Optimism Tax Guide

We are pleased to announce that our integration with Optimism is now live!

Optimism is an EVM (Ethereum Virtual Machine) equivalent Optimistic Rollup chain, designed to be fast, simple and secure. An Optimistic Rollup is a combination of “optimistic contracts”, smart contracts that accept all information as fact until proven otherwise, to reduce the cost of data verification on-chai and “on-chain data availability”, where the system rolls up the data to create a more efficient submission process.

Crypto Tax Calculator’s integration with Optimism allows users to simplify the complexities of tracking trades on Optimism’s L2, making tax compliance far easier. All users will need to do is import their Optimism wallet address into Crypto Tax Calculator, and the software will automatically categorize transaction history as appropriate.

Quick Start

Keen to get started? Here’s a simple step-by-step tutorial on how to import your Optimism transaction history into Crypto Tax Calculator:

- Locate and copy the wallet address/es associated with your Optimism account. This will be accessible via the wallet you used to connect to the Optimism network originally (e.g. if you use Metamask, navigate to the Optimism network and you’ll be able to copy your wallet address from there).

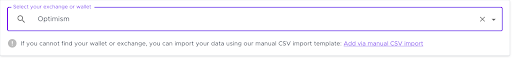

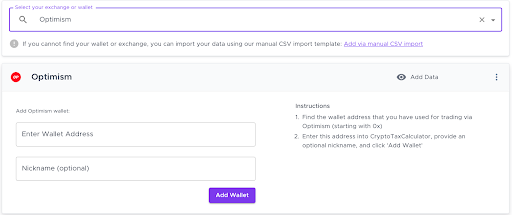

- In Crypto Tax Calculator enter Optimism into the search field or scroll down and select it from the list.

- Enter your Optimism wallet address into Crypto Tax Calculator, provide an optional nickname, and click Add Wallet. It is possible to add multiple wallet addresses after you add the first.

- Your wallet/s will now sync and Crypto Tax Calculator will pull in all the transactions associated with your Optimism wallet.

Tax guide for Optimism

L2s are a complex world in and of themselves, and Optimism is no exception. Crypto Tax Calculator is your solution to simplifying tracking and categorizing your transactions on Optimism, thereby making tax time much more straightforward.

After importing your Optimism wallet address/es into Crypto Tax Calculator, the software will have imported all of your transactions on the Optimism network. You can see these by navigating to the ‘review transactions’ tab in the app. The beauty of Crypto Tax Calculator software means that the majority of these transactions will have been auto-categorized - buys, sells, fees, staking rewards, you name it. If any outstanding transactions haven’t been categorized, you may need to manually adjust them. For information on how to do so, please refer to our guide here.

Depositing / Withdrawing

As with any L2 solution, Optimism requires users to have ETH and/or ERC20s on their protocol. There are two ways of doing so; if a user already has ETH/ERC20 tokens on ETH mainnet, they’ll be able to deposit them into Optimism via a bridge. If a user is looking to buy tokens and deposit them directly into Optimism, they can use a fiat onramp that supports Optimism.

Bridging

- To bridge onto the Optimism network, users can navigate to the Optimism gateway, the Teleporter or Hop. These bridging avenues allow users to select the type of ERC20 token they wish to deposit, as well as the location where these assets currently reside. If you are merely sending assets from ETH mainnet to Optimism, this will be considered a transfer event and therefore won’t incur any taxes. However, when bridging onto or off Optimism, users will incur two transaction fees; one on ETH mainnet, one on Optimism - these transaction fees are taxable. In order for Crypto Tax Calculator’s software to be able to correctly track and categorize all transactions, you’ll need to import both your Optimism wallet address and the ETH wallet address you bridged the assets from.

Fiat Onramps

- When purchasing tokens using a fiat on-ramp, you select the amount of fiat you’d like to spend and the type/amount of token you’d like to purchase. Let’s use Transak as an example of fiat onramping onto Optimism: if you pay $800USD to purchase 0.26ETH on Optimism, this $800 (plus any transaction fees) becomes your cost basis. Purchasing the ETH is not a taxable event in itself, but if you then decide later to withdraw and sell your ETH for fiat, the cost base becomes relevant. If the value of 0.26 ETH has increased to $900USD at the point of selling, you’d likely be liable for CGT on the $100 gain. When all relevant wallet addresses are imported into Crypto Tax Calculator, the software will be able to track these values for you, and auto-categorize them when they become tax-relevant.

Optimism Fees

Every Optimism transaction has two costs: An L2 (execution) fee and an L1 (security) fee. At a high level, the L2 fee is the cost to execute your transaction in L2, and the L1 fee is the estimated cost to publish your transaction on L1 (in a rollup batch). As you can imagine, manually tracking each and every one of these transaction fees associated with your Optimism activity would be a nightmare. Once you’ve imported your relevant Optimism and ETH mainnet wallet addresses into Crypto Tax Calculator, these fees will be automatically tracked and categorized accordingly.

Liquidity Mining and Staking

For anyone who has participated in liquidity mining or staking on L1, you’ll know that transaction fees can be quite the pitfall. Enter: L2 solutions like Optimism. There is currently a consensus that staking and liquidity mining on L2s like Optimism is much more profitable, as transaction fees are either non-existent or negligible. If you’re someone who has staked or liquidity mined on Optimism’s network, look no further. While liquidity mining generally involves receiving remuneration in the form of the protocol or platform’s native token in return for participating, staking involves pledging your crypto to a certain protocol or platform to help validate transactions and be rewarded with interest. Sending funds to a liquidity pool or staking pool will likely not incur any tax, as in most cases you don’t immediately receive anything in return for doing so. However, if you receive a token in return for just depositing crypto into a liquidity pool or staking pool, this may be subject to capital gains tax. When receiving rewards from liquidity mining or staking on Optimism’s network, the tax incurred will depend on the nature of the reward: if you earn new or additional tokens in return for participating, this will likely be subject to income tax, if your token balance remains the same but increases in value, this will likely be subject to capital gains tax.

In most instances on Crypto Tax Calculator, both liquidity mining and staking transactions on Optimism are imported and auto-categorized. If any aren’t recognized, you have the ability to choose specific categorization options (staking reward, mining, interest, income etc) yourself.

NFTs

With L2s like Optimism comes the glorious experience of purchasing NFTs on the network without hefty transaction costs. If you’ve been picking up Octavas, OptiPunks, Optimistic Loogies or any NFT that lives on Optimism’s protocol, or you’ve been minting and selling them, Crypto Tax Calculator has your back. If you’re an artist who has made profit from selling NFTs on Optimism, you will likely be subject to income tax. If you’ve bought NFTs and have earned profit from any trades or sales, you will likely be subject to capital gains tax. Crypto Tax Calculator will calculate any gains or losses from NFT related activity on Optimism, simplifying the tracking requirements.

Swapping / Trading / Lending / Borrowing

Optimism’s ecosystem is full of dApps that facilitate a range of DeFi activity - UniSwap, WePiggy, Perpetual Protocol, just to name a few. When interacting with dApps such as these, you’re likely to participate in swapping, trading, lending and/or borrowing processes. In most cases, these actions are likely categorized as a ‘disposal’ event. If you’ve swapped one ERC20 token for another on UniSwap while connected to the Optimism network, this will likely be categorized as a crypto to crypto swap. In most regions, a crypto to crypto swap is considered a taxable event, incurring capital gains tax. Hypothetically, if you’ve swapped a certain amount of ETH for an equivalent amount of SNX, this will be subject to capital gains tax - but the fact that the values are equal means there will be no profit or loss. Crypto Tax Calculator recognizes crypto to crypto swaps once the relevant wallet addresses are imported and will categorize them accordingly.