Ripple Tax Guide

Crypto Tax Calculator is proud to introduce tax support for Ripple. Ripple is a distributed consensus ledger system with a network of validating servers and crypto tokens called XRP (or sometimes referred to as ‘Ripples’). It was developed primarily for the purpose of implementing secure, instant and low-cost global money operations.

Quick Start

Although it is widely used, a growing problem which Ripple users encounter is how to determine their tax obligations for Ripple transactions. To help address this problem and reduce the complexity of crypto taxes for you, Crypto Tax Calculator has automated this process by developing an integration with Ripple. Simply follow these steps to automatically import and categorize all your transactions.

- Find and copy your Ripple Wallet address (This is generally found on your wallet manager)

- Log in to Crypto Tax Calculator and navigate to the ‘import data’ section. From here you can enter Ripple into the search field or scroll down to find it manually

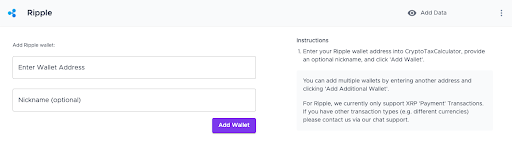

- Enter your Ripple wallet address into Crypto Tax Calculator, provide an optional nickname, and click 'Add Wallet'

4. Once your Wallet has synced, you will see a green tick which means that Crypto Tax Calculator will have successfully pulled in your transaction history associated with this wallet from the Ripple network

4. Once your Wallet has synced, you will see a green tick which means that Crypto Tax Calculator will have successfully pulled in your transaction history associated with this wallet from the Ripple network