How to do your MetaMask taxes in 2025

Key takeaways

- Tax agencies can track your Metamask transactions, so it’s important to file your crypto taxes properly.

- MetaMask doesn’t currently provide ready-to-file tax forms, but there is a manual process you can follow to get your relevant data.

- You can use crypto tax software, such as Crypto Tax Calculator, which easily integrates with MetaMask to give you an overview of your taxes within minutes.

When it comes to filing MetaMask taxes, it’s important to understand what’s involved to stay compliant. Using MetaMask to sell, swap, or stake crypto is typically treated as a taxable event in most countries, and as a user of the platform, you’ll most likely need to calculate and report taxes for your transactions.

MetaMask does not collect or report taxes on your behalf, making it your responsibility to manage and file your crypto income. While MetaMask tax reporting may seem complicated, with the right tools and guidance it doesn’t have to be.

In this guide, we’ll walk you through:

-

How to calculate taxes for MetaMask

-

How to use crypto tax software for reporting accurate MetaMask taxes

-

How to get MetaMask tax documents

-

Which MetaMask transactions are taxable

-

If MetaMask reports to the IRS

How to calculate taxes for MetaMask

If your MetaMask activity has been limited to basic buying, selling, and staking, you may be able to calculate your transactions manually. You can do this by exporting your transaction data using a block explorer like Etherscan (see our section below on how to get MetaMask tax documents for a detailed walkthrough).

However, since MetaMask is often used for DeFi and more complex transactions, calculating taxes manually can be challenging. To simplify the process, you can use crypto tax software like Crypto Tax Calculator . All you need to do is connect your MetaMask account and CTC will automatically import your transactions and handle the tax calculations in accordance with your country’s regulations.

The best crypto tax software for MetaMask – Crypto Tax Calculator

We may be a little biased, but Crypto Tax Calculator is the best tax software for MetaMask. In case you missed the news, in 2024 we officially partnered with MetaMask, making your tax reporting a whole lot easier.

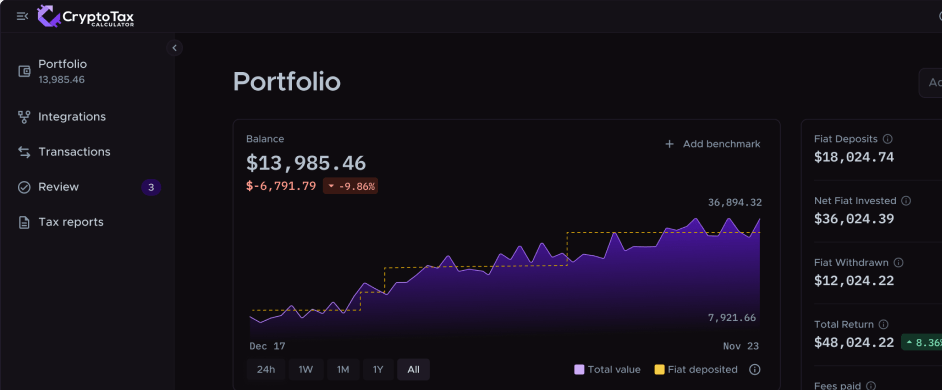

Crypto Tax Calculator is designed with DeFi users in mind, and can handle even the most complicated of portfolios and transaction types. Simply link your wallet address and it will automatically scan, categorize and calculate the tax owed on your transactions.

You can add as many accounts as you like from other on-chain wallets and centralised exchanges, streamlining the tax process and saving you a headache.

There’s no need to worry about meeting the reporting standards of your local tax authority either. CTC generates tax reports that comply with the requirements of numerous tax authorities, including the IRS, HMRC, ATO, CRA, and many more.

But don’t just take our word for it. Crypto Tax Calculator has a 4.8-star rating on Trustpilot, with countless positive reviews. Here’s one from Mike Drav:

“I've tried Koinly, TaxBit, CoinLedger… and my conclusion is that CryptoTaxCalculator is the best crypto accounting/tax software on the market and it's not even close.”

Built for DeFi.

No credit card required

How to do your MetaMask tax with Crypto Tax Calculator

Reporting your MetaMask taxes using Crypto Tax Calculator is straightforward. You don’t need to manually export data or calculate anything.

Instead, simply link your public wallet address and Crypto Tax Calculator will analyse the data to identify things like swaps, staking, liquidity pools and other DeFi activities. It will then produce a tax report, ready for your accountant or local tax authority.

Here’s how to get started:

Connect all of your exchanges, wallets, and platforms to import your transaction history. Make sure to link all of your accounts besides just MetaMask to ensure you receive an accurate tax report.

While Crypto Tax Calculator does the hard work for you, it may flag some missing data or errors which you you will need to review to ensure accuracy.

Generate a comprehensive tax report ready for your accountant or local tax authority.

If you're new to Crypto Tax Calculator, start with our Getting Started Guide for an overview of how the platform works.

How to get MetaMask tax documents

MetaMask doesn’t currently provide complete tax reports ready for you to file. You’ll need to either export your transaction data in a CSV file–which MetaMask doesn’t currently have the option for–or extract your on-chain trade information with a blockchain explorer, which can be a complicated process. Here’s how you can export your transaction data using Etherscan:

-

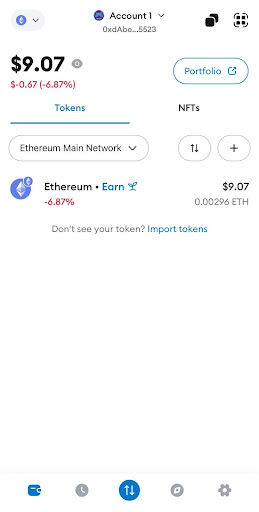

Open your MetaMask wallet.

-

Click on your account name (in this case “Account 1”).

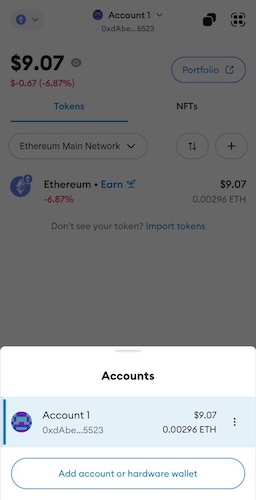

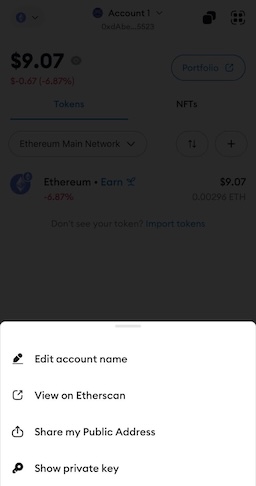

- This will open up a window at the bottom of your screen.

- Click on the three dots at the bottom right, then select “View on Etherscan.”

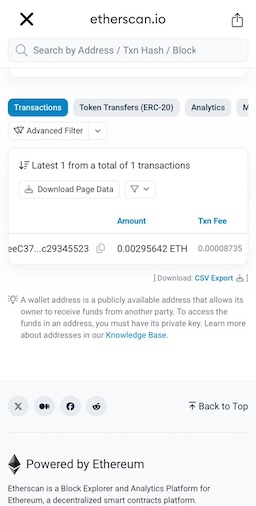

- Underneath your transactions, you’ll see an option to download a CSV export.

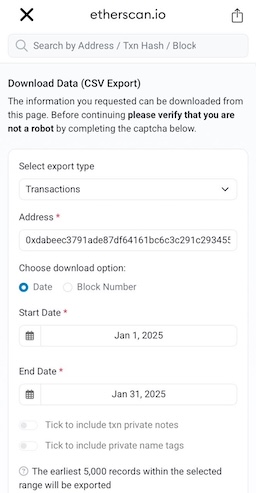

- Click on “CSV Export” and it will open a window where you’ll be asked to specify a date range for your transactions.

- Once you complete the verification widget, you’ll be able to download the CSV file showing all of your MetaMask transactions for the specified time frame.

Keep in mind: these steps will only help you create a record of your MetaMask transaction history, and may not provide all the details you need to file an accurate tax return.

Alternatively, you can use crypto tax software like Crypto Tax Calculator, which is an official partner that integrates seamlessly with MetaMask so you can easily import your transactions and have an overview of your taxes almost immediately.

Are MetaMask transactions taxable?

Yes, MetaMask transactions are taxable. If they result in capital gains or income, chances are you’ll need to report and pay tax on them. The specific tax amount depends on where you live and the type of transactions you have made. If you used MetaMask for the following decentralized finance (DeFi) activities, then they are taxable events:

-

Swaps (buying and selling)

-

Providing liquidity and yield farming

-

Lending

-

Earning interest

Read more about how cryptocurrency is taxed in your local country here.

Does MetaMask report to the IRS?

No, MetaMask does not currently report to the IRS.

But just because MetaMask doesn’t report transactions to the IRS, it doesn’t mean the IRS can’t track your activity. Transactions on blockchains such as Ethereum are available for the public to view, which the IRS can trace back to your wallet. So, it’s important to make sure you report all taxable events to prevent any unwanted issues with tax authorities.

It’s also important to know that the crypto tax reporting landscape is evolving in the US. In 2025, centralized crypto exchanges (CEXs) will be required to report users’ digital currency trades–including crypto–to the IRS. Starting in 2026, certain digital brokers will send taxpayers a 1099-DA form for digital asset proceeds from broker transactions and file it with the IRS.

For years, DeFi protocols have been operating in a complex regulatory environment, but that’s changing with the new DeFi broker tax regulations. The IRS regulations state that front-end trading services–including websites, non-custodial wallets, and browser extensions that allow users to exchange digital assets–will be classified as “brokers” moving forward.

As a result, starting January 2027, DeFi trading platforms will be required to track and report customer transactions and file a 1099-DA form with the IRS.

Sources

Crypto Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes.

Learn about crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes so you can file with confidence.

Learn about NFT taxes