While cryptocurrency usage in Sweden is starting to grow, the nation still falls slightly behind the rest of the world when it comes to adoption; sitting at 7% ownership compared to the global average of 14%. This partly due to the lack of frameworks and definite crypto legislation within the nation. With that being said, the Swedish Tax Agency (Skatteverket) has started to pave the way by setting crypto-specific tax rules, potentially encouraging higher levels of adoption within the nation. Swedish tax payers need to be aware of these important tax rules in order to correctly file their cryptocurrency taxes.

This comprehensive guide will explain everything about Skatteverket’s classification of cryptocurrency, the tax treatment of cryptocurrencies and related activities in Sweden, as well as how Swedish cryptocurrency traders and investors can report their taxes with Crypto Tax Calculator.

Is crypto taxed in Sweden?

The short answer is yes, cryptocurrencies are taxed in Sweden. In 2018, the Supreme Administrative Court stated that Bitcoin and cryptocurrencies will have different tax implications to foreign currencies, shares and equities. Skatteverket treats cryptocurrencies as ‘other assets’ and are subject to three different types of taxes:

- Capital Gains

- Employment Income Tax

- Interest Income Tax

It is important to understand the different types of cryptocurrency activities (e.g., trading, mining, staking, etc…) and the tax implications for each scenario.

When is the deadline to report my crypto taxes in Sweden?

The tax year in Sweden runs from the 1st January to 31st December, with the online tax portal generally opening on the 15th March in the given tax year. The filing deadline falls on the 2nd May.

If it is the case you need to apply for an extension, you can do this via “My Pages” (“Mina sidor”) using your Swedish e-identification. Most extensions will last you until the 16th May, but in some special cases, you may be able to extend it for a full month (up until 31st May).

| Item | Date |

|---|---|

| Tax year period | 1st January - 31st December |

| Online tax portal opens | 15th March |

| Filing deadline | 2nd May |

| Extension deadline | 16th May OR 31st May (depends on your case) |

Does Skatteverket know about my crypto holdings?

Despite popular belief, cryptocurrency is extremely easy to track and is not as anonymous as many believe. Due to much stricter regulation around cryptocurrency exchanges and digital asset investment, almost all exchanges require users to complete a ‘Know-Your-Customer’ (KYC) identification application before the account can be used to purchase crypto. If you have signed up to any exchange which required this check, it is highly likely that Skatteverket has your user record from that exchange. Withdrawals to external wallets are also tracked, and it is a simple process to follow the money trail from an exchange account to external wallets due to the availability of data on public blockchains.

The European Union’s sixth Anti-Money Laundering Directive means that any company that provides financial services to customers or other businesses must adhere to stricter regulations regarding customer identification. This directive also means that data is made available between EU member states, so signing up to an exchange in another EU country does not mean that Skatteverket will be unable to gain access to your data.

The European Commission’s proposed Directive on Administration cooperation (DAC8) is a step towards stricter regulation regarding cryptocurrency ownership and trading. The proposed update will likely take effect in the next 12 months, increasing the availability of data on cryptocurrency owners to financial authorities across EU member states to address tax evasion or fraud. Once this takes effect, DAC8 may allow Skatteverket to specifically search if a person owns cryptocurrency, as well as other information such as holdings, transaction history and withdrawal addresses.

What happens if I don’t report my crypto taxes?

Depending on the circumstances and time periods, if you fail to report your crypto taxes or provide insufficient / incorrect information, the Swedish Tax Authorities may impose a penalty of up to 40% of the evaded taxes, on top of the normal tax rate. That is, you would have to pay the correct tax amount AND up to an additional 40% of the amount you evaded. In some extreme circumstances, Swedish tax payers could be subject to criminal prosecution and face up to 6 years in prison (depending on the severity of the tax evasion). Skatteverket takes tax evasion as a very serious offence and as mentioned earlier, it is highly likely that they have access to data on individuals who have KYC’d on a centralised exchange. As such, we strongly recommend that investors ensure they have applied the correct tax treatment to their crypto transactions and file their taxes accurately.

How does Skatteverket tax crypto?

As mentioned earlier, crypto activities are subject to 3 different types of taxes - capital gains, employment income or interest income. Below, we’ll cover the different scenarios and tax rates.

Capital Gains

Cryptocurrencies are considered capital assets and attract Capital Gains Tax in Sweden. The following activities are subject to capital gains:

- Selling crypto for Swedish kroner or another fiat currency (USD, EUR, etc)

- Trading crypto for crypto (e.g: BTC → ETH)

- Paying for goods or services with crypto

- ICOs (Initial Coin Offerings)

- Trading/Transfer fees

- Lending crypto

- Margin trading

- Futures / Derivatives trading

- Trading NFTs

- Liquidity Pools

Example:

- Let’s say John bought Bitcoin twice. The first time, he bought 0.1 BTC for 100,000 kr and then 0.3 BTC for 200,000 kr. So he’s bought 0.4 BTC for 300,000 kr.

- He then sells 0.2 BTC for 220,000 kr.

- His average cost basis of this sell is 0.2 / 0.4 * 300,000 kr = 150,000 kr.

- His net capital gains: 220,000 kr - 150,000 kr = 70,000 kr.

| Type | Date | Amount | Price | Cost Basis | Profit/Loss |

|---|---|---|---|---|---|

| Buy | 01-01-2022 | 0.1 BTC | 100,000 kr | 100,000 kr | |

| Buy | 13-03-2022 | 0.3 BTC | 200,000 kr | 200,000 kr | |

| Sell | 28-10-2022 | 0.2 BTC | 220,000 kr | 150,000 kr | 70,000 kr |

Capital Gains Tax Rate

Capital assets are taxed at a flat rate of 30%, with only 70% of losses allowed to be used to offset gains (according to Chapter 52 of the Swedish Income Tax Act):

Bitcoin cannot be a so-called personal asset, which means that the cost amount must be calculated according to the so-called the average method and that 70 percent of a loss may be deducted.

**In other words, your net capital gains = capital gains - 70% of losses.

The above statement also tells us that we must use the average cost method to calculate the cost basis of the disposed asset. This can be calculated by adding up the total cost base for a specific coin and then dividing it by the total number of purchased coins.

For example:

| Date | Trade | Price | Balance | Cost Basis | Proceeds | Gain (Loss) |

|---|---|---|---|---|---|---|

| 1st Jan | Buy 1 BTC | 3,000 | 1 | 3,000 | - | - |

| 3rd Feb | Buy 1 BTC | 6,000 | 2 | 6,000 | - | - |

| 4th Jun | Buy 1 BTC | 2,000 | 3 | 2,000 | - | - |

| 6th Aug | Sell 1 BTC | 4,500 | 2 | 3,666.67 | 4,500 | 833.33 |

Looking at the table above, we sell a BTC that is assigned the average cost basis of the 3 previous buys. This is calculated by adding the cost basis of each BTC (12,000) and then dividing by the number of BTC held (11,000 ÷ 3) to give a cost basis of (3,666.67). When sold for 4,500, the gain on this BTC is 833.33.

Employment Income

Employment income activity includes:

- Mining

- Rewards (e.g., referrals)

- Income (e.g., salary, freelancing)

- Creating and selling NFTs

You will be taxed (as employment income) according to the value of the proceeds in your local currency on the day you received the cryptocurrency. However, if you choose to hold onto that crypto and sell it at a later date, you will be subject to capital gains taxes with the cost basis being equal to the amount you declared in income.

Example:

- Let’s say you earn 10 ETH in salary which was worth 100,000 kr, which you then declare as income tax are you received the ETH.

- Two months later, you sell the 10 ETH for 150,000 kr.

- You will have made a profit of 150,000 kr - 100,000 kr = 50,000 kr which is subject to capital gains.

Employment Income Tax Rate

There are 2 types of employment income tax in Sweden:

-

National income tax

-

Municipal income tax

NOTE: this varies between different municipalities in Sweden

Once your income exceeds 540,700 SEK - the national income tax kicks in:

| Taxable Income (SEK) | National Income Tax (%) | Municipal Income Tax* (%) |

|---|---|---|

| From 0 - 540,700 | 0 | 32 |

| 540,700 + | 20 | 32 |

*average municipal tax rate Source: PricewaterhouseCoopers

Interest Income Tax

Interest income activities include receiving crypto in the form of:

- Loan interest

- Staking rewards

Interest Income Tax Rate

Interest income is taxed at a flat rate of 30%. Unlike capital gains where the losses can be used to offset gains by only 70%, any losses from interest income will be fully deductible.

To calculate your interest income tax, simply sum up the total income from your loan interest and staking rewards activities.

How are airdrops taxed?

Skatteverket hasn’t provided full guidance on the tax treatment of airdrops so it’d be best to speak to a tax professional on this.

Non-Taxable Crypto Transactions in Sweden

Similar to tax rules in other nations, the following activities are regarded as non-taxable events. However, be sure to read through the below cases as some scenarios have little nuances in their tax treatment.

- Transfers of Crypto between wallets

- Moving your crypto between your own wallets and exchanges is not a taxable event. Only the transfer fee is taxable - for more on this, please visit here.

- Lost / Stolen crypto

- While you don’t need to pay taxes on crypto that is lost or stolen, you unfortunately can’t offset the lost or stolen crypto against your profits.

- Gifting / Receiving crypto

- Gifting crypto is non-taxable however you can’t deduct this from your profits (similar to lost / stolen crypto).

- The action of receiving crypto is also non-taxable until you actually sell it. The price at which the person who gifted you the crypto bought the crypto for will be the cost base you need to use when you sell the crypto. Ideally, you would want them to send you a receipt or proof of purchase of the gifted crypto.

- Donating crypto

- Similar to gifting crypto, donating crypto is non-taxable and also non-tax deductible (unlike some other countries where it is tax deductible). For a donating to be tax deductible in Sweden, the donation must be given in the form of a currency (whereas Skatteverket does not consider crypto to be one).

- Forks

- A fork in crypto is essentially when there is a change in the protocol, generally leading to a new version of the coin. Alike an airdrop, a hard fork is considered as a gift from the new blockchain fork and is only taxed when you sell it - with a cost basis of zero.

Keeping hold of your transaction history

It’s important to keep record of your complete transaction history to ensure you have correctly calculated your tax return, but also, in case you get audited by Skattverket after filing your taxes.

Skatteverket may ask for the following records:

- Transaction history dates and timestamps

- List of cryptocurrencies traded

- Quantities of traded cryptocurrencies and value in SEK at the time of transaction

- Types of transactions

- Records from exchanges and wallet addresses

If you don’t keep records of your data and you lose access to an exchange/wallet you were trading on (whether that be due to the exchange shutting down or you’ve lost your crypto keys), you will have trouble filing an accurate tax return with missing data.

To avoid situations like this, it’s best to keep regular backups of your transaction history or you can use a cryptocurrency tax software like Crypto Tax Calculator to aggregate all your data and tax reports in one place.

Reporting crypto taxes in Sweden

Once you have calculated your crypto taxes manually, with an accountant or using the Crypto Tax Calculator app, you will need to file your capital gains, employment income and interest income taxes online or via mail.

Submitting capital gains tax

You have 3 different ways to submit your capital gains taxes:

- Report your crypto taxes in Section D of the K4 tax form using a paper form then print it out and mail it to Skatteverket

- Manually fill in the K4 form on Skatteverket’s online portal

- Upload SRU (Standardiserad Räkenskaps Utdrag) files to the online portal which will automatically fill in the K4 form

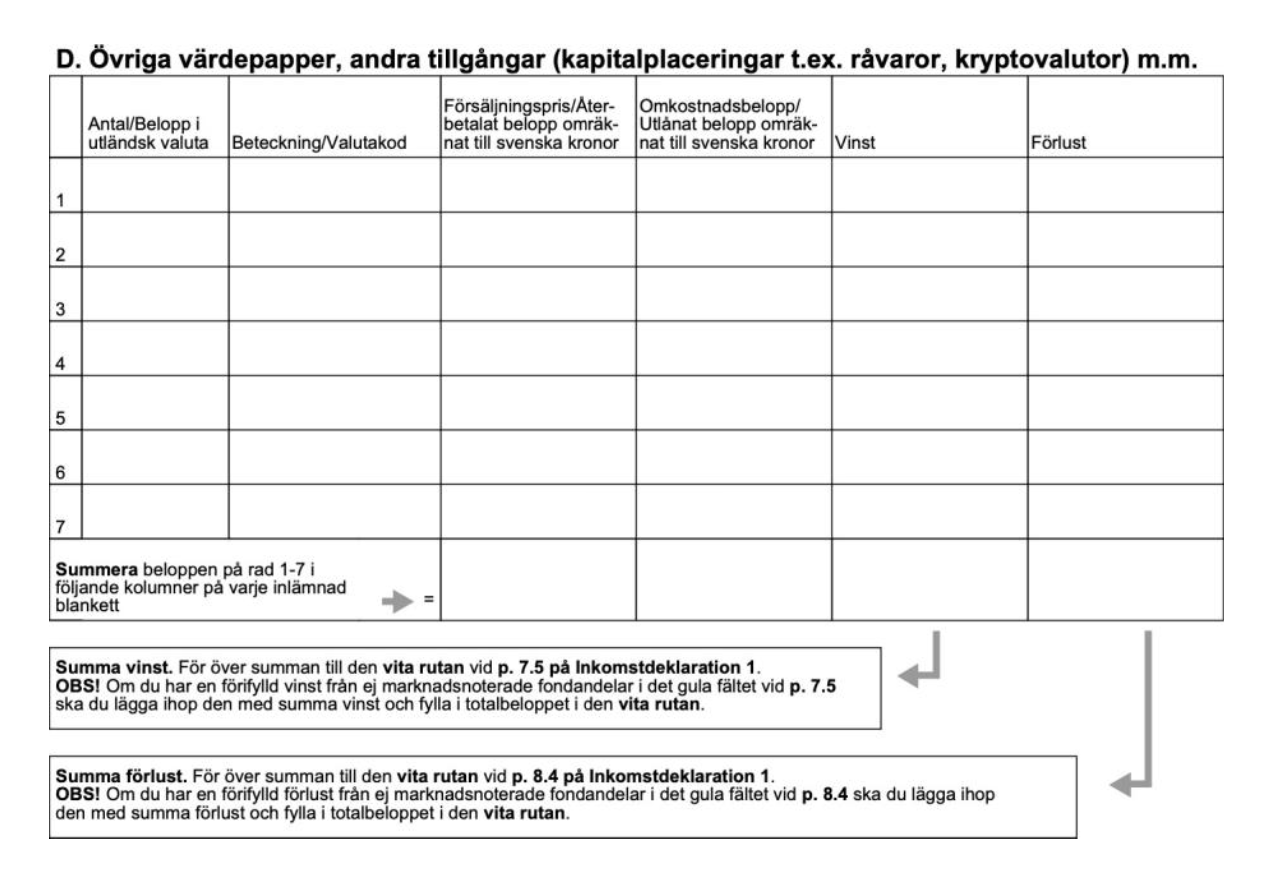

What is the K4 Tax form?

- This is where all profits and losses need to be reported

- There are 6 columns:

- Antal/Belopp i utländsk valuta: The number of coins/tokens that were disposed of

- Beteckning/Valutakod: Ticker symbol of coin/token

- Försäljningspris: The total sales price or proceeds received from disposing of the cryptocurrency

- Omkostnadsbelopp: The total cost basis of the cryptocurrency disposed of

- Vinst: Total gains summarized for each individual cryptocurrency

- Förlust: Total losses summarized for each individual cryptocurrency

- This is what Section D of the K4 form looks like:

Submitting employment income tax

You report both capital gains and income in the same tax return.

- Salary:

- This should already be declared by your employer but if they failed to report it, you can head to Ändra (on the K4 form under section D) and enter in the value of income you received.

- Rewards/Mining:

- You will need to fill out a T2 form which can be found in the online portal by navigating to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2).

Submitting interest income tax

You need to add your interest income total to section 7.2. This can be done by following the below instructions:

- Log into your online portal and head to Ändra. Click the dropdown and select 7.2 Ränteinkomster, utdelningar m.m.

- Add your crypto interest income to your current sum of interest to get your new total and fill it in.

- Click on Spara then go back to the previous page Ändra.

- Select 17. Övriga upplysningar and describe the type of interest income (e.g., staking reward, loan interest etc).

How Crypto Tax Calculator can help

Manually maintaining records of all of the above doesn’t sound like much fun, does it? Spoiler: it’s not. That’s where we come in! Our crypto tax calculator software can help you aggregate your crypto transaction data to help calculate any gains, losses, income and/or expenses. As an added bonus, we’ve worked with tax professionals from Sweden to ensure our platform follows your region’s guidelines.

Once you’ve imported all your data to form a complete overview of your trading history, you’ll be prompted to reconcile any outstanding lines. After those are reconciled, you’ll have the option to download reports showing these values clearly. These reports and the information included will give you the amounts needed to complete your yearly tax return for Skatteverket.

Patrick has been in the crypto industry for the last 7 years and is passionate about sharing his knowledge and experience in web3. Patrick has also covered the crypto space for Forbes Advisor, Canstar and The Chainsaw.