Gnosis Tax Guide

We are proud to announce an official partnership with xDai Chain to help users calculate their tax obligations on their trading activity. xDai Chain is the first-ever USD stable blockchain operating as an EVM-compatible Ethereum Sister Chain, allowing for fast and inexpensive transactions.

With a growing range of Projects and DApps built on top of xDai, determining your tax obligations arising your DeFi trading activity can become increasingly complex. To help reduce this complexity, Crypto Tax Calculator has developed an integration with xDai Chain that allows for the automatic importing and categorisation of your trading history.

Quick Start

You can easily upload your xDai Chain wallet and associated transaction history into Crypto Tax Calculator by following the below steps:

- Locate and copy the wallet address associated with your xDai Chain account. This is typically found on your wallet manager (e.g. MetaMask). The wallet address should start with '0x'.

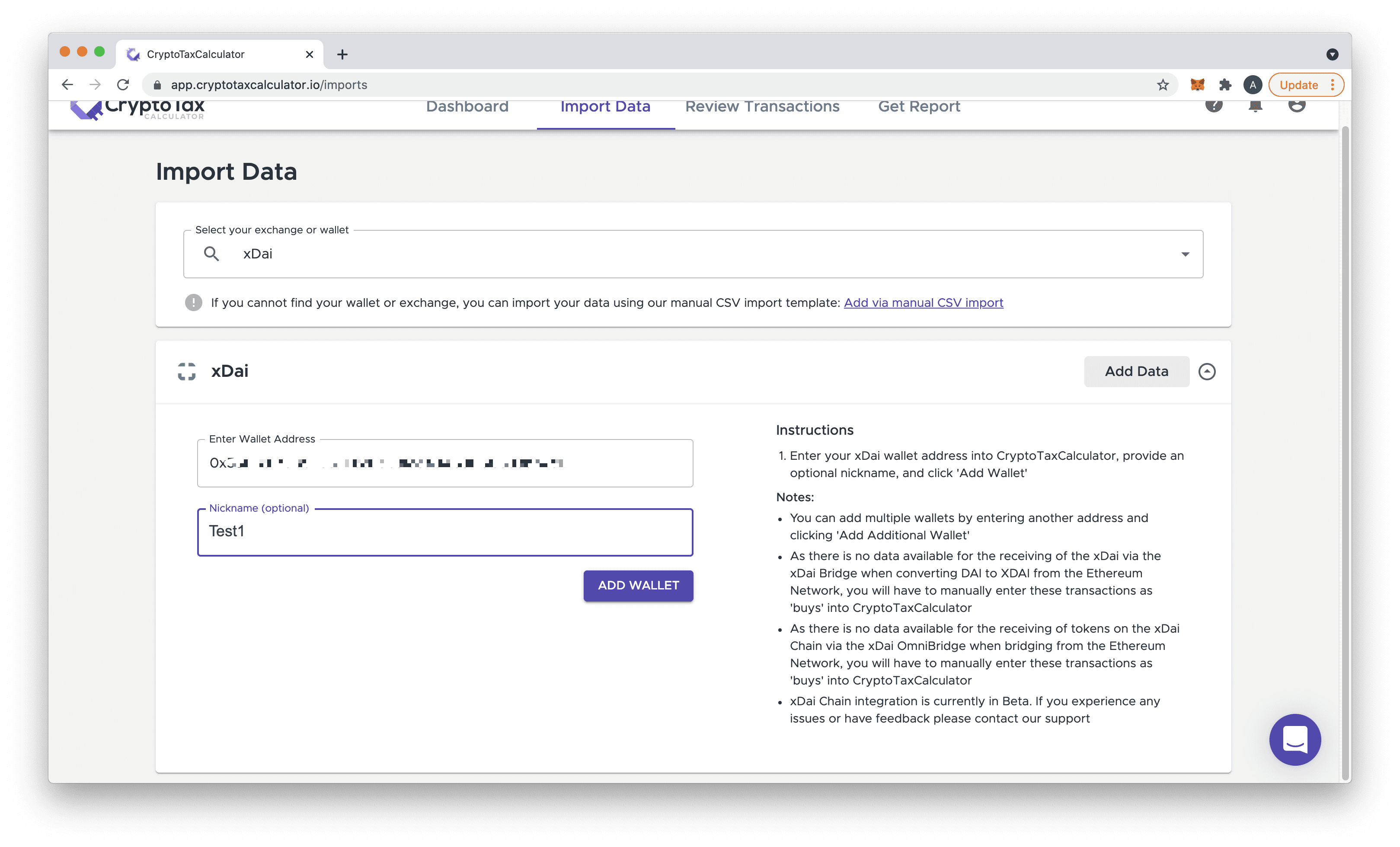

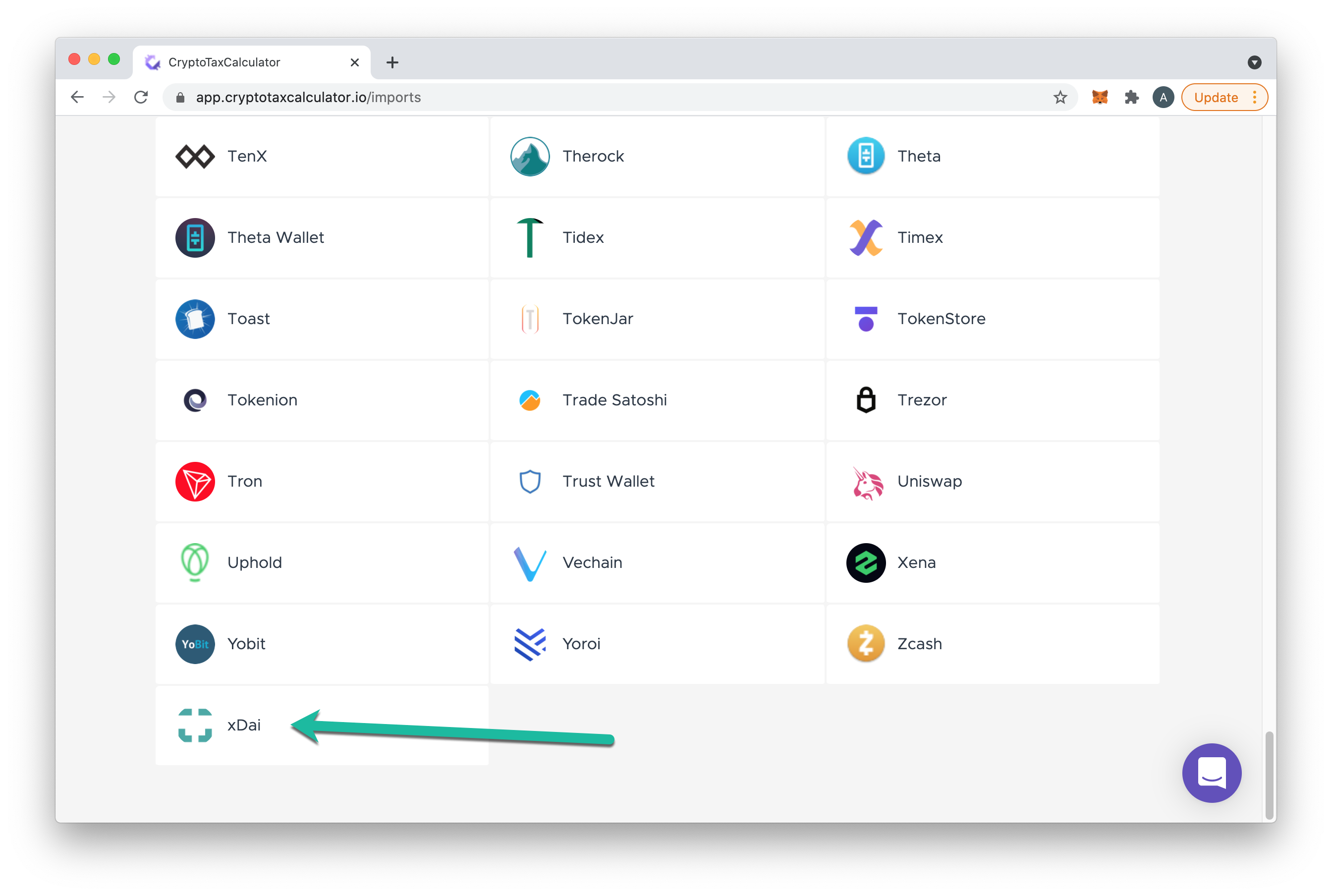

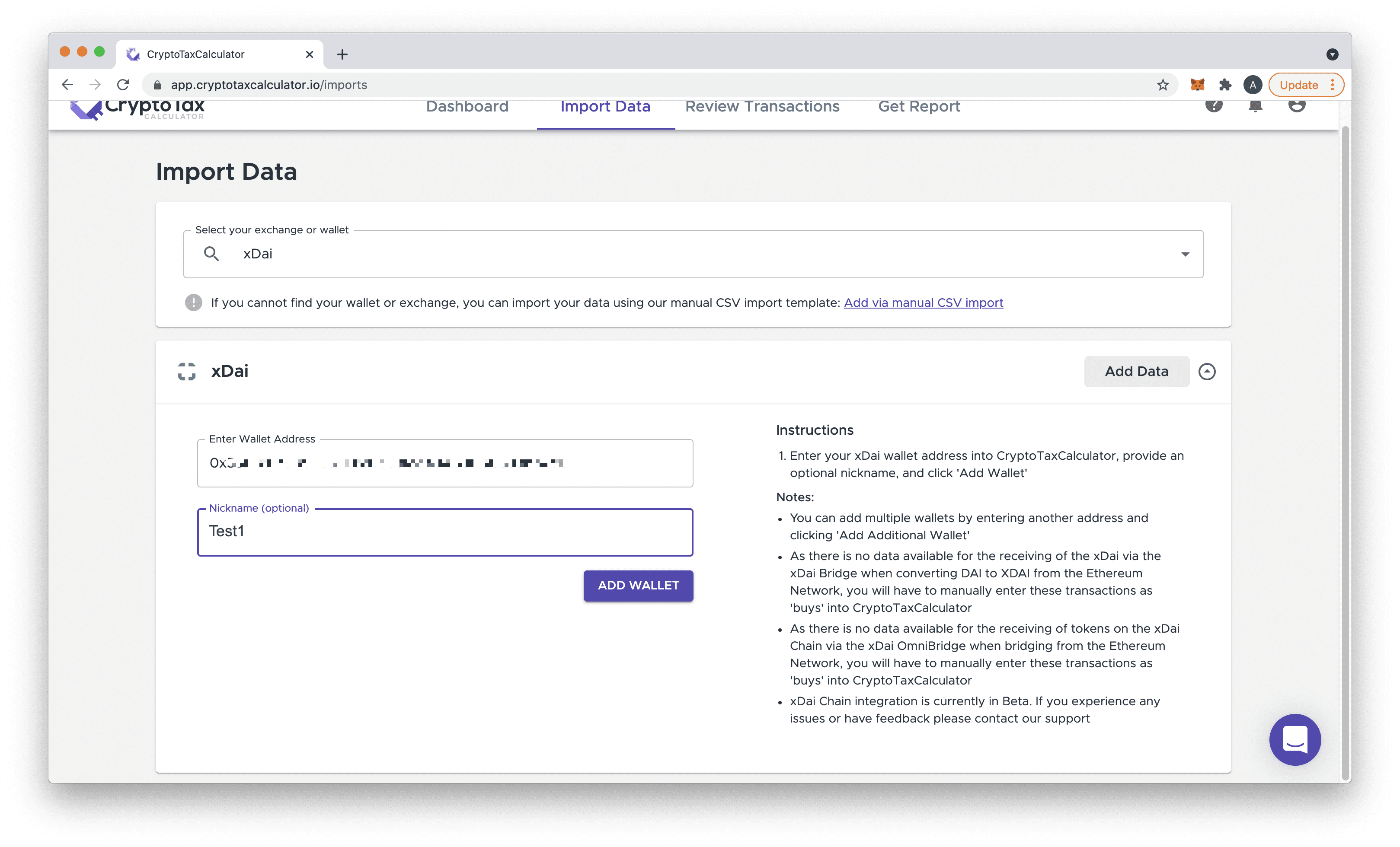

- In Crypto Tax Calculator enter xDai into the search field or scroll down and select from the list.

- Enter this xDai wallet address into Crypto Tax Calculator, provide an optional nickname, and click Add Wallet. It is possible to add multiple wallet addresses after you add the first.

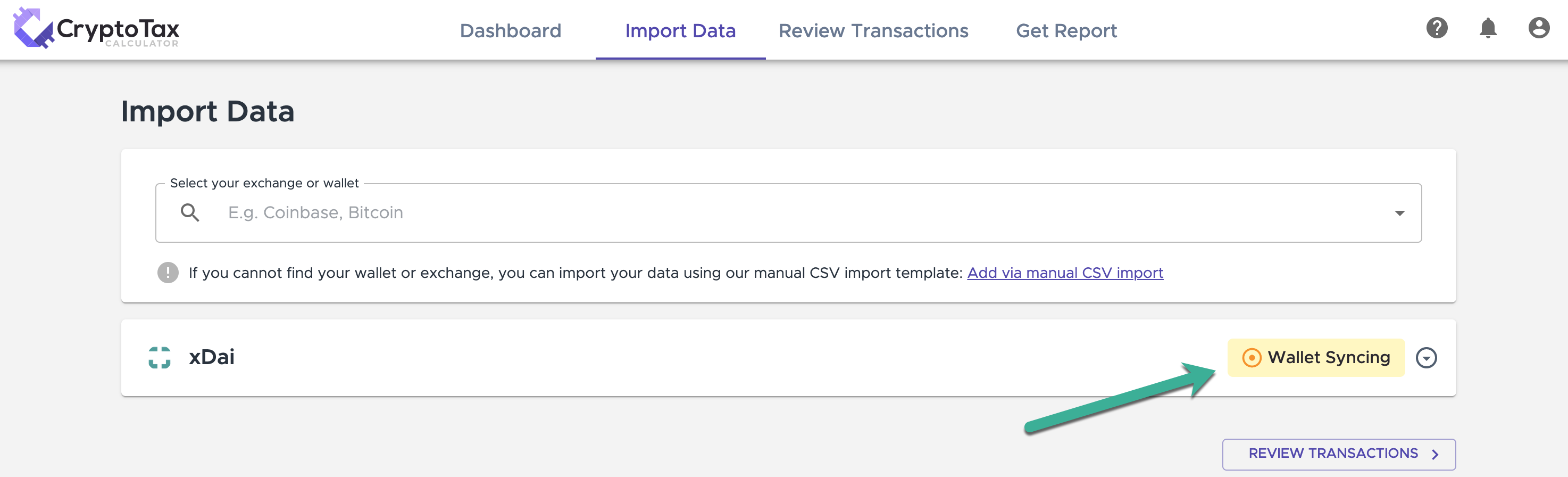

- Your wallet will now sync and Crypto Tax Calculator will pull in all the transactions associated with this wallet from the xDai blockchain.

Tax Guide for xDai Chain Projects & DApps

Once you've imported your xDai Chain wallet, you will see that your transactions on xDai have been pulled in, and some have already been auto-categorized. If Crypto Tax Calculator has not been able to automatically determine the type of the transaction, you may need to manually adjust and/or categorise some transactions. For more details regarding the transaction categories which are available on Crypto Tax Calculator, please refer to our guide How to correctly categorise transactions. The remainder of this guide provides an overview of our support for various xDai protocols.

xDai Bridge

To start trading on xDai Chain, you will need to have some amount of XDAI in your xDai Chain wallet. If you have converted DAI from an existing blockchain (such as Ethereum) into XDAI via the xDai Chain Bridge this conversion will trigger a Capital Gains Tax (CGT) event. Similarly, when you bridge XDAI back to DAI, this will trigger a CGT event. As the bridging occurs between two chains, you will need to import both your Ethereum Wallet and your xDai Chain wallet to obtain the complete transaction history between the two chains.

Bridging from DAI (Ethereum Network) to XDAI (xDai Chain)

In this scenario, when you bridge from DAI to XDAI you are disposing of DAI (triggering a CGT event) and acquiring XDAI. Crypto Tax Calculator can automatically determine the disposal of the DAI when it is sent to the xDai Bridge. There are two sides of this transaction; the Ethereum Network side, and the xDai Chain side.

- Ethereum Network: To correctly determine the cost base of the disposal of DAI, you will need to import your associated Ethereum wallet that was used for the xDai Bridge. We will then automatically categorise this disposal of the DAI:

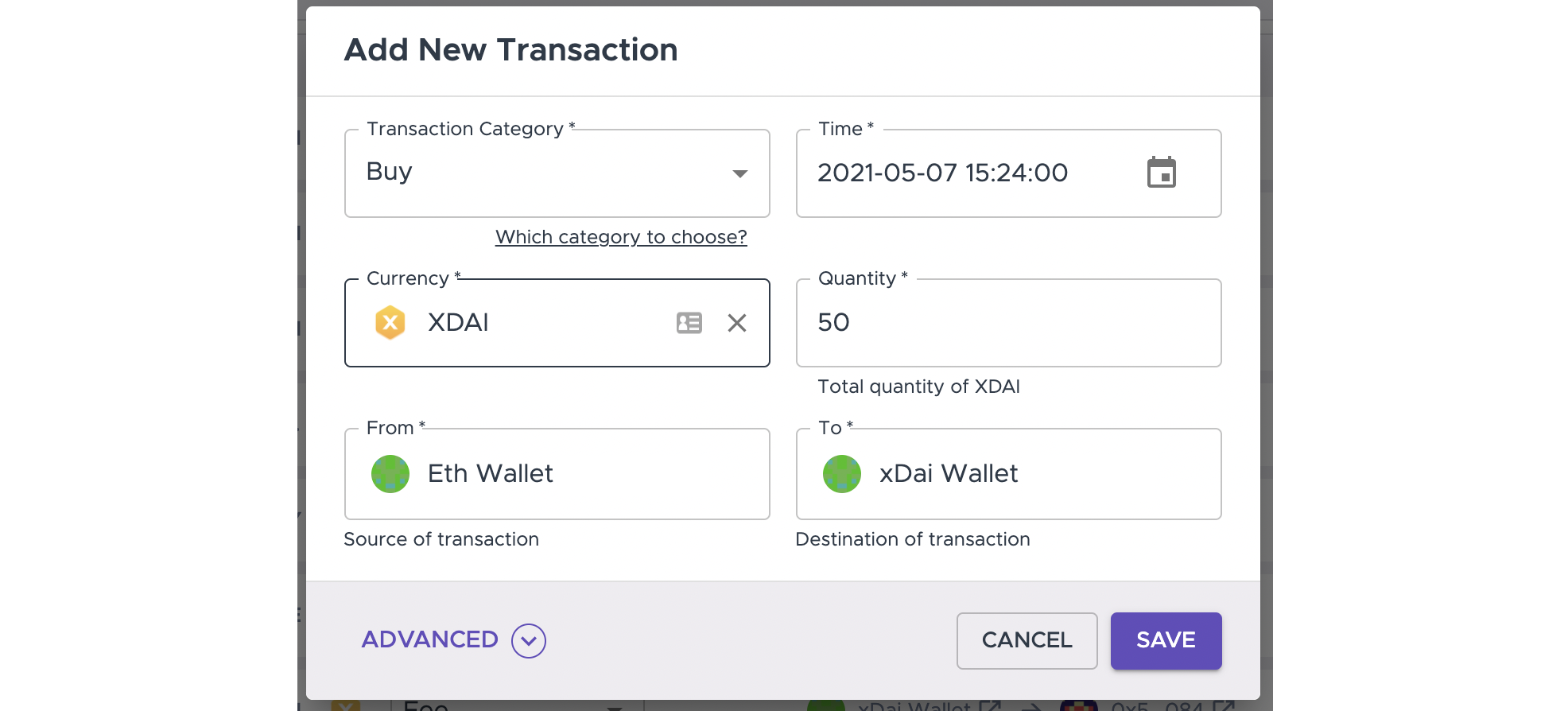

- xDai Chain: Due to the nature of how the XDAI is minted during the bridging process (as detailed by xDai here) there will be no associated purchase of the XDAI recorded as part of your xDai Chain transaction history (once imported). You will need to manually create a transaction with the acquisition of this xDAI via the bridge:

Bridging from XDAI (xDai Chain) to DAI (Ethereum Network)

In this scenario, when you bridge from XDAI to DAI you are disposing of XDAI (triggering a CGT event) and acquiring DAI. Crypto Tax Calculator can automatically determine the disposal of the XDAI when it is sent to the xDai Bridge. There are two sides of this transaction; the xDai Chain side, and the Ethereum Network side:

-

xDai Chain: Once your xDai Chain wallet is imported, you will be able to see the disposal of the XDAI when it is sent to the xDai Bridge:

-

Ethereum Network: To correct determine the cost base of the acquired DAI, you will need to import your associated Ethereum wallet where you received the DAI from the xDai Bridge. We will then automatically categorise the acquisition of the DAI.

xDai OmniBridge

The xDai OmniBridge is a cross-chain bridge used to convert any ERC20 token between the Ethereum Network to xDai Chain. Crypto Tax Calculator supports both the bridging from the Ethereum Network to xDai Chain and back from the xDai Chain to the Ethereum Network. Due to the underlying implementation of the bridging, ERC20 tokens which are bridged via the OmniBridge are a different asset to the native token. As a result, the bridging of tokens between the two networks triggers associated CGT events. For details regarding the difference between Bridged and Native ERC20 tokens and the tax implications of converting between these tokens, please refer to the next section.

Bridging ERC20 Tokens from Ethereum to xDai

In this scenario, when you bridge any ERC20 token from Ethereum to xDai you are disposing of the native ERC20 token (triggering a CGT event) and acquiring a xDai-bridged version of the token. Crypto Tax Calculator can automatically determine the disposal of the ERC20 when it is sent to the xDai OmniBridge. There are two sides of this transaction; the Ethereum side, and the xDai Chain side.

-

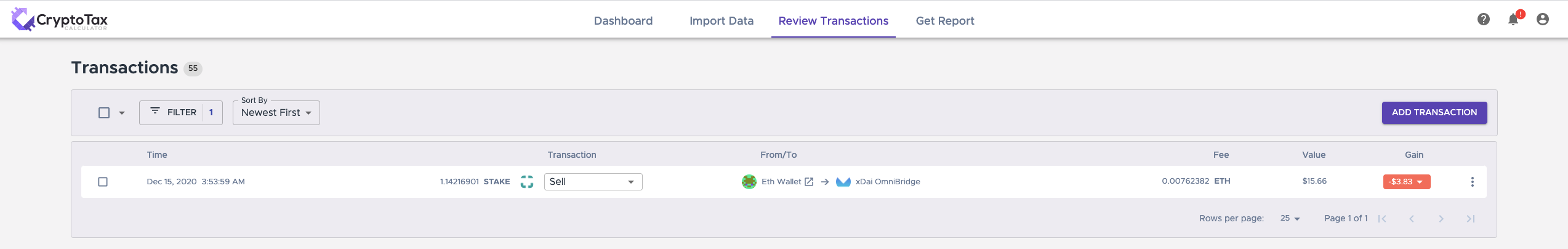

Ethereum Network: To correctly determine the cost base of the disposal of ERC20 token, you will need to import your associated Ethereum wallet which was used for the xDai OmniBridge. We will then automatically categorise this disposal of the ERC20 token:

-

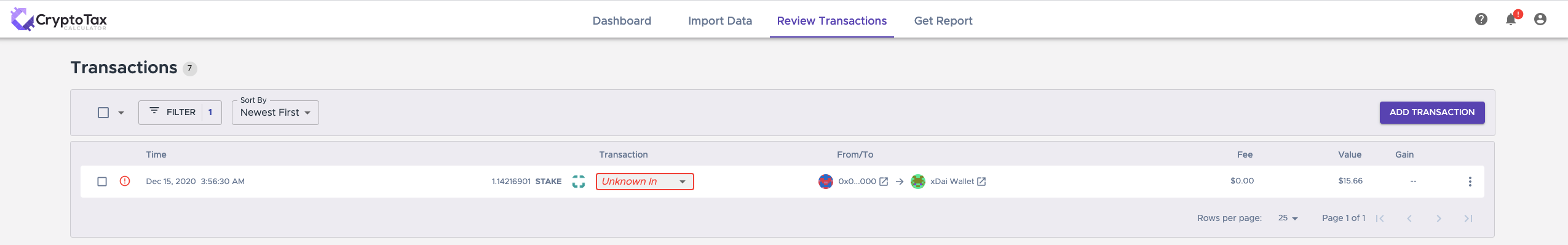

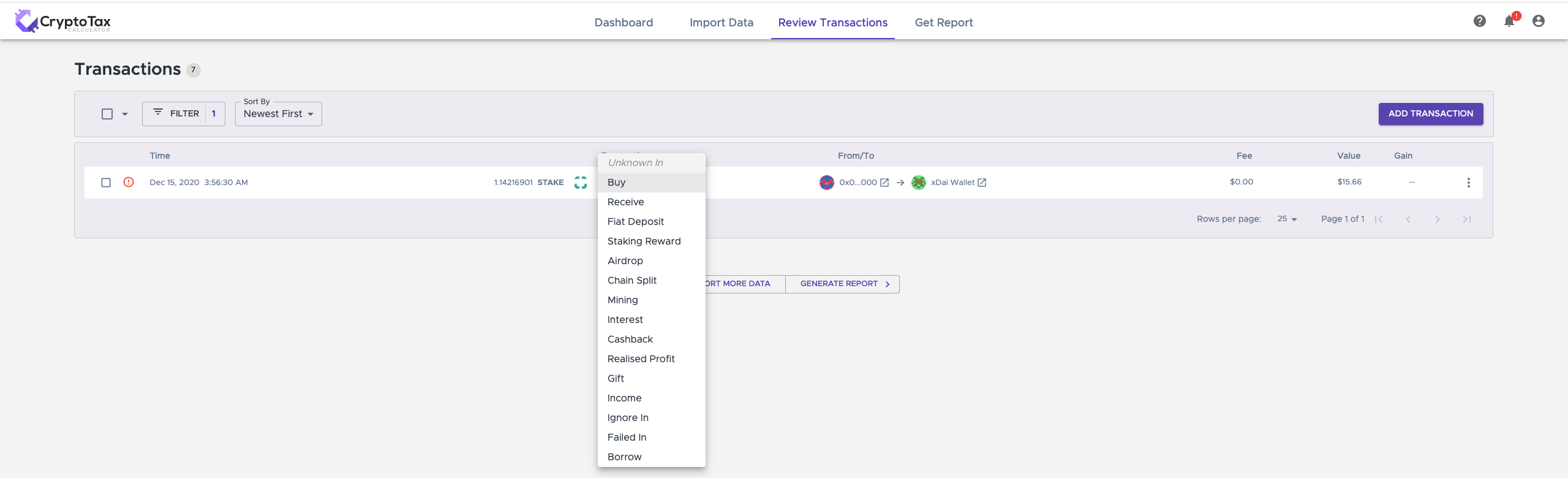

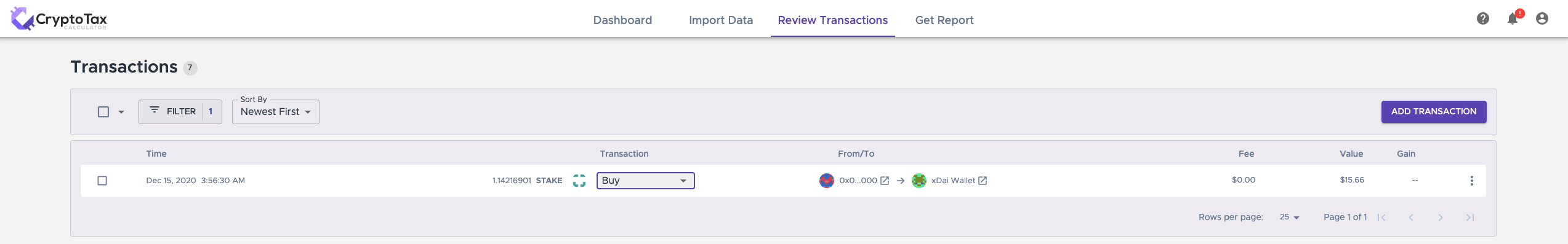

xDai Chain: Due to the nature of how the bridged token is minted during the bridging process, we are not able to auto categorise the purchase of the 'bridged token' recorded as part of your xDai Chain transaction history. You will need to manually update the transaction category to Buy:

-

The original transaction as imported via xDai Chain:

-

Update the transaction by selecting Buy from the available options:

-

The report will refresh and the transaction will be now correct categorized:

-

Bridging from xDai back to Ethereum ERC20 tokens

In this scenario, when you convert your xDai 'bridged' tokens back to their ERC20 equivalent native tokens on Ethereum via the xDai OmniBridge, you are disposing of the bridged token (triggering a CGT event) and acquiring the ERC20 native token. Crypto Tax Calculator can automatically determine the disposal of the bridged token when it is sent to the xDai OmniBridge. There are two sides of this transaction; the xDai Chain side, and the Ethereum Network side:

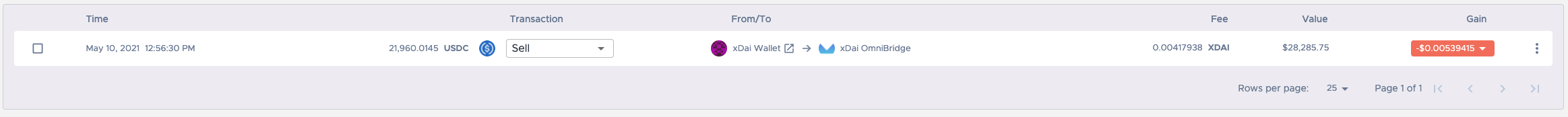

-

xDai Chain: Once your xDai Chain wallet is imported, you will be able to see the disposal of the bridged token when it is sent to the xDai OmniBridge:

-

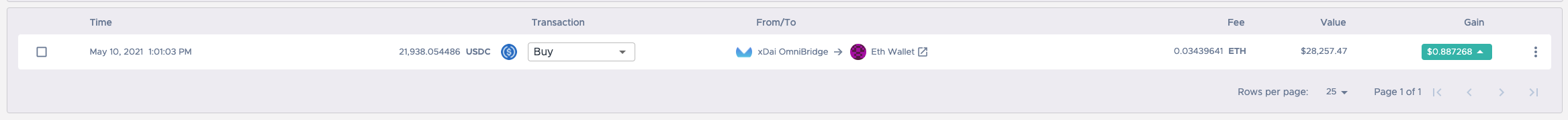

Ethereum Network: To correct determine the cost base of the acquired DAI, you will need to import your associated Ethereum wallet where you received the ERC20 token from the xDai OmniBridge. We will then automatically categorise the acquisition of this token:

Bridged Tokens (Pegged Tokens) vs Native Tokens

xDai Chain maintains a list of 'Bridge Tokens from Ethereum' as can be seen here. Despite the bridged tokens and the native tokens being 'pegged' to the same price, when you bridge from Ethereum to xDai Chain, the original token you bridge is sold, triggering a CGT event, and you receive the 'bridged' or 'pegged' version of the token. For example:

- You wish to bridge 10 'xDAI Stake' ERC20 tokens which you have in your Ethereum wallet to the xDai Chain via the OmniBridge so you can trade them on Honeyswap.

- From your Ethereum wallet, you send the 10 tokens via the OmniBridge to your xDai Chain wallet. This is a disposal (not a transfer) of the tokens, which triggers a CGT event.

- You receive approximately 10 'Stake from Ethereum' Bridged tokens on your xDai Chain wallet. This is an acquisition, (not a transfer) of the tokens. This does not trigger a CGT event.

Similarly, when you bridge back from xDai Chain to Ethereum, the bridged token is sold, triggering a CGT event, and you acquire the 'native' ERC20 token.

Wrapping & Unwrapping of XDAI and WXDAI

Crypto Tax Calculator automatically detects the wrapping of XDAI to WXDAI and the unwrapping of WXDAI to XDAI, and automatically categorises these transactions as detailed below:

- When you wrap XDAI to WXDAI (Wrapped XDAI), you are disposing of XDAI (triggering a CGT event) and acquiring WXDAI

- When you unwrap WXDAI back to XDAI, you are disposing of WXDAI (triggering a CGT event) and acquiring XDAI

Honeyswap DEX

To import your Honeyswap transaction history, you simply need to import your xDai wallet address into Crypto Tax Calculator as detailed earlier in this guide. Crypto Tax Calculator automatically detects and categorises Honeyswap DEX trading activity. We support the following types of transactions on Honeyswap DEX:

- XDAI to token swaps

- Token to token swaps

- Wrapping and unwrapping XDAI

- Adding liquidity to a pool (V2 Liquidity)

- Removing liquidity from a pool (V2 Liquidity)

For further information regarding the different trading activity available on Honeyswap and their associated tax implications please review our Honeyswap Tax Guide.