Swyftx Tax Guide

What is Swyftx?

As one of Australia’s most popular and trusted crypto exchanges, Swyftx is revolutionising the digital currency space. Based in Queensland and founded in 2017 by two cryptocurrency enthusiasts, Alex Harper and Angus Goldman, Swyftx strives to place customer needs at the forefront of their overall vision – to provide an All-In-One crypto trading and investing solution for all users.

What are the benefits of using Swyftx?

- Over 320 assets to trade at the highest liquidity

- Live chat support with average response rates under 3 minutes offering exceptional customer service

- A demo mode that allows you to learn to trade and gain experience risk free!

- Powerful and intuitive user interface that is optimised for both Mobile and Desktop apps

- Real-time price feed ensures your assets are updated in real-time, so you always get the best price with Swyftx market orders

- Registered under Australian Transaction Reports and Analysis Centre (AUSTRAC)

- Multi-Layered Security through partnering with Auth0, an Authentication-as-a-Service platform to deliver unparalleled account and password safety

- Swyftx utilises Two-Factor Authentication (2FA) and Breached Password detection to confirm withdrawals, account detail changes and high-volume trades, ensuring security of client accounts

How do crypto taxes work?

Investing in cryptocurrency incurs different tax liabilities and these might be in the form of Capital Gains Tax (CGT) or Income Tax. However, the type of tax payable and the quantity will depend on the specific features of the transaction such as the type of transaction made, as well as the entity making the transaction (i.e. business vs. individual).

Capital Gains Tax refers to the tax paid on a capital gain made from the sale of a capital asset. Specifically, capital gain (or loss) = capital proceeds (price that the capital asset was disposed of for) – cost base (price it was purchased for).

Therefore, different transactions involving the disposal of cryptocurrency may give rise to a ‘Capital Gains Tax Event’ and result in some CGT payable to the ATO. Once taxable quantity is determined, the tax payable will be calculated according to your individual income tax bracket.

You can read more about how crypto taxes are calculated in our Crypto Tax Guide.

What records do you need to keep to do your Swyftx taxes?

Whether you are a business, investor or personal user of cryptocurrency, remember that crypto gains or losses are taxed. Therefore, to accurately calculate your tax liability – it is important to maintain records of all your cryptocurrency exchanges.

Records may be requested at the discretion of the ATO and generally need to be held for a period of 5 years after the cryptocurrency exchange.

As stated on the ATO website as of 9th July 2020

You need to keep the following records in relation to your cryptocurrency transactions:

- the date of the transactions

- the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be taken from a reputable online exchange)

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

The sorts of records you should keep include:

- receipts of purchase or transfer of cryptocurrency

- exchange records

- records of agent, accountant and legal costs

- digital wallet records and keys

- software costs related to managing your tax affairs

Keeping good records will make it easier to calculate and meet your tax obligations, and if you are in business, they will assist you to manage your cash flow and see how your business is doing.

You can use an accountant or third-party software to help meet your record-keeping obligations and working out your tax.

As you can see there is a lot of record keeping requirements, and this can be painful to manage. For example, if you traded Bitcoin for Ethereum you are required to record both sides of the transaction back to Australian dollars, and declare any applicable taxes. If you were to do this manually it can literally take days, but luckily Crypto Tax Calculator is here to help automate this for you.

How to import Swyftx data into Crypto Tax Calculator

To import your Swyftx data into Crypto Tax Calculator, you have two options: Using a CSV, or using our API integration.

Import via CSV

- Login to Swyftx

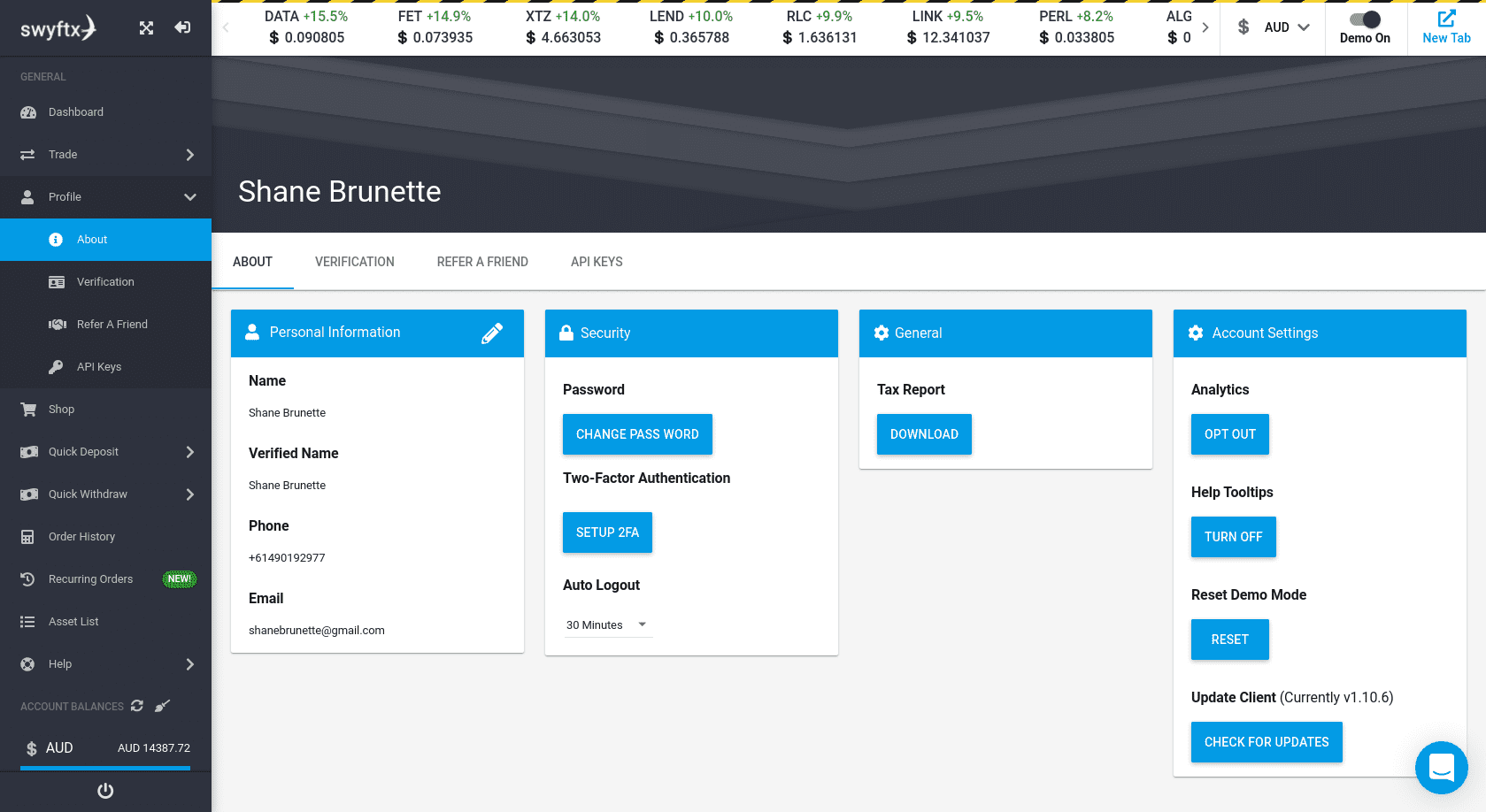

- Navigate to Profile Tab in left hand menu

- Click About > General > Tax Report > Download 1.

- Select the entire date range you traded on Swyftx

- Download the report

- Sign up to Crypto Tax Calculator

- In the drop down menu search for Swyftx

- Click the browse button and select the csv file downloaded from Swyftx

- Click the upload button

- Navigate to the review transactions tab and verify you can see all your crypto transactions

- Navigate to the "generate report" tab and select the financial year you want the report for.

- Download the report and send to your accountant.

Import via API

- Log in to your Swyftx account

- On the left side navbar, select Profile and then select API Keys (https://trade.swyftx.com.au/profile/api/)

- Click ‘I Understand' once you have read the warning

- Click ‘Create New Key’ button

- In the popup, enter a label keep track of this key (e.g. Crypto Tax Calculator), set the 'Scope' to be 'Read Only', and confirm by entering your Swyftx password

- Copy both the 'API Key' and 'Access Token' from Swyftx and paste them here into Crypto Tax Calculator as the 'API Key' and 'Secret' respectively