Terra Detailed Tax Guide

We’re excited to announce that our integration with Terra is now live!

Terra is a public blockchain protocol focused on deploying a suite of algorithmic decentralized stablecoins, underpinning an ecosystem that aims to bring DeFi to the masses. It’s unique in that it’s able to host a multitude of algorithmic stablecoins on its network. Using a combination of open market arbitrage incentives and decentralized governance processes, the Terra protocol creates stablecoins that consistently track the price of any fiat currency.

Our integration with Terra was facilitated by a partnership with the TrackTerra team. We’re working together to provide Terra users with a straightforward way to stay tax compliant. The integration allows for the importing and categorization of users’ Terra transaction activity; something that isn’t currently available with any other crypto tax software!

Quick Start

Let’s dive right into it! Here’s a quick and easy breakdown of how to import your Terra transaction history into Crypto Tax Calculator:

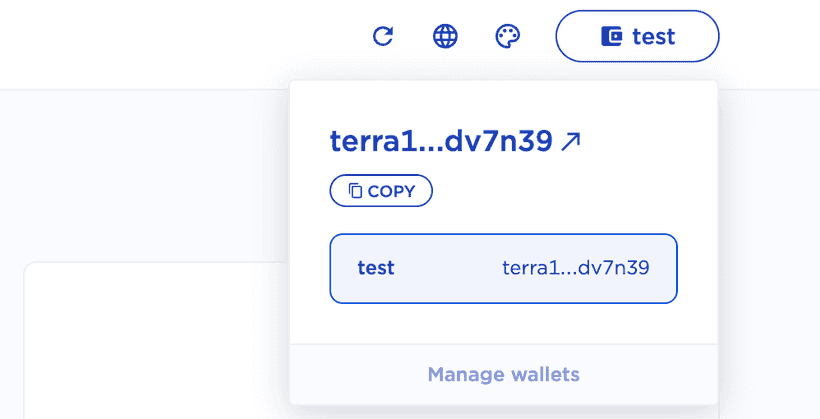

- Locate and copy the wallet address/es associated with your Terra account. Your wallet address will appear at the top of the Terra station Desktop app near your wallet name. Your wallet address will look like this: terra

-

In Crypto Tax Calculator enter Terra into the search field or scroll down and select it from the list.

-

Enter your Terra wallet address into Crypto Tax Calculator, provide an optional nickname, and click Add Wallet. It is possible to add multiple wallet addresses after you add the first.

-

Your wallet/s will now sync and Crypto Tax Calculator will pull in all the transactions associated with your Terra wallet.

Tax Guide for Terra

If you’re one of the many crypto users who has dived into the world of Terra, Crypto Tax Calculator is the go-to product for you to manage your transaction activity heading into tax time. Our partnership with TrackTerra means that we have a direct line to Terra-native developers and engineers, making your tax management as easy as possible.

Once you’ve imported your Terra wallets into Crypto Tax Calculator, you’ll be able to see in the ‘review transactions’ tab that your activity on the protocol has been imported into the app. Our algorithm will have auto-categorized the majority of these transactions, but it’s imperative that you review each yourself to ensure total compliance. If there are any transactions that haven’t been identified or categorized, you will need to manually adjust there. For information on how to do so, please refer to our guide here. Make sure to also work with your tax professional to ensure that the categorization options you choose are correct for your specific region.

The Terra Protocol

The Terra protocol consists of two main tokens, Terra and Luna.

- Terra: Stablecoins that track the price of fiat currencies. Users can mint new Terra tokens by burning Luna tokens. There are a range of Terra stablecoins, including TerraSDR (SDT), TerraUSD (UST), and TerraKRW (KRT).

- Luna: The Terra protocol’s native staking token that absorbs the price volatility of Terra. Luna is used for governance and in mining. Users stake Luna to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees.

Stablecoins

The purpose of stablecoins is to afford users the benefits of cryptocurrency (namely; an unchangeable public ledger, instant transactions, faster settlement times, and fewer fees) without exposing them to as much risk of depreciation.

Stablecoins a significant feature of the Terra protocol, underpinning the infrastructure of the network by providing the market with self-stabilizing features. As such, stablecoins and their tax implications are important to take note of.

Despite the value relationship between stablecoins and fiat currencies, most regions treat stablecoins the same as any other asset. In most cases, this means that transactions involving stablecoins could be subject to income tax and/or capital gains tax. It’s important to talk to your local tax professional to get an understanding of how your region regulates stablecoin transactions so that you can correctly categorize these in our app.

Market Module and Arbitrage

Terra’s algorithmic protocol is achieved through their market module, which incentivizes the minting and/or burning of Terra through arbitrage opportunities. Arbitrage occurs in Terra when a user profits from price differences between markets. The Terra market module allows users to always trade 1 USD worth of Luna for 1 USD worth of Terra, and vice versa. This incentivizes users to maintain the price of Terra (and is replicated across all Terra stablecoin denominations).

If you’ve used the mint and/or burn function of Terra’s market module by performing market swaps in a product like Terra Station, you’ll need to be able to track this activity in order to stay tax compliant. Let’s look at an example of this type of transaction activity and how it could be relevant to your tax compliance:

- If 1 Terra USD is trading at 1.01 USD, users can use the market swap feature of Terra Station to trade 1 USD of Luna for 1 Terra USD. The market burns 1 USD of Luna and mints 1 Terra USD. Users can then sell their 1 Terra USD for 1.01 USD, profiting .01 USD through arbitrage.

In the example above, the actions of swapping one type of stablecoin for another could be considered a crypto-to-crypto swap, which is a taxable event in most regions. In the example, there is also a profit gained of .01 USD via the arbitrage incentive. This .01 reward could also be considered a taxable event.

It is important to note that each region may have different regulations on crypto-to-crypto swaps and/or rewards earned. While using our software you won’t have to worry about individually tracking every swap and reward, you will have to ensure the categorization options chosen are compliant in your region. Make sure to work with your local tax professional to choose which categorization option applies best.

Validators and the Consensus Mechanism

In the Terra protocol, validators are responsible for securing the ecosystem and ensuring its accuracy. They run programs called full nodes which allow them to verify each and every transaction made on the Terra network. In reward for proposing blocks, voting on their validity, and adding each new block to the chain, Terra Validators receive staking rewards made up of transaction fees.

This process and its rewards become more widespread when you bring in the consensus element of the Terra protocol. Delegators and proposers work together with validators in a consensus mechanism to ensure Terra is a secure, instant network. Delegators are users who add to a validator’s total stake and receive a portion of the overall rewards. Proposers are chosen to submit a new block of transactions for review and are rewarded more for their added participation in the process.

If you’ve been any of the above, a validator, a delagator, or a proposer, on Terra’s protocol, you’ll need to monitor any related transaction activity to remain tax compliant. Our software will help track every related transaction and give you the ability to categorize them accordingly.

Bonding

Diving further into the deep end of the world of Terra validation, we reach the process of bonding. Bonding is defined as when a delegator has attributed Luna to a validator, the Luna gets ‘bonded’ to the aforementioned validator, and then this bonded Luna gets added to the validator’s total stake amount. If you’ve bonded your Luna in Terra in this fashion, you’ll start earning staking rewards the moment the bonding process is complete. This is relevant to your tax compliance, so you will need to record any relevant activity.

Swap Fees

We’ve touched on staking rewards within the consensus mechanism in the previous two paragraphs, but there is another set of fees that are associated with validator activity: swap fees. Swap fees are incurred when swapping one Terra stablecoin denomination for another, in a process known as Tobin tax. Any swap fees are directed to Terra’s Oracle reward pool, where they are then distributed to validators who report correct Oracle prices over the period of two years.

If you’ve received rewards from Terra’s Oracle reward pool, these will also likely be taxable. As mentioned previously, it’s important to confirm with your local tax professional how rewards from staking and validating are treated in your region so you can correctly categorize any transactions within our app.

Redelegation

Relegation in Terra is when staked Luna is sent from one validator to another. A delegator can redelegate their staked Luna at any time using Terra Station’s redelegate function. As stipulated in Terra’s development documentation, staked Luna never leaves the possession of the delegator, and is never owned by the validator in question. This is important because the way this transfer of staked Luna is treated will affect how your region views its tax relevancy.

Governance

The Terra protocol is a decentralized blockchain governed by community members. Governance allows users and validators to participate in a democratic process to make changes to the Terra protocol. Members can submit, vote, and implement proposals.

To create a new proposal, a user has to submit a minimum of 50 Luna. If the proposal reaches an outcome, this initial deposit is refunded. This could have tax implications in that some regulatory bodies may see it as a disposal event, when you transfer the ownership of your Luna into someone else’s custody (even if only for a short amount of time).

To vote on a proposal, a user does so by allocating a certain amount of staked Luna. The more Luna staked, the heavier the vote. Once again, this could have tax implications as mentioned above.

If a proposal does not meet the required minimums (e.g. 50 Luna deposit within the two-week deposit period), any deposit amount allocated to the proposal will be burned. If this is the case, you will need to track this transaction so you can categorize it accordingly.

The information provided on this website is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek professional advice. Cryptotaxcalculator disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this website. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information in this website is no substitute for specialist advice.