Introduction

While investing in crypto assets can be rewarding, you need to be aware that there are differences between investing in crypto assets and traditional assets (such as foreign currency and shares) for Australian tax purposes. The Australian Taxation Office (ATO) applies existing tax legislation to crypto asset transactions; and, given the unique and dynamic nature of crypto asset activities, this can produce tax liabilities that may not always be clear.

This guide breaks down the tax implications of engaging in crypto asset transactions, provides explanations of crypto assets generally and answers common questions about the Australian tax system.

Ultimately, your tax liability depends on the nature of the crypto asset, the type of activities you engage in, the circumstances surrounding those activities, and whether those activities are done as part of a business or not.

Please note that this Guide reflects the views contained in ATO publications and web guidance as of 10 July 2024.

What is Capital Gains Tax?

Overview

The capital gains tax (CGT) regime taxes the profits made on particular assets and rights (‘CGT assets’) during an income year. Despite common belief, CGT is not a separate tax in Australia. Instead, CGT affects your liability for income tax because your assessable income includes ‘net capital gains’ made during an income year. This means that individuals who have a net capital gain from crypto assets add that gain to their total assessable income and pay tax at their marginal tax rate.

Broadly, your net capital gain is the total of your ‘capital gains’ for an income year, reduced by certain ‘capital losses’ you have made. If you are entitled to apply any previous losses, discounts, concessions or rollovers, this can further reduce your net capital gains.

Net Capital Gain = Capital Gains – Capital Losses

For example: You make a capital gain of $500 following the sale of shares, and you make a capital loss of $250 following the sale of foreign currency. Provided that you are not entitled to apply any previous losses, discounts, concessions or rollovers, your net capital gain is $250 ($500 - $250). This amount is then included in your assessable income.

For more information about Capital Gains Tax, visit the Australian Taxation Office website and search “QC69844”.

Are crypto assets CGT assets?

In 2014, the ATO issued a public ruling concluding that bitcoin is a CGT asset for Australian taxation purposes. As a result, the ATO considers that bitcoin and other crypto assets with similar characteristics are subject to the CGT regime. This means that gains and losses arising from crypto assets must be declared.

What are capital gains

Capital gains are the profits made on the sale of a CGT asset. You can only make a capital gain (or loss) if a ‘CGT event’ happens. There are over 50 different CGT events which happen often and affect many taxpayers; however, the most common CGT event is the disposal of a CGT asset, such as the sale of crypto assets, shares or real property.

Generally, your capital gains are calculated by reducing the sale price (‘capital proceeds’) of a CGT asset by its original purchase price (‘cost base’).

Capital Gain = Capital Proceeds – Cost Base

For example: You purchase shares for $10,000 and later sell them for $15,000. Your capital gain is $5,000 ($15,000 – $10,000).

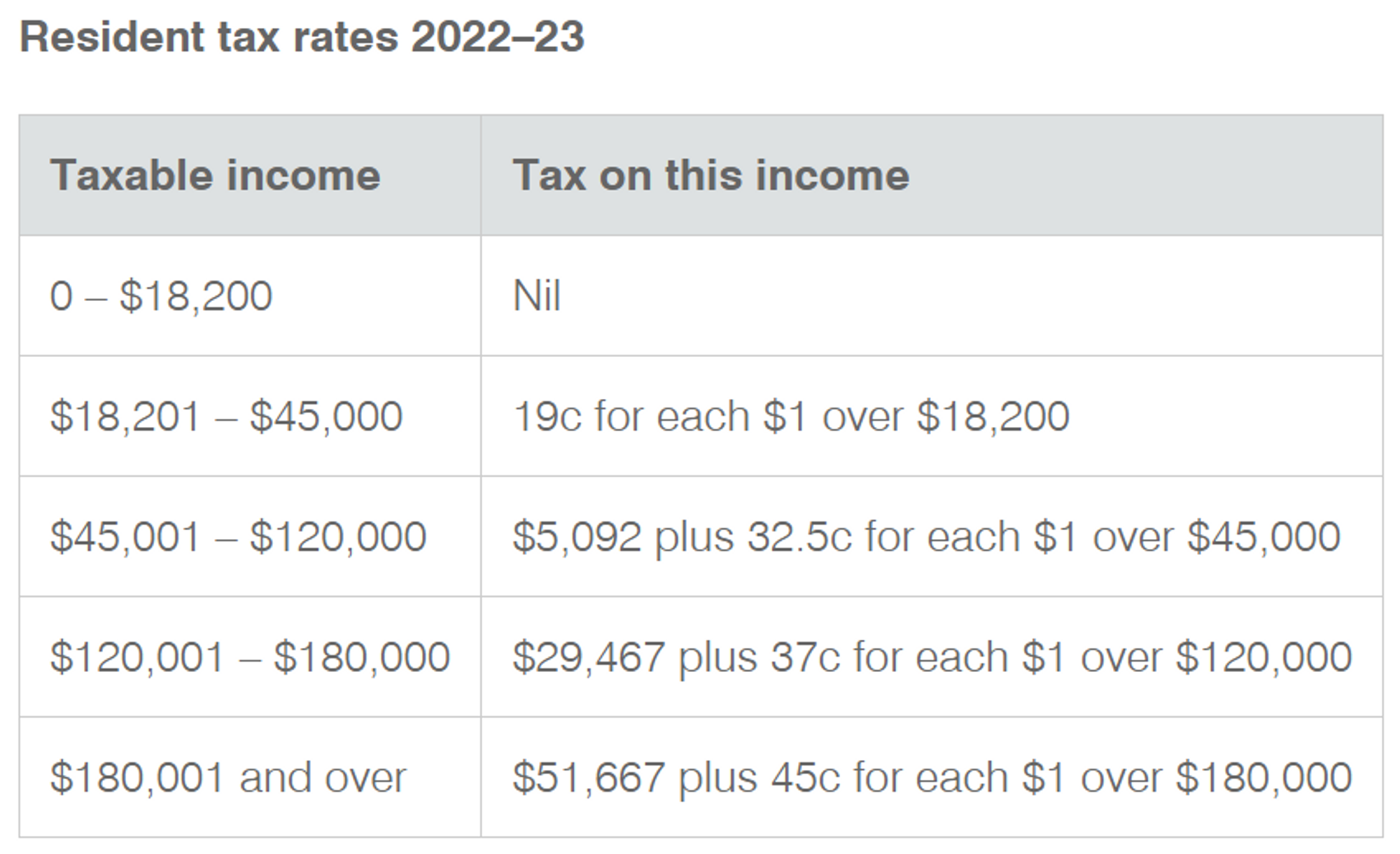

The same principles apply for crypto assets. Once you, or your accountant, have calculated the capital gains arising from your crypto asset activities, this is used to determine your net capital gain. This net capital gain is included in your assessable income, and your taxable income is calculated. The total tax payable on your taxable income is calculated according to the individual’s income tax bracket (see below).

Please note that these figures do not include the Medicare Levy of 2%. For more information about Australian Tax Rates, visit the Australian Taxation Office website and search “QC73320”.

What are capital losses?

Capital losses are losses incurred following the sale of a CGT asset. Similar to capital gains, you can only make a capital loss if a CGT event happens. Generally, your capital losses are calculated by reducing the original purchase price (‘reduced cost base’) by the sale price (‘capital proceeds’) of the CGT asset.

Capital Loss = Reduced Cost Base – Capital Proceeds

For example: You purchase shares for $15,000 and later sell them for $5,000. Your capital loss is $10,000 ($15,000 – $5,000).

It is important to understand that capital losses can only offset capital gains within the current income years, and unused losses are carried forward to future years. For example, if you make a capital loss from crypto assets but a capital gain from selling shares during the income year, you can use the capital losses from your crypto assets to reduce your capital gains. Please note though that capital losses cannot offset capital gains from previous financial years, and capital losses cannot be used to reduce your other assessable income such as salary or wages.

If your capital losses exceed your capital gains for an income year, you will likely have a ‘net capital loss’. This amount can be carried forward and applied to reduce capital gains in future income years.

You should also be aware that the ATO issued a media release warning taxpayers not to engage in ‘wash sales’, which involve disposing of crypto assets just before the end of the financial year and reacquiring the same or substantially similar assets shortly after. These arrangements increase losses and reduce actual or expected gains without changing your economic exposure to the asset. As a result, the ATO considers that wash sales are a form of tax avoidance, and the capital losses can be denied.

How to report your crypto asset activity

Lodgment dates

If you have engaged in any form of crypto asset activity, you will most likely have to declare this activity in your income tax return.

As of the date of this Guide, the current Australian income tax year commences 1 July 2024 and ends on 30 June 2025. If you are an Australian resident individual, you must submit your income tax return before 31 October 2024. If you have a tax agent who submits income tax returns on your behalf, they must follow the appropriate lodgment date pursuant Tax Agent Lodgment Program which can be as late at May 2024.

Lodging your tax return online

You can declare your crypto asset activities in your income tax return in the same way that you would your normal income, capital gains and/or losses. If this is your first time lodging, you will have to sign into your myGov account and link your account with the ATO. Once you have linked your account, your myGov Dashboard should include the ATO under ‘Your services’:

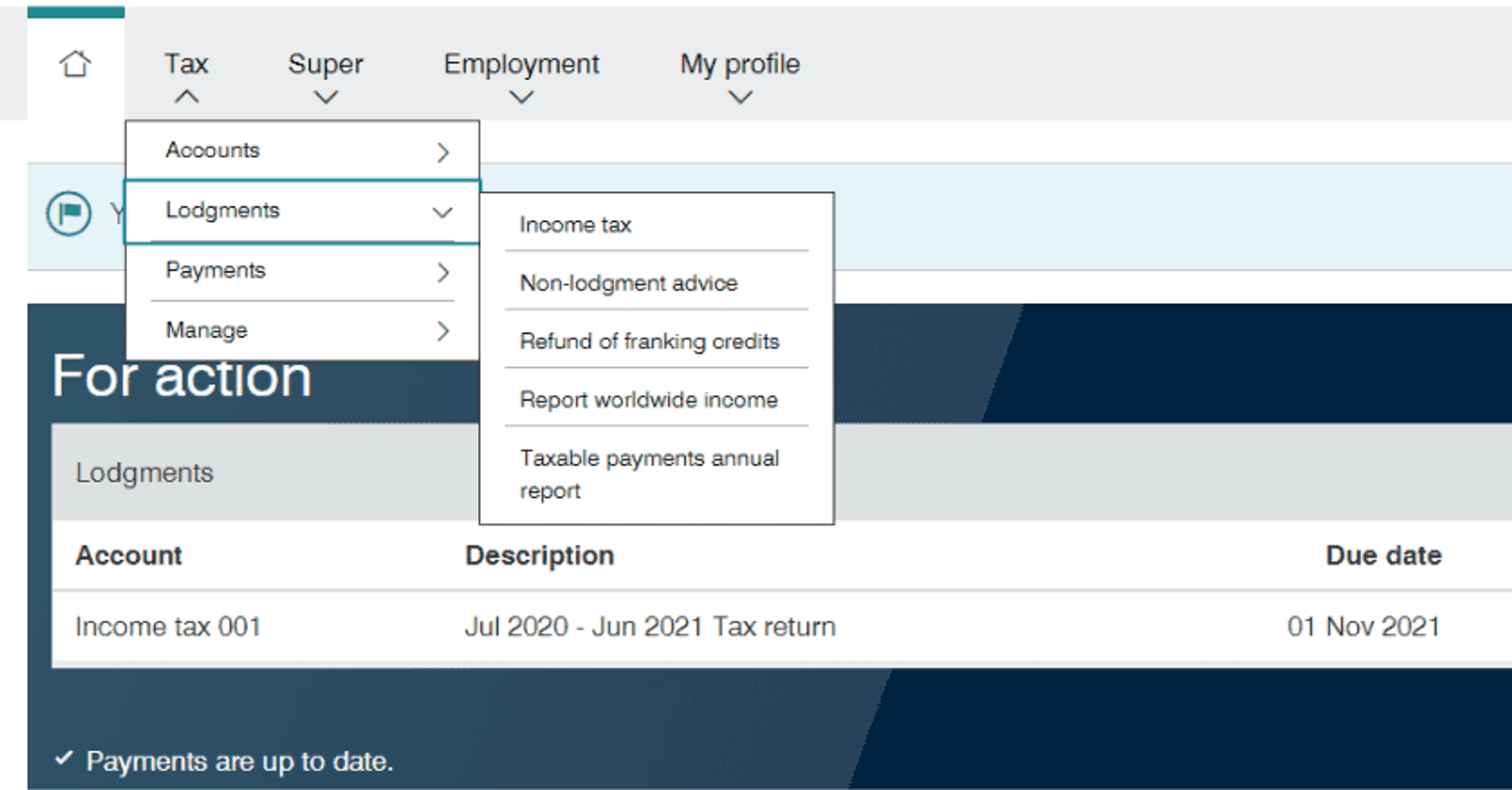

You can access the services necessary to lodge your income tax return by selecting ‘Australian Taxation Office’ from your Dashboard. Once on the ATO website, select ‘Tax’ from the navigation bar and then select ‘Income Tax’ under the Lodgments option as below.

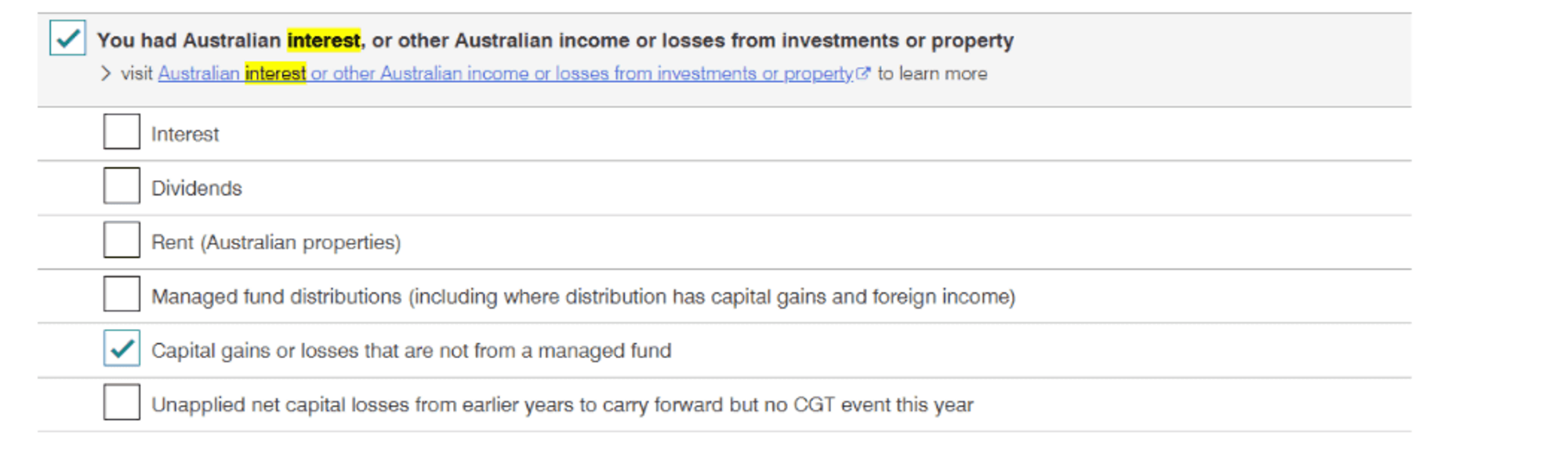

Once you have done this, select the current year’s income tax return lodgment and follow Step 1 and Step 2 to ensure your personal and bank account details are accurate. When you reach Step 3, make the following selection in addition to your regular income to ensure that your tax return reflects your crypto asset activity.

You can then proceed to Step 4 to prepare your tax return.

Calculating your crypto taxes with Crypto Tax Calculator

If you have undertaken more than one crypto transaction over the course of the financial year, you may find it is incredibly difficult to manually calculate your taxes. But don’t worry, you are not alone. This is an issue faced by many crypto users, and accountants continue to struggle handling the compliance burden that comes with trading in crypto. Luckily, we have made it simple to import all your crypto asset activity into one place to generate a tax report.

With our software, you can either:

(a) copy and paste your public wallet addresses into our application, or (b) use our wide range of API and/or CSV integrations.

Once you have done this, CryptoTaxCalculator auto-categorises your transactions into activity types. For example: You paste your public wallet addresses into our application. Our application recognises that you have received an airdrop. This transaction is categorised into the ‘Airdrop’ activity type. As a result, this transaction is recognised in your final tax report as income or not depending on the airdrop type itself – more on airdrops below.

If you need to make amendments, you can manually select the activity types that are relevant to the data you imported. Our application includes many categories, such as:

(a) Buys

(b) Sells

(c) Staking rewards

(d) Chain split

(e) Airdrops, and

(f) Mints

This allows CryptoTaxCalculator to produce a complete tax report for any financial year, personalised to meet your Australian tax requirements.

You can import data for all crypto assets you trade. CryptoTaxCalculator will combine them into various report formats. Our most frequently used format is ‘Report Summary’, where you can view your income and/or capital gains and losses for a particular financial year. Other options include ‘Income Report’, ‘Miscellaneous Expenses Report’ and more.

For more information on the different types of crypto asset activities and their taxation, we have summarised and provided examples below further to existing ATO guidance.

Examples of crypto asset activities and their taxation

There are many ways to deal in crypto assets, and this Guide has pulled together some common activities and their tax implications. The following examples are separated into:

- Acquiring crypto assets: which includes further information about airdrops, staking rewards, receiving new tokens from forks or chain splits, and earning tokens from work or services rendered, gifts of crypto assets, and initial coin offerings.

- Using crypto assets: which includes using crypto assets for personal use, loaning, inter-wallet transfers, margin trading, derivatives, contracts for difference, wrapped tokens, and decentralised financing.

- Disposing of crypto assets: which includes disposing of crypto assets for fiat currency, crypto to crypto transactions, losing crypto assets, where crypto assets are stolen, and moving crypto assets to an exchange.

- Guidelines for particular crypto assets: such as non-fungible tokens (NFTs) and stablecoins.

- Record-keeping obligations: for crypto asset activities.

Crypto Tax Calculator categorises many of these activities automatically when producing your final report. If your activities do not appear in the examples below, we recommend that you seek professional advice.

Acquiring crypto assets

‘Airdrops’ and ‘Initial Allocation Airdrops’

An airdrop is a term used to describe when a crypto asset project delivers a small quantity of their native token to an individual by depositing it into their wallet. This is often employed as a marketing technique to raise awareness about relatively new tokens or reward early adopters for participating in those projects.

In late 2022, the ATO has published web guidance on airdrops and income tax treatment, stating that the money value of an established token received through an airdrop will be taxed as ordinary income of the recipient at the time it is received.

For example: You have a wallet and receive 0.001 BTC as part of an airdrop. The market value of 0.001BTC at the time you received it is $45. Therefore, as BTC is an established token, your assessable income includes $45. If you exchange the BTC in the future, the cost base of your BTC will be $45.

If the airdropped token is part of an ‘initial allocation airdrop’ (that is, it is the first distribution of that token before any trading commences), the ATO takes the view that you do not derive ordinary income, and you do not make a capital gain at the time of receipt. If the airdropped tokens are free, they will have a zero-cost base for CGT purposes. However, if you have made some payment in return for acquiring the token, the cost base of the airdropped token will be the amount you paid.

It is also important to note that the timing for the 12-month discount starts when the tokens are received by the user.

For example: You have a wallet and receive 1 NewCoin as part of an initial allocation airdrop. You paid $100 for your NewCoins. NewCoins have not been traded before and have no established market value. Therefore, as NewCoins are not an established token, you do not derive any ordinary income and you do not make a capital gain. In the future, if you exchange the tokens, the cost base of your NewCoin will be $100.

Another example: You have a wallet on a new layer 1 blockchain. After doing many activities on the testnet version, you are rewarded with 100 MainCoins. The MainCoins have not been traded before and have no established market value at the time you received them. Therefore, as MainCoins are not an established token, you do not derive any ordinary income and you do not make a capital gain. In the future, if you exchange the tokens, the cost base of your NewCoin will be zero as you paid nothing to obtain them.

Receipts from ‘Staking’

Staking is a process where individuals ‘lock up’ their crypto assets to support the operation and maintenance of a blockchain network. When decisions are made about the blockchain, the group in consensus (that is, the majority) are rewarded with additional crypto tokens. The process is comparable to earning interest on a bank deposit.

Other activities also called “staking” refer to locking up tokens to restrict supply to support the price; and, often, a rate of return is paid in that token.

The ATO has published web guidance on staking rewards and income tax treatment, stating that the rewards received because of staking are ordinary income, rather than a capital gain. This tax treatment also applies to:

(a) individuals participating in a staking pool, where those individuals will indicate that they always wish to agree with the majority. In these instances, when the pool forms part of the majority, these individuals will receive a small number of coins as a reward.

(b) token holders participating in proxy staking or who vote their tokens in delegated consensus mechanisms. Their assessable income includes the money value of the tokens they receive.

(c) Any lockup mechanism where your tokens are locked into a smart contract, or are not tradeable, and you receive more tokens for doing this.

For example: You hold 100 ETH in a liquid staking pool. Your staking pool forms part of the majority for consensus purposes. As a result, you receive an additional 1 ETH as a reward. The additional 1 ETH is worth $1,000 when you receive it and is treated as your ordinary income. In the future, if you exchange or sell the coins, the cost base of your ETH will be $1,000.

‘Chain Splits’

A chain split can occur when there are two competing versions of a blockchain. The two blockchains share a common history (for example, identical blocks from Block 0 to Block 1,000) but diverge from a point in time (for example, from Block 1,001 onwards the blocks are different).

When a chain split occurs, holders of the token that existed prior to the chain split are often entitled to the same quantity of tokens on the new blockchain. A well-known example of this occurred when Bitcoin Cash forked from Bitcoin. This resulted in holders of Bitcoin also having an entitlement to an equivalent quantity of Bitcoin Cash.

The ATO has published web guidance on chain splits, stating that the receipt of the new crypto asset as an investor is neither ordinary income nor a capital gain. Instead, the cost base of the new crypto asset will be zero. If you dispose of the new crypto asset at some later time, you will need to work out your capital gain or loss. If you held the new crypto asset for 12 months or more before disposing of it, you may be entitled to access the 50% CGT discount.

You can work out which is the ‘new’ crypto asset by considering the rights and relationships of the crypto assets you hold. If the crypto asset has the same rights and relationships as the original crypto asset it is likely a continuation of the original asset. Put another way, the ‘new’ crypto asset is the one with different rights from the original one. If you are unsure, you should seek advice from a crypto tax specialist.

In some cases, the chain split can result in the creation of two new crypto assets and the discontinuation of the original one. If this occurs, the individual incurs a capital loss on the original cryptocurrency and holds two new cryptocurrencies with a cost base of $0.

Example 1: You hold 20 BTC. There is a chain split, and you now hold 20 BTC and 20 BCH. BCH has different rights to BTC. As a result, it is classified as a new crypto asset and has a cost base of zero.

Example 2: You hold 20 BTC. There is a chain split, and you now hold 20 BCH and 20 Bitcoin Gold (BTG). BCH and BTG have different rights to BTC. As a result, they are treated as new crypto assets with a cost base of zero, and you make a capital loss on your BTC.

Keeping track of the crypto assets arising from a chain split can be confusing. CryptoTaxCalculator gives you the ability to categorise particular transactions as ‘Chain Split’, which will help you determine the relevant cost base for your original and new crypto assets.

Salary and wages paid in crypto assets

More employers are now offering crypto assets as remuneration for services rendered by their employees. If you receive crypto assets as remuneration for your services, your employer needs to consider whether the payment is made as part of a valid salary sacrifice agreement or not.

The ATO has published web guidance on salary and wages paid in crypto asset, stating that crypto assets provided to an employee as part of a valid salary sacrifice agreement is a fringe benefit and subject to fringe benefits tax (FBT). In the absence of a valid salary sacrifice agreement, the employee is considered to have derived their normal salary or wages, and the employer will need to meet their pay-as-you-go (PAYG) obligations on the Australian dollar value of the crypto assets paid to the employee.

For example: You are employed by Company A. You do not have a valid salary sacrifice agreement, but your employer pays you 0.1 BTC each month instead of Australian dollars. For that financial year, your employer should meet PAYG withholding obligations for the Australian dollar value of the 1.2 BTC paid to you. If they do not, you are not entitled to any PAYG withholding credits when you lodge your tax return.

Crypto Tax Calculator categorises future sales of crypto assets earned as income as capital gains, with the cost basis being the price when you received the cryptocurrency. We recommend that you check with your accountant if this approach is suitable for you.

Receiving crypto assets for services rendered

The ATO has published web guidance on receiving crypto assets as payment for services rendered as part of a business including as a contractor. Broadly, the Australian dollar value of the crypto assets is your ordinary income of the business, worked out at the time that the income is derived.

For example: You run a technology business. As part of the ordinary course of your business, you provide technology services to Individual A in exchange for 0.1 BTC. The Australian dollar value of the 0.1 BTC at the time you derive it forms part of your ordinary income.

Receiving and giving a gift of crypto assets

Further to the ATO’s web guidance on receiving gifts in crypto assets, no CGT arises at the time you receive the gifted crypto asset. However, if you sell that crypto asset, Crypto Tax Calculator calculates any gains or losses made from the sale as a CGT event with a market value cost base calculated when you received the gift. You will need to check with your tax professional on the nature of the gift and if this assumption is appropriate given your individual circumstances.

Giving a gift of crypto assets is a CGT event and the tax law assumes that you received market value proceeds at the time of the gift. You should seek tax advice before making gifts of crypto assets, including to a charity or Deductible Gift Recipient (DGR).

Initial Coin Offerings

Initial Coin Offerings (ICOs) are events where a crypto asset is distributed for the first time to interested participants in exchange for fiat currency or other crypto assets. Crypto Tax Calculator will categorise most ICO-related transactions as crypto-to-crypto trades for tax purposes. If you have received a crypto asset as a result of an ICO, you may need to seek professional advice as there are circumstances where the receipt of a crypto asset from an ICO could form part of your assessable income.

If you later dispose of your crypto asset, the standard rule that you must calculate whether you made a capital gain or loss from this disposal still applies.

From the ATO Community page, you will need to keep records of your investment regarding the ICO, but tax won't apply until you dispose of your cryptocurrency. You will have to maintain records related to the costs of acquiring and owning the particular crypto from the ICO to form your cost base and work out if you’ve made a capital gain or loss.

For example: Ethereum conducted an ICO, and you acquired 10 ETH for $50. In the future, you sell your ETH for $100. Your capital gain is $50 ($100 – $50).

Using crypto assets

Personal Use Assets

If you keep or use your crypto asset mainly for personal use, it may be treated as a ‘personal use asset’. Any capital gains made on a crypto asset that is a personal use asset is disregarded, provided that you originally acquired the crypto asset for less than $10,000.

When determining whether your crypto asset holding is a personal use asset, the ATO will consider the time between acquisition and the ultimate disposal of that crypto asset. The ATO also considers other factors when making that determination, such as how the crypto asset had been used and the purpose of holding or disposing of it.

Generally, the longer you hold your crypto asset, the less likely it is that the ATO will consider your holding to be a personal use asset. This is particularly the case when you have made significant gains on that asset. The relevant time for determining when a crypto asset amounts to a personal use asset is when you dispose of it. That is, when you dispose of your crypto asset, you look back over your ownership period to consider the nature of your use of the crypto asset.

Crypto assets can be personal use assets if they are kept or used mainly to purchase items for personal use or consumption.

Crypto assets are not personal use assets if they are kept or used mainly:

- as an investment

- in a profit-making scheme, or

- in the course of carrying on a business.

If you have to exchange your crypto asset for Australian dollars (or other crypto assets) in order to acquire items for personal use, it is unlikely that your crypto assets are personal use assets. This also applies when you are required to use a payment gateway or other bill payment intermediary to pay for the item on your behalf.

Where crypto assets are acquired and used within a short period of time, such as acquiring items for personal use or consumption, the crypto asset is more likely to be a personal use asset. It is best to work with your accountant to determine what will or will not fall into this category in terms of your crypto activity.

Example: You have held 0.1 BTC for two years. Occasionally, if you see the opportunity to pay for goods you wish to buy online with Bitcoin, you will make the purchase with Bitcoin. The primary purpose for your holding of Bitcoin is assumed to be an investment. Your holding of Bitcoin is not as a personal use asset.

Example 2: You see an advertisement online for a good you wish to purchase. There is a 2-for-1 offer if you decide to pay with Bitcoin rather than $AUD. You acquire the quantity of Bitcoin required to make the purchase and complete the transaction within a week of acquiring Bitcoin. Your holding of Bitcoin is considered as a personal use asset.

Some individuals are claiming that NFTs are personal use assets because you can enjoy the associated artwork (if any) or use it as a profile picture on social media. You should seek tax advice before taking this position.

Crypto Tax Calculator can assist in tracking holding times, quantities, and use of crypto assets. You can then use this information to determine whether or not it would be considered a personal use asset by the ATO.

Loaning Your Cryptocurrency

In an ATO’s community forum, a staff member of the ATO stated that when crypto is loaned, either to an individual or a lending protocol, this may constitute a disposal event depending on the particulars of the loan and therefore your transaction may be subject to capital gains tax.

However, there is another element to this situation: loaning your cryptocurrency and receiving interest. At Crypto Tax Calculator, our algorithm will categorise any interest earned as income (including staking rewards that are paid periodically like interested). We recommend checking with your tax professional if these assumptions are valid given your individual circumstances.

Example 1: You loan 3 Bitcoin worth a total of $1,000 with a flat interest rate payable in $AUD at 10%. You maintain ownership over the Bitcoin during this period so there is no CGT payable. At some time in the future, you receive 3 Bitcoin from the borrower (Your principle) as well as $100 (Your interest payment). The $100 you received will be subject to income tax according to your tax bracket.

Example 2: You acquire 3 Bitcoin for a total cost of $800. Nine months later you loan your 3 Bitcoin valued at $1,000 with a flat interest rate payable in $AUD at 10%. Due to the terms and conditions of the loan, you do not maintain ownership of the Bitcoin during the period of the loan. Because your ownership ceases at the time of the loan, you must pay CGT.

Capital Gains = $1,000 - $800 = $200

We note Example 2 above is more likely to apply to DeFi lending, which typically does not have legal terms and conditions for you to rely on. This is a complex area and you should seek professional assistance if you are unsure.

6 months after the commencement of the loan, you receive your 3 Bitcoin back, valued at a total of $1,000 as well as your interest repayment of $100.

You must pay income tax according to your income bracket on the $100 interest.

Your ownership of the 3 Bitcoin has ‘reset’ meaning that you will only be eligible for the 50% CGT discount after holding the Bitcoin for 12 months from this point. If you sell the 3 Bitcoin in the future, your cost base is $1,000; the value of the Bitcoin when you re-acquired ownership.

Crypto Assets, Gift Cards and Debit Cards

As the popularity of using crypto assets grows, so do the methods of using your crypto assets to acquire goods and services. The ATO is aware that users can use crypto assets to acquire new gift cards or debit cards, and/or top-up existing gift cards or debit cards. The ATO warns taxpayers that these activities, including using a crypto-denominated gift card or debit card can give rise to tax consequences.

If you acquire a gift card using crypto assets, regardless of whether the gift card is denominated in Australian dollars or crypto assets, you dispose of your crypto assets and acquire the gift card. The capital proceeds from the disposal of the crypto assets are equal to the market value of gift card when it is acquired.

For example: You acquire 0.001 BTC for $80. You later use your 0.001 BTC to acquire a gift card with 0.00099 BTC, when the market value of 1 BTC is $90. You are treated as having disposed of your 1 BTC and the capital proceeds from the exchange are equal to the AUD market value of the gift card. Therefore, your capital proceeds are equal to $89.10, and your capital gain is $9.10.

Similarly, if you transfer crypto assets to a card provider’s wallet as part of the gift card or debit card arrangement, a disposal event can arise. The capital proceeds are equal to the amount indicated on the balance of the card that represents the increase in value of the balance (the top-up amount).

For example: You have a debit card that holds $100. Your debit card provider allows you to add AUD value to this card using crypto assets. You dispose of 0.001 BTC to increase the balance of the card by $80. The disposal of the 0.001 BTC triggers a taxing event, and your capital proceeds are equal to $80.

You should also be aware that when you go to use your gift card or debit card, if the balance is denominated in crypto assets, this too can trigger further taxing events. The ATO states that you must calculate whether a capital gain or loss arises when using the card as part of transactions. This is because the AUD value of the denominated crypto asset changes over time.

Transferring Cryptocurrency Between Your Wallets

The ATO has published guidance that transferring crypto assets from one digital wallet to another digital wallet is not considered a taxable event as long as you maintain ownership of it.

This means that, if you transfer cryptocurrency from your wallet to a wallet owned by someone else, that is a taxable event. If you have received something in exchange for your cryptocurrency transfer, there will be a tax liability calculated according to the standard CGT rules.

If you have not received anything for this transfer (i.e. you transferred the cryptocurrency as a gift), you still have to pay CGT according to the ATO. To calculate CGT in these circumstances, the capital proceeds are the market value of the cryptocurrency at the time of exchange.

Example: You purchase 2 Bitcoin for $2,000. At a point in the future, you send 2 Bitcoin to your friend. You receive nothing in exchange. You have given your friend a gift of 2 Bitcoin.

At the time of your gift, 1 Bitcoin has a market value of $1,500. The total value of your gift is $3,000 (2 x $1,500).

Capital Gain = $3,000 - $2,000 = $1,000

Margin Trading, Derivatives, and Contracts For Difference

Margin trading, derivatives and contracts for difference (CFD) are forms of trading activities that speculate on the price movement of an asset (in this case, cryptocurrency) without necessarily owning the underlying asset.

You are engaging in margin trading if you borrow cryptocurrencies for the purpose of trading and profiting from the difference between the total value of the cryptocurrencies traded over time and the original cryptocurrency loan amount. The ATO has responded to questions about crypto margin trading in the ATO Community forum, indicating that the proceeds from these activities are ordinary income.

Comparatively, you are engaging in a CFD where you enter into a legally binding agreement with a third party that speculates on the short-term movement of an underlying asset’s value. You effectively bet on the change between the opening and closing value of the cryptocurrency. Similar to margin trading, the ATO takes the view that the proceeds from these activities are ordinary income.

For more information about the ATO views expressed above, please see:

ATO CFD Taxation Community Discussion ATO Tax Ruling for Contract For Difference

Example:

You transfer 1 BTC to Bitmex as collateral. You leverage the BTC to 100x at a price of $10,000 USD per BTC (this makes you $1 million long on BTC). BTC goes up 5% before you close your position at 1,050,000.Your balance has increased $50,000 and you still have the BTC. Therefore your total income is $50,000 from this trade

Losses on these products are usually income losses and can be used to offset other income, such as wages. Some of these products are complex and you should seek professional advice to confirm.

Wrapped Tokens and Bridging

In some circumstances, you may have exchanged your crypto assets for “wrapped” versions of that crypto asset which allow you to use the wrapped token in ways not offered by the original token. The conversion from an unwrapped token into a wrapped token may occur on the same blockchain or across different, incompatible blockchains (“bridging”).

A key function of the wrapping and bridging process is that the wrapped token may also allow you to redeem it to regain control over your original token. For example, you hold 1 BTC that you commit to a bridging process. As a result of that process, you are entitled to hold 1 WBTC (wrapped BTC) on the Ethereum network. You could, at any time, redeem the 1 WBTC and regain control over the 1 BTC.

The ATO has now confirmed that the process of wrapping AND unwrapping a crypto asset gives rise to a disposal event. The capital proceeds from the process will be the market value of the crypto asset you received from the transaction.

For example: You acquire 1 BTC for $80,000. Later, you wrap the BTC and receive 1 WBTC. The market value of the WBTC at the time of the process was $70,000. Therefore, you will generate a $10,000 capital loss.

Wrapped Tokens

As the industry grows, there are more and more types of transactions coming into cryptocurrency activity. One of the recent innovations is the ability to transfer cryptocurrency between blockchains by wrapping the underlying token and receiving a new 'similar' token in return.

In terms of the tax implications, there are two arguments:

- Wrapping a cryptocurrency is a 'like-for-like' trade, so it is not a taxable event. It is just a deposit/withdrawal similar to transferring money from one bank account to another and so does not trigger a CGT event.

- Wrapping a cryptocurrency creates a different asset class for CGT purposes as there are new rights for a token on a different blockchain, and so it is taxed as a regular crypto-crypto transaction and hence triggers a CGT event.

Since the ATO has taken rather conservative positions when there are discrepancies like this, we have worked with tax professionals and came to the conclusion to categorise these sorts of transactions in the app as CGT events by default. You should check with your tax professional to see if this categorisation applies to your individual circumstances.

Decentralised Finance and Lending Arrangements

‘Decentralised finance’ (DeFi) has given crypto users the opportunity to use their own crypto to earn more crypto through liquidity pools, yield farming, staking, lending or borrowing. The ATO has confirmed that several taxing events can arise with DeFi arrangements, typically if you are “lending” or “earning” as part of that arrangement. The kind of taxable event and the extent of the tax consequences will depend upon the legal relationship you have with any third parties and the terms of the DeFi arrangement.

The ATO also highlights that the terms used by participants in DeFi arrangements may not reflect their common or legal meaning, which plays a large role in determining your tax consequences. Therefore, we strongly recommend that you speak to your accountant and/or a legal professional to determine what particular types of DeFi transactions would accrue which type of tax.

In recently published web guidance, the ATO has confirmed that most crypto lending arrangements involve a disposal because the beneficial ownership of the crypto asset is transferred under the arrangement. Specifically, you may have transferred your crypto asset for:

another crypto asset or fiat currency, or a right to receive an equivalent amount of crypto assets in the future.

The capital proceeds for the transfer are equal to the market value of the property you received in exchange for the transfer of your crypto assets. The same view applies where you deposit crypto assets as part of a liquidity pool.

Unfortunately, the ATO has taken the view that the tax concessions that apply to “security lending” arrangements do not apply to crypto asset lending.

If you receive a reward, interest, return or yield as part of your DeFi or lending arrangements, these amounts are treated as ordinary income, similar to interest income.

Example 1: You acquire 3 BTC for a total cost of $800. Nine months later you loan your 3 BTC valued at $1,000 with a flat interest rate payable in $AUD at 10%. Due to the terms and conditions of the loan, you do not maintain ownership of the BTC during the period of the loan. Because your ownership ceases at the time of the loan, you must pay CGT.

Capital Gains = $1,000 - $800 = $200

Six months after the commencement of the loan, you receive 3 BTC back, valued at a total of $1,000 as well as your interest repayment of $100.

You must pay income tax according to your income bracket on the $100 interest.

Your ownership of the 3 BTC has ‘reset’ meaning that you will only be eligible for the 50% CGT discount after holding the BTC for 12 months from this point. If you sell the 3 BTC in the future, your cost base is $1,000; the value of the Bitcoin when you re-acquired ownership.

Disposing of crypto assets

Crypto to Fiat Currency

It is common for individuals to exchange crypto assets for ‘fiat currencies’ like Australian dollars, often when an investment is finalised. As highlighted above, the ATO considers that this amounts to a disposal of crypto assets, which is a taxable event under the CGT regime. If you have or are planning to dispose of crypto assets, there are several tax considerations to keep in mind.

-

If you acquire cryptocurrency as an investment, you may have to pay tax on any capital gain you make on the disposal of the cryptocurrency. If you are engaging in high volume or high value crypto asset transactions, you may need to consider whether your activities will amount to the carrying on of a business.

-

You will make a capital gain if the capital proceeds from the disposal of the cryptocurrency are more than its cost base. Even if the market value of your cryptocurrency changes, you do not make a capital gain or loss until you dispose of it.

-

If you hold the cryptocurrency as an investment, you will not be entitled to the personal use asset exemption. However, if you hold your cryptocurrency as an investment for 12 months or more, you may be entitled to the CGT discount to reduce the capital gain you make when you dispose of it.

Example: You have purchased 3 Bitcoin for $1,000. 2 months later you decide to exchange 3 Bitcoin for $1,500.

The capital gain in this transaction can be calculated with the cost base as $1,000 (Purchase price of 3 units of Bitcoin) and the capital proceeds as $1,500 (Exchange value of 3 units of Bitcoin at the time of exchange).

Capital Gain = $1,500 - $1,000 = $500

Hypothetically if you held the 3 Bitcoin for 13 months (instead of 2) and made the same capital gain, the tax payable would be discounted by 50%. Your CGT would be calculated based on $250 instead of $500.

Crypto to Crypto Transactions

It is common for individuals to trade one cryptocurrency for another, often in the course of investment or capital acquisition. Exchanging one cryptocurrency for another (e.g. Bitcoin for Ethereum) will be considered by the ATO to be a CGT event.

If you dispose of one cryptocurrency to acquire another cryptocurrency, you dispose of one CGT asset and acquire another CGT asset. The ATO recognises cryptocurrencies to be property rather than money, which means that the cryptocurrency you receive in return needs to be accounted for in Australian dollars. If the cryptocurrency you received can't be valued, the capital proceeds from the disposal are worked out using the market value of the cryptocurrency you disposed of at the time of the transaction.

Example:

You purchase 0.1 Bitcoin for a total of $10,000. A week later you exchange 0.01 Bitcoin for 20 ETH. At the time of the exchange, 20 ETH is worth $2,000.

The capital gain in this transaction can be calculated with the cost base as $1,000 (Purchase price of 0.01 BTC) and the capital proceeds as $2,000 (Market value of ETH at the time of exchange).

Capital Gain = $2,000 - $1,000 = $1,000

This process can be tedious to calculate for multiple transactions. In the example above, our CryptoTaxCalculator software would automatically calculate the capital gain of $1,000 for you once you import the data sources from which you made the trade/s.

The 50% CGT Discount

Generally, if you hold an asset for more than 12 months and make a capital gain, you can reduce the capital gain by 50%. The remaining 50% you declare as income.

There is serious contention within crypto tax circles about whether dealings such as wrapping, staking or moving on and off centralised changes triggers a capital gain, and hence resets the 12 month period for the 50% discount. This is a critical issue for individuals who hold crypto assets long term.

We are seeking confirmation from the ATO on when CGT is triggered as this is a very important concession that many individuals rely on.

Lost or Stolen Cryptocurrency

If you have lost your cryptocurrency private key or it has been stolen, it may be possible to claim a capital loss. However, you cannot claim a capital loss if you have the ability to recover your cryptocurrency (e.g., because you can use a recovery phrase to access your digital wallet).

Before you can claim a capital loss, you will need to be able to provide evidence that you lost ownership of your crypto assets. Examples of evidence to provide include:

- when you acquired and lost the private key

- the wallet address that the private key relates to

- the cost you incurred to acquire the lost or stolen cryptocurrency

- the amount of cryptocurrency in the wallet at the time of loss of private key

- that the wallet was controlled by you (for example, transactions linked to your identity)

- that you are in possession of the hardware that stores the wallet

- transactions to the wallet from a digital currency exchange for which you hold a verified account or is linked to your identity.

As stated on the ATO website as of 29 June 2022.

In the event of loss or theft, CryptoTaxCalculator gives you the ability to categorise specific transactions as such. Any transactions submitted in-app under the ‘Lost’ or ‘Stolen’ categories will be automatically categorised as a capital loss for you. You may need legal documentation for the loss, contact your tax professional if this happens.

Moving Crypto assets to an Exchange

Moving crypto assets from your personal wallets onto an exchange (or between exchanges) is common for crypto asset users. However, it is important to read the terms and conditions of each exchange as this transfer may involve a disposal event.

You will need to establish whether moving your crypto assets to an exchange transfers ownership over the asset to the exchange or whether they simply negotiate transactions on your behalf.

This distinction is important because, in the first instance, moving your cryptocurrency to an exchange that acquires ownership over the asset may constitute a CGT event. In exchange, you may have received a right to an equivalent amount of crypto assets at a future point in time.

In the second instance, where the exchange simply negotiates on your behalf, you would maintain ownership of the cryptocurrency. If this is the case, “moving” cryptocurrency to the exchange may not constitute a CGT event. Some new and larger exchanges have this functionality.

Unfortunately, the ATO has adopted conflicting views on this point in responding to ATO Community forum questions. On one hand, the ATO states that transferring cryptocurrency between an exchange and your wallet isn’t a CGT event if the asset remains in your name. Conversely, other ATO posts do indicate that a CGT event can occur based on the terms and conditions of the exchange.

Until the ATO view is formalised in web guidance, Crypto Tax Calculator does not categorise deposits and withdrawals to exchanges as CGT events. You should check with your tax professional if that approach is appropriate for your individual circumstances. If so, you can categorise these transactions accordingly in the Crypto Tax Calculator app.

Guidelines for particular crypto assets

Non-Fungible Tokens (NFTs)

Cryptocurrency collectibles known as Non-Fungible Tokens (NFTs) are discrete digital assets built on a cryptocurrency blockchain. They can be bought from a variety of sources and are ultimately stored in a cryptocurrency wallet. As they are non-fungible, they are not designed to be interchangeable with other NFTs on that blockchain. This means that they cannot be exchanged 1:1 for another crypto asset, and each NFT likely possesses an independent market value.

NFTs are often digital representations of characters, animated objects or creatures (e.g. Bored Apes, Cryptounks etc). These assets derive their value from their non-fungibility as the supply of a particular cryptocurrency collectable is always fixed at 1, meaning that their value can quickly be driven up if they have some desirable qualities (e.g. aesthetic appeal).

The ATO has now given specific guidelines on the tax obligations for NFTs. As stated on their website, “the tax treatment of NFTs follows the same principles as cry

ptocurrency.” This means that NFTs are treated as CGT assets, and so the following activities will likely trigger a taxable event:

- Selling NFTs in exchange for cryptocurrency

- Exchanging one NFT for another NFT, or fungible cryptocurrency

- Giving an NFT as a gift

Similar to how cryptocurrencies are currently taxed, investors that make a loss when disposing of an NFT will be able to claim a capital loss to offset any capital gains made otherwise.

The cost base is the cost of acquiring the cryptocurrency collectible (in $AUD) and the capital gain is the price (in $AUD) that it is exchanged for at the point of sale.

Example: You purchase one CryptoPunk for $1000. A lot of people are attracted to your CryptoPunk due to its appearance. As a result, 2 weeks later you can exchange your CryptoPunk for $10,000.

Capital Gain = $10,000 - $1000 = $9000

Having to accurately locate the data above for every NFT transaction is a challenging task, especially when considering that most NFT users aim to flip them for a profit, accruing hundreds of NFT transactions. Rather than calculating NFT taxes by hand, the easiest way to automate this process is by using CryptoTaxCalculator, where you can easily import and reconcile NFT transactions for tax purposes in a few clicks.

There are also GST implications for people dealing in NFT’s as a business, either trading or minting them. If you are engaged in NFT trading as an enterprise, you should seek advice from a tax professional who specialises in crypto.

‘Stablecoins’

Stablecoin is a term used to describe crypto assets that have their value pegged to an underlying asset. The purpose of stablecoins is to afford users the benefits of cryptocurrency without exposing them to as much risk of volatility.

It is common for stablecoins to be pegged to a fiat currency, such as Tether (USDT) which is fixed to the US Dollar. The price stability of these cryptocurrencies leads them to be a preferable choice of payment for employees who seek to be paid in cryptocurrency.

Despite the value relationship between these cryptocurrencies and fiat currencies, for taxation purposes, they are considered by the ATO to be the same as any other cryptocurrency and not as foreign currency.

If you receive a stablecoin as income as part of your job, you will have to pay income tax on the stablecoin according to your income bracket. In addition, you will have to pay CGT upon your disposal of the stablecoin if you make a capital gain. However, since stablecoins are ‘stable’ by nature, it is unlikely that the size of the CGT event will be large.

Example: You receive a monthly payment of 1,000 Tether as part of your income package. The $AUD value of the 1,000 Tether is $1,300. You will have to pay income tax on $1,300 for that month according to your income bracket.

At some time in the future, you exchange the 1,000 Tether for 3 Bitcoin. The 3 Bitcoin are worth a total of $1,500. You must pay CGT on the capital gain from this transaction.

Capital Gain = $1,500 - $1,300 = $200

Similar to NFTs, there can be GST implications if you are dealing with stablecoins as part of a business. If you are engaged in stablecoin trading as part of an enterprise, you should seek advice from a tax professional who specialises in crypto.

Record Keeping for Cryptocurrency

ATO Data Matching Protocol

The ATO has announced the continuation of its crypto asset data matching protocol for the 2023/24 financial year through to the 2025/26 financial year. As part of this protocol, the ATO acquires account identification and transaction data from Australian digital currency exchanges (DCEs) and links that information with ATO systems.

This means that the ATO acquires crypto records relating to approximately 1.2 million Australian taxpayers and, using a specialised matching process, identifies whether users are meeting their tax obligations. Despite what you may hear through public forums, the ATO is aware of your crypto asset transactions.

Therefore, if you are an Australian resident engaging in crypto asset transactions, it is critical that you meet your tax obligations. While identifying the tax treatment of crypto assets and preparing the necessary records may be difficult, CryptoTaxCalculator can help you streamline this process to make the complicated process of declaring your crypto asset activities with tax regulators easier.

Keeping Records

It is critical that you maintain records of all your crypto asset activities. Records may be requested at the discretion of the ATO and generally need to be held for a period of 5 years after the crypto asset activity.

The records you maintain must include the following:

- the date of the transactions

- the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be taken from a reputable online exchange)

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

In addition to the above requirements, you should keep records of:

- receipts when you buy, transfer or dispose of crypto assets

- a record of the date of each transaction

- a record of what the transaction is for and who the other party is

- exchange records

- a record of the value of the crypto asset in Australian dollars at the time of each transaction

- records of agent, accountant and legal costs

- digital wallet records and keys

- a record of software costs that relate to managing your tax affairs.

If you routinely engage in crypto asset transactions, this can be a tedious process. Crypto Tax Calculator offers a range of functions to help streamline the record-keeping process for you, by helping handle importing and categorising your data automatically.

How can Crypto Tax Calculator help?

Crypto Tax Calculator wants to make the complicated process of declaring your crypto asset activities with tax regulators easier. From decentralised exchanges to non-fungible tokens, we are one of the most integrated crypto tax software products on the market. If you are not already taking advantage of crypto tax software, try it today for free. We also offer a 30-day money back guarantee on all purchases.

Disclaimer

Please note that this Guide is for general information purposes only and represents the opinions of Crypto Tax Calculator and our experienced crypto tax professionals. We note that some topics outlined by this Guide have not been clarified by the ATO and remain debated amongst professionals. Ultimately, the ATO could release further guidance on these topics which conflicts with the information outlined by this Guide. The ATO could also publish views which retrospectively change the tax implications outlined by this Guide. If you rely on information contained in this Guide, you do so at your own risks.

This Guide should not be used as or in substitution for legal, financial or taxation advice. An attorney-client or tax advisor-client relationship is not created by viewing this Guide, or by purchasing or using the software from CryptoTaxCalculator. Any assumptions and default positions of the CryptoTaxCalculator software for transactions are not advice or endorsement that the position suggested is accurate.

If you have concerns about how the Australian tax laws apply to your circumstances, consult a professional advisor.

Tim Brunette is the CTO of CTC, where he leads technical operations and applies his expertise in cryptography, and machine learning to solve challenging problems in the cryptocurrency ecosystem. He previously worked at Accenture, holds a Bachelor in Space Engineering and a Masters in AI.