How to report crypto on your taxes in 2025

Key takeaways

- Crypto is classified and taxed as property. Capital gains tax applies to crypto sold for a profit, and income tax applies to crypto earned via rewards like staking.

- You need to collect all of your transaction data for the tax year and calculate the net income and capital gains.

- You report your crypto income and capital gains on your annual federal income tax return and state tax return.

The IRS requires you to report and pay taxes on all of your income and capital gains each year, including any from cryptocurrency. Whether you made money by selling your crypto for a profit, earning crypto rewards, or collecting crypto as payment for goods and services you'll have to pay taxes on what you earned.

You'll report your crypto transactions when you file your federal income tax return each year. While you'll largely complete your return as you would for any other income or gains you earn, you may be required to complete some additional forms, depending on your crypto earnings.

Keep reading for a step-by-step guide about reporting your crypto on your taxes, how various types of crypto income are taxed, how to reduce your crypto taxes, and more.

How to report crypto on your taxes in 5 steps

If you had crypto transactions throughout the year and need to report them on your tax return, you'll need to follow these steps:

-

Gather relevant documents and data

-

Calculate your gains and losses using Form 8949

-

Report your gains and losses on Schedule D

-

Report any other crypto income on Schedule 1 (Form 1040) Line 8z

-

Complete and file your income tax return

Save yourself time with Crypto Tax Calculator's IRS-ready tax reports

Step 1: Gather your documents

Accurately reporting your crypto transactions on your taxes requires thorough recordkeeping.

Before starting on your tax return, you will need to collect data that summarizes your crypto transactions throughout the year, including sales, swaps, purchases, mining, staking, airdrops, crypto payments, and more.

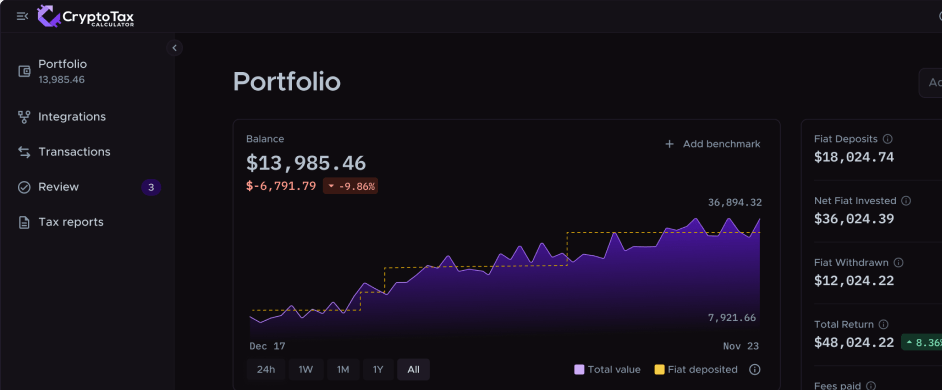

The easiest way to do this is to use tax software like Crypto Tax Calculator which will automatically analyse your transaction history once you connect your exchange accounts or wallets.

Alternatively, most exchanges will let you download a spreadsheet with your transaction history and relevant information, which can be used to manually calculate your taxes. If you're unable to get this information from your exchange or wallet, then you may need to keep your own records.

Here's the information you'll need for each crypto transaction to report it on your taxes:

-

Description of property

-

Date acquired

-

Date sold or disposed of

-

Proceeds

-

Cost or other basis

-

Adjustments to your gain or loss

-

Total gain or loss

You can wait until you're preparing to file your tax return to gather these documents and transaction data. However, keeping records throughout the year will likely be easier (and more accurate) so they're ready to go when tax season rolls around.

Step 2: Calculate your gains and losses using Form 8949

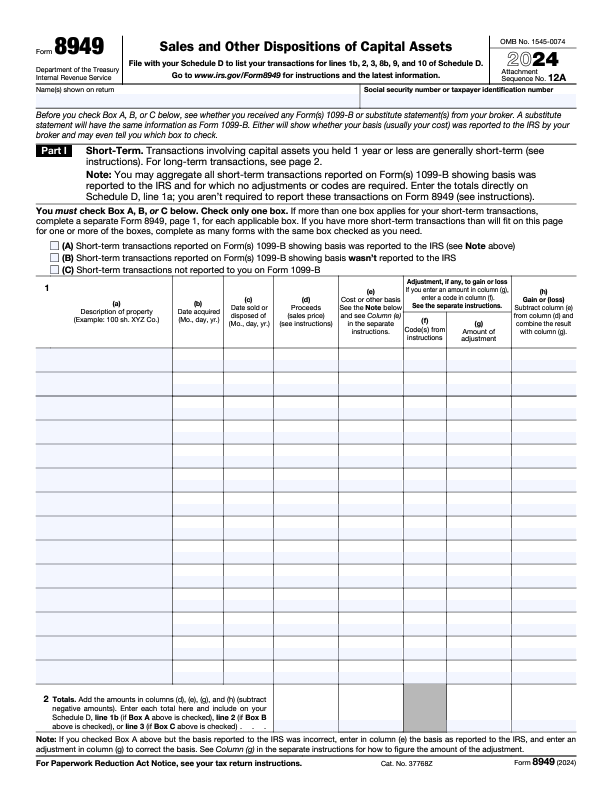

Once you've gathered information about all of your crypto transactions, you'll record them all on IRS Form 8949.

You'll separate your short-term from your long-term transactions (meaning those held for one year or less versus those held for longer than one year).

The purpose of Form 8949 is to calculate your total capital gains or losses for both short-term and long-term capital gains.

You'll also be asked which of the following is true:

-

Your transactions reported on Form 1099-B show your basis was reported to the IRS

-

Your transactions reported on Form 1099-B show your basis was not reported to the IRS

-

Your transactions weren't reported on Form 1099-B

Form 1099-B is typically only used for securities (eg, stocks) and is not normally issued for cryptocurrency. So if you were using a crypto exchange or wallet to trade, you will likely answer question C -- Your transactions weren't reported on Form 1099-B.

Once you record all of your transactions on the 8949, you can follow the instructions on the form to add (or subtract) your gains and losses from each transaction to find your total capital gain and loss for both short-term and long-term transactions.

Step 3: Report your gains and losses on Schedule D

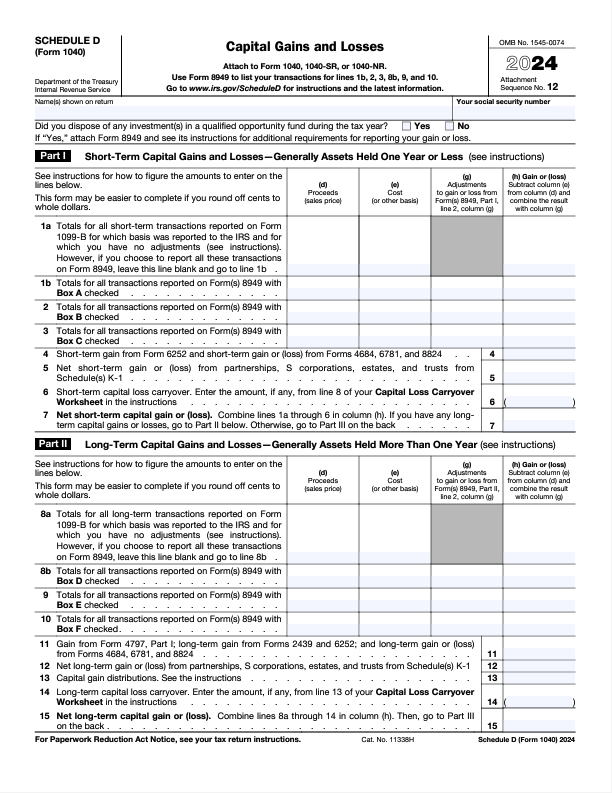

Once you've completed Form 8949, you'll take all of that information and report it on Schedule D of Form 1040. Part I is where you'll report your short-term gains and losses, while Part II is where you'll report your long-term gains.

Step 4: Report any other crypto income

It's possible you have crypto income that isn't considered a capital gain and, therefore, isn't reported on Form 8949 or Schedule D. Examples of this type of income would be crypto you earned through mining, staking, rewards, airdrops, etc.

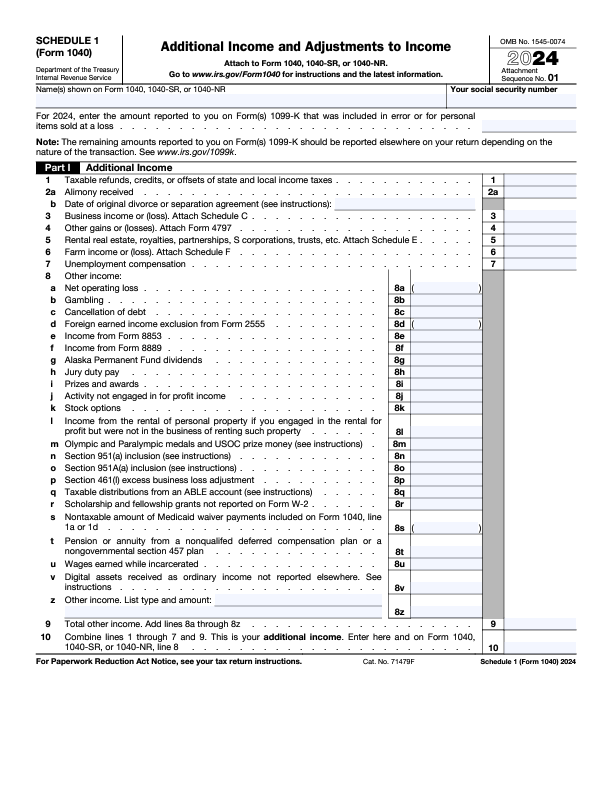

If you have any of these types of crypto income, you'll report it on line 8z of Schedule 1 of Form 1040.

Finally, if you received cryptocurrency for your wages as an employee or in exchange for goods or services as an independent contractor, you'll report your crypto income on either Form 1040 or Schedule C of Form 1040, respectively.

Step 5: Complete your income tax return

Now that your crypto transactions are recorded, you are now ready to finish filing out your tax forms with any non-crypto-related income such as from your employer.

Once you are sure that they are accurate and complete, you are ready to submit them to the IRS.

How to report your crypto tax with Crypto Tax Calculator

Reporting your crypto taxes is much more simple and time-efficient with Crypto Tax Calculator. Follow these steps to generate accurate reports which meet IRS reporting standards. You can file them with the IRS directly, using software like TurboTax, or hand them over to your accountant.

-

Add Integrations and Import Transactions

Connect your exchanges, wallets, and platforms to import your transaction history. -

Review for Accurate Results

Check your data for errors or missing details to ensure accuracy. -

Get Your Tax Reports

Generate comprehensive tax reports ready for your accountant or tax authority.

If you're new to Crypto Tax Calculator, start with our Getting Started Guide for an overview of how the platform works.

Need more help? Visit our US Report Guides or explore the Help Center for step-by-step instructions.

Accurate tax reports. Without the headache.

No credit card required

How to report your crypto tax using TurboTax

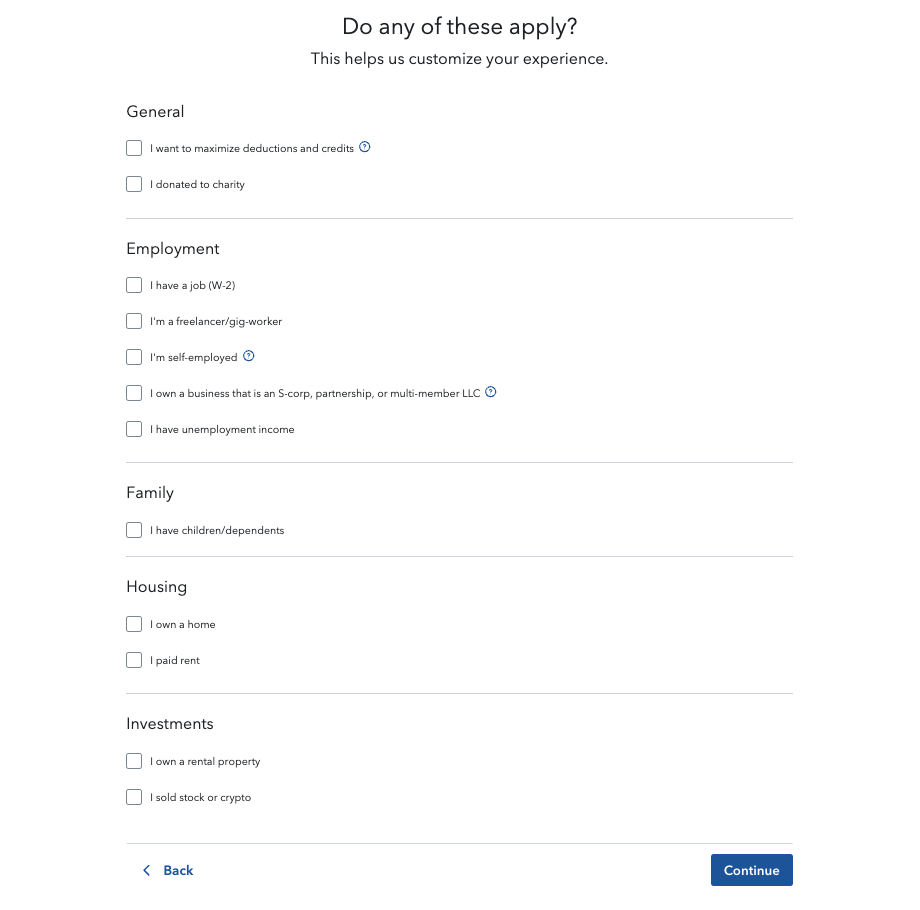

TurboTax makes it easy to report your cryptocurrency transactions on your tax returns. When you sign up or log in and start your return, TurboTax will ask you a few basic questions about your situation, including whether you sold any stock or crypto last year.

If you indicate you sold stock or crypto, it will automatically choose the correct package. You'll also be able to indicate how you'd like to file your taxes: on your own, with some help, or by having an expert do it for you.

The good news is that TurboTax has plenty of prompts throughout the filing process to ensure you report all of your various types of crypto income.

You can read our full guide for reporting your crypto using TurboTax for step-by-step instructions to accurately report all of your gains and income.

How to report crypto losses on taxes

You'll have to pay taxes on the crypto gains you report on your taxes. The good news is that the IRS also allows you to deduct your losses. For example, if you bought $500 worth of Bitcoin and later sold it for $450, you could deduct the $50 loss.

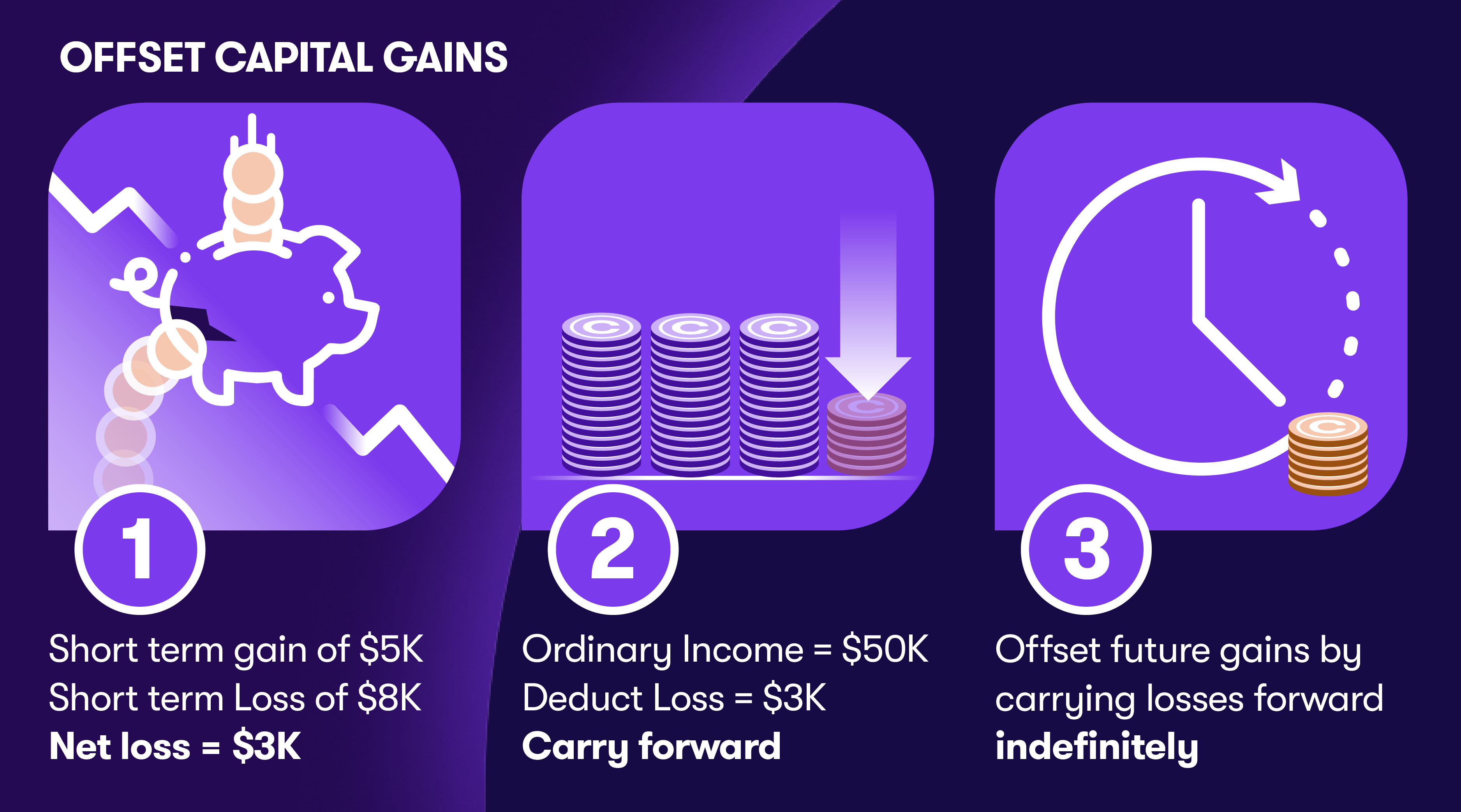

Your crypto losses can be used to offset your gains. For example, if you had $1,000 worth of crypto gains for the year and $250 in losses, you'd subtract your losses from your gains. So, you're only actually taxed on $750 of your gains.

When you complete Form 8949 and Schedule D, you'll report your losses along with your gains to ensure you end up at the correct net number.

In years where your losses exceed your gains, you can claim up to a $3,000 net loss to offset your other income. If the total amount of net losses exceeds $3,000, then you can carry any excess forward to future years. This amount reduces to $1,500 if married and filing separately.

How to report crypto staking rewards on taxes

Crypto staking rewards are treated differently to crypto sales for tax purposes.

While crypto sales result in capital gains, staking rewards are a form of income.

For example, let's say you can earn 20% with crypto staking. You stake 1,000 coins and, in return, earn an additional 200. The Fair Market Value of the 200 coins at the time you receive dominion and control over them is considered income, and you'll have to report it on your tax return.

Staking rewards and other forms of crypto income are reported on Schedule 1 of Form 1040. They'll be combined with any other income you report (eg, income from your job) and taxed at the same rate.

You'll also be subject to capital gains taxes if and when you eventually sell, trade, or spend your crypto staking rewards, just as you do with other crypto you hold.

How to report crypto airdrops on taxes

The tax treatment of crypto airdrops is the same as that of staking rewards. Regardless of whether you receive an airdrop in exchange for doing something or not, it'll still be considered taxable income.

You'll pay income taxes on the value of the crypto you receive at the time you receive it. And if you eventually sell those coins, you'll also pay capital gains taxes on the difference between your cost basis (meaning their value when you received them) and the amount you sell them for.

Just like staking rewards, you'll report the value of your airdropped crypto on Schedule 1 of Form 1040 when filing your annual tax return.

How to reduce your crypto tax liability

If you made a lot of money from your crypto transactions last year, you could be in for an unwelcome surprise in the form of a large tax bill. The good news is there are a few strategies you can use to help minimize your tax liability, but they may require a bit of upfront planning. Here are a few things you can do to reduce your crypto taxes, especially in future tax years:

-

Offset your gains with losses: One of the easiest ways to reduce your crypto taxes is to use a strategy called tax loss harvesting, where you sell underperforming assets. You can claim those losses on your taxes to reduce your capital gains.

-

Hold your crypto for more than one year: You'll pay a lower tax rate on your crypto gains if you hold your crypto for more than one year before you sell. While this isn't always practical, it's an easy way to lower your tax rate.

-

Hold your crypto in an IRA: Individual retirement accounts enjoy tax-free investment growth. When your crypto is in a self-directed Roth IRA, you won't pay taxes on any of your gains or other crypto income when you withdraw.

-

Donate your crypto: You won't pay taxes on your appreciated crypto if you donate it to a qualified charitable organization. In fact, you can use donations to reduce your tax liability because you'll be eligible to claim the charitable contribution tax deduction. Just make sure you obtain a receipt for donations over $500, and get a qualified appraisal for donations exceeding $5000.

Pay the least tax possible using CTC’s tax optimisation tools

Tax forms you need to report crypto

There are several different tax forms you may need to use to report your crypto transactions. While we've already mentioned almost all of them, we'll quickly summarize them so you can ensure you've included all the correct forms when you file your income tax return:

-

Form 8949: If you sold or otherwise disposed of any crypto in the last tax year, you'll report all information about those transactions on Form 8949, "Sales and Other Dispositions of Capital Assets."

-

Schedule D (Form 1040): After completing Form 8949, you'll report all of your short-term and long-term capital gains and losses on Schedule D (Form 1040), "Capital Gains and Losses."

-

Schedule 1 (Form 1040): If you had additional crypto income from staking, mining, airdrops, swaps, or compensation, you'll report it on Schedule 1 (Form 1040), "Additional Income and Adjustments to Income."

-

Schedule C (Form 1040): If you're self-employed and earned any crypto from clients or other payments, you'll report it on Schedule C (1040), "Profit or Loss From Business."

-

Form 709: If you gifted any crypto last year and the value exceeds the current gift tax exclusion set by the IRS, you'll have to report the gift on Form 709, "United States Gift (and Generation-Skipping Transfer) Tax Return."

New rules for reporting crypto on taxes in 2025

Moving into 2025, the federal government will implement several new regulations about how crypto transactions must be reported, both for brokers and individual investors. These new rules come into effect in 2025, meaning that they do not apply to transactions made in the 2024 tax year.

First, The IRS will require investors to use wallet-based cost basis tracking. Previously, they could use universal tracking, meaning all of your cryptocurrency was treated as being in the same wallet. Under the wallet-based method, each wallet is treated separately when calculating your cost basis. In other words, when you sell a digital asset, you must use the cost basis from that specific wallet, not from your entire crypto portfolio.

Next, the IRS has issued new regulations that require crypto brokers to issue each investor Form 1099-DAs, summarizing the gross proceeds of their digital asset sales. This new regulation doesn't change anything for investors --- you've technically always been required to report these transactions on your taxes. The difference is now you'll receive a 1099-DA form from your broker (and so will the IRS).

How is crypto taxed?

The IRS considers crypto to be property rather than a currency. For that reason, it's taxed the same way as other physical and financial assets, including stocks.

Crypto that you receive as income is taxed as such at your ordinary income tax rate. This includes any crypto you earn from staking, mining, airdrops, payment for goods and services, etc.

Capital gains on your crypto --- meaning when you sell it for more than you bought it --- are taxed as either short-term or long-term capital gains, depending on how long you owned it.

-

Short-term capital gains: Classified as gains on assets you held for one year or less, short-term gains are taxed at your ordinary income tax rate.

-

Long-term capital gains: Classified as gains on assets you held for more than one year, long-term gains are taxed at either 0%, 15%, or 20%, depending on your taxable income for the year. Most people will pay either 0% or 15%.

Do I have to report crypto transactions under $600?

There's some confusion about the tax returns for small crypto transactions. While you may not receive a tax form from your crypto exchange until you have $600 of taxable transactions, you'll still have to report all crypto gains and income on your tax return, whether they're $600, $6,000, or $6.

What is the tax rate for Bitcoin and crypto?

Cryptocurrency held for 1 year or less before being sold or exchanged is subject to short-term capital gains tax.

These gains are added to your income and taxed at your ordinary income tax rate, which can range from 10% to 37%, depending on your total taxable income.

Cryptocurrency sold after being held for more than 1 year qualifies for long-term capital gains tax, which is generally more favorable.

Tax rates for long-term gains are 0%, 15%, or 20%, depending on your taxable income.

Sources

-

Schedule D (Form 1040), Internal Revenue Service (IRS), 2024

-

Schedule 1 (Form 1040), Internal Revenue Service (IRS), 2024

-

Schedule C (Form 1040), Internal Revenue Service (IRS), 2024

-

Topic no. 449, Capital gains and losses, Internal Revenue Service (IRS), 2025

-

Topic no. 515, Casualty, disaster, and theft losses, Internal Revenue Service (IRS), 2024

-

Internal Revenue Bulletin: 2024-31, Internal Revenue Service (IRS), 2024