BGL Integration Guide

We are proud to announce that we’ve integrated with BGL, a trusted cloud-based SMSF management tool favoured by accountants.

In the fast-paced realm of self-managed superannuation funds (SMSFs), change is constant, bringing both challenges and opportunities. The SMSF landscape evolves continuously, and cryptocurrencies have added an intriguing layer of complexity in recent years.

Follow these steps to connect your SMSF to Crypto Tax Calculator and export this data into BGL’s Simple Fund 360 platform:

- Sign up to Crypto Tax Calculator

If you haven’t yet, head over to our homepage where you can create a free Crypto Tax Calculator account.

NOTE: If you have an existing Crypto Tax Calculator account, you will need to create a second, separate SMSF account.

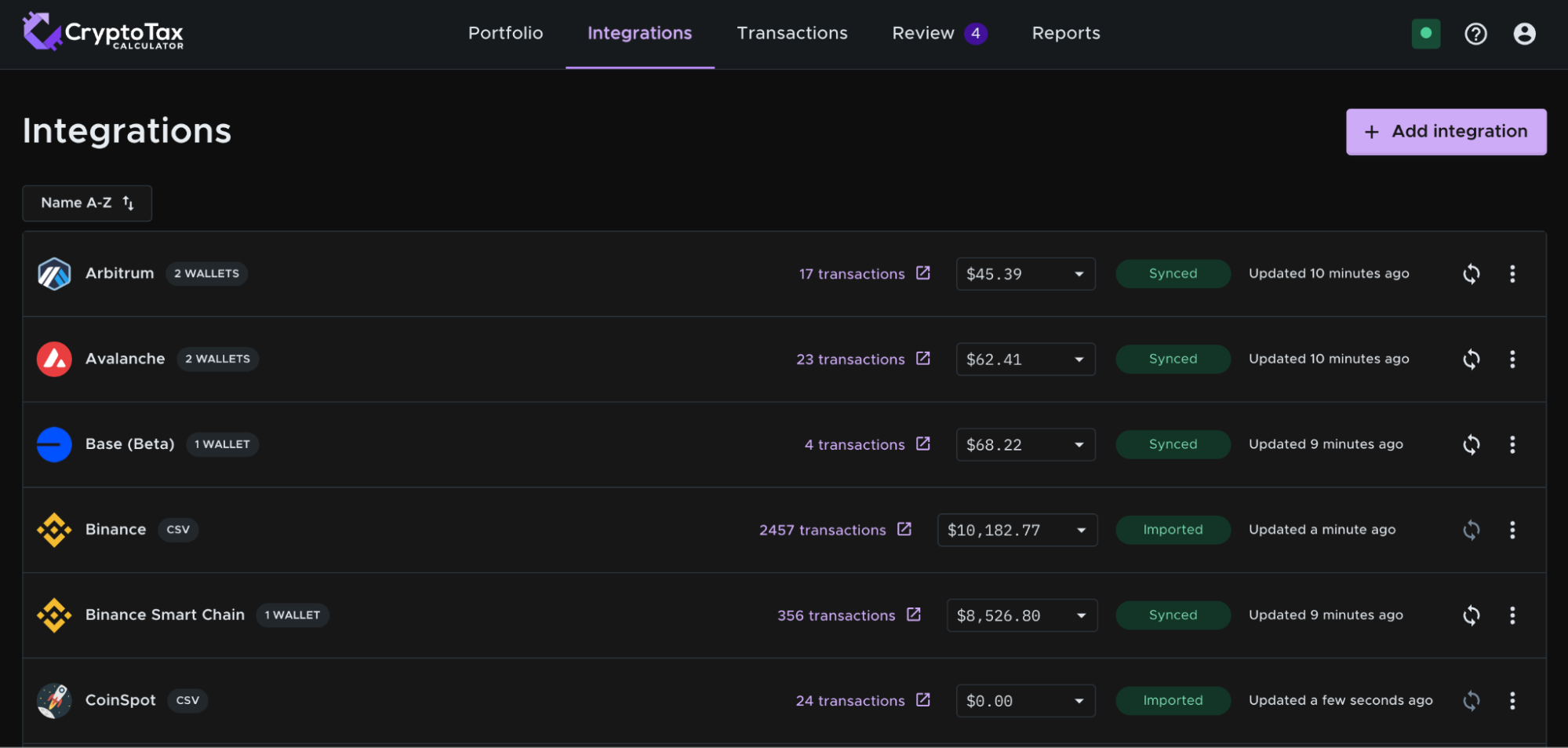

- Connect your exchanges & wallets

In the ‘Integrations’ page, import all your different crypto exchanges and wallets which your SMSF account has interacted with.

NOTE: Make sure to only import your SMSF transactions and don’t mix these up with transactions you’ve done on your other personal accounts.

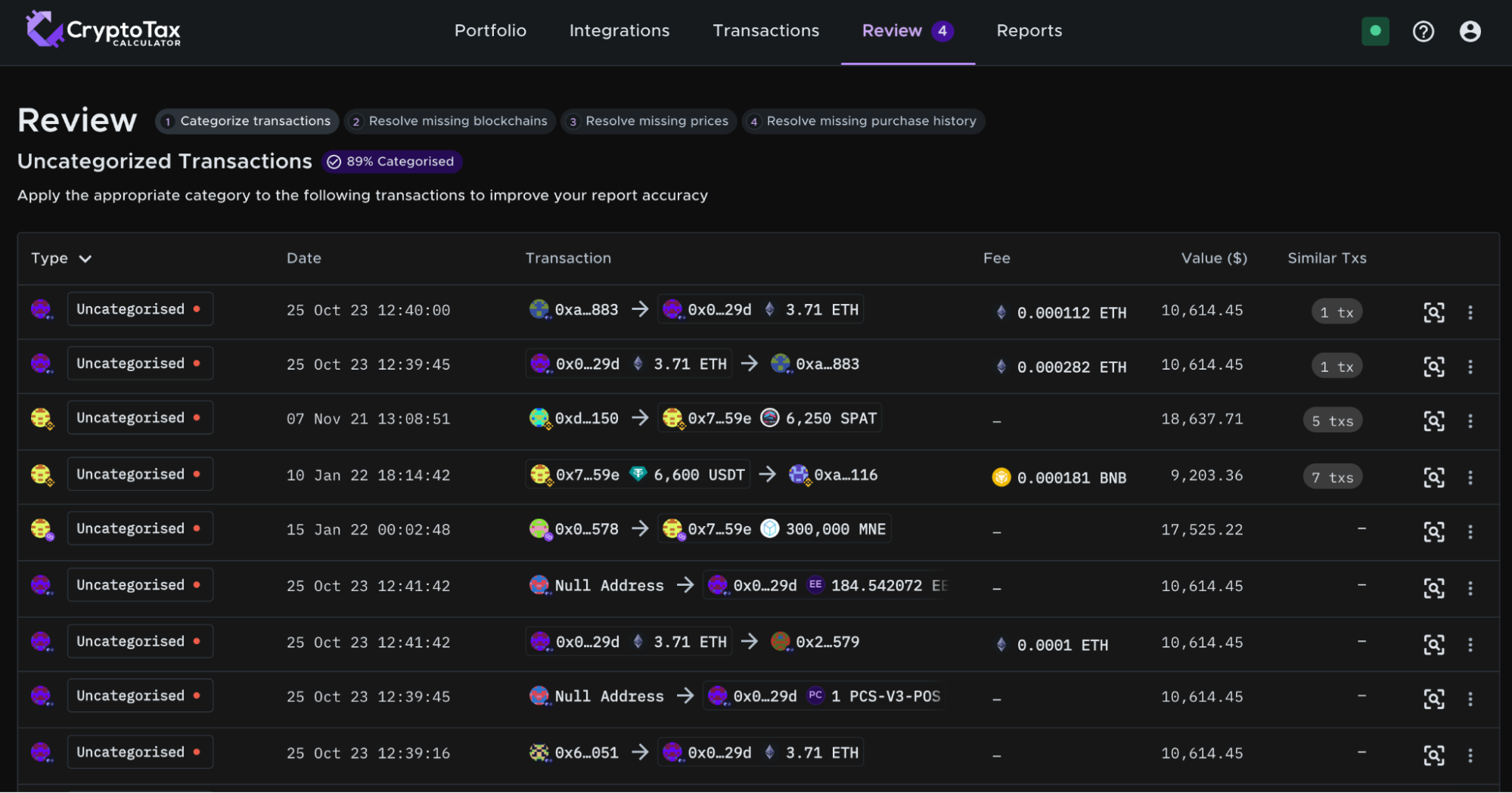

- Review any outstanding transactions

Go to the ‘Review’ page to check to see if there are any transactions that you need to reconcile.

If you need further information on the review process, please check our help guide here.

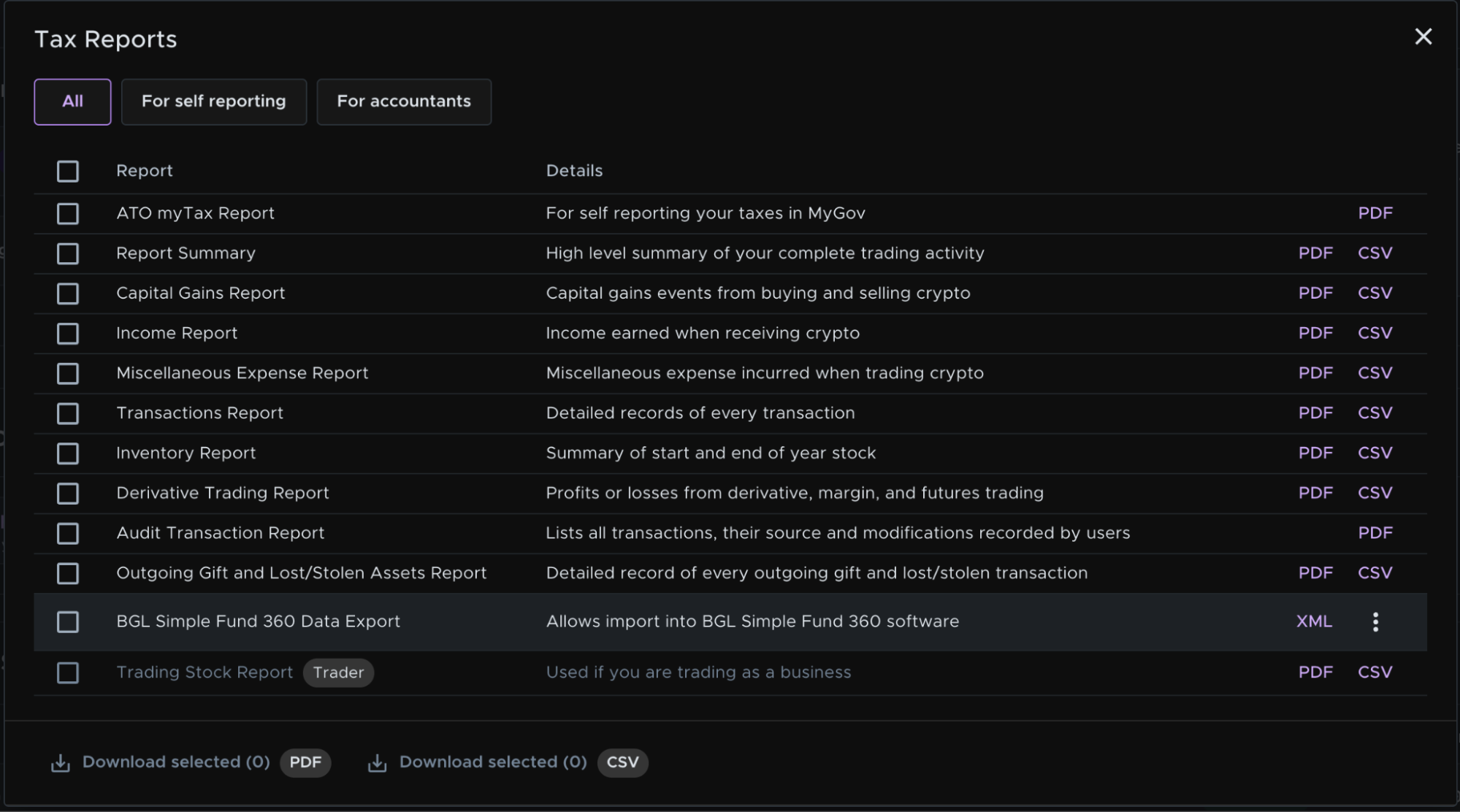

- Download the BGL tax report

In the ‘Reports’ page, scroll down to where you see the option to download the reports. In here, you’ll see the ‘BGL Simple Fund 360 Data Export’ report.

Click the ‘XML’ button to the right of it then this should be saved to your Downloads folder.

- Import BGL tax report into your Simple Fund 360 platform

Log into your BGL Simple Fund 360 account then import the XML file.

Voila! Once uploaded, the report will sync with your BGL account.