The Ultimate Guide to Bitcoin Taxes

When you look at recent years, you will soon find that there has been a steady increase when it comes to the overall use of virtual currencies. This includes Dogecoin, Litecoin, Ethereum and Bitcoin. Crypto currencies are used not only as payment methods, but also as investment opportunities. Virtual currencies have also created a legal vacuum, which is now full to the brim with regulations. A lot of them revolve around tax and the way that cryptocurrency taxes are paid.

All About Bitcoin Tax

Bitcoin is the most prominent virtual currency. It’s important to know that it is a substitute for real currency and therefore holds the same value. You can change Bitcoin into Euro, Australian dollars, US dollars or another virtual currency. Usually any kind of cryptocurrency is traded online, anonymously. Bitcoin is unregulated as well, which means that it is not dependent on governmental backing or central banks. It’s important to know that Bitcoin has not obtained any kind of legal tender status in a lot of jurisdictions yet and certain tax authorities have noted its significance. If you want to find out more about Bitcoin tax, then take a look below.

The United States

The United States IRS service treats the currency, Bitcoin as being property as opposed to a currency. Any transactions that use Bitcoin will be taxed in the same way as property. This means that you need to report any Bitcoin transactions you do to the IRS so that they can be taxed. If you are a US taxpayer and you sell goods in exchange for Bitcoin currency, then you will be obliged to state the value of any Bitcoin you receive. You can file your crypto taxes in your annual tax return. The value of Bitcoin is based on the fair market value, on the date when the currency was received by the taxpayer. This would otherwise be the exchange data on the date of the receipt. If your virtual currency is an asset, such as stocks, bonds or any other type of investment property then it is your job as a taxpayer to take into account the taxable gains or losses. A taxable gain is when the USD market value in relation to Bitcoin is greater than the basis of the currency. A loss is when the market value is lower than the basis of the currency. If you happen to engage in Bitcoin mining or if you use your computer to validate transactions, then this will be subject to US taxation. If you find that the mining is successful, then the miner will need to include the fair market value and add it to your gross income. Wages that are paid in any kind of cryptocurrency, including Bitcoin are subject to tax withholding and social security. Taxpayers who do not comply may become subject to a range of penalties. For this reason, it’s vital that you take the time to understand the crypto tax in your area.

The EU

In the EU Bitcoin taxes are dependent on the country you are in. The purchase and sale of Bitcoin does not incur any VAT and Bitcoin transactions are in fact subject to other taxes as well. This can include income tax or capital gains. In the year 2015, the European Court of Justice ruled that any transactions that include Bitcoin are exempt from value-added tax. This is under the provision that it relates to currency, banknotes or coins, which are legal tender. According to the Court of Justice, Bitcoin is listed as being currency and it is not property. Nonetheless, many countries do tax Bitcoin with capital gains as well as income taxes.

The UK

In the UK, Bitcoin is a foreign currency. The tax rules that apply to losses and gains do in fact apply to transactions. Speculative transactions may not be subject to tax. HMRC do provide some vague information regarding the taxation and enforcement of Bitcoin transactions but they also say that each will be considered on the basis of circumstances and individual fact.

Germany

In Germany, Bitcoin has been considered as being private money since the year 2013. Although it is subject to 25% gains tax, this tax is only levied if the profits on the currency are acquired within a year of the receipt. This means that taxpayers who hold Bitcoin are not going to be subject to capital gains tax if they hold it for longer than a year. If this is the case, then their transaction will fall under the scope as being a private sale. The treatment of Bitcoin in Germany is very similar to shares and stocks.

Japan

In Japan, Bitcoin is known as being a payment method that is widely recognised. The sale of Bitcoin is completely exempt from consumption tax from 2017 and virtual currencies are asset-like values. This means that they can be transferred digitally. In the country of Japan, profits which are gained are considered as being business income and therefore are treated in accordance with capital gains for tax purposes. Source: Pexels (CC0 License)

Australia

In Australia, any transactions which use Bitcoin or any other type of virtual currency falls under the barter arrangement scope. AU tax authorities see Bitcoin as being an asset that can be used for capital gains. Businesses which conduct any kind of transaction by using Bitcoin should record and date the transaction, so that the value in AUD can be declared as being ordinary income. If Bitcoin transactions were being used for personal purposes then they would be exempt from taxation if any Bitcoin was used to buy goods or a service, which is for personal use or if the value is lower than AUD 10,000. It is important to note that if you held Bitcoin for investment purposes then you need to pay taxes on the gains. If you were to mine or exchange Bitcoin as a business, or for business purposes, then this would be considered as stock trading and would be taxed.

The World of Bitcoin Taxes

Different countries around the world view Bitcoin very differently and the tax you pay will largely depend on where you live, or where you are trading from. The EU consider Bitcoin to be a currency, but other jurisdictions, including Australia or even the US consider Bitcoin to be more of an asset or a property. If you want to find out how Bitcoin tax is calculated then the best thing that you can do is try and use an online tax calculator. When you do this, you can then simplify the whole process.

But how do I get my taxes sorted?

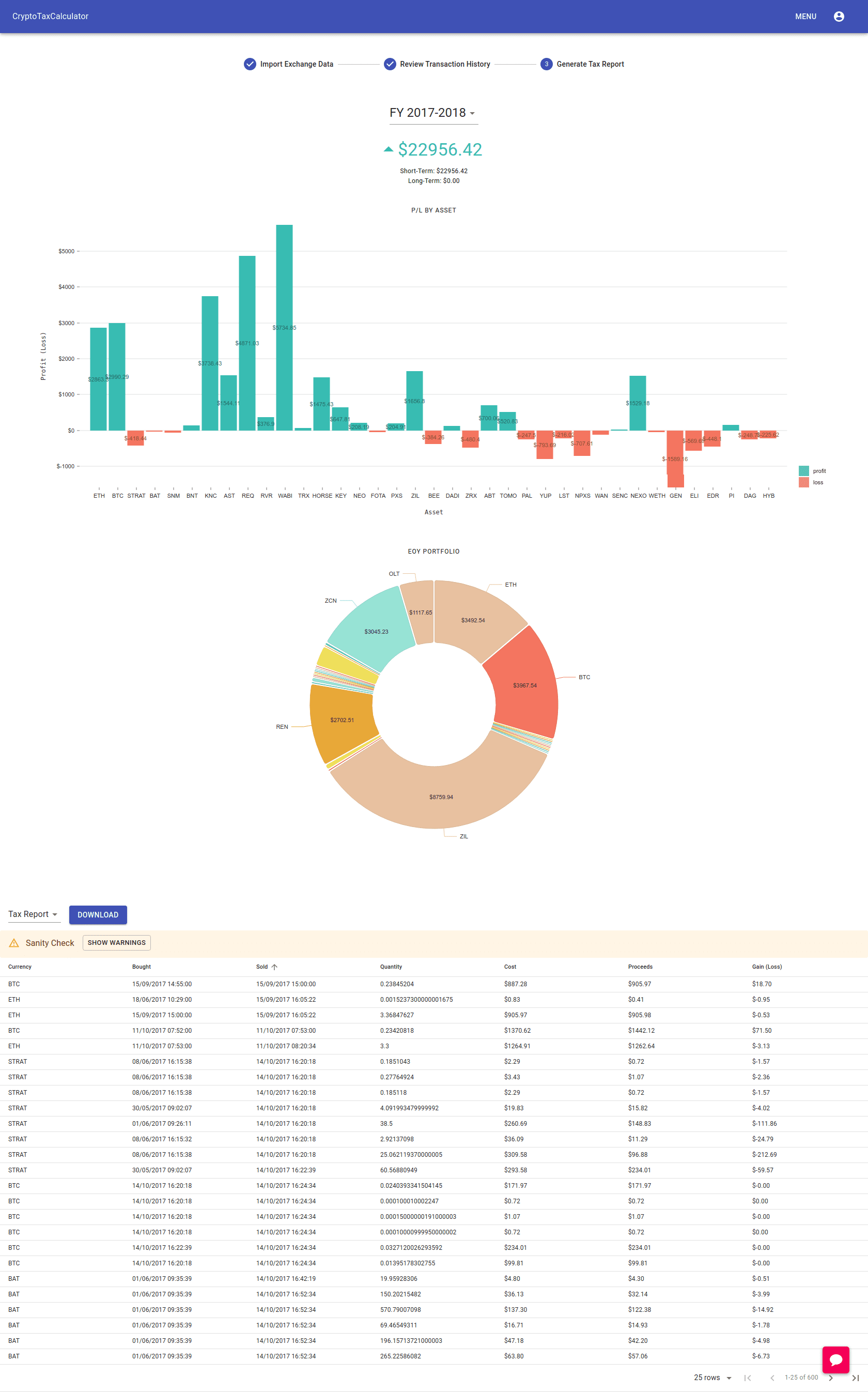

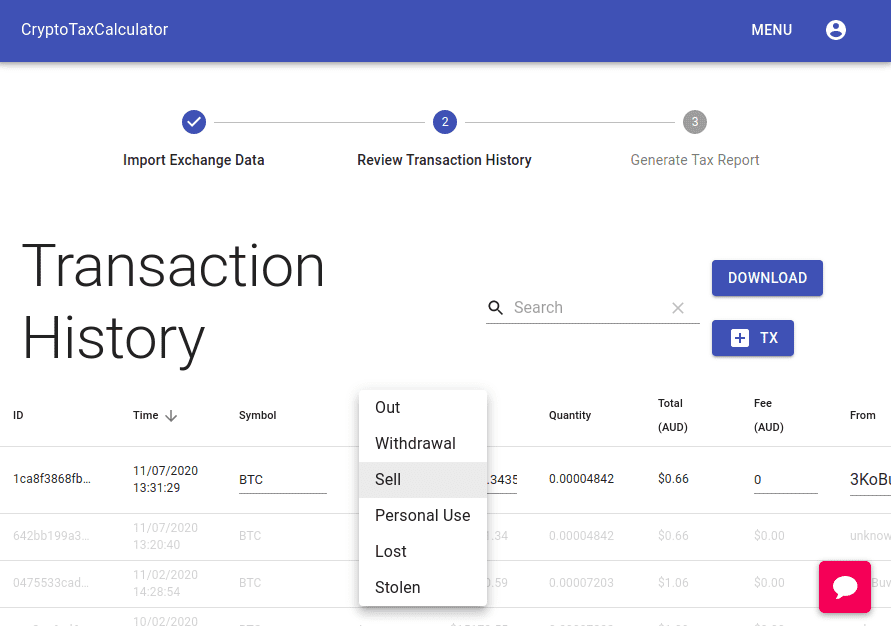

Fortunately Crypto Tax Calculator can help you sort out your Bitcoin taxes. You can import all your Bitcoin transaction history by simply copying and pasting your public wallet address into our app. From there you can select different transaction categories such as personal use, withdrawals to exchanges, purchases or sales, and mining, among many others. Based on the categorisation of your transactions, we will help you calculate your crypto tax obligations and generate appropriate records based on your country requirements.

How to Import Your Bitcoin Wallet Data into Crypto Tax Calculator

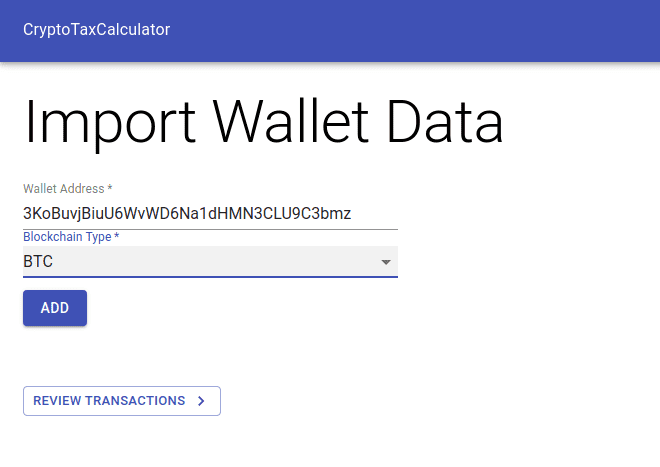

- Sign up to Crypto Tax Calculator

- Navigate to https://app.cryptotaxcalculator.io/wallets

- Copy your Bitcoin public wallet address and select Bitcoin as the blockchain

- Click on "Review Transactions"

- Review and categorise your Bitcoin transaction history

- Once complete check out your tax report for any financial year