How to report your crypto taxes to the HMRC

In recent years in the UK, the HMRC has developed an increasing focus on crypto users and their trading activity. As a part of their efforts, they’ve put together a comprehensive manual covering all things crypto tax in their jurisdiction. It’s very clear that they are providing UK taxpayers with guidelines to abide by in regards to crypto taxes, and expect these rules to be followed. If you’re interested in the specifics of how the HMRC taxes crypto activity, you can read our UK Crypto Tax Guide.

How to calculate what crypto taxes you owe to the HMRC

The first step you’ll need to take before reporting your crypto taxes to the HMRC is calculating your taxable obligations for:

- Crypto capital gains

- Crypto capital losses

- Income from crypto activity

- Any relevant expenses related to your crypto investments

There are two ways you can manage these calculations; manually in a spreadsheet or using crypto tax software like our platform CryptoTaxCalculator. To abide by the HMRC’s record-keeping requirements, you’ll need to maintain consistent records of each transaction in the equivalent GBP value, record the type of cryptocurrency and/or crypto asset, the date of the transactions, if it was bought or sold, the number of units, the cumulative total of the investment units held, and bank statements or wallet addresses in case of an audit. As you can imagine, doing this manually for each and every transaction you make would be a nightmare… That’s where we come in! Import your crypto transaction data into our platform via our API or CSV integrations, reconcile any outstanding instances and get an up-to-date calculation of your values in each respective category.

How to report crypto taxes to the HMRC

The HMRC has two options for reporting your taxes; either online or via the postal service. They also have different methods for reporting crypto taxes based on whether you are or aren’t self-employed.

Online submission method

If you are self-employed, you will need to log onto your business tax account and add an additional ‘self-assessment’ entry. If you haven’t created an online business tax account yet, you’ll need to do so before being able to proceed.

If you aren’t self-employed and haven’t created an online self-assessment tax return online before, you’ll need to submit an online SA1 form before being able to proceed.

Postal submission method

If you are self-employed and want to submit your crypto taxes by post, you will need to register for Self Assessment and Class 2 National Insurance by filling in a form on-screen then printing it off and posting it to HMRC. You’ll receive a reminder letter telling you to complete a Self Assessment tax return before it’s due.

As with the online submission, if you aren’t self-employed and are choosing to submit your self-assessment tax return by post, you will need to submit a physical SA1 form before being able to proceed. You’ll get an activation code for your new account in the post within 7 working days (21 if you’re abroad). When you get the code, sign in to activate your Self Assessment.

Forms you’ll need to complete

In order to report your crypto taxes accurately to the HMRC, you will need to fill out two forms: the HMRC Self-Assessment Tax Return SA100 form (for income from crypto activity), and the HMRC Self-Assessment Capital Gains Summary SA108 (for crypto capital gains and/or losses). Let’s dive in.

HMRC Self-Assessment Tax Return SA100 for Crypto Tax Reporting

The HMRC Self-Assessment Tax Return SA100 form is the main tax return form for individuals. It is used to report taxes for income and capital gains, student loan repayments, interest, pensions, and more. If you have capital gains and/or losses, you will need to tick box 7 in the SA100 form, and also submit a Self-Assessment: Capital Gains Summary SA108 form which is explained in more detail below.

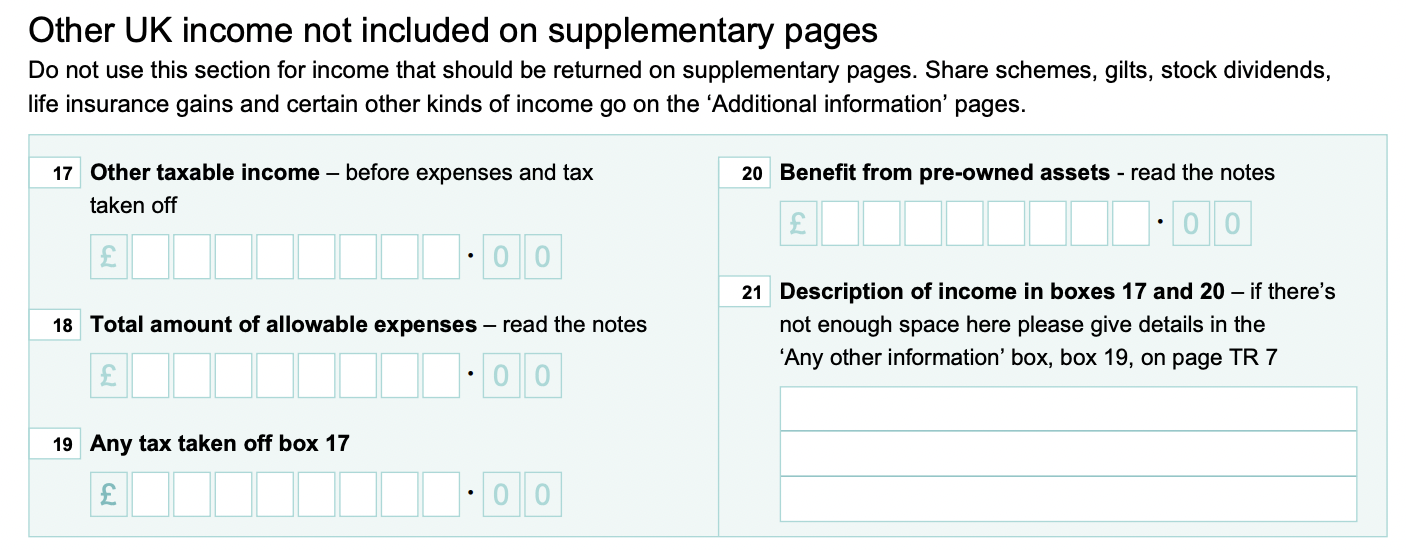

Firstly, fill out the form with the necessary information that matches your personal circumstances. To report any income from crypto activity, you will have to fill out box 17. If you have any allowable expenses related to your crypto activity, you can fill out box 18. Use box 21 to give an overview of how the income was earned, for example: if you’ve mined crypto and earned tokens as a reward, you could say “Income earned from crypto mining”. The more detail you can provide in this box, the better.

Note: the instructions above relate solely to your crypto activity. If you need to report any other income, make sure to do so in this same form.

HMRC Self-Assessment: Capital Gains Summary SA108 for Crypto Tax Reporting

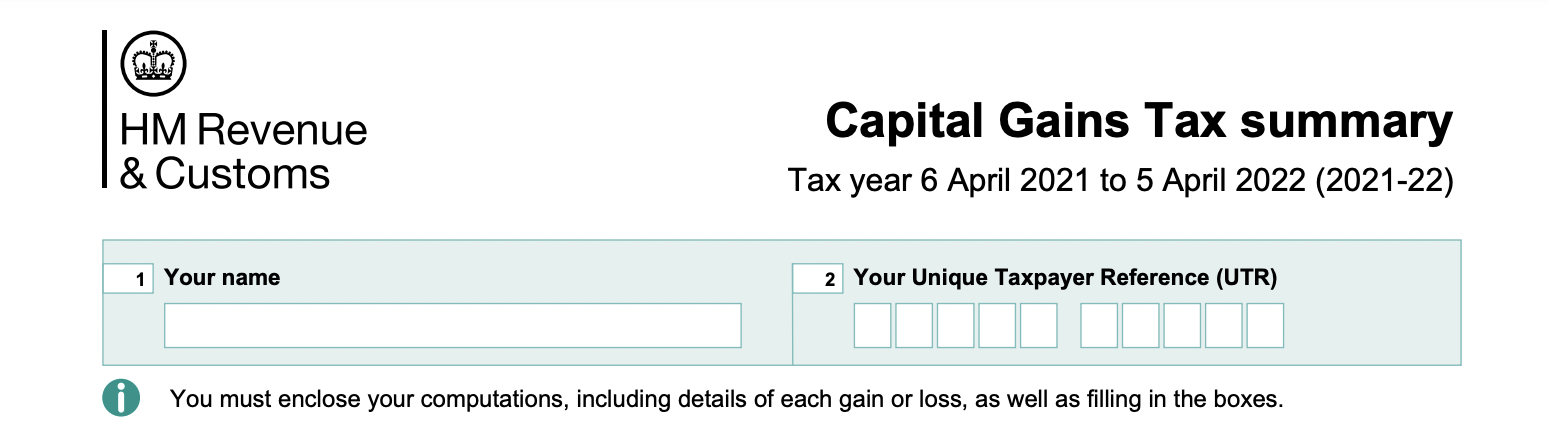

The second cab off the rank is the HMRC Self-Assessment Capital Gains Summary SA108 form. For crypto related capital gains and losses, you will need to fill out multiple sections of this form. Firstly, fill out box 1 and 2, then move onto the ‘Other property, assets and gains’ section.

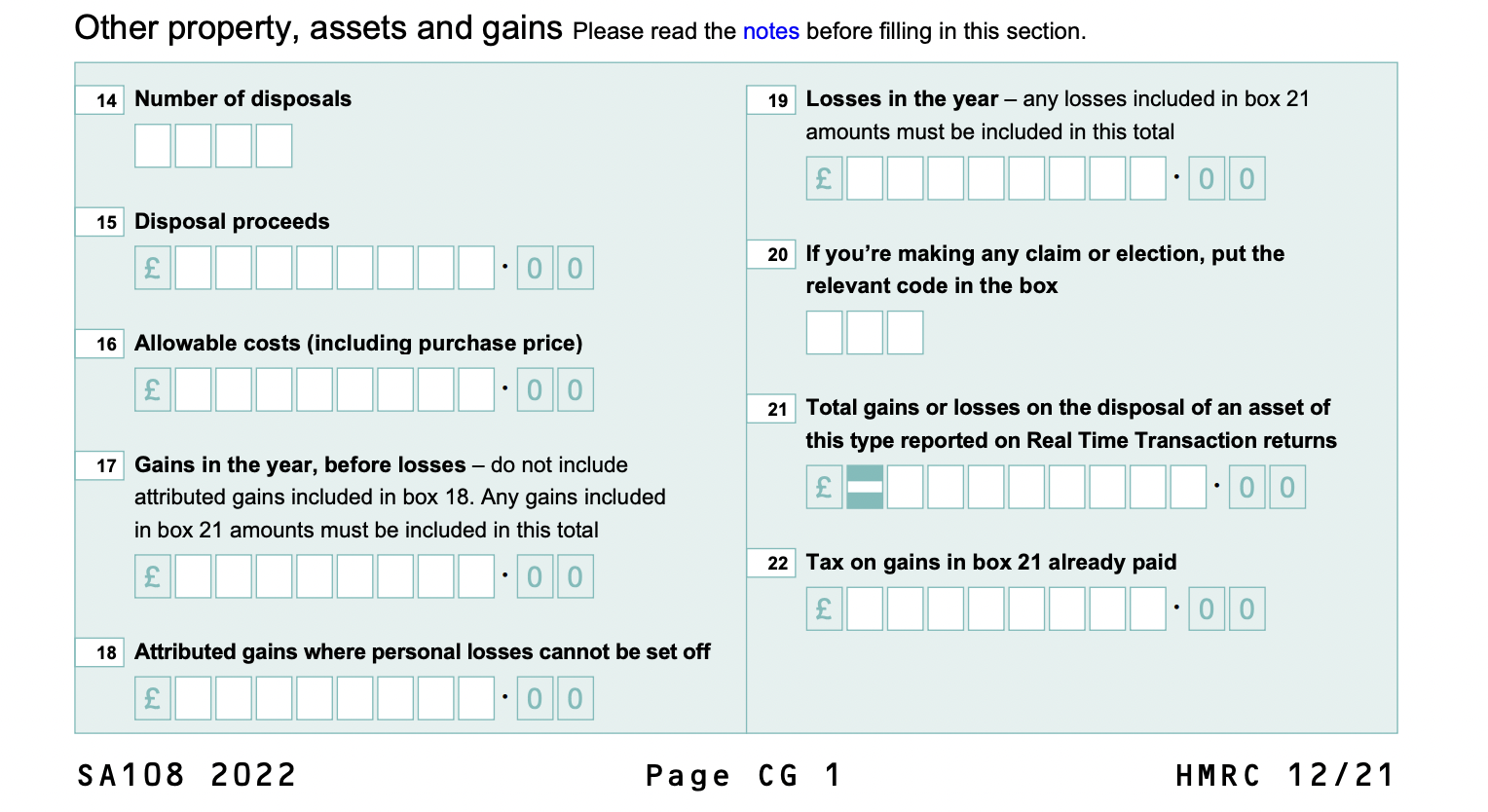

Boxes 14 - 22 will need to be filled with accurate values of your totals from the financial year in question.

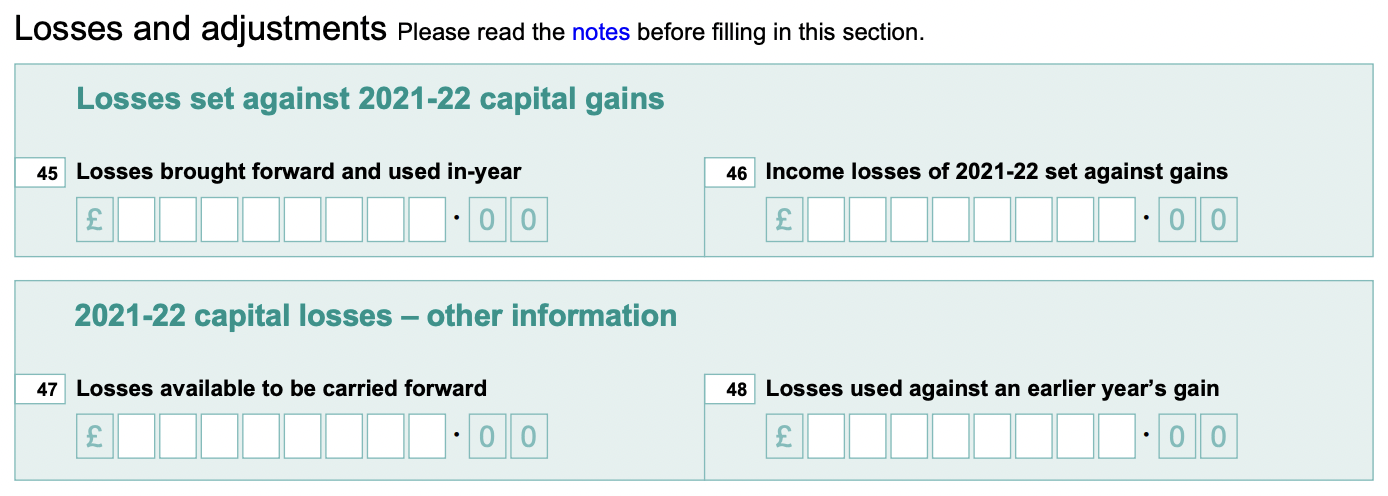

After you’ve completed this section, move on to the section named ‘Losses and adjustments’. If you have used any capital losses from previous years, and/or income losses used, and/or have any capital losses you’re carrying forward, you will need to complete boxes 45 - 47.

Note: the instructions above relate solely to your crypto investments. If you need to report any other type of capital gains or losses, make sure to do so in this same form.

How Crypto Tax Calculator can help

As mentioned earlier in this blog, our platform can help you aggregate all of your crypto transaction data to help calculate any gains, losses, income and/or expenses. Once you’ve imported all of your data to form a complete overview of your trading history, you’ll have the option to download reports specifically for income from crypto activity, capital gains and losses, and more. These reports and the information included will give you the values needed to complete your SA100 and SA108 forms for the HMRC.