Preparing Your Poloniex Taxes

The first and most important step when using Crypto Tax Calculator is to import all your crypto data onto our platform. If you have just traded on Poloniex Crypto Tax Calculator can calculate your Poloniex tax, otherwise, you can find out your general tax obligation and a profit and loss breakdown by token.

There are two ways to import your transactions from Poloniex, an API, or a CSV history upload.

Using an API

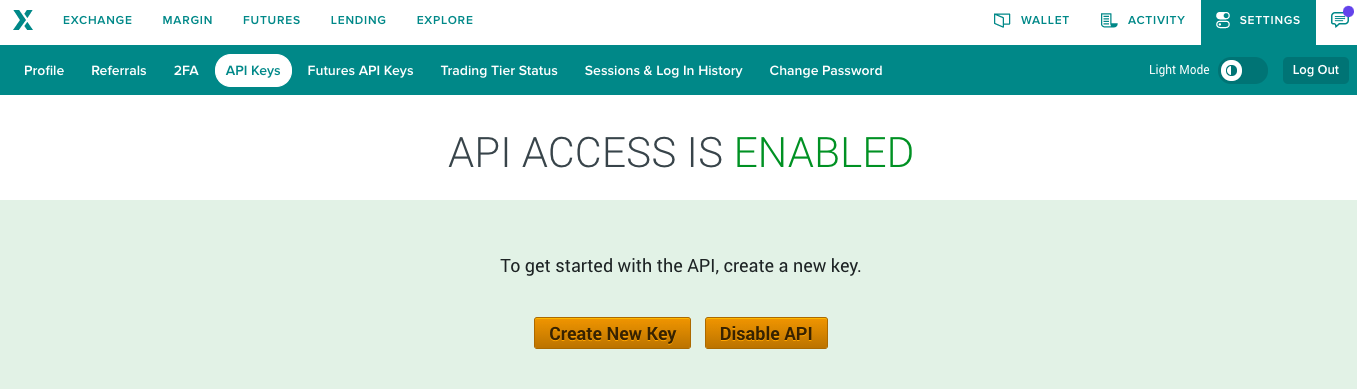

On Poloniex:

- Once logged in click on Settings in the top right corner and then navigate to the API keys page

- Click create new key and verify through email if needed

- Uncheck the enable trading option (for security purposes)

- Save your API and secret keys

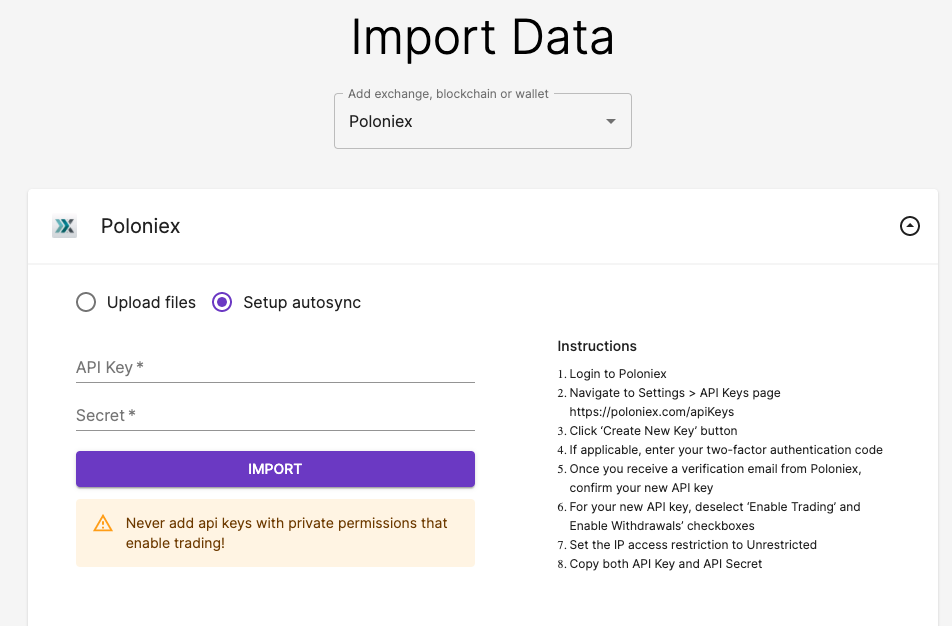

On Crypto Tax Calculator:

- Once logged in navigate to the Import page

- Select Poloniex from the dropdown menu

- Enter your API and secret keys

- Click Import

- While Crypto Tax Calculator is uploading your data you can continue importing transactions from your other accounts

Using a CSV Upload

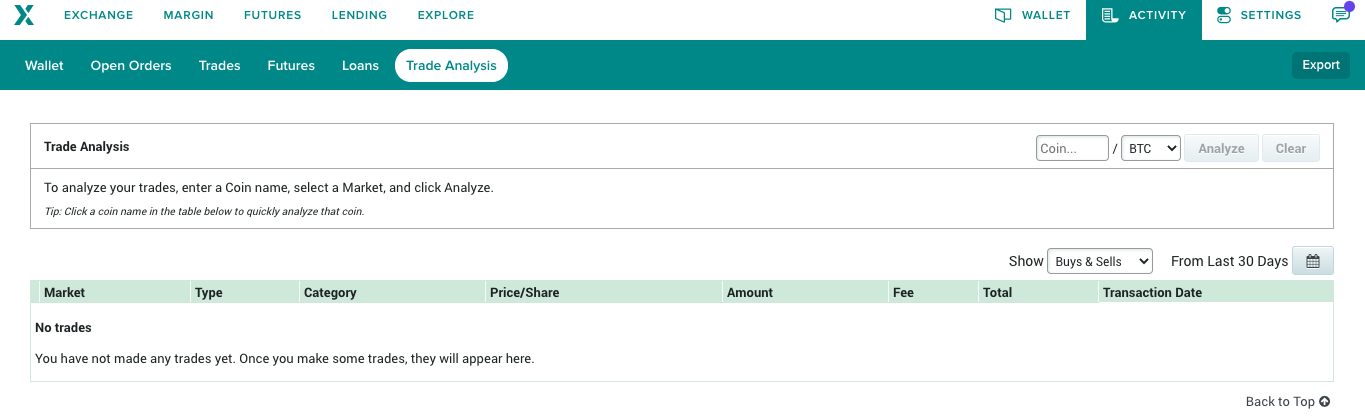

On Poloniex:

- Click on the Activity tab on the top of the page and navigate to the Trade Analysis page

- Click Export on the top right of the page

- From the activity type options select trades and enter the date range you have traded over

- Click Download

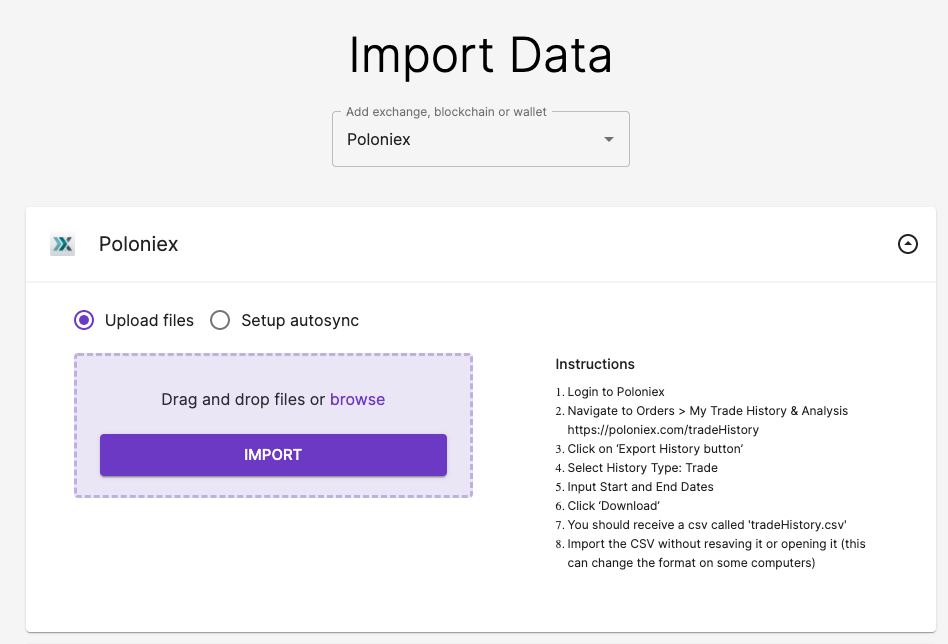

On Crypto Tax Calculator:

- Once logged in navigate to the Import page

- Select Poloniex from the dropdown menu

- Upload the file downloaded previously and click import

Wrapping Up

If you can’t import your transactions you also have the option to manually add them on the review transactions page, after this, you can view a summary report of your tax obligations, profit and loss as well as holdings over time.