How to survive in a crypto bear market

So, are we even in a bear market?

According to Investopedia, “a bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.” Stepping aside from this more technical definition of a bear market, a decision on whether or not we’re in one can come down to some as intangible as ‘feeling’. If you’ve noticed a reduction in enthusiasm in the industry, then it’s likely on an emotional level, we’ve dropped into a bear market. With this being said, it’s really up to you to determine whether we are or aren’t in a bear market right now.

Risk Profile Analysis

If you’ve come to the conclusion that we are indeed in the midst of a bear market, then it’s time to strategize how to get the most out of it. The most important first step to developing a bear market strategy is to evaluate your risk profile. A risk profile is a tool that investors use to identify if a particular investment falls within their appetite for risk.

Aggressive risk profile: This is a trader whose portfolio consists predominantly of small market cap tokens, maybe some BTC and ETH and no stablecoins. They’re open to using platforms that haven’t been audited and are likely to be among the first user groups. They’re likely invested in dozens of different projects.

Moderate risk profile: This is a trader whose portfolio consists mostly of BTC and ETH, with a smaller proportion of stablecoins and small market cap tokens. They likely only use protocols that they’ve put the work in to understand, and have a good reputation in the space.

Low-risk profile: This is a trader whose entire portfolio is made up of BTC, ETH, and stablecoins. They likely don’t invest more than 5-10% of their net worth in crypto.

Crypto Bear Market Strategies

Now that you can use the above as a high-level guide to assess where your risk profile is sitting, we can dive into relevant bear market strategies. As always, this is neither financial nor tax advice. Make sure to do your own research and talk to a professional if you’re ever uncertain.

Dollar-cost averaging

Dollar-cost averaging is an investment strategy that aims to reduce the impact of volatility on the purchase of assets. It involves buying equal amounts of the asset at regular intervals. An example of this would be to set a recurring buy on a monthly basis for 0.2 ETH. You can set and forget, and your accumulation of the asset will continue to grow in time for the next bull market.

Buying the dip

The first step in this strategy is to identify which assets you want to own. It helps to have a risk profile in mind when you make this selection. Ideally during a bear market, you’ll allocate a portion of your spend into typically low-risk assets.

Portfolio diversification

Portfolio diversification is the practice of spreading risk across your portfolio, and consequently limiting exposure to any single type of asset. By diversifying, you’re ensuring that the future of your portfolio doesn’t rest on the performance of a single asset.

Staking

If you’re bullish on holding your crypto assets for the long-term, then you could double down on this strategy by participating in staking protocols. By staking, you’ll be able to lock your crypto (that wouldn’t have been doing anything else!) into a program to generate a passive income. This means that regardless of what the market is doing, you’ll be increasing the value of your portfolio incrementally. For more information on staking, check out our blog here.

Margin trading

Margin trading is the practice of borrowing crypto funds in order to gain access to a higher amount of capital. As mentioned in our margin trading blog, this isn’t for the noob trader, so tread carefully. During a bear market, experienced investors can profit by shorting - by betting that the price of a particular asset will decrease. Read more about it here.

Tax-loss harvesting

Tax-loss harvesting, the bear market, and the tax world come together in one simple process. We go into more depth on how to tax-loss harvest in our blog here, but the main takeaway is that if you sell any crypto assets at a loss, you might be able to use these losses to offset any capital gains. Depending on your region’s guidelines, you might even be able to carry over these losses to consequential financial years!

Hodling (Holding on for dear life)

Quite possibly the most simple strategy to implement during bear marketing: hodling. Obviously, the onus is on the individual trader, but if you’re bullish on crypto in the long-term, then you can hold onto your assets regardless of the market action. This means regardless of if the value of your portfolio may shift up and down and all around, you let your assets sit tight.

How can Crypto Tax Calculator help in a bear market?

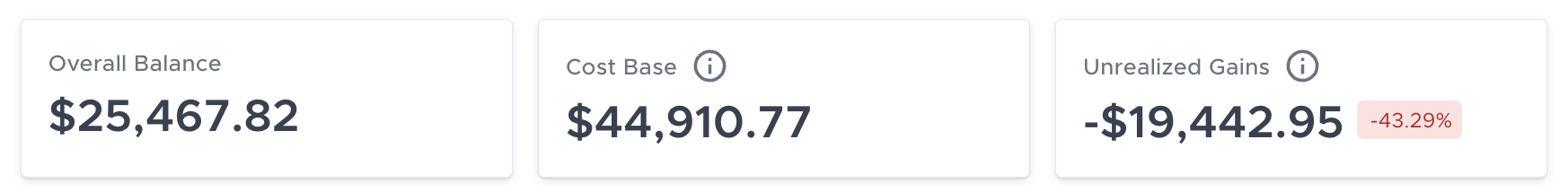

So, how can Crypto Tax Calculator help an individual in a bear market? The answer is twofold. First up, the platform’s dashboard acts as a portfolio tracker. This gives you a quick way to see an aggregate of all of your holdings and how they’re performing at any given time. Secondly, you can view your total value, cost basis and unrealized gains and/or losses as part of our crypto tax algorithm.

Once you’ve imported your transaction history from any exchanges, wallets and/or blockchains you’ve engaged with, our software will be able to provide you with the insights you need to make informed decisions.