PancakeSwap Tax Guide

In the recent wave of new Decentralised Finance (DeFi) protocols, PancakeSwap has taken the world of Decentralized Exchanges (DEX) by storm and become one of the most popular exchanges for DeFi users. Steering away from the Ethereum chain which most DApp’s are built on, PancakeSwap operates on the Binance Smart Chain (BSC), but remains similar in design to the SushiSwap and Uniswap protocols on Ethereum.

PancakeSwap’s native token ‘CAKE’ uses the Binance Smart Chain token standard BEP-20. However, other tokens such as the ethereum ERC-20 may also be brought over via bridging (e.g. Binance Bridge). This essentially ‘wraps’ other tokens as a BEP-20 so that they can be used on PancakeSwap.

Quick Start

PancakeSwap is rising in popularity, with hundreds of millions USD worth of crypto-to-crypto trades settled by the platform every day. However, a common problem that users encounter is how to calculate taxes on these transactions. Fortunately, Crypto Tax Calculator has developed an integration with PancakeSwap to recognize, categorize and report all taxable transactions. Simply follow the below steps to automate your PancakeSwap taxes.

- Locate and copy the Binance Smart Chain wallet address that you have used for trading via PancakeSwap.

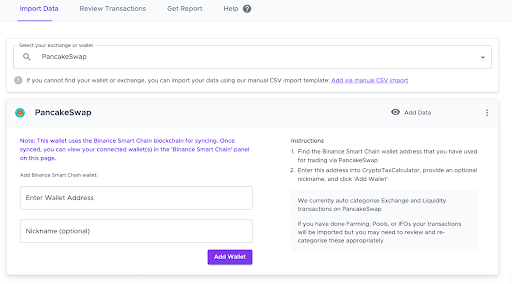

- Log in to Crypto Tax Calculator, and navigate to the ‘import data’ section. Here, you can enter PancakeSwap into the search field or scroll down to find it manually

- Enter your address here, provide an optional nickname and click ‘Add Wallet’

4. Once your Wallet has synced, you will see a green tick indicating that Crypto Tax Calculator has successfully pulled in the transaction history associated with this wallet address from the Binance Smart Chain.

4. Once your Wallet has synced, you will see a green tick indicating that Crypto Tax Calculator has successfully pulled in the transaction history associated with this wallet address from the Binance Smart Chain.

Wrapping Up

Once you have imported your data, Crypto Tax Calculator can calculate your portfolio breakdown and tax obligations. If for some reason you can’t upload your transactions you can add them individually on the review transactions page.