How to submit your cryptocurrency report using TurboTax

Key takeaways

- TurboTax has two different main page layouts depending on your account type. This guide explains the process for both of them.

- You will need to report both your capital gains from crypto as well as your income from crypto.

- Crypto Tax Calculator (CTC) simplifies your crypto tax reporting and supports both the Desktop and online versions of the TurboTax app.

Given the popularity of TurboTax in the US and Canada for tax reporting, you'll probably want to learn how to report your crypto profit or loss alongside your regular income and capital gains.

To comprehensively report your crypto on Turbo Tax, you will need to upload both a crypto capital gains report and a crypto income report.

You can get both of these reports from Crypto Tax Calculator, which supports both the Desktop and online versions of the TurboTax app.

Here's a quick overview of how to file your crypto tax in TurboTax. Read on for detailed step-by-step instructions with screenshots of the TurboTax software.

| CTC Report | Tax Type | Import Method |

|---|---|---|

| TurboTax - Capital Gains Report (Online) | Capital gains | Upload the downloaded file |

| TurboTax TXF - Capital Gains Report (Desktop) | Capital gains | Upload the downloaded file |

| Income Report | Income | Manually enter the figures |

Multiple methods below

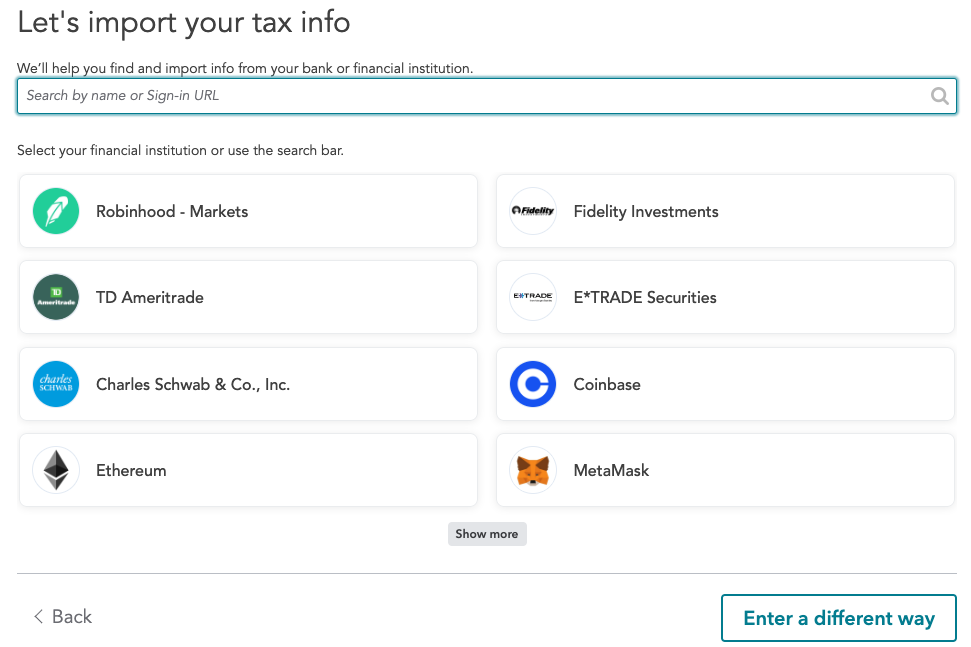

As of February 2025, TurboTax has two different main page layouts upon login. This article covers both layouts. If the sidebar shown in Layout 1 is not visible on your screen, please skip ahead to Layout 2.

How to Import Your Capital Gains Report into TurboTax (Layout 1)

1. Set up your account on TurboTax

Go to the TurboTax website and create an account or sign in if you already have one. Follow the prompts to set up your account. Make sure to check the box for "I sold stock or crypto" or a similar option if it’s available.

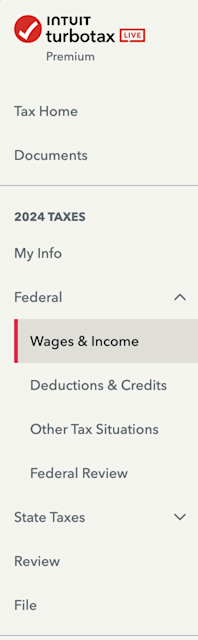

2. Navigate to Federal > Wages & Income

Click on the Federal Tab on the sidebar once you have completed the “My info” section to start filing your wages and income. Follow the prompts and check crypto investment-related boxes.

3. Add 'Investments and Savings Income'

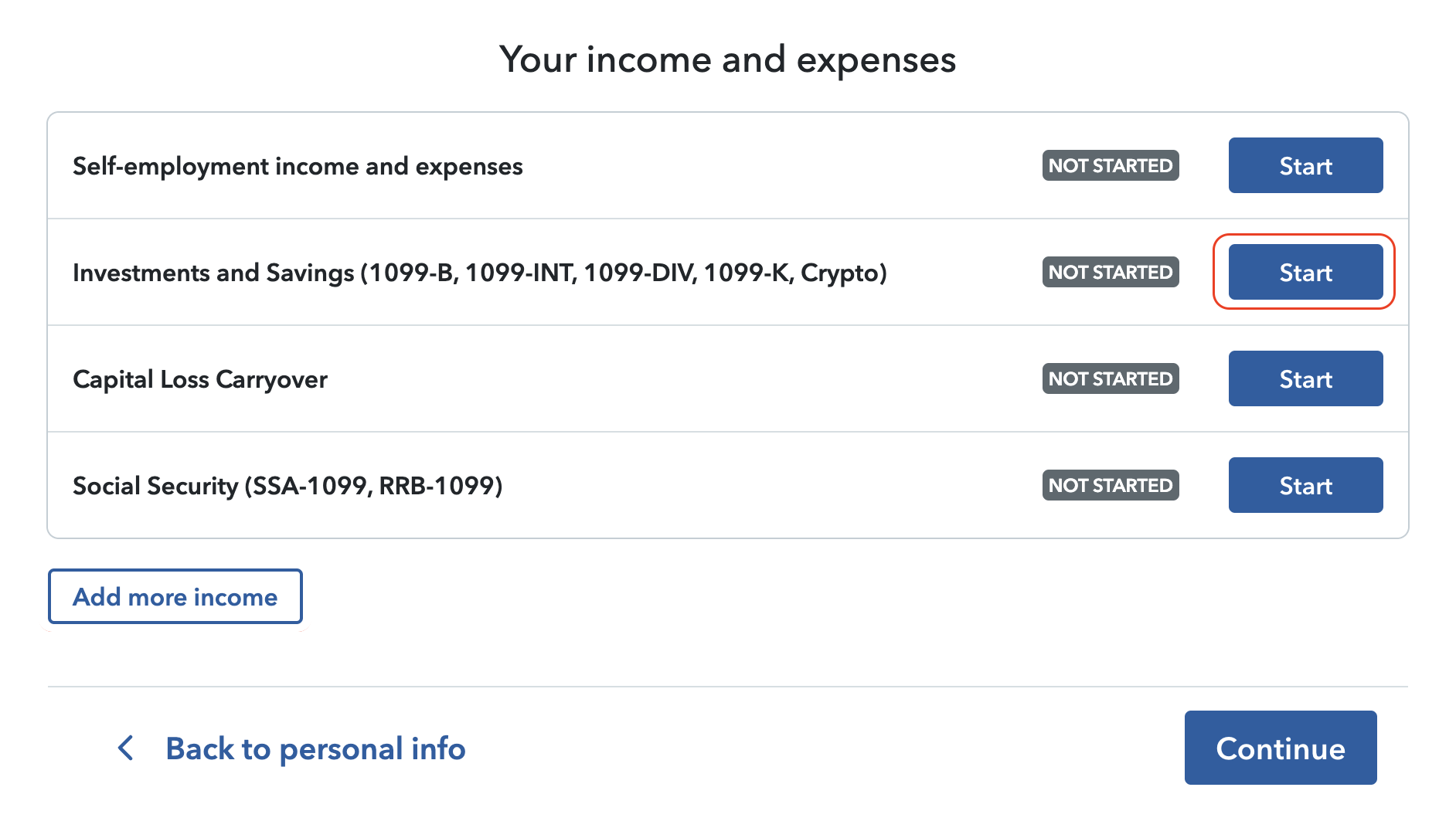

TurboTax updates its website from time to time and provides different workflows tailored to its users' individual situations. After prompts, you will be led to a page that looks similar to the image below. Click Start on Investments and Savings and answer the questions accordingly.

If you don’t see this option, scroll down and look for Investments and Savings to get started.

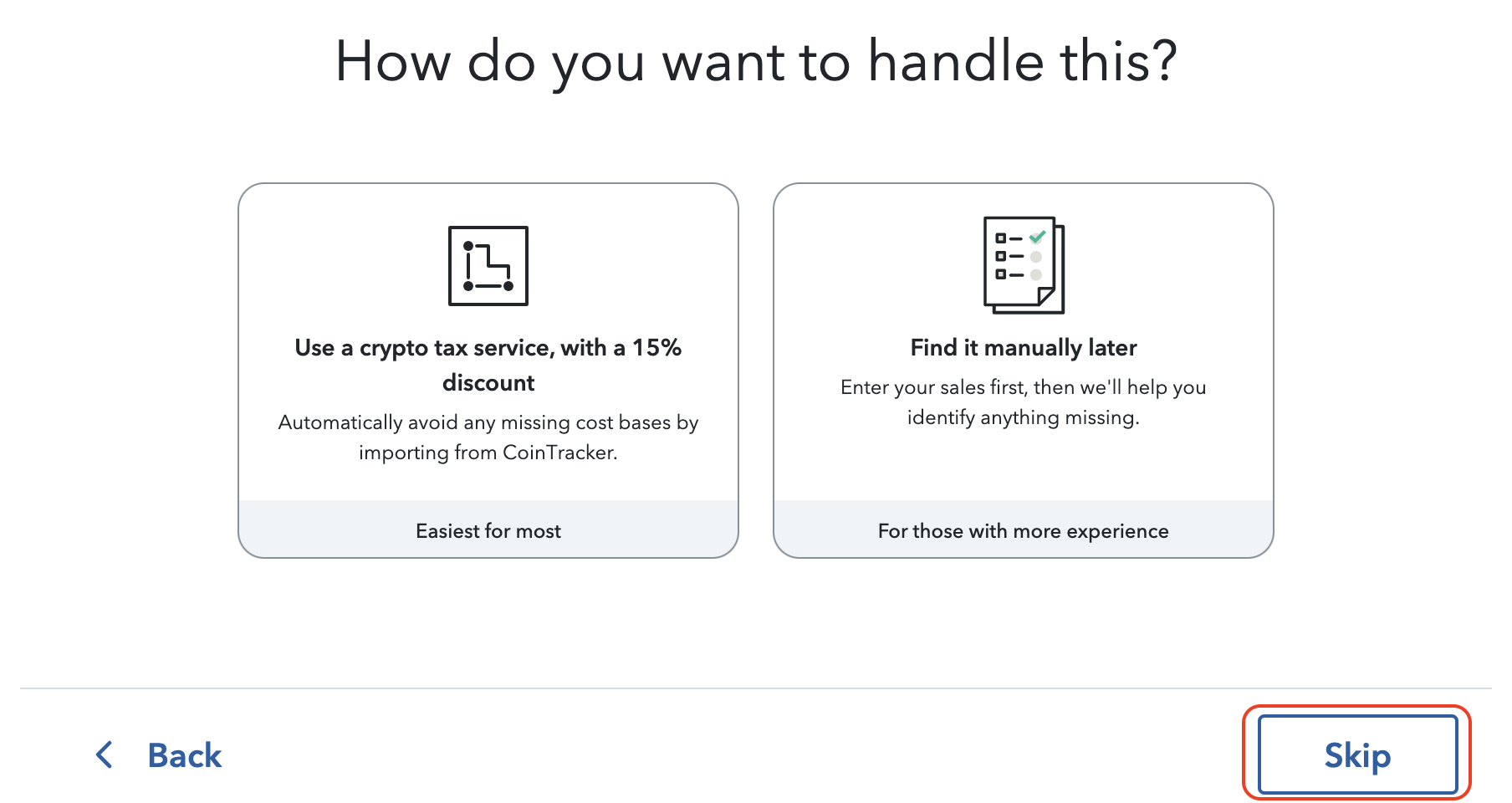

When asked how to handle it, click Skip.

4. Upload your TurboTax Capital Gains Report

You will be prompted to choose which cryptocurrency service to import your information. Select Enter a different way.

Then select Cryptocurrency.

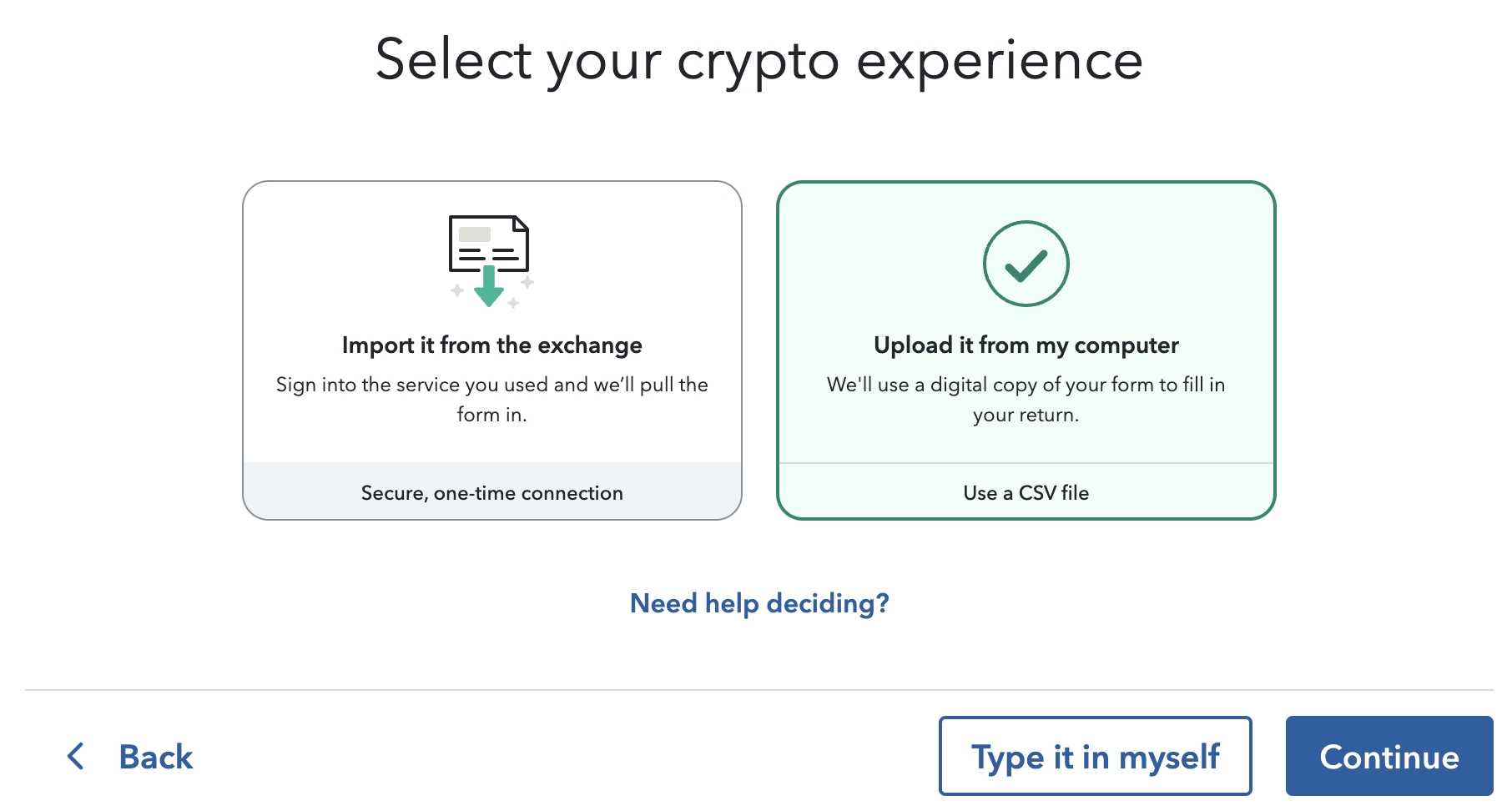

Then select Upload it from my computer.

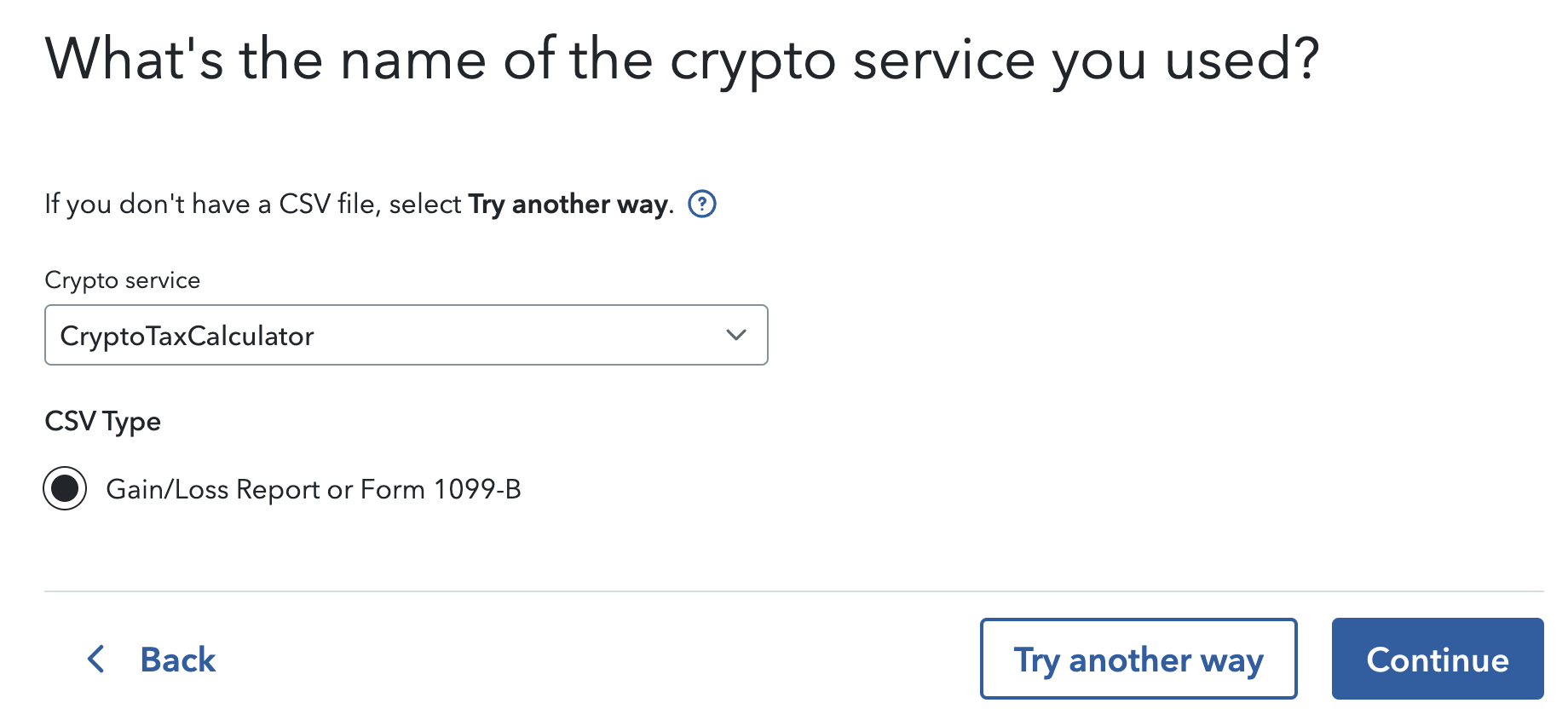

Select CryptoTaxCalculator in the 'Crypto service' dropdown menu, and select Gain/Loss Report or Form 1099-B as your CSV Type, and click Continue.

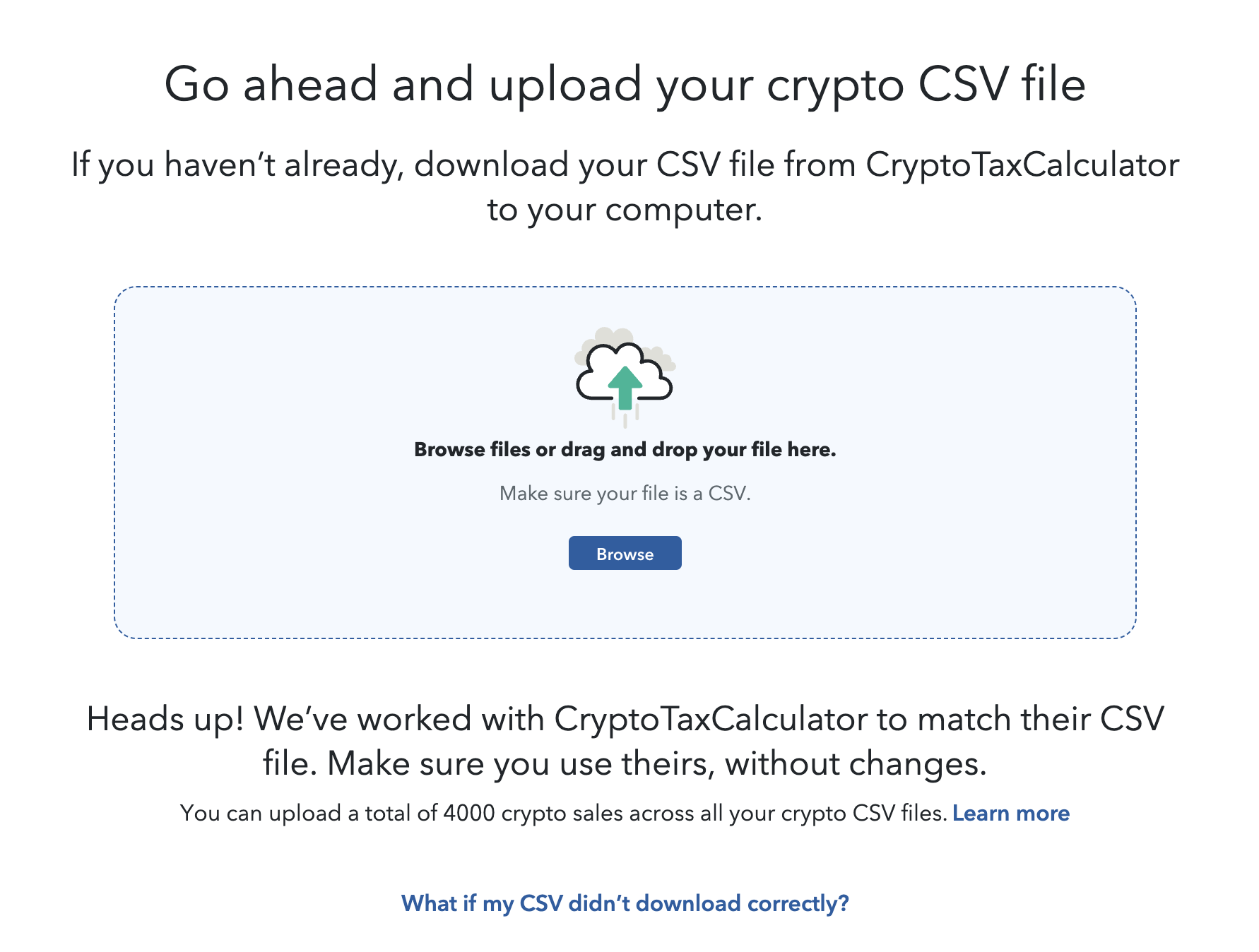

If you have already downloaded the TurboTax file from Crypto Tax Calculator onto your computer, you can now upload it to TurboTax.

If you have not downloaded this form yet, follow the below steps to download the TurboTax Online report from your CTC account and import it directly into TurboTax:

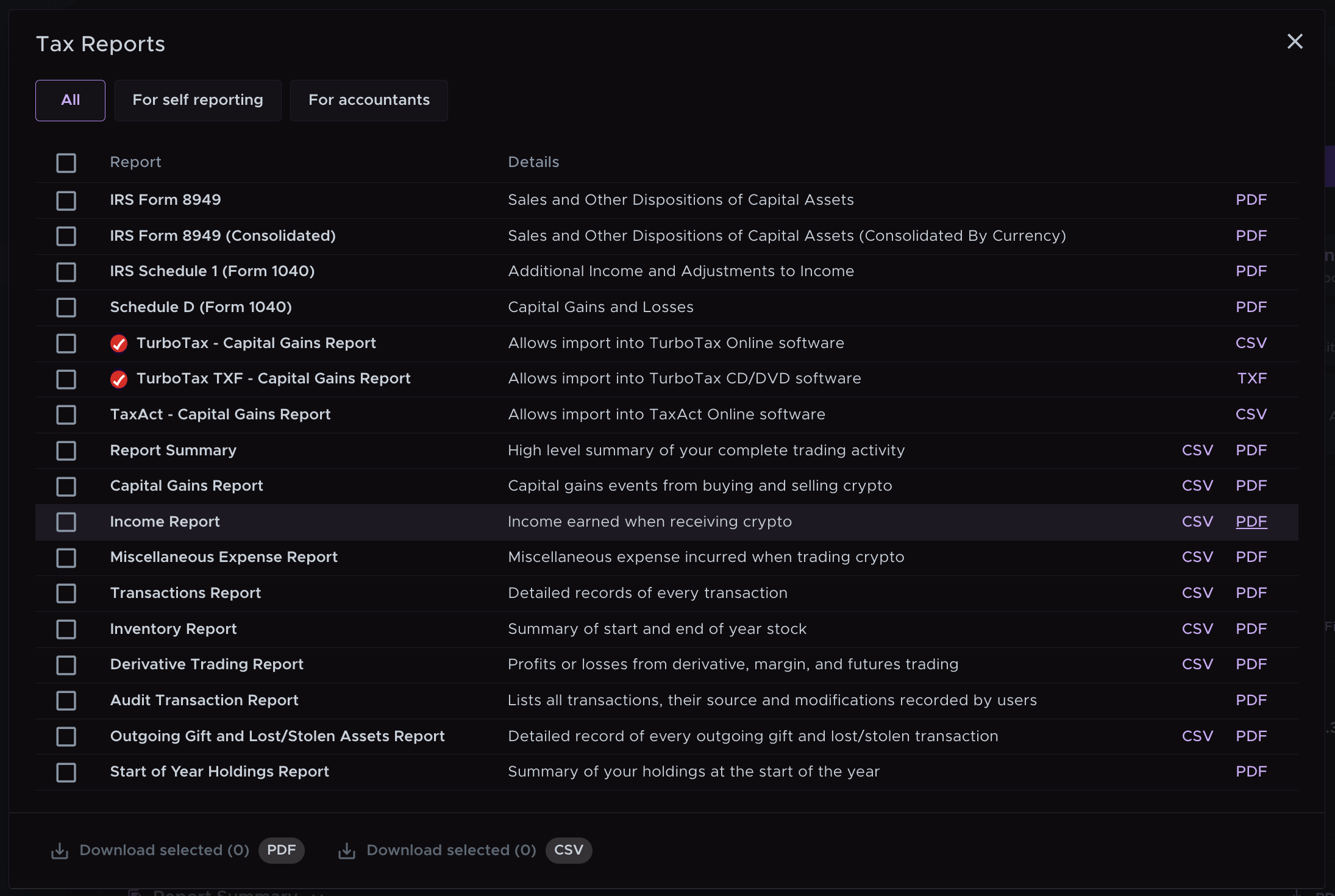

- Go to the Reports page, confirm the report period and tax settings are correct, and proceed to download the report.

- With TurboTax Online: Click 'Turbotax Online' to download the TurboTax - Capital Gains Report.

- With TurboTax CD/DVD: Click 'Download reports'. Download TurboTax TXF - Capital Gains Report in the report menu.

5. Review Taxable Transactions in TurboTax

Once the file is uploaded, you can review the imported transactions. A few things to be noted:

- Only capital gain transactions are imported from the TurboTax Capital Gains Report file. To report your income, check the following section.

- Short-term and long-term gains are listed separately, even with the same token.

- Edit or add transactions if necessary.

Get a crypto tax report ready for TurboTax in minutes.

1

Select country

2

Connect accounts

3

Get tax report

No credit card required

How to Import Your Capital Gains Report into TurboTax (Layout 2)

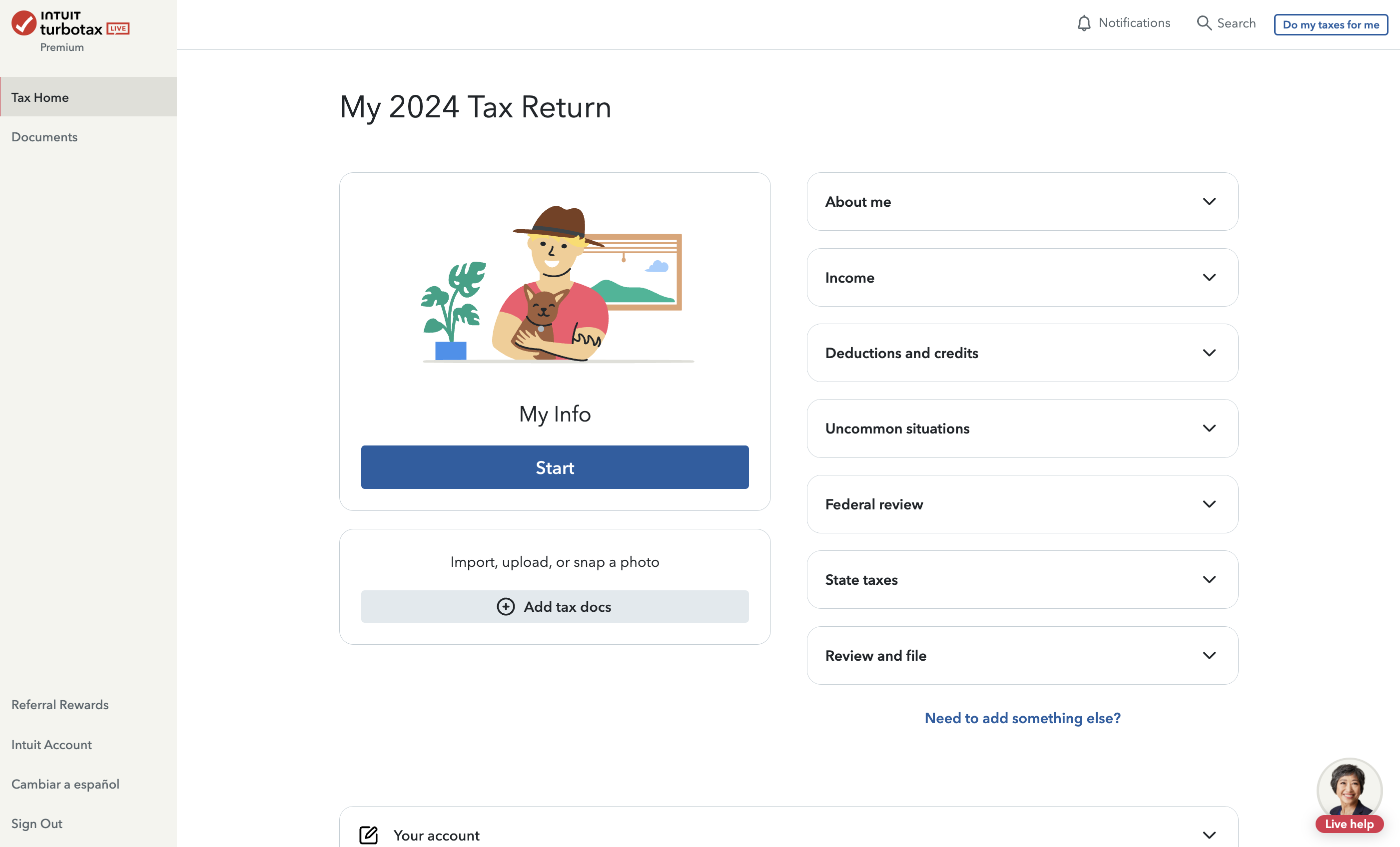

Note: TurboTax has two different main page layouts. If your screen looks different from the one shown below, please follow the instructions in this section instead.

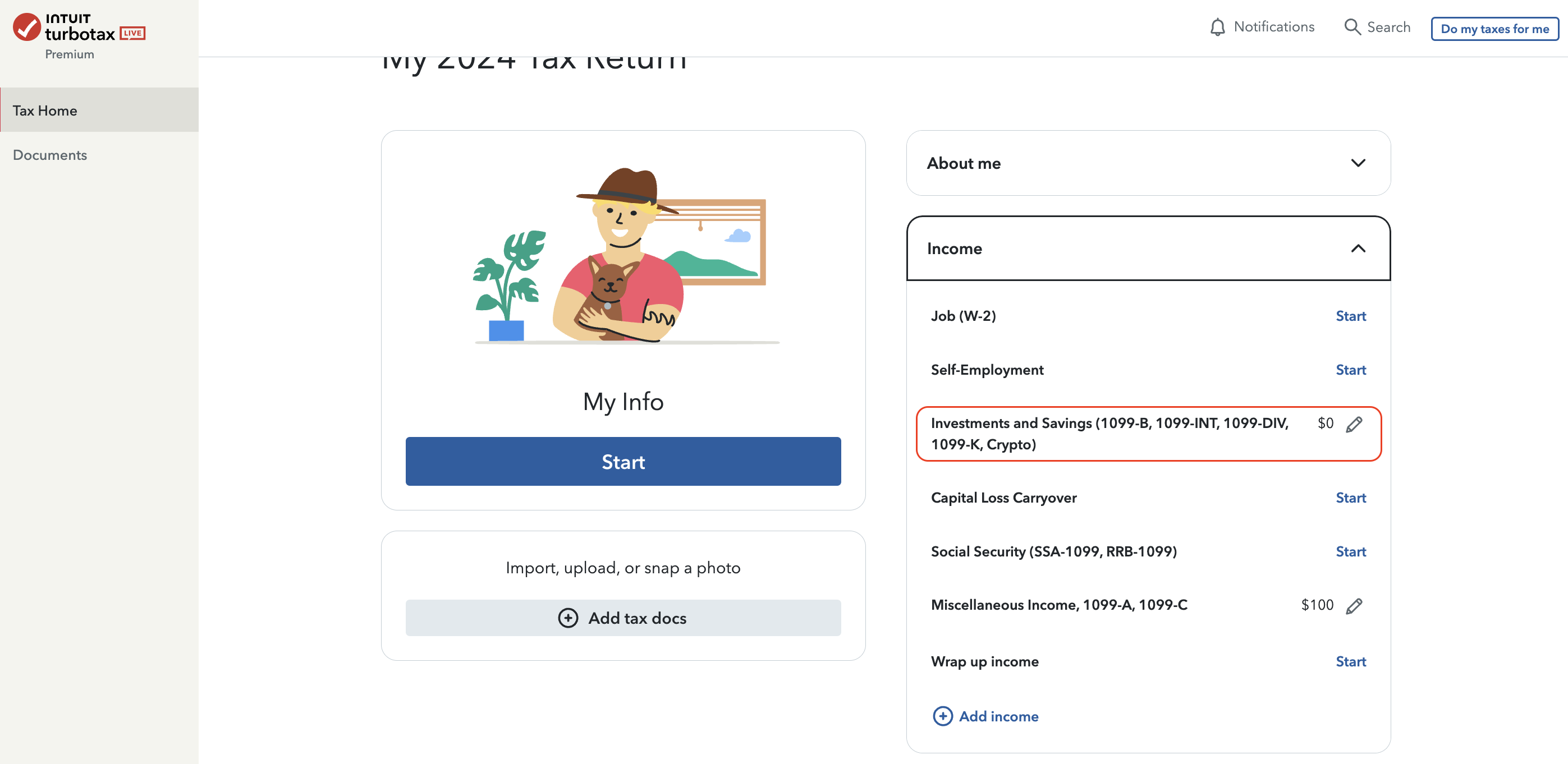

After setting up your account and logging in, you should see the following page.

Click the edit icon next to Investments and Savings and answer the questions based on your situation.

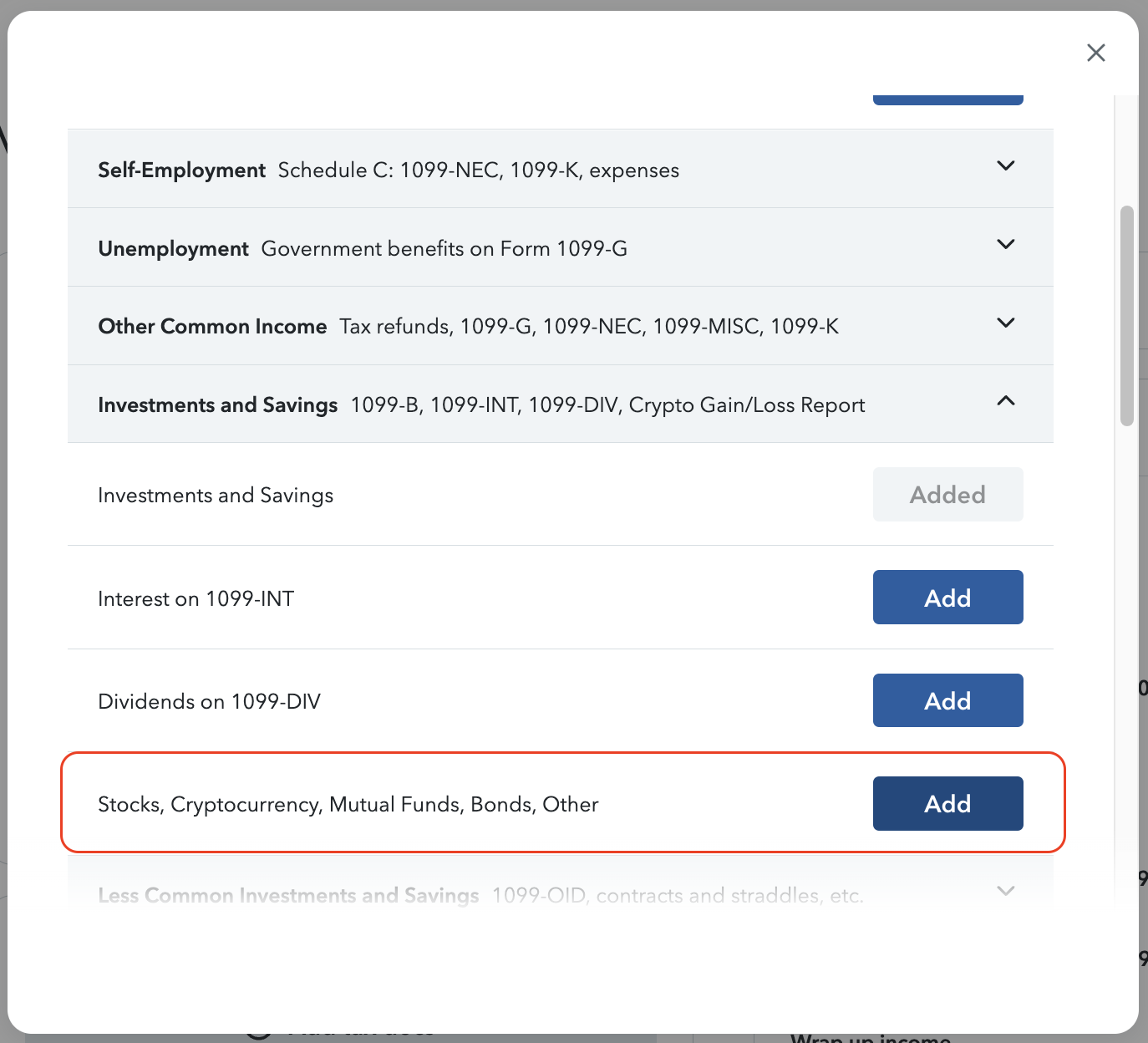

If you don’t see this option in the dropdown menu, click Add income, then select the Investments and Savings category that includes cryptocurrency.

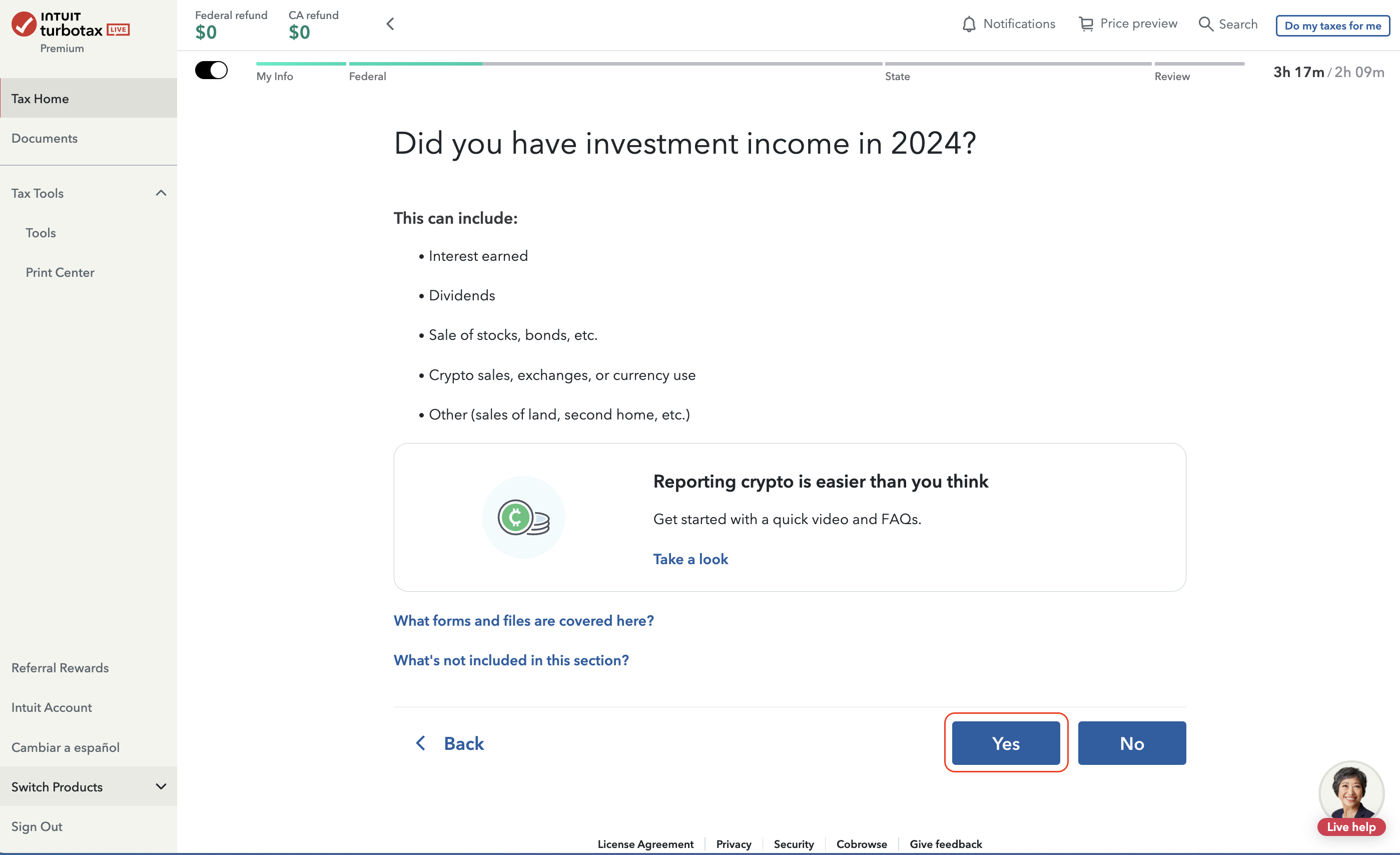

Select Yes to proceed.

Return to Step 4 in the section above and continue with the instructions.

How to Report Other Crypto Income in TurboTax

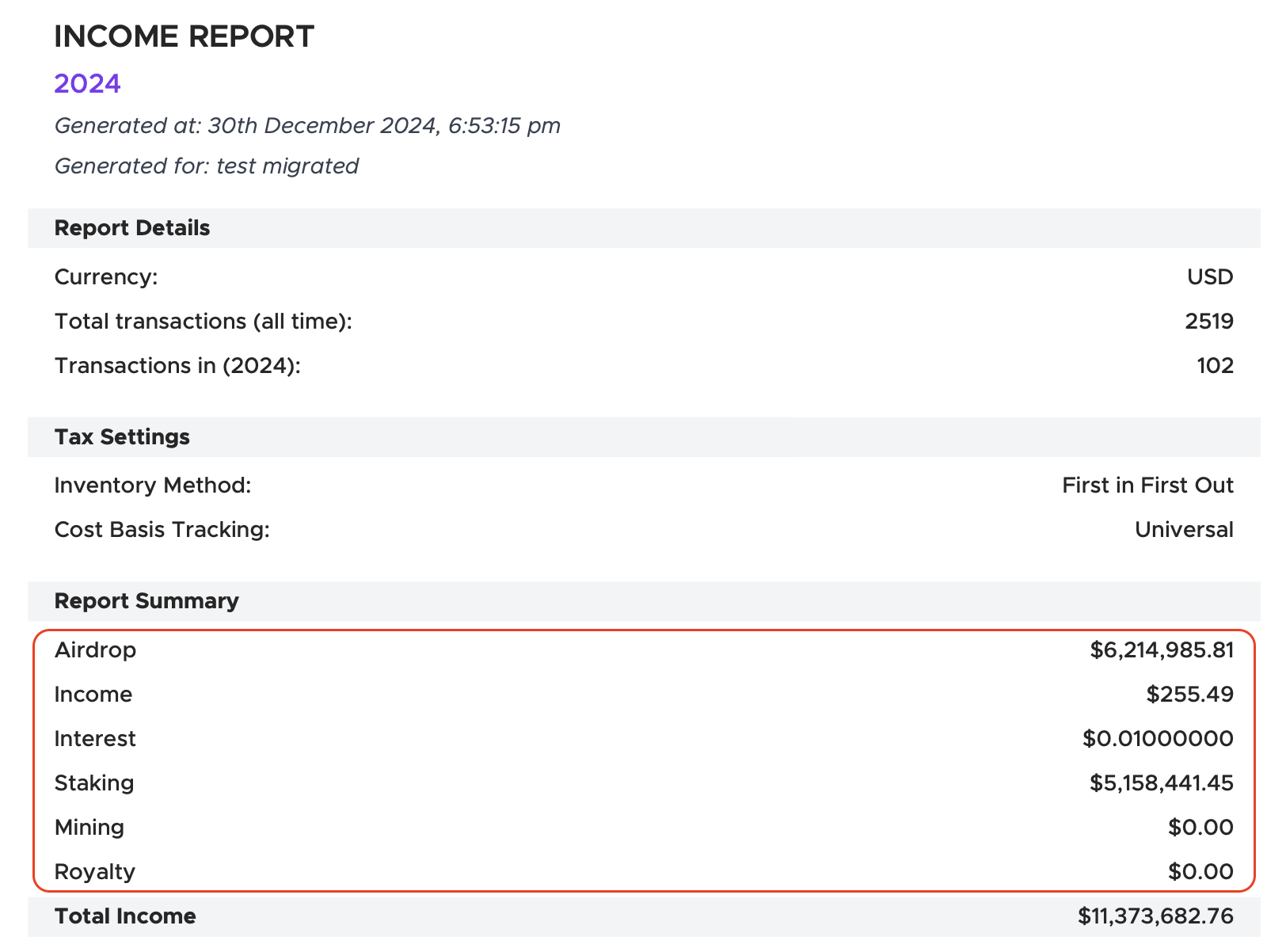

1. Download your CTC Income Report

Go to the Reports page and select Download Reports. From the tax report menu, download the Income Report PDF.

2. Navigate to Federal > Wages & Income In TurboTax

As explained above.

3. Fill out your other crypto income

- Click Add More Income.

- Choose Less Common Income.

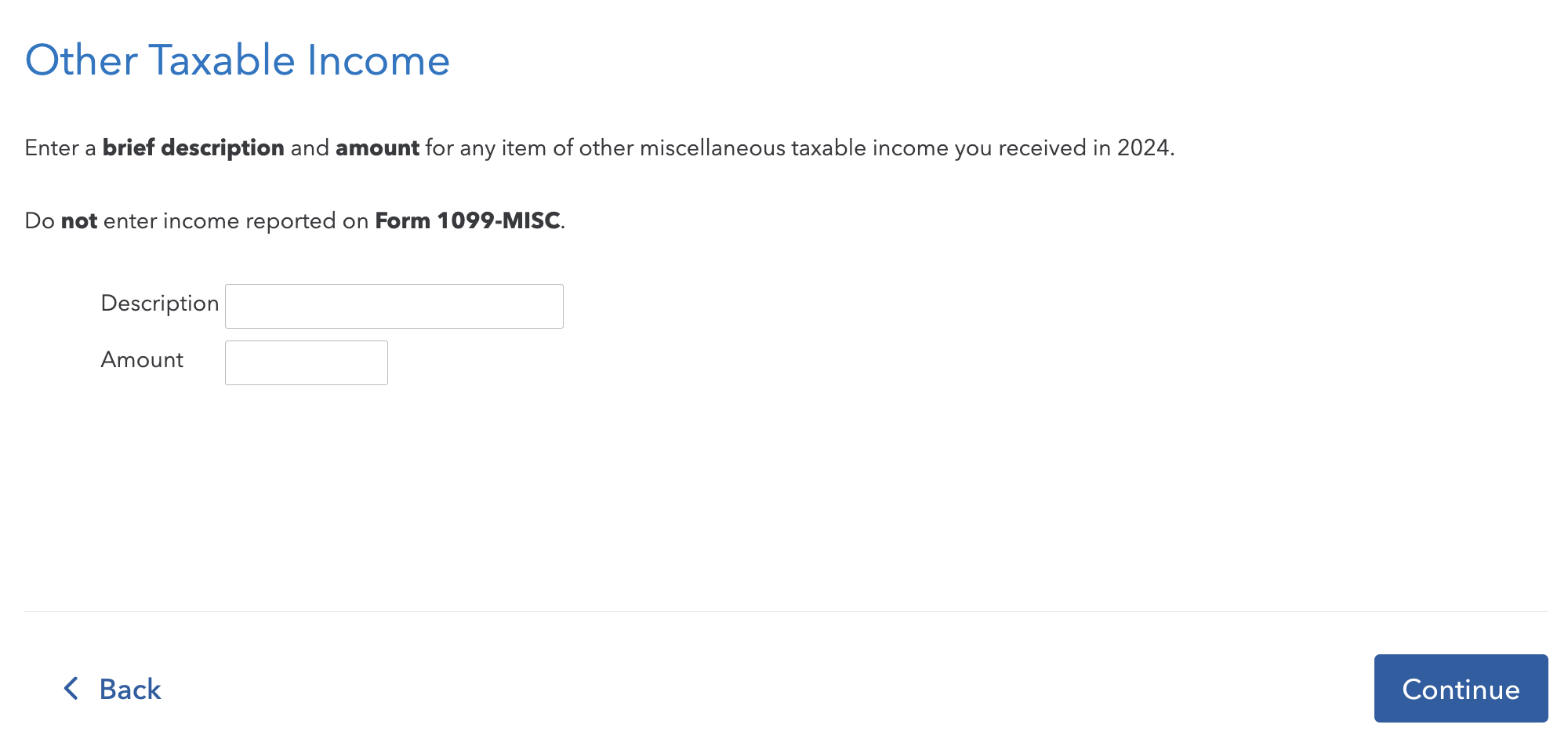

- Select Miscellaneous Income, 1099-A, 1099-C.

- Select Other Reportable Income.

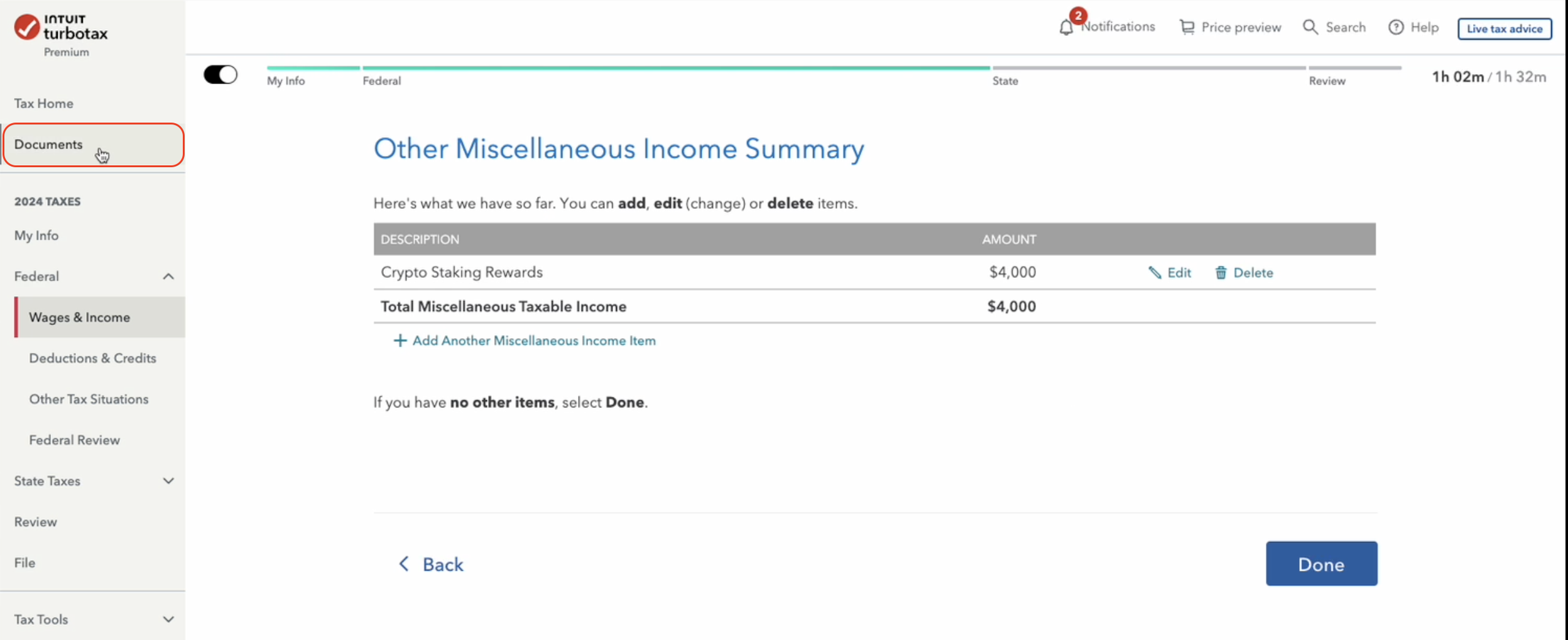

4. Fill out your income items.

Enter the amount and income type (e.g., Crypto staking income, Crypto airdrop income) from your CTC Income Report. For multiple income items, add a new entry for each one.

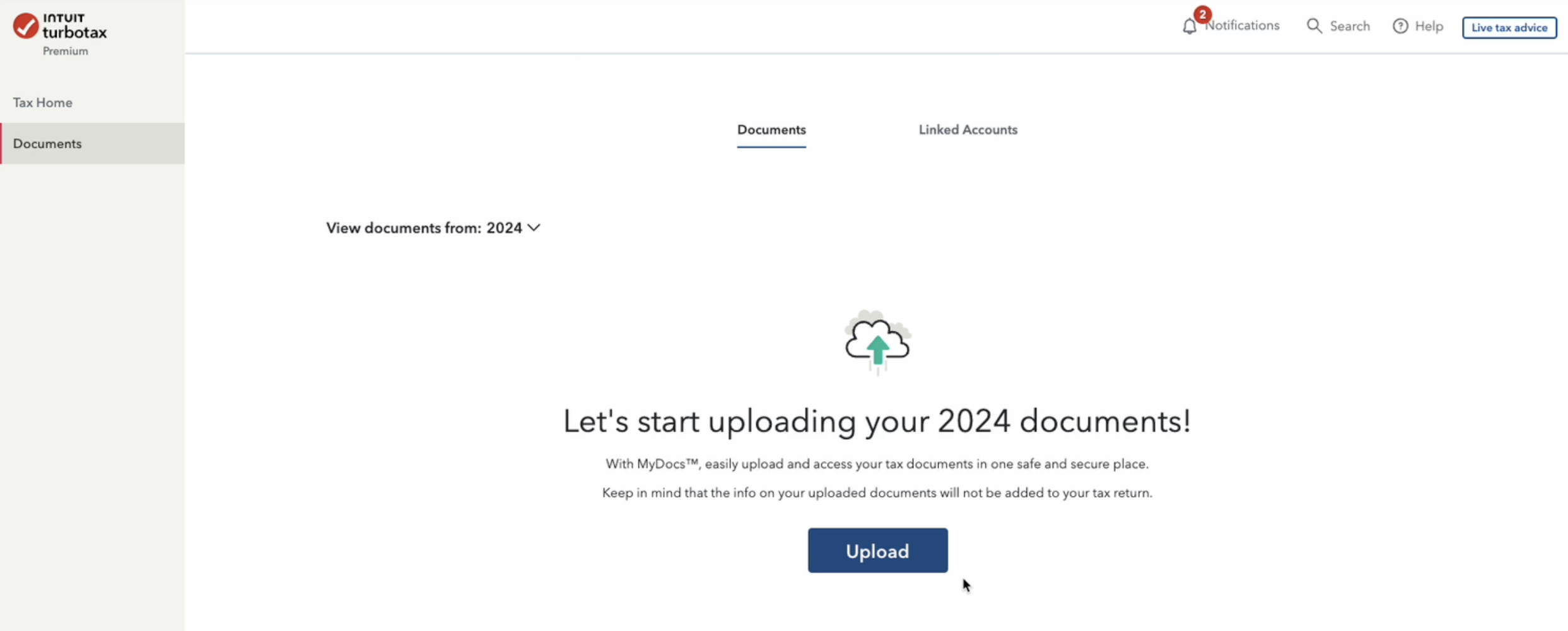

5. Upload your CTC Income Report

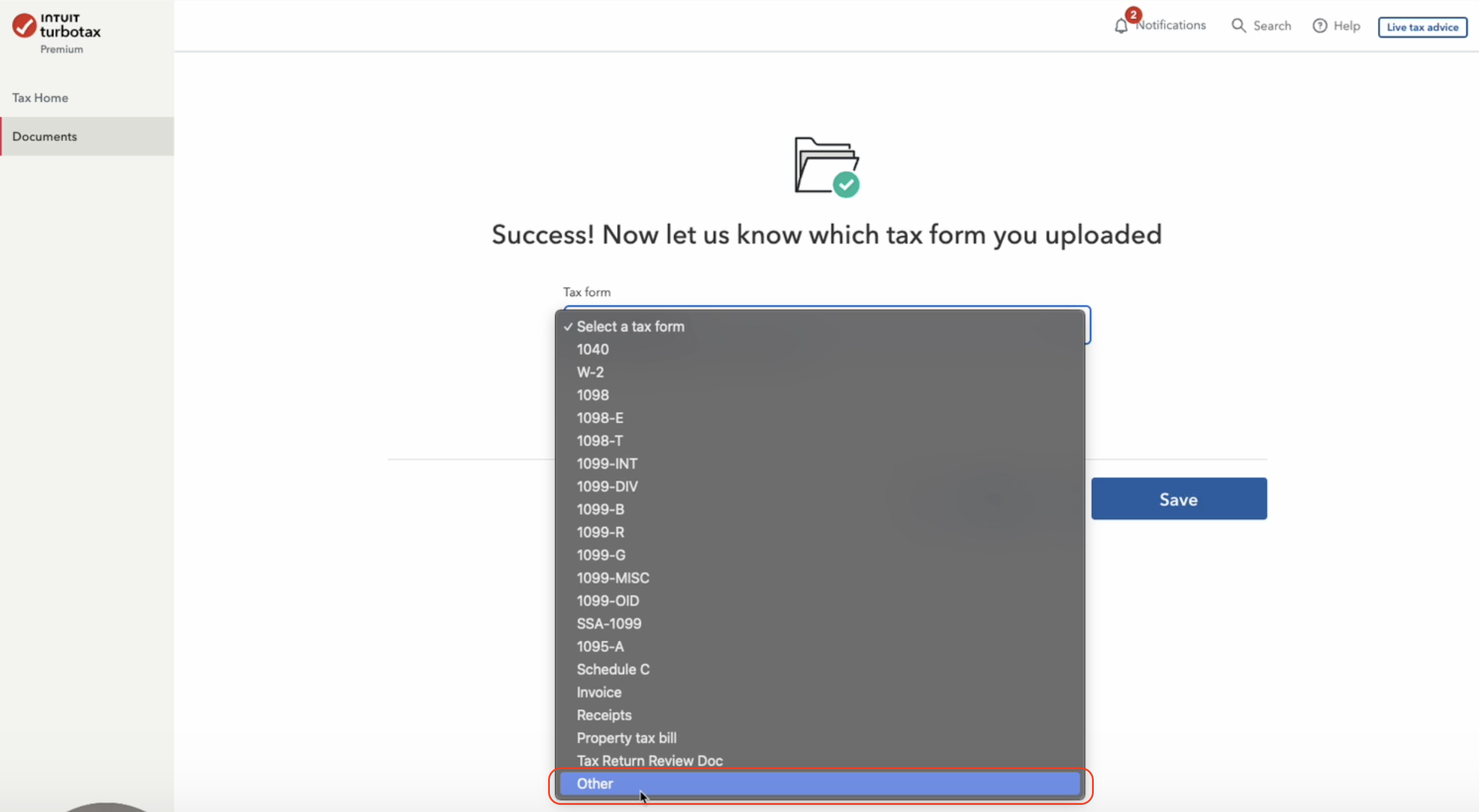

Click on Documents in the left-side menu bar.

Upload your CTC Income Report.

In the Tax Form dropdown menu, select Other for the CTC Income Report you just uploaded.

US Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in US.

Learn about US crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in US so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in US so you can file with confidence.

Learn about NFT taxes