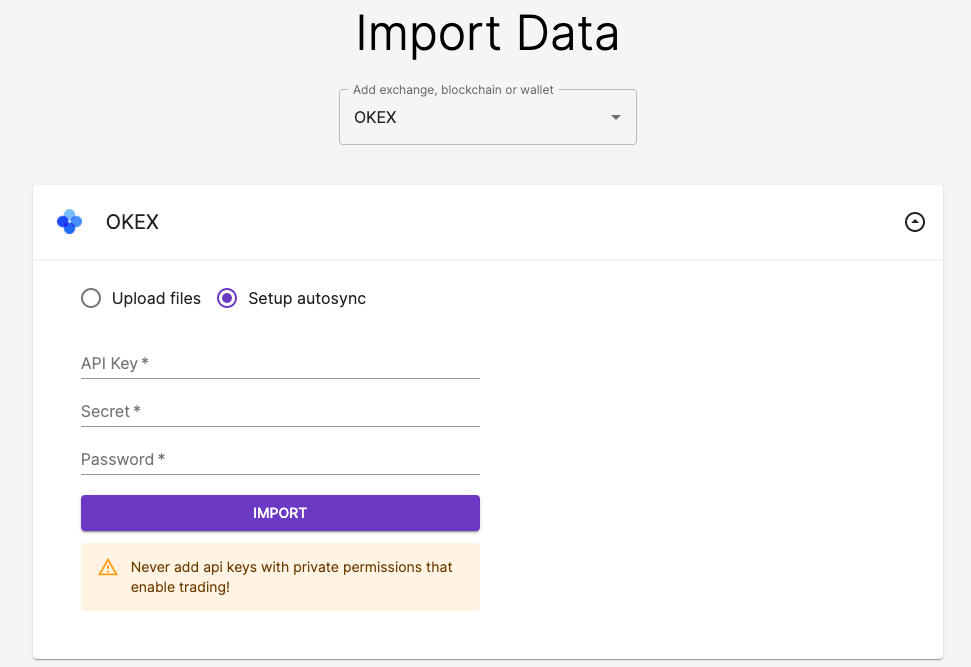

On Crypto Tax Calculator:

- Once logged in navigate to the import page

- From the dropdown menu select OKEX

- Enter your API key, secret key, and password

- This might take a few minutes but in the meantime, you can continue uploading data from other exchanges

Using a CSV transaction history

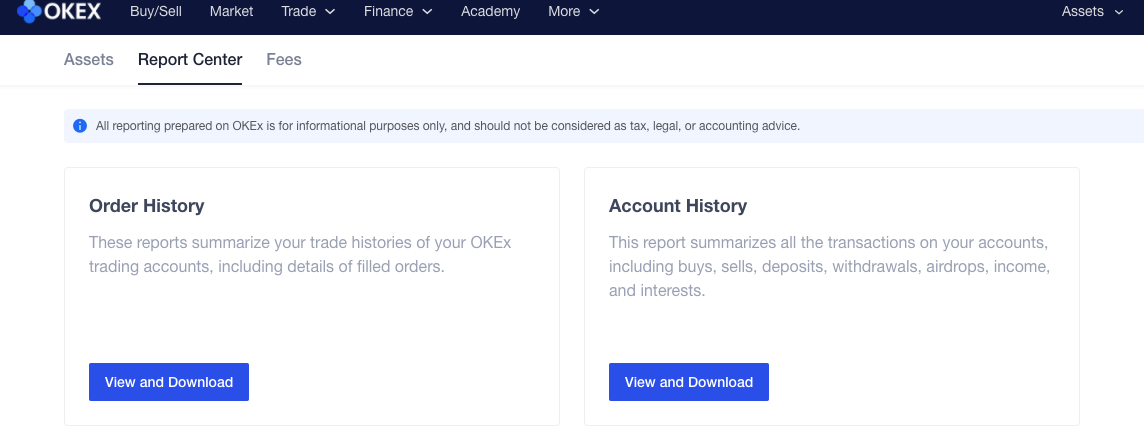

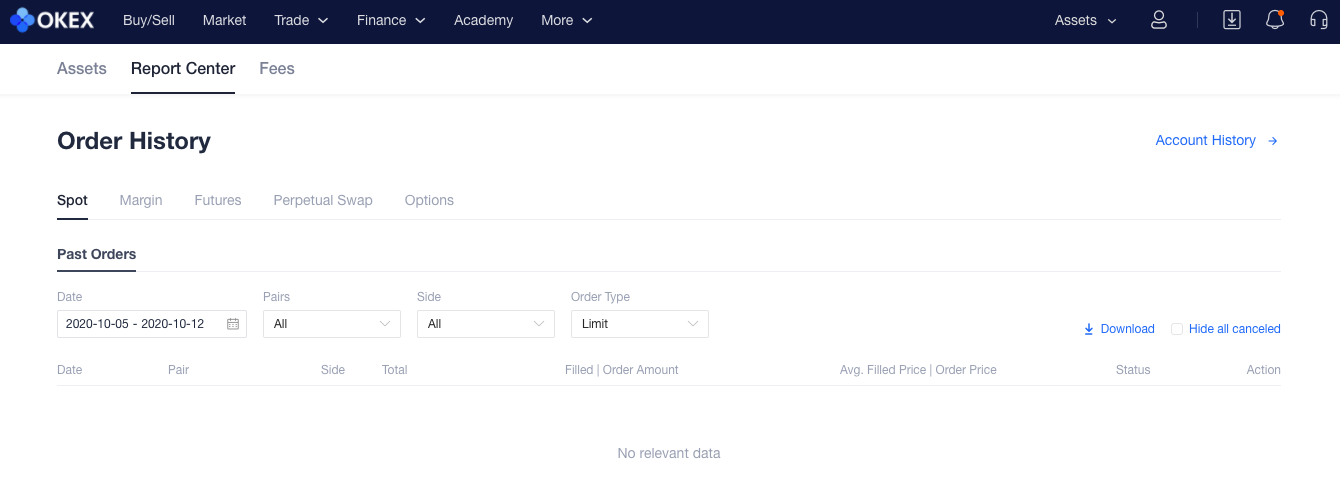

On OKEX:

- On the top right hover over the Assets section and click my assets

- Navigate to the Reports section

- Click view and download for the order history option

- Download the order history

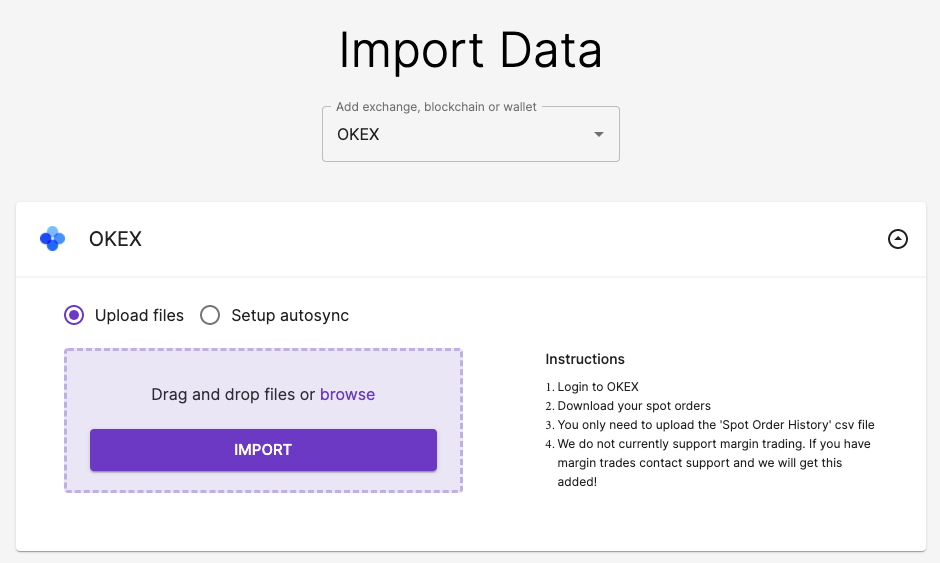

On Crypto Tax Calculator:

- Once logged in navigate to the Import page

- From the dropdown menu select OKEX

- Upload your CSV file and click import

Wrapping Up

From here Crypto Tax Calculator can classify your transactions and generate your tax reports. If you cannot for whatever reason import your transaction data you can manually add and edit transactions in the review transactions page.